Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 04, 2025

Week Ahead Economic Preview: Week of 7 July 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Economic risks in focus as tariff deadline looms

Fed minutes, UK GDP and inflation data for mainland China are key releases in a week which is likely to be dominated by the looming US tariff deadline.

April's pause on higher US tariffs is due to expire on 9th July, in theory resulting in far higher levies on goods exported to the US for economies that have yet to secure trade deals. Few deals (notably the UK, Vietnam and a framework with China) have so far been announced at the time of writing, meaning countries will be eager to secure extensions.

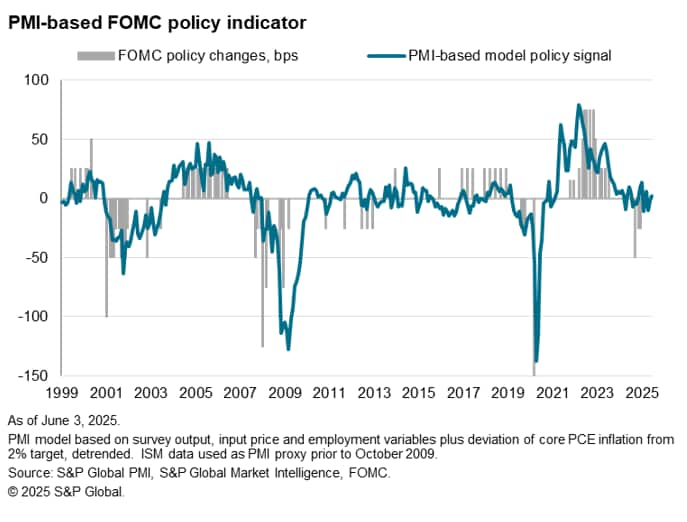

Fed policymakers will be eager to learn what the tariff landscape is going to look like. The FOMC's wait-and-see approach to interest rates weighs up the risks of higher tariff-related inflation against the dampening effects on growth and hiring from recent US policy changes. A guide to policymaker views on potential rate cuts will come from the minutes of the last FOMC meeting, which saw interest rates on hold. While there have been recent signs of splits toward a more dovish stance, PMI and payroll data have indicated a resilience in the economy alongside rising price pressures, supporting the postponement of rate cuts until later in the year.

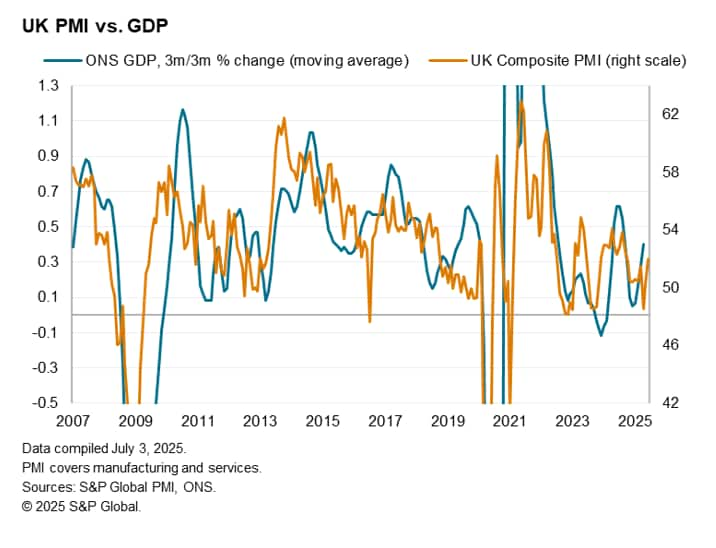

The health of the UK economy will also come under scrutiny with GDP data for May. April's 0.3% decline had indicated a marked deterioration after 0.7% growth in the first quarter. Another weak month would add to fears that the UK economy is spluttering amid headwinds of trade uncertainty, Budget measures which led to higher payroll costs starting in April, and low consumer confidence. However, the PMIs suggest that these headwinds have started to ease.

Meanwhile, industrial production data for Germany will be eyed for signs that rising domestic demand (linked to prospects for greater fiscal spending) will have helped offset some of the dampening impact of global trade tensions, while trade data will be assessed for tariff impact.

In APAC, rate cuts are on the table as central banks in Australia, New Zealand, South Korea and Malaysia weigh up prospects amid US trade uncertainties. The deflationary impact of US trade policies has been especially evident in mainland China, according to PMI data, drawing focus on the upcoming consumer price data to be released in the week.

