Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 09, 2025

Currency gains help to relieve inflationary pressures in sub-Saharan Africa

A number of economies in sub-Saharan Africa have seen inflationary pressures wane in recent months amid currency appreciation versus the US dollar. In turn, this is allowing central banks to lower interest rates, helping business activity in the region to expand solidly. PMI® data and the anecdotal evidence provided by our survey respondents can help to illustrate the impact of currency movements.

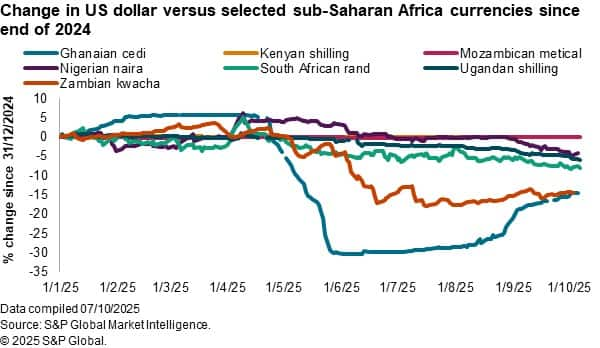

Range of currencies gain versus the US dollar in 2025

Of the seven economies in sub-Saharan Africa for which S&P Global compile PMI surveys, five have seen currency appreciation against the US dollar over the course of 2025 so far. While this to some extent reflects the weakness of the dollar itself this year, there have also been positive factors supporting local currencies, including support from IMF programmes, fiscal consolidation and tight monetary policy.

In particular, the Ghanaian cedi and Zambian kwacha have each appreciated by 15% against the US dollar in 2025 so far, while the South African rand and Nigerian naira have also seen gains.

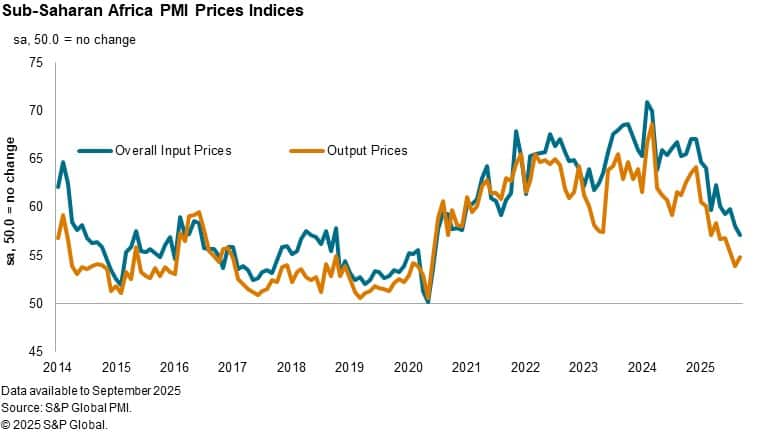

Currency appreciation has contributed to a sustained easing of inflationary pressures in the sub-Saharan Africa business sector. PMI data showed that overall input costs increased at the slowest pace since the COVID-19 pandemic in September. While selling prices rose at a slightly faster pace than in August, here too the pace of inflation was among the weakest in the past five years.

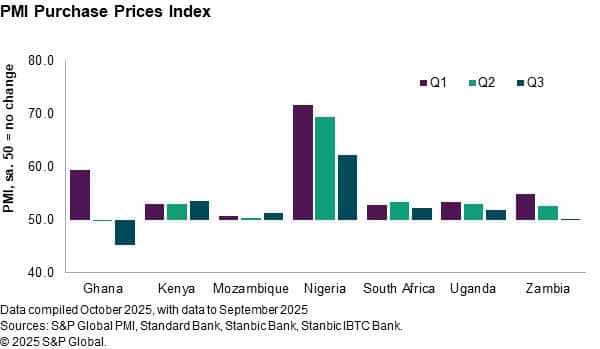

Country level PMI data show that most of the economies we cover in sub-Saharan Africa have seen either a slowdown in inflation of purchase costs or outright falls in prices over the course of 2025. Those countries seeing the strongest currency appreciations against the US dollar - Ghana and Zambia - have recorded periods of decreasing purchase prices. Such price falls are rarely seen among the sub-Saharan Africa PMIs, which normally suffer from marked inflationary pressures. Even Nigeria, where purchase costs continued to rise sharply during the third quarter, posted the weakest pace of inflation since March 2020.

Survey comments highlight impact of currency gains

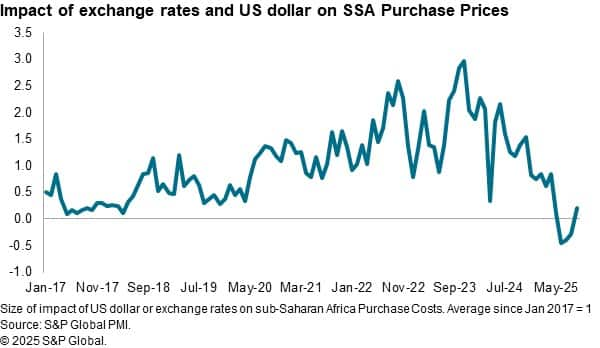

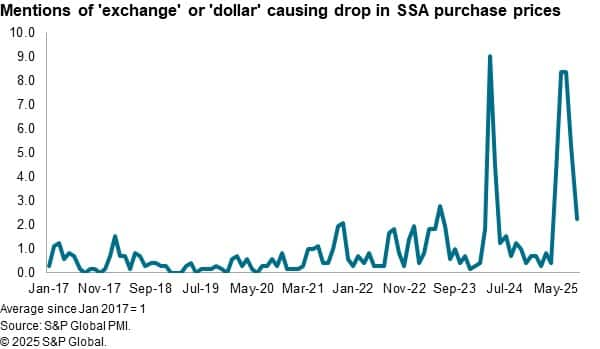

Anecdotal evidence from our PMI surveys can help us to see what is driving the drop in price pressures in the region, with comments from panellists highlighting the impact of currency appreciation on purchase costs.

Normally we see any references to exchange rates or the dollar being linked to rises in purchase prices as downward pressure on local currencies feeds through to higher costs for imported items and those priced in dollars. But between June and August this year we recorded more mentions of these factors pushing down prices rather than lifting them; the only time this has been the case since we have had the full complement of seven sub-Saharan Africa PMI surveys.

Similarly, recent months have seen above-average mentions of either exchange rates or the dollar causing a drop in purchase prices, to a degree second only to that seen in April 2024, when firms in Kenya were responding to a substantial appreciation of the shilling against the US dollar.

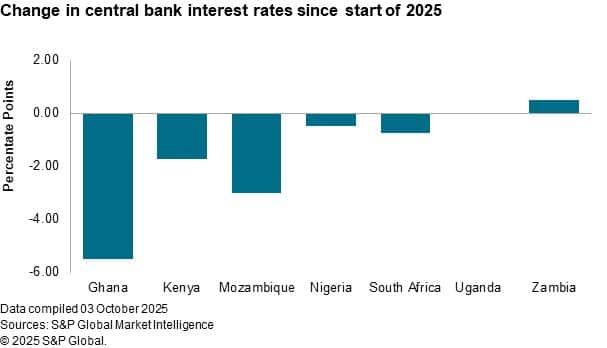

Central banks lower interest rates amid waning inflation

Easing inflationary pressures have enabled central banks across much of the region to lower their interest rates over the course of 2025. Of the seven economies we cover, five have lower levels of interest rates now than at the start of the year. Most notably is Ghana, where the central bank has cut rates by 650 basis points in the past two meetings. Interest rates in Uganda are at the same level as they were at the start of 2025, while only Zambia has posted an increase. Here though, S&P Global Market Intelligence expects a cut of 50-100 basis points at the upcoming November monetary policy committee meeting.

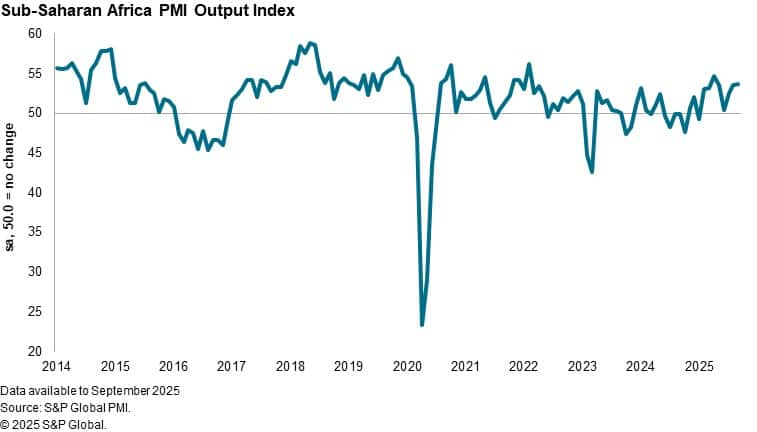

Output rises solidly at end of third quarter

The softening inflation environment has coincided with a period of solid growth in the sub-Saharan Africa private sector. September saw output increase at the fastest pace in five months in response to higher inflows of new orders. Employment rose for the twelfth month running, while firms increased their purchasing activity and inventory holdings.

Most notably, the Stanbic Bank Zambia PMI signalled the fastest rise in business activity since June 2023, while Stanbic Bank PMI data for Kenya signalled a return to growth following mid-year disruptions caused by protests. The only economy covered by PMI data to see a drop in output during September was Ghana, but even here new orders expanded and business confidence remained elevated, meaning that we could potentially see renewed growth in the months ahead.

Overall, the sub-Saharan Africa private sector enters the final quarter of the year on a solid footing, in part at least due to the currency gains seen over the course of 2025 so far.

Access the global PMI press releases.

Andrew Harker, Economics Director, S&P Global Market Intelligence

Tel: +44 134 432 8196

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcurrency-gains-help-to-relieve-inflationary-pressures-in-subsaharan-africa-Oct25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcurrency-gains-help-to-relieve-inflationary-pressures-in-subsaharan-africa-Oct25.html&text=Currency+gains+help+to+relieve+inflationary+pressures+in+sub-Saharan+Africa+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcurrency-gains-help-to-relieve-inflationary-pressures-in-subsaharan-africa-Oct25.html","enabled":true},{"name":"email","url":"?subject=Currency gains help to relieve inflationary pressures in sub-Saharan Africa | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcurrency-gains-help-to-relieve-inflationary-pressures-in-subsaharan-africa-Oct25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Currency+gains+help+to+relieve+inflationary+pressures+in+sub-Saharan+Africa+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fcurrency-gains-help-to-relieve-inflationary-pressures-in-subsaharan-africa-Oct25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}