Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsThe Shift in Automotive Loyalty: Tracking Hybrid and BEV Buyers' Next Moves

Sales of hybrid and battery electric vehicles (BEVs) in the United States have grown exponentially over the last few years; however, a larger question faces the industry: where do these buyers go next when returning to market?

Through S&P Global Mobility's automotive loyalty data, which analyzes new vehicle registrations and return-to-market activity, we can track exactly how these buyers behave when choosing their next vehicle.

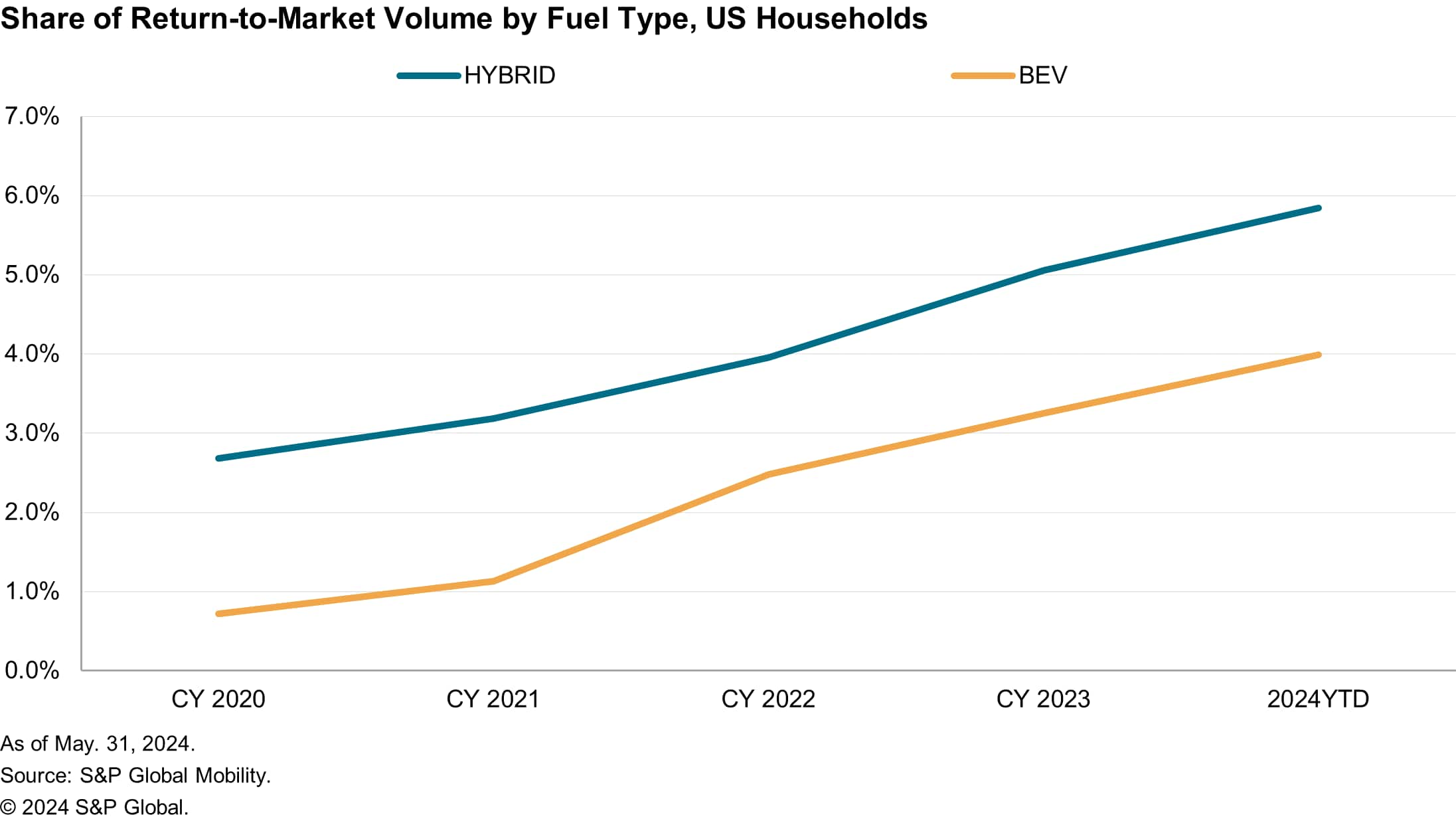

Since 2020, the share of households that previously purchased either a hybrid or BEV and then bought another new vehicle afterward has steadily increased by an average of ~1 percentage point each year. As of May 2024, these households represent close to 10% of total industry return-to-market share for the year so far — more than double the percentage from just a few years ago.

