Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsApril Auto Sales to Sustain Spring Volume Push

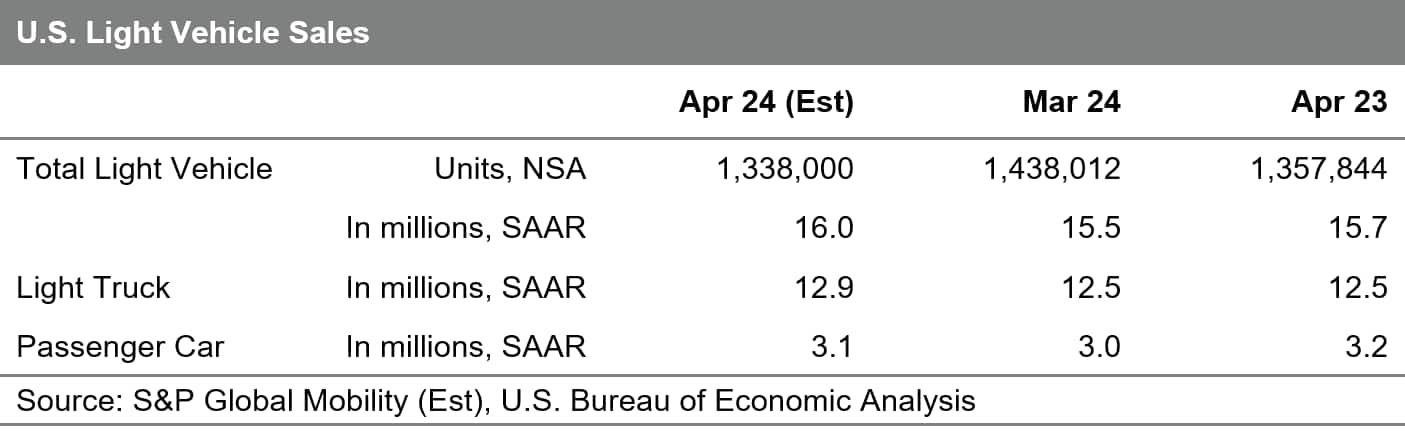

While expected to be below the March 2024 volume total, new light vehicle sales volume in April should sustain some of the spring selling momentum.

Key Takeaways:

- April US auto sales expected to reach 1.34 million units.

- Advertised retail inventory in April is 65% higher compared to last year.

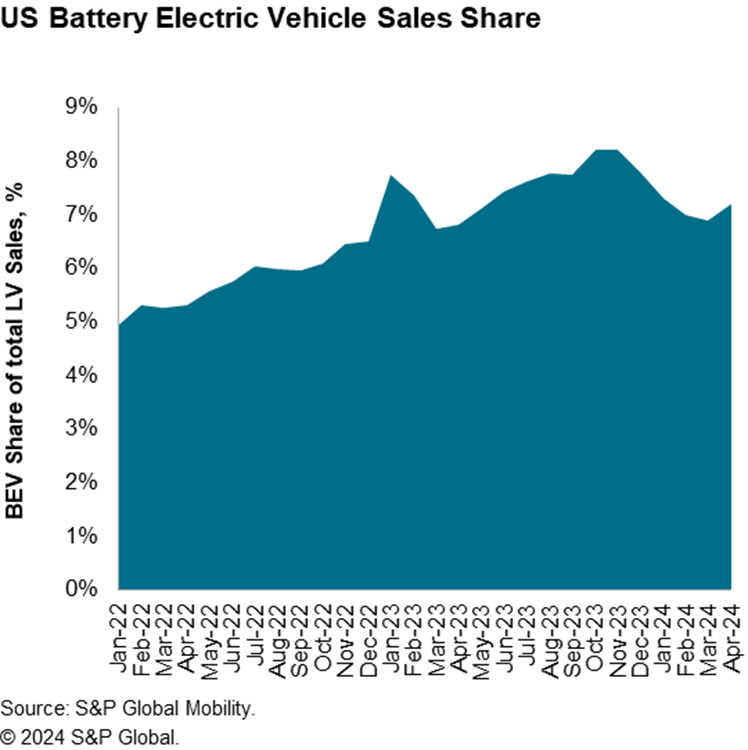

- BEV share is expected to reach 7%, similar to March.

- Calendar-year 2024 light vehicle sales volume projected to hit 16.0 million units, a 3% increase from 2023.

