Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 04, 2025

Global PMI signals subdued growth as confidence and hiring sentiment slide lower

The worldwide PMI surveys - produced S&P Global in association with ISM and IFPSM for J.P.Morgan - signalled a modest improvement in business activity growth for a second successive month in June. However, the overall pace of expansion remained subdued, rounding off the worst calendar quarter since 2023.

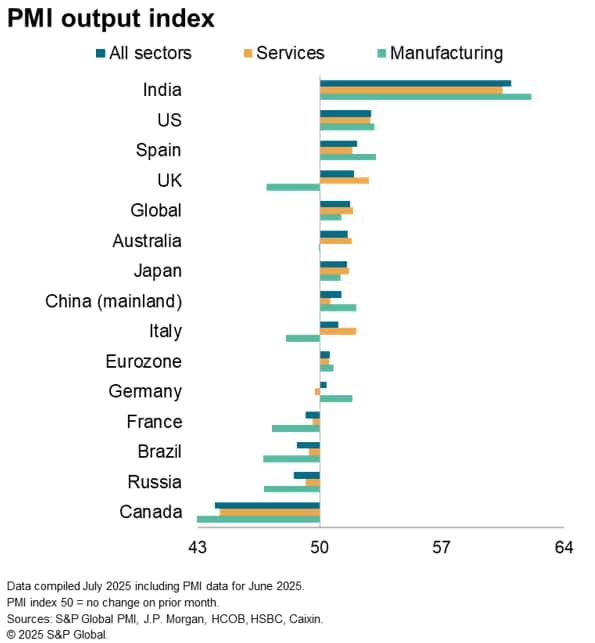

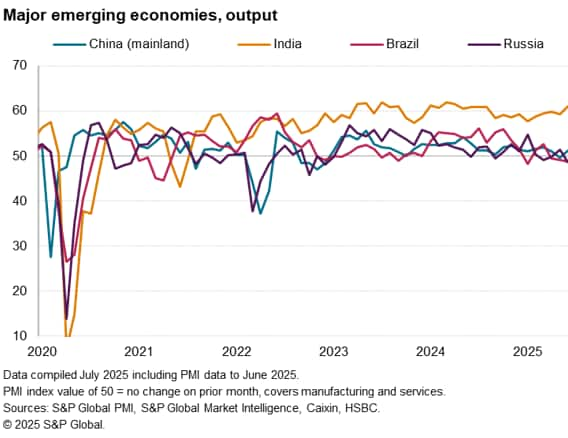

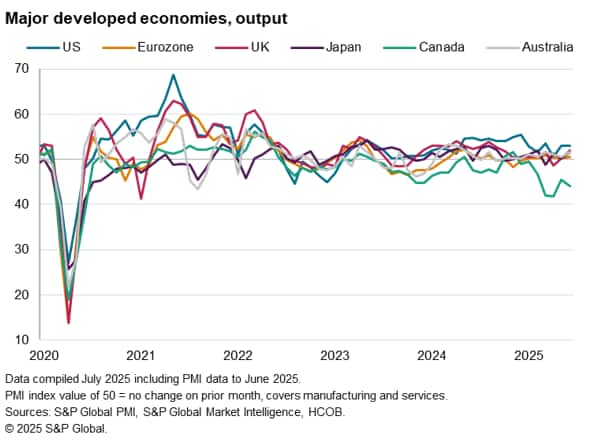

Growth was led by India, followed by the US. But while improved expansions were reported in Japan, the UK, Australia, mainland China and the eurozone, growth in all cases remained modest at best, and especially weak in the eurozone. Canada meanwhile continued to report the steepest contraction of the major economies, followed by Russia and Brazil.

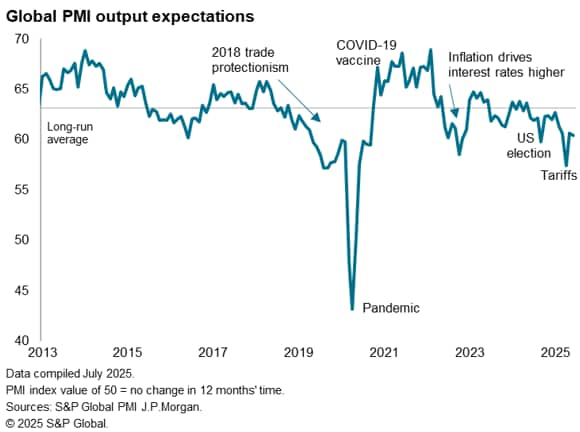