The increase in return-to-market share among hybrid and BEV purchasers can be attributed to a growing portfolio of available options, with the number of models in these vehicle categories increasing by 12% and 157%, respectively, over the last four years. As a result, the opportunity for dealers to retain customers is stronger than it has ever been.

Recent results, however, show retention behavior differs depending on fuel type.

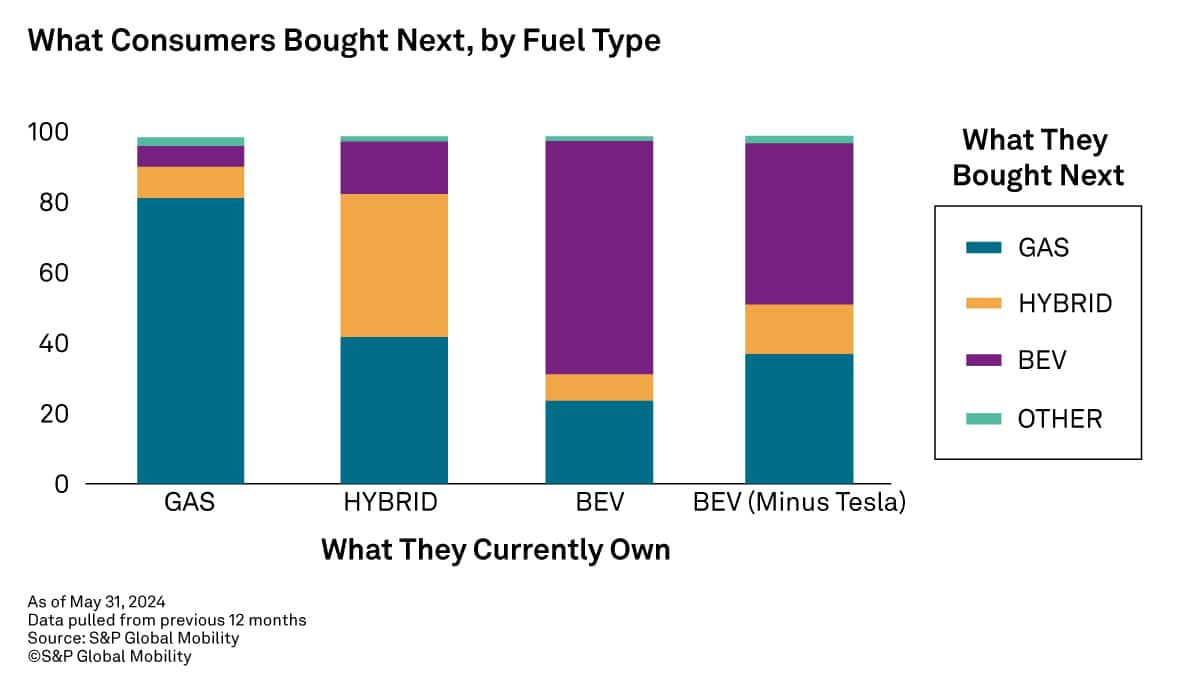

When analyzing household return-to-market activity, we observe that each buyer's loyalty to their previous fuel type varies when making their next purchase. In the case of households that previously came from a gas vehicle, they tend to be more stable, with more than 82% of them purchasing another gas vehicle. For those gas households that choose an alternative powertrain instead, they are more likely to prefer a hybrid over a BEV, as 9% choose the former vs. 6% who go with the latter.

For hybrid households, on the other hand, choices are more distributed across all fuel types. Hybrids can be viewed as the mid-point between a gas and electric powertrain, yet only 15% of hybrid owners choose a BEV for their next purchase. Instead, they are split evenly on remaining with another hybrid (41%) or moving back to a gas powertrain (41%). The lack of movement to BEVs could persist due to continued struggles in building a prevalent charging infrastructure along with a slowdown in EV demand.

For returning BEV households, there are two different patterns, depending on how you view the data. On the surface, when looking at all BEV return-to-market activity, there is an overwhelming commitment to the powertrain with ~68% of these households remaining loyal to the fuel type. However, a key driver of this loyalty is the strong retention and popularity of Tesla, which accounts for most of these households. Tesla's industry-leading 67% brand loyalty, and 65% share of all BEV return-to-market volume, makes them the primary driver of any activity among BEV owners with the household's next purchase.

However, without Tesla in the mix, return-to-market activity among the rest of BEV households shows less of a commitment to the electric powertrain. Only 47% of non-Tesla BEV households choose another BEV vehicle for their next purchase, preferring instead to move to either a gas vehicle (38%) or a hybrid (14%). Although the highest percentage of return-to-market activity remains in a BEV, the difference in movement to either a gas or hybrid vehicle signals these households may not be as committed to the electric powertrain compared to a Tesla household.

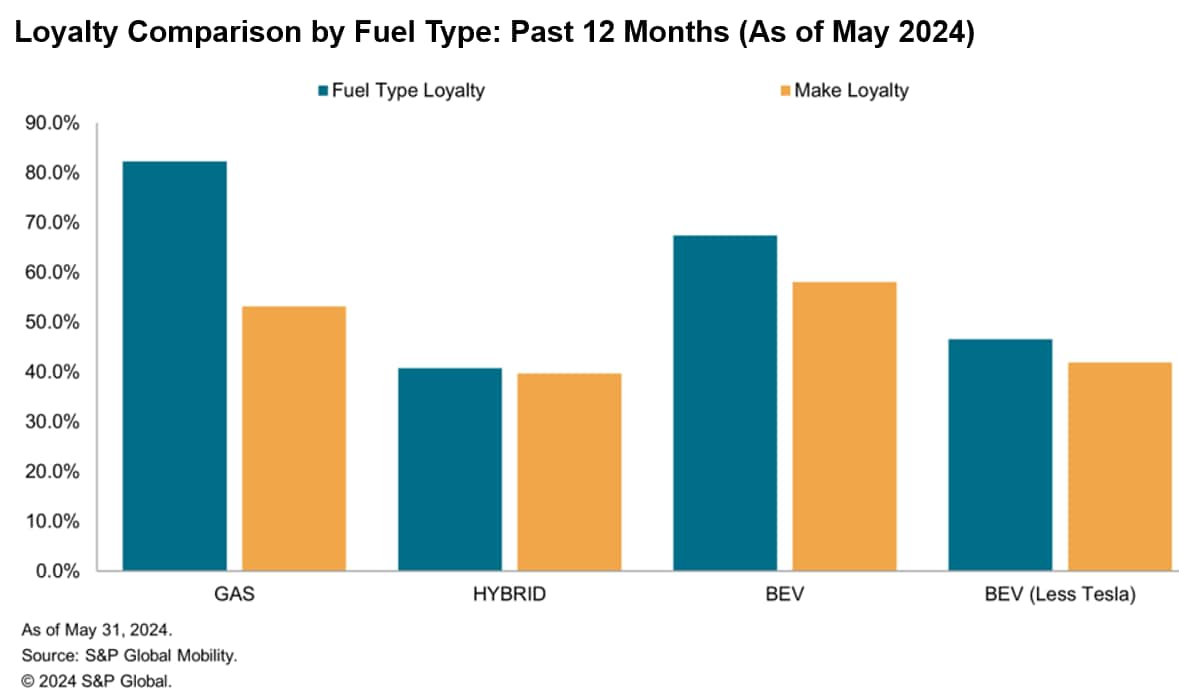

The Tesla effect among BEV households can better be explained when comparing loyalty to fuel type versus brand. Given its early market entry, Tesla had the advantage of building a reputation as the leader in this field, yielding strong loyalty to the brand as well as the fuel type.

When looking at all BEVs, the results show these households have high loyalty to the fuel type (68%) and the brand (58%). But if you just looked at Tesla, the loyalty numbers are even higher (76% fuel type / 67% brand). Removing Tesla from the mix causes a drastic shift, with loyalty to the fuel type dropping to 47% and brand loyalty falling to 42%. These numbers are more in line with hybrid vehicles (41% fuel type / 40% brand).

While an assumption could be made that the lower fuel type loyalty can be attributed to non-Tesla buyers having more gas options within the brand they purchased an EV from, this is not the case. What the data shows is non-Tesla households, who come from either a hybrid or BEV, are not very loyal and are more likely to defect away from both the powertrain and brand with the next purchase.

Although the current state of retention among hybrids and BEVs, outside of Tesla, is challenging, continued investment in infrastructure and new model production could help strengthen these numbers in the future. Growing familiarity with the technology and a larger pool of available options will help in giving returning households more reasons to commit to alternative powertrain vehicles with their next purchase.

Register for our loyalty trends webinar.

Demo our loyalty analytics tool.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.