Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 10, 2025

Week Ahead Economic Preview: Week of 13 October 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US shutdown prompts more data worries as policy clues are sought

Clues as to the path of US interest rates will hopefully be provided from updated inflation numbers and economic activity data, but a prolonged government shutdown would mean a lack of key US data releases, engendering more uncertainty in the markets and heightened growth worries. US tariff impact will, however, be monitored via industrial production numbers for the US as well as trade numbers out of mainland China and the eurozone. In the UK, labour market and GDP come under scrutiny.

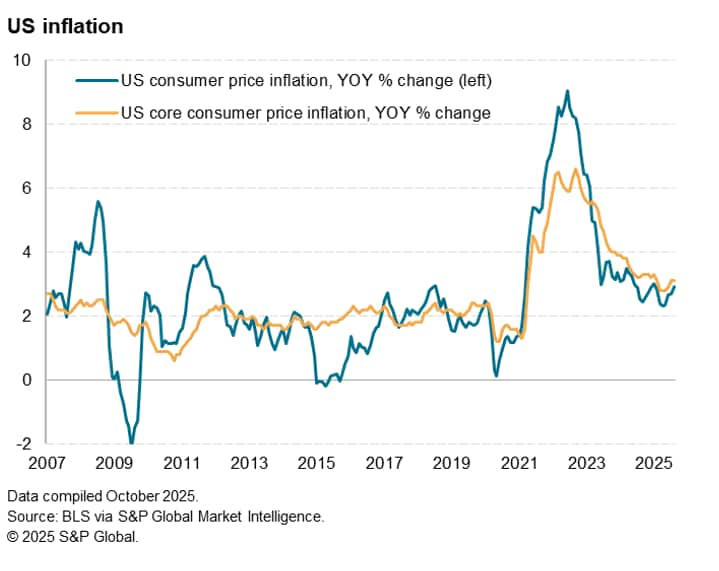

At the time of writing, an ongoing federal government shutdown is set to affect US data releases in the coming week, including consumer and producer price inflation numbers, as well as retail sales data. The markets are expecting consumer prices to have risen 0.3% after a 0.4% rise in August, but for core inflation to hold steady at 0.3%. Producer prices are meanwhile anticipated to have risen 0.3% after a surprise 0.1% drop in August. Weakening price trends will add to the odds of a further FOMC rate cut, but the case for lower rates will also likely hinge on the activity data. Fed-compiled industrial production data could therefore prove the US data highlight of the week, alongside New York and Philly Fed surveys.

Trade and inflation data are meanwhile issued for mainland China, as are industrial production and trade data for the eurozone. The data will be scoured for clues as to the impact of US tariffs, though to also see whether domestic factors such as increased fiscal spending may be offsetting some of the dampening impact of the levies.

GDP data for August and the latest official labour market data will be digested by UK economy watchers keen to gauge fiscal implications ahead of November's Budget. Prior data showed the economy flatlining in July and ongoing steep job losses, the latter largely blamed on last year's Budget. Recent PMI survey data have also disappointed, likewise signalling a stagnating economy and falling employment. More weak data could tip the scales further toward rate cuts by the Bank of England. The Bank held rates steady at 4.0% at its last meeting, but two of the nine policymakers voted to cut rates due to growth concerns.

S&P Global will also be publishing the Investment Manager Index (IMI) survey, revealing how institutional US equity investor sentiment trends have changed in October. Last month's survey showed heightened risk aversion amid worries over valuations and the political environment.

If released, US inflation numbers will be watched for signs of tariff levies being passed through to end consumers. So far, the inflation numbers have not risen as much as many analysts had feared, but headline inflation was up to 2.9% in August with core at 3.1%, and it remains early days in terms of the degree to which the import levied might be expected to impact high street prices.

Key diary events

Monday 13 Oct

Americas

Canada Market Holiday

- Brazil Business Confidence (Oct)

EMEA

- Germany Current Account (Aug)

APAC

Japan, Thailand Market Holiday

- China (Mainland) Trade (Sep)

- India Inflation (Sep)

Tuesday 14 Oct

S&P Global Investment Manager Index* (Oct)

Americas

- Canada Building Permits (Aug)

EMEA

- UK BRC Retail Sales Monitor (Sep)

- Germany Inflation (Sep, final)

- UK Labour Market Report (Aug)

- France IEA Oil Market Report

- Eurozone ZEW Economic Sentiment (Oct)

- Germany ZEW Economic Sentiment (Oct)

APAC

- Singapore GDP (Q3, adv)

- Australia NAB Business Confidence (Sep)

- Australia RBA Meeting Minutes (Oct)

- India WPI (Sep)

- China (Mainland) New Yuan Loans, M2, Loan Growth (Sep)

Wednesday 15 Oct

Americas

- Brazil Retail Sales (Aug)

- Canada Manufacturing Sales (Aug, final)

- US Inflation (Sep)

- US NY Empire State Manufacturing Index (Oct)

EMEA

- Germany Wholesale Prices (Sep)

- France Inflation (Sep, final)

- Spain Inflation (Sep, final)

- Eurozone Industrial Production (Aug)

APAC

- China (Mainland) Inflation (Sep)

- Japan Industrial Production (Aug, final)

- India Unemployment (Sep)

- India Trade (Sep)

Thursday 16 Oct

Americas

- Canada Housing Starts (Sep)

- US PPI (Sep)

- US Retail Sales (Sep)

- US Initial Jobless Claims

- US Philadelphia Fed Manufacturing Index (Oct)

- US Business Inventories (Aug)

- US NAHB Housing Market Index (Oct)

EMEA

- UK monthly GDP, incl. Manufacturing, Services and Construction

Output (Aug)

- Italy Inflation (Sep, final)

- Eurozone Balance of Trade (Aug)

- Italy Balance of Trade (Aug)

APAC

- Japan Machinery Orders (Aug)

- Australia Employment Change (Sep)

Friday 17 Oct

Americas

- US Building Permits (Sep, prelim)

- US Housing Starts (Sep)

- US Industrial Production (Sep)

- US Capacity Utilization (Sep)

EMEA

- Eurozone Inflation (Sep, final)

APAC

- South Korea Export and Import Prices (Sep)

- South Korea Unemployment Rate (Sep)

- Singapore Non-Oil Domestic Exports (Sep)

- Malaysia Balance of Trade (Sep)

- Malaysia GDP (Q3, prelim)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-october-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-october-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+13+October+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-october-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 13 October 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-october-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+13+October+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-13-october-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}