Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

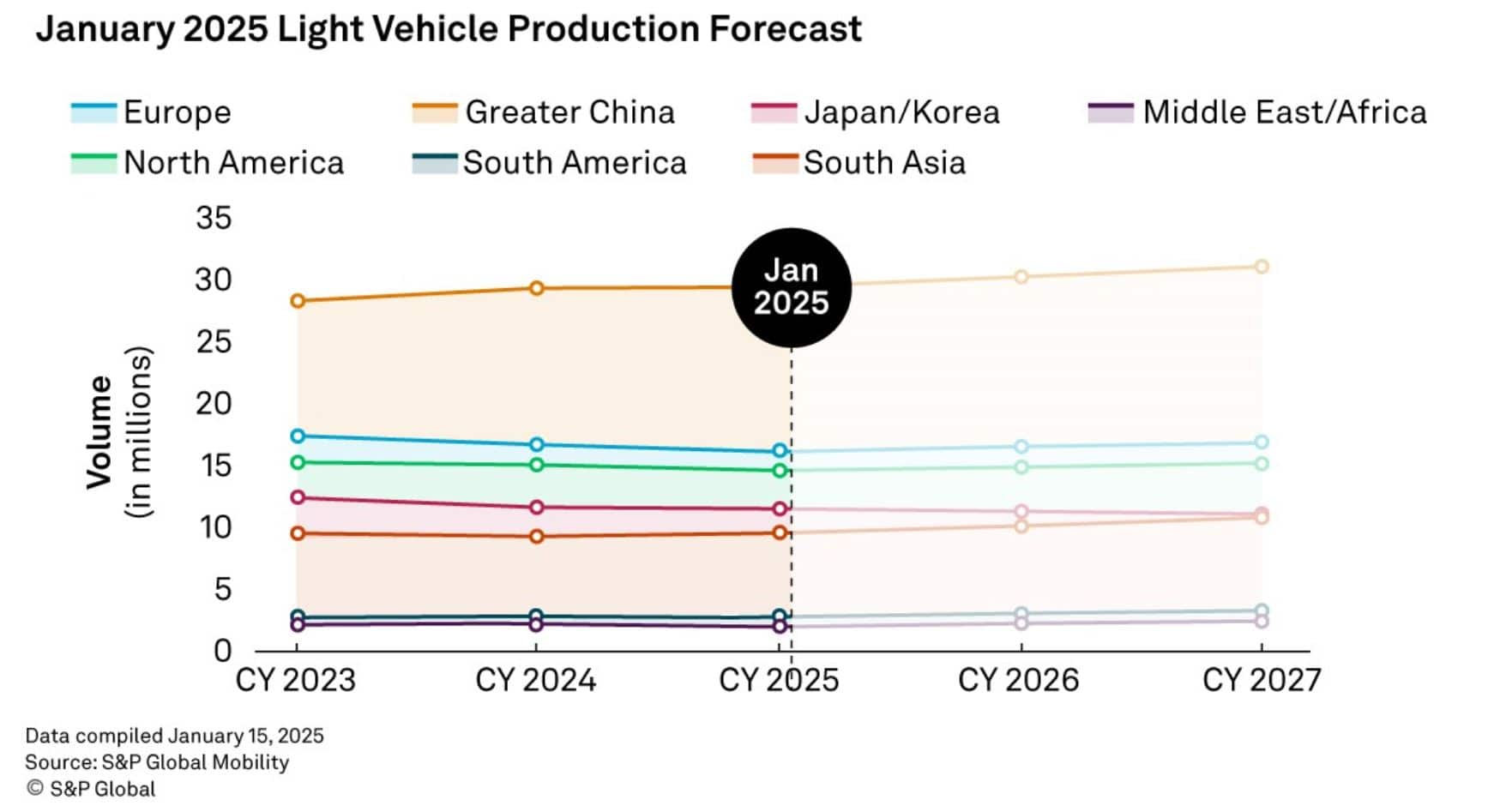

Customer LoginsJanuary 2025 Light Vehicle Production Forecast

Each month, we leverage global light vehicle production actuals, registration data, and sales data to provide the most up-to-date, short-term production forecast available.

Here's a closer look at global production data by region and our updated January production forecast.

Top Takeaways for the Month

As we enter 2025, the global auto industry presents a landscape of mixed opportunities and challenges. Market dynamics are influenced by varying demand levels, regulatory changes, and geopolitical factors. The propulsion mix is evolving, with some regions experiencing slower electric vehicle (EV) adoption while others show promising growth. The incoming Trump administration's anticipated revisions to US emissions standards are expected to significantly impact battery electric vehicle (BEV) production and market share.

Regional Highlights

Europe: The light vehicle production outlook for Europe has been adjusted upward by 34,000 units for 2025 and 47,000 units for 2026, while also reflecting a positive adjustment of 86,000 units for 2024. This growth is driven by strong performances from manufacturers like Volkswagen, Stellantis, and Toyota, particularly in the ICE segment. However, a projected decline of 10.5% year-on-year in Q4-2024 output indicates ongoing challenges, with an overall expected decrease of 3.0% in 2025 before a modest recovery in 2026.

Greater China: Greater China's light vehicle production outlook has been increased by 319,000 units for 2025, buoyed by robust domestic demand and scrappage incentives. December 2024 saw a year-over-year growth of 9%, with new energy vehicles (NEVs) capturing over 50% market share in H2-2024. The government's scrappage subsidy extension is expected to further support production growth, leading to an anticipated total output of 30.1 million units in 2024, representing a 3.8% increase from the previous year.

Japan/Korea: Japan's short-term production forecast has been reduced by approximately 30,000 units annually due to expected US tariff impacts on US domestic demand. Conversely, the long-term outlook has been upgraded by 140,000 units, driven by anticipated stronger demand for ICE models in the US. South Korea's production forecast for 2025 has been lowered by about 20,000 units, reflecting local demand challenges stemming from recent political instability.

North America: The North American light vehicle production outlook has seen a slight increase of 7,000 units for 2025 and 2026. The market remains stable but is subject to uncertainties due to the incoming administration's policies and inflationary pressures. Significant reductions in BEV production forecasts highlight a shift towards ICE vehicles, with over 1.7 million units of dedicated BEV nameplate production removed from projections through 2032.

South America: The South American light vehicle production outlook has been slightly decreased by 2,000 units for 2025 and 9,000 units for 2026, with a minor increase of 2,000 units for 2027. Overall, the production landscape appears stable, with adjustments primarily reflecting demand changes. Long-term forecasts indicate a modest downward revision of 1.1% in production volumes, aligning with evolving market demand.

South Asia: The outlook for South Asia has been raised by 70,000 units for 2025, driven by positive developments in the Indian market, particularly for EVs. However, challenges persist in the ASEAN region due to stricter auto loan policies and a sluggish market in Indonesia. The overall ASEAN production forecast reflects ongoing economic uncertainties and trade tensions, with a slight downgrade for 2026 as recovery may take longer than expected.

Download a free light vehicle production forecast here.

Subscribe to this newsletter on LinkedIn.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.