Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsAuto-finance delinquencies rise past Great Recession peak, but…

The surge is concentrated primarily in subprime, with remaining categories remaining near historic norms. Tightening credit means recent-vintage loans should stabilize the market.

With American households battling inflation and rising interest rates, auto lenders are seeing increased occurrences of auto-loan delinquencies - but almost entirely in the subprime segment.

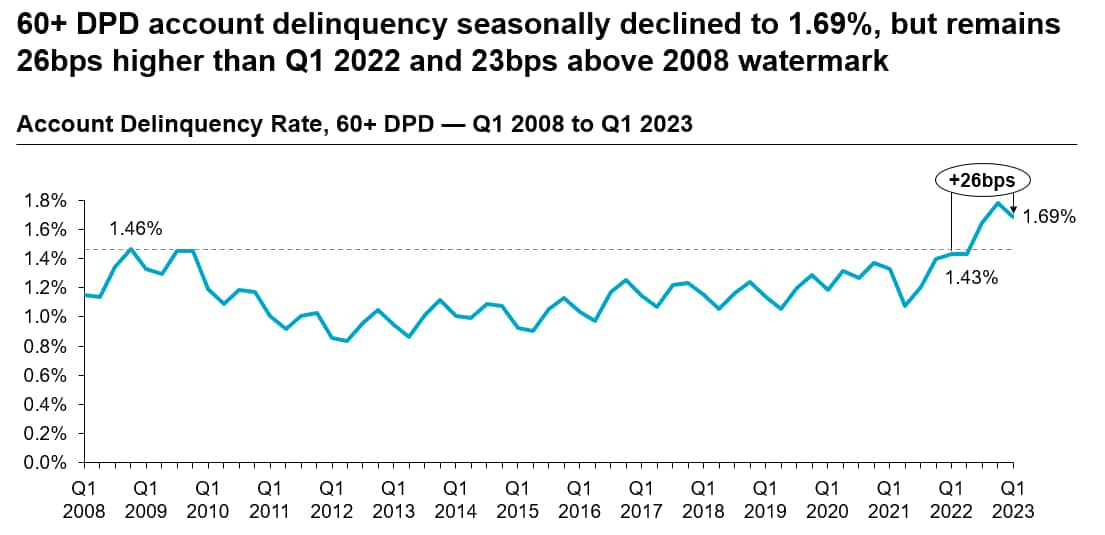

Surpassing levels last seen during the Great Recession, account-level delinquency rates of auto loans 60+ days past due (DPD) have risen 26 basis points from Q1 2022's 1.43% to 1.69% in Q1 2023, according to a recent Credit Industry Insight Report (CIIR) by TransUnion.

This has resulted in captive finance companies, banks, credit unions and independent lenders tightening underwriting standards on new- and used-vehicle loans to stem losses due to charge-offs, according to TransUnion / S&P Global Mobility AutoCreditInsight.

Source: AutoCreditInsight by S&P Global Mobility, TransUnion

That said, there is nuance in the numbers, and TransUnion and

S&P Global Mobility analysts urged caution in drawing

sensationalistic conclusions across the broader auto-financing

market.

The spike in delinquencies is not impacting a large slice of lenders - represented by OEM captive finance companies and major banks - doing near-prime, prime, prime-plus and super-prime originations. The brunt of the delinquencies is being felt by the independent lenders who operate in the subprime space and primarily lend for used-vehicle purchases.

"The interest rate rise is squeezing the monthly budget for the average American consumer," said Jill Louden, product management associate director for S&P Global Mobility. "Consumers set aside money monthly for housing, vehicles, and insurance, but may not pay other obligations with the same frequency, such as medical bills and credit cards. People need their vehicles to get to work to make money and pay their obligations."

Here is where the nuance really comes in. "Vintage performance" - which reflects the performance of an account in different periods of time after the loan was originated - continues to show relatively strong results in the new-vehicle segment, with more recent vintages remaining at pandemic-era lows and performing better than the pre-pandemic portfolio at the same age.

