Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 13, 2020

Week Ahead Economic Preview: Week of 16 March 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

- FOMC rate cut expected

- Eyes on Eurogroup meeting for joint action

- Japan, Taiwan, Indonesia, Philippines, Russia, Norway and Switzerland set monetary policy

- China fixed asset investment and credit data

- ZEW surveys

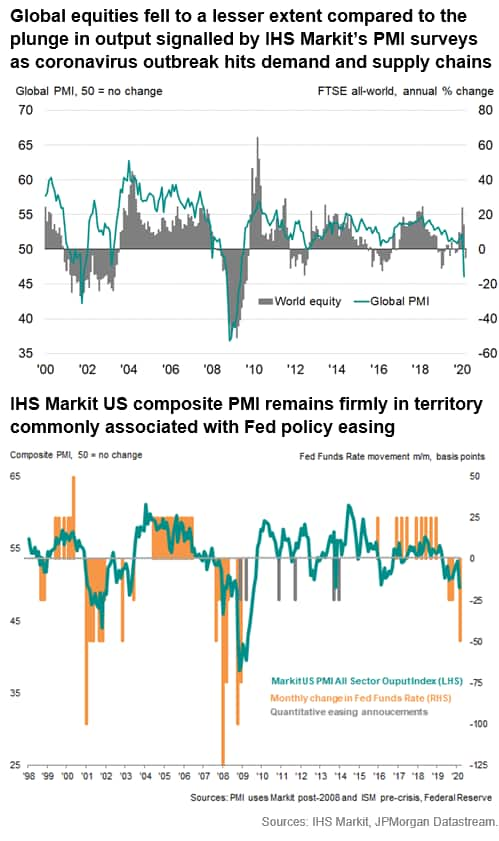

After a week of turmoil in global markets, triggered by the oil price slump and increasing use of containment measures amid the escalating spread of the coronavirus disease 2019 (COVID-19), investors will be keenly anticipating stimulus policy action from both central banks and governments.

With IHS Markit Business Outlook surveys showing subdued employment and investment plans amid increasing economic uncertainty, and after the European Central Bank announced greater monetary support, all eyes are now turned to the Fed, with high expectations of a further rate reduction following its emergency cut earlier in the month. Markets are already pricing a second rate cut, with the size of the reduction the only difference.

Markets will closely monitor the Eurogroup meeting with EU finance ministers convening at a time of rising recession risks across a number of European economies. With France pressing for an EU-wide fiscal spending plan, expectations for a coordinated policy response to the economic impact of COVID-19 are widespread. However, there's a risk that European policymakers may struggle to reach an agreement over the extent of any concerted budgetary action. Europe also sees ZEW surveys coming out of the euro area and Germany, which will add insights into the health of the wider-EU economy. Meanwhile in the UK, labour market data will be closely watched.

In the US, retail sales data may provide guidance to Fed policymaking, giving an assessment of the strength of consumption. In the same week, democratic primary voting will continue in five states. In Asia, monetary policy decisions will come from Japan, Indonesia, Philippines and Taiwan while China data will provide further clues as to the health of Chinese economy. Asian trade performance will also be gleaned from export data in Taiwan and Singapore.

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

Recent week ahead economic previews

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-march-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-march-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+16+March+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-march-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 16 March 2020 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-march-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+16+March+2020+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-march-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}