Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer LoginsA Breakdown on Europe’s Chinese EV Tariffs

The S&P Global Mobility AutoIntelligence service provides daily analysis of global automotive news and events, providing our clients timely context and impact analysis for navigating the fast-moving industry. This Behind the Headlines series offers a bi-weekly dive into the most recent top stories.

November 2024 updated analysis available.

Tariffs on Chinese-made EVs will impact automakers in Europe and China, plus the global supply chain.

The European Commission put provisional tariffs on Chinese battery electric vehicles (BEVs) as of July 5, 2024. An investigation, which began in September 2023 and concluded in June 2024, by the EU's legal arm determined that the BEV value chain in China benefits from unfair subsidization—causing a threat of economic injury to European Union (EU) BEV producers. The investigation also examined the likely consequences and impact of these tariffs on BEV importers and consumers in the EU.

The commission imposed different levels of duty on the three main Chinese OEMs—SAIC, BYD and Geely—influenced by what they described as the amount of cooperation received from each, among other factors. The full breakdown is:

- BYD is subject to 17.4% additional duty for its Chinese-made vehicles sold in the EU.

- The individual duties for Geely and SAIC are 19.9% and 37.6%, respectively.

- Other BEV producers in China who cooperated but were not as thoroughly investigated are subject to a 20.8% weighted average duty.

- The duty for other non-cooperating companies is 37.6%.

These provisional duties will apply for a maximum duration of four months, during which period EU member states will vote and a final decision will be made. If approved, definitive duties would be in place for five years. Tesla is the largest China-based exporter to the EU by volume, and it may receive an individually calculated duty rate at the definitive stage.

There has been pushback from the mainland China automakers affected, including SAIC who has requested a hearing. SAIC insists that its cooperation and evidence was unfairly evaluated by the Commission.

With the US imposing 102.5% tariffs on Chinese EVs and Canada considering similar duties, these measures imposed by the EU add to China's concerns that domestically based companies will face more trade barriers in global markets and will be pressured to shift production somewhere else. Turkey has joined the countries imposing a tariff, while in Brazil the regional automakers' association is now calling for a 35% import tax.

However, perhaps counterintuitively, German automakers and the industry oppose the import tariffs. The German Association of the Automotive Industry (VDA) has argued that the tariffs would not only affect Chinese manufacturers but also European companies and their joint ventures in China in particular. "This is because a large proportion of vehicle imports from China into the EU come from European and American manufacturers," said the VDA.

The association further warned of the possibility of countermeasures from China; one potential is reports that Chinese automakers have requested the country's government to impose import tariffs on EU-made vehicles with large engine displacements. In 2023, China was the third-largest export market for German-made cars, in terms of units, after the United States and the United Kingdom. Volkswagen and BMW also issued statements opposing the duties. Outside of Germany, Stellantis CEO Carlos Tavares expressed similar criticism.

The hefty duties will slow down the pace of some smaller-scale mainland China-based automakers seeking to launch EV sales in Europe with exported models. Major Chinese carmakers such as BYD, however, are determined to expand into the global market.

For these larger players, production outside of China may be an option that skirts tariffs. BYD is expanding, including recently opening a plant in Thailand, considering a plant in Mexico, developing a manufacturing base in Brazil, setting up a European production plant in Hungary, and working with the Turkish government to set up a site there.

While the duties are meant to protect businesses long-term, there are often unintended consequences of such actions which can take years to reveal themselves. The reaction of the European automakers also demonstrates the complexity, as the tariff has potential to hurt their business in both the EU and China. Western automakers planning or already exporting from mainland China to global markets, including the EU, North America and Brazil, will also have to rethink sourcing plans.

In the immediate term, consumers in the EU may well face higher prices for BEVs. Tesla, MG and China's NIO have already indicated they may raise European prices of their Chinese-made models following the EU's decision. China may also retaliate with tariffs against goods or services outside the auto industry.