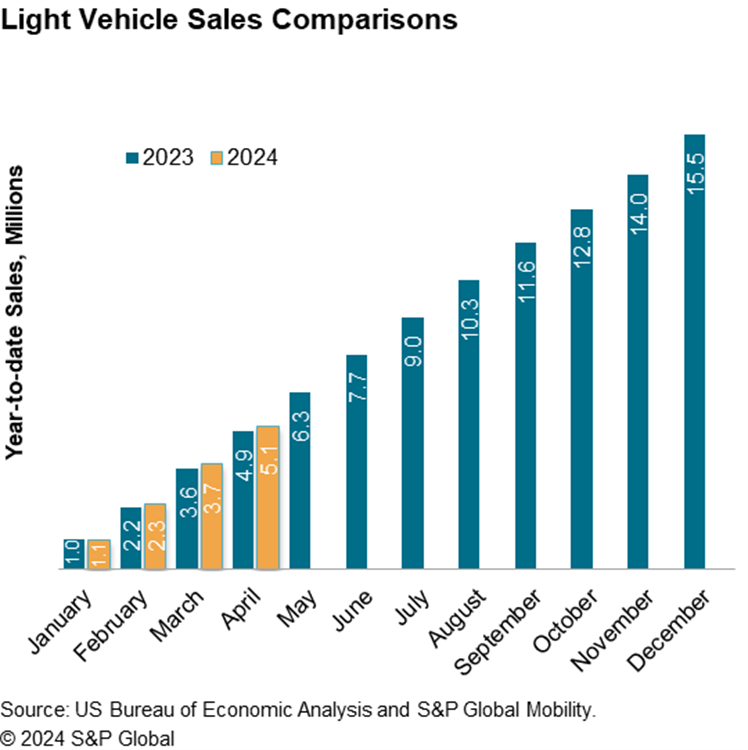

S&P Global Mobility projects new light vehicle sales volume in April 2024 to reach 1.34 million units. While this unadjusted volume total would be a drop from both the month prior (down 7%) and year-ago (down 2%) levels, two fewer selling days than March 2024 and one less than April 2023 more than account for any potential declines. This volume would translate to an estimated sales pace of 16.0 million units (seasonally adjusted annual rate: SAAR), just the third time in the past 24 months the metric has reached this level.

"With an auto sales environment currently defined by the mixed signals of advancing inventory and incentives, together with affordability concerns from high interest rates and still-high vehicle prices, the anticipated April result reflects that consumers are still in the market for a new vehicle," said Chris Hopson, principal analyst at S&P Global Mobility.

Retail-advertised inventory continues its steady rise, and stands now at 2.97 million units, an increase of 65% vs. last year. While most dealer inventory comprises 2024 and some 2025 model year vehicles, pockets of older inventory remain.

"Consumers in the market for a new vehicle are increasingly able to find opportunities for discounts coming from the availability of more vehicles in dealer inventory," said Matt Trommer, associate director at S&P Global Mobility.

The supply side of the auto equation is continuing to show signs of advancement, hinting at sustained growth for inventories and incentives moving through 2024. According to Joe Langley, associate director at S&P Global Mobility, "The outlook for North American light vehicle production for 2024 was revised higher by 1.5% to 16.0 million units on demand resilience and more importantly on stronger production results, indicating minimized impact of supply chain issues."

"Advancing production levels set the stage for incentives and inventory to continue to develop, potentially enticing new vehicle buyers who remain on the sidelines due to higher interest rates," said Hopson. "It will be a bumpy ride and month-to-month sales volatility is likely. S&P Global Mobility projects calendar-year 2024 light vehicle sales volume of 16.0 million units, a 3% increase from 2023."

Continued development of battery-electric vehicle (BEV) sales remains an assumption in the longer term S&P Global Mobility light vehicle sales forecast. In the immediate term, some month-to-month volatility is anticipated. April BEV share is expected to reach 7%, similar to March, as Telsa volumes are likely to be reflective the first quarter levels. BEV share is expected to advance over the next several periods though, supported by the pending the launches of vehicles such as the Chevrolet Equinox EV, Honda Prologue and Fiat 500e, all scheduled for market introductions over the first half of 2024, as well as advancing Tesla Model 3 and Cybertruck sales.

Learn More: S&P Light Vehicle Sales Forecast

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.