Finally, the S&P Global Investment Manager Index for June will gauge appetite for risk and equity market preferences. amid the changing political and economic environment. Read May's IMI, which showed easing risk aversion, here.

The outlook for US interest rates will come under scrutiny via the publication of FOMC meeting minutes, which saw rates on hold in June, a decision in line with recent PMI data.

UK GDP growth is expected to have improved in May after a disappointing 0.3% decline in April.

Key diary events

Monday 7 July

Thailand Inflation (Jun)

Germany Industrial Production (May)

Sweden Inflation (Jun, prelim)

United Kingdom Halifax House Price Index* (Jun)

Eurozone Retail Sales (May)

United Kingdom Regional Growth Tracker* (Jun)

Tuesday 8 July

Japan Current Account (May)

Philippines Unemployment and Industrial Production (May)

Australia NAB Business Confidence (Jun)

Australia RBA Interest Rate Decision

Germany Balance of Trade (May)

Sweden Inflation (Jun, prelim)

France Balance of Trade (May)

Taiwan Balance of Trade and Inflation (Jun)

Brazil Retail Sales (May)

S&P Global Investment Manager Index* (Jul)

Wednesday 9 July

Australia Westpac Consumer Confidence (Jul)

China (Mainland) CPI, PPI (Jun)

New Zealand RBNZ Interest Rate Decision

Japan Machine Tool Orders (Jun)

Malaysia BNM Interest Rate Decision

Mexico Inflation (Jun)

United States Wholesale Inventories (May)

United States FOMC Meeting Minutes (Jun)

GEP Global Supply Chain Volatility Index* (Jun)

Thursday 10 July

Thailand Market Holiday

S&P Global Business Outlook* (Jun)

South Korea BoK Interest Rate Decision

Sweden GDP (May)

Turkey Industrial Production (May)

Italy Industrial Production (May)

Brazil Inflation (Jun)

United States Initial Jobless Claims

Friday 11 July

Singapore GDP (Q2, adv)

Malaysia Industrial Production (May)

Germany Inflation (Jun, final)

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (May)

United Kingdom Goods Trade Balance (May)

France Inflation (Jun, final)

Switzerland Consumer Confidence (Jun)

Mexico Industrial Production (May)

Canada Employment Change and Unemployment Rate (Jun)

United States Monthly Budget Statement (Jun)

Saturday 12 July

China (Mainland) Trade (Jun)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: Fed minutes; Mexico and Brazil inflation; Canada labour market data

Minutes from the June US Federal Open Market Committee (FOMC) meeting will be published midweek for insights into the Fed's thoughts after they kept interest rates unchanged. Criteria for the Fed to resume lowering rates will continue to be sought via the minutes with market expectations pointing to a September move currently, though with Fed Chair Powell having notably not ruled out rate cuts at any meeting.

Inflation data out of Mexico and Brazil will also be closely watched amid ongoing tariff impact, while Canada updates its labour market data for June. This followed early indications of subdued labour conditions in the manufacturing sector, according to the Canada Manufacturing PMI, linked largely to trade disruptions.

EMEA: UK GDP and house prices; German trade figures

The UK publishes monthly GDP data for May with early PMI data having indicated that tax hikes and tariffs had weighed on the UK economy midway through the second quarter, but that growth has started to revive from April's low, with services growth notably rising to a ten-month high in June.

Germany's industrial production and trade figures will also be in focus with the PMI revealing improvements in goods trade over May and June, though this is set against a backdrop of subdued eurozone and global conditions.

Final June inflation data out of Germany, Italy and France are also anticipated, as well as industrial production numbers from various European economies and eurozone retail sales numbers.

APAC: RBA, RBNZ, BoK, BNM meetings; mainland China inflation and trade data; Singapore GDP

Central bank meetings in Australia, New Zealand, South Korea and Malaysia unfold in the new week with rate cuts on the table, according to market expectations amidst ongoing trade uncertainties.

On the data front, key releases from mainland China include inflation and trade numbers, with the latest Caixin China General Manufacturing PMI indicating improvements in manufacturing sector conditions as pressures from trade eased. Singapore also updates advance GDP data for the second quarter, serving as a bellwether for the APAC region.

Investment Manager and Supply Chain Volatility Indices

Insights into equity market expectations, sector and regional preferences will be sought with the July Investment Manager Index. Additionally, with GEP, we publish our June Supply Chain Volatility Index for a check on conditions ahead of the July 9 deadline expected for higher US tariffs.

© 2025, S&P Global. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-july-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-july-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+7+July+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-july-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 7 July 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-july-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+7+July+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-7-july-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}