And while the used-vehicle portfolio's vintage performance had a worse start out the gate in H1 2022, lenders reacted quickly to manage delinquencies - resulting in originations in the second half of '22 showing improved performance at the same vintage, according to the TransUnion report.

"We continue to pay close attention to delinquencies, while seeing positive signs among vintage data," said Satyan Merchant, senior vice president and automotive business leader at TransUnion.

Source: AutoCreditInsight by S&P Global Mobility, TransUnion

The used-vehicle market is expected to remain tight, as the low

level of new car sales starting in 2020 means fewer recent

model-year used cars available, Merchant added. Going forward,

affordability remains critical to consumers, particularly those

with credit scores below prime.

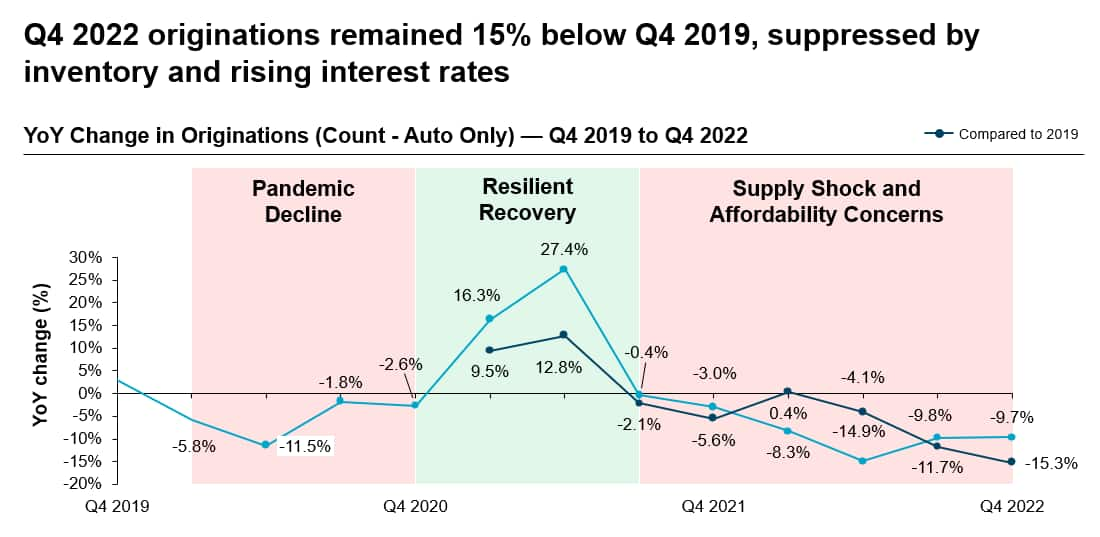

The tighter underwriting standards for auto loans, plus higher interest rates, combined with a renewed squeeze in used-car inventories and prices, have resulted in a decrease in loan originations. Originations for Q1 2023 are the lowest in four years: 5.87 million in Q1 2022 vs. Q1 2020 at 6.88 million, just as the pandemic started.

Source: AutoCreditInsight by S&P Global Mobility, TransUnion

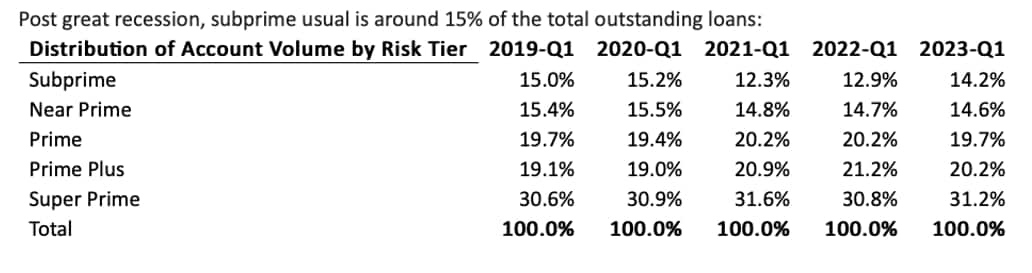

As the pandemic struck in earnest, lenders began pulling back from

the deteriorating subprime market as the shuttered economy

triggered massive job losses. On average, subprime volume since the

Great Recession of 2008-11 has held steady at around 15% of total

outstanding loans - but dipped to 12.3% and 12.9% respectively in

Q1 2021 and Q1 2022 before rebounding to 14.2% in Q1 2023.

"Driven by lower inventories and higher interest rates, originations remain down from the same quarter a year ago," Merchant said. "However, as production begins to catch up to demand, there is hope that this trend will reverse course soon, at least among new cars."

Source: AutoCreditInsight by S&P Global Mobility, TransUnion

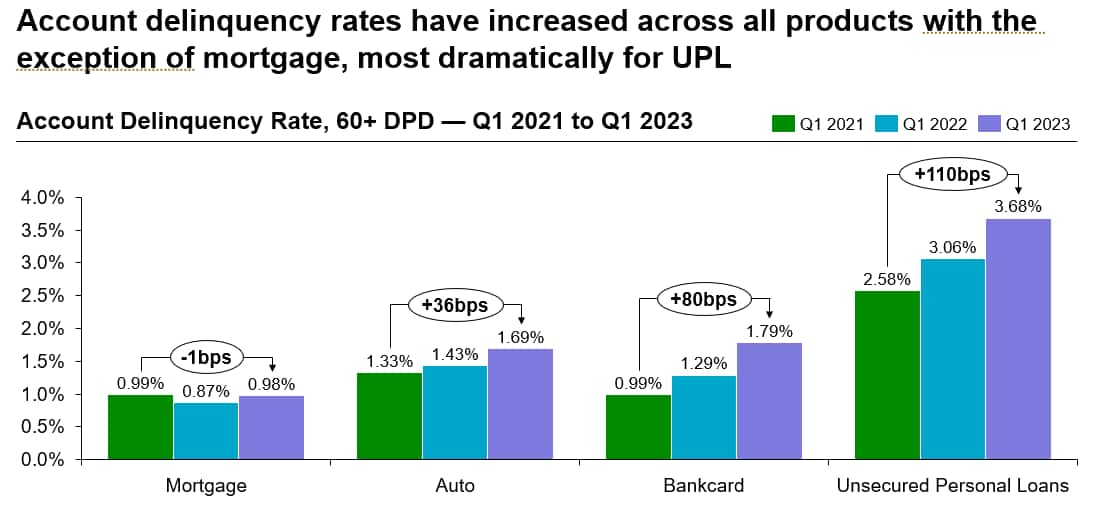

But if misery loves company, the U.S. automotive lending industry

is not alone. Account delinquency rates since Q1 2021 have

increased across most of the major lending products, except when

mortgages which declined in 12 basis points (bps) in Q1 2022 and

regained 11 bps in Q1 2023 to remain relatively flat from Q1 2021

to Q1 2023, according to the report.

Source: TransUnion US consumer credit database

The tougher pills to swallow are the 60+ DPD account delinquency

rates in bankcards and unsecured personal loans (UPL). In a

two-year span since Q1 2021, the delinquency rate for the massive

bankcard industry has risen 80 basis points from 0.99 percent to

1.79 percent. Meanwhile, in that same time span, UPLs have risen

110 basis points from 2.58 percent to 3.68 percent.

TO SUBSCRIBE TO AUTO CREDIT INSIGHTS

LOWER-CREDIT BUYERS PUSHED OUT OF NEW VEHICLES

THE AUTO INDUSTRY SHARE WARS WILL RESUME IN '23

AVERAGE VEHICLE AGE REACHES RECORD 12.5 YEARS

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.