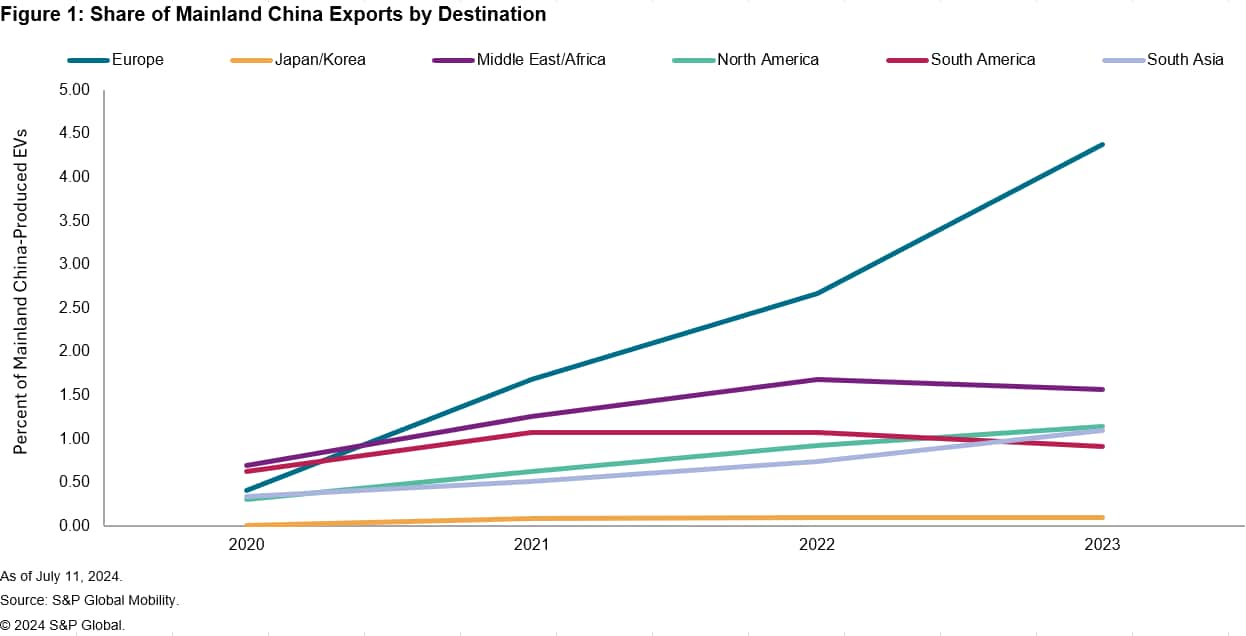

As a share of mainland China exports, Europe has grown from seeing less than 0.5% of exports from the country in 2020 to 4.4% in 2023; Europe is the largest region for mainland China exports today, followed by Middle East/Africa, at 1.6%, according to the June 2024 S&P Global Mobility light vehicle production forecast. In 2020, nearly 93% of the vehicles produced in mainland China remained in the country. In 2023, 84% of the vehicles produced in the country were sold there. Over that same period, light vehicle production in mainland China grew 23%, from 23.3 million units in 2020 to 28.8 million in 2023.

Battery manufacturing ups and downs

Increasing battery manufacturing is among the elements needed for BEVs to be successful, in the sense that it contributes to reducing cost. However, BEV adoption is in a particularly choppy phase, likely to last through 2026, with inconsistent and uneven growth.

Against that backdrop, Swedish battery company Northvolt recently announced a strategic review of its business, due to be completed in third quarter 2024, evaluating timelines and capital allocation. The company reported 19% growth in revenues in 2023, to US $128 million, but also 106% increase in adjusted losses, to US $569 million. The company's CEO indicated that there may be a refocus to plans already in process, with projects not yet started being reined in for now.

On the other hand, Hyundai and LG Energy Solutions inaugurated their joint venture battery plant in Indonesia on July 2 (production started earlier in the second quarter). The plant has an annual capacity of 10 gigawatt hours (GWh). In the US, a joint venture between PACCAR, Daimler Truck and Cummins, called Amplify, broke ground on a new plant due for production to start in 2027 with annual production capacity of 21 GWh. And Stellantis announced a collaboration with a French research organization looking to develop next-generation battery cell technology, though it's unclear when that project will result in production-ready technology.

Get Free Trial of AutoIntelligence.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.