Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 20, 2020

Week Ahead Economic Review: Week of 23 March 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

- Flash PMIs for the US, Eurozone, UK, Japan and Australia

- COVID-19 policy response, including Bank of England Policy meeting

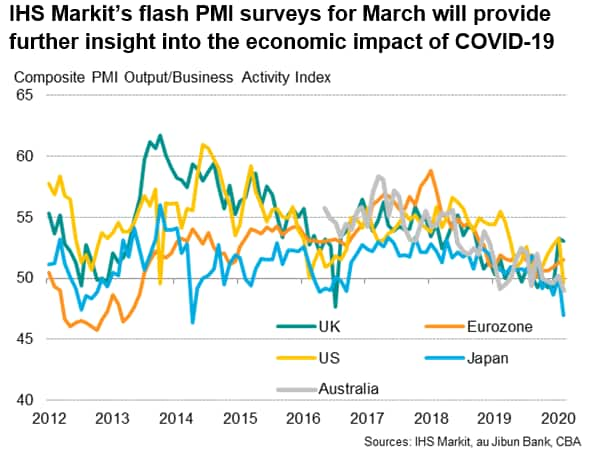

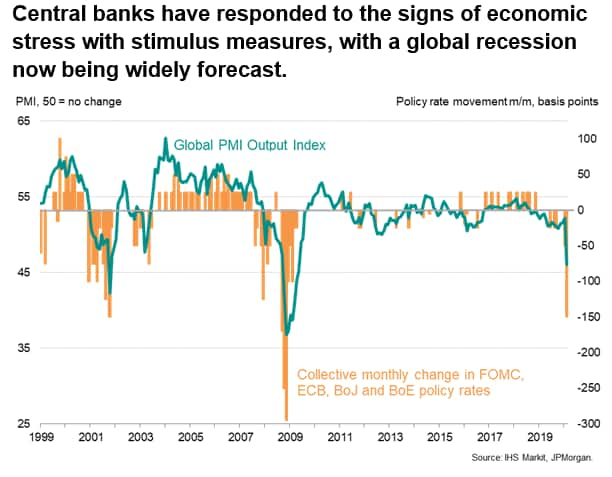

With the global economy facing recession and markets showing increased signs of stress, flash PMI surveys will be eagerly watched for the extent of the economic impact of the COVID-19 outbreak in March. The March flash PMI data for the US, Eurozone, UK, Japan and Australia follow worldwide PMI surveys which showed the global economy contracting at the steepest rate since 2009 in February as the coronavirus disrupted manufacturing supply chains and hit service sectors such as travel, tourism, restaurants and transport.

In the US, the IHS Markit PMIs will come on the heels of February numbers which had indicated one of the toughest months for business since the global financial crisis. Although recent weeks have seen news of stimulus from both the Federal Reserve and the government, including a slashing of rates to near zero, markets are fearing even worse numbers to come with recession now forecast. Regional Fed surveys and the University of Michigan consumer survey will also be eagerly assessed for virus impact in March (page 3).

The Eurozone and UK PMIs had meanwhile shown surprising resilience in February, but the spread of COVID-19 has since widened markedly into Europe, meaning March flash surveys will likely reflect widespread disruptions to business across the region. The UK flash PMI comes out ahead of the Bank of England's first scheduled Monetary Policy Committee meeting with new governor Andrew Bailey at the helm, although two emergency meetings so far in March have already taken the base rate to a new all-time low of 0.1% and instigated a new asset purchases programme, which accompanies a new quantitative easing programme in the eurozone (page 4).

In Asia, expectations of a weak set of PMI data for Japan would cement fears of the economy already being in recession after the contraction seen late last year due to the sales tax hike, while Australia's PMI will be eyed for the impact of travel restrictions on tourism in particular (page 5). Elsewhere, a focus is likely to remain on the recent US dollar's rise, notably in emerging markets with high dollar debt servicing burdens.

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

Recent week ahead economic previews

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-review-week-of-23-march-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-review-week-of-23-march-2020.html&text=Week+Ahead+Economic+Review%3a+Week+of+23+March+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-review-week-of-23-march-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Review: Week of 23 March 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-review-week-of-23-march-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Review%3a+Week+of+23+March+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-review-week-of-23-march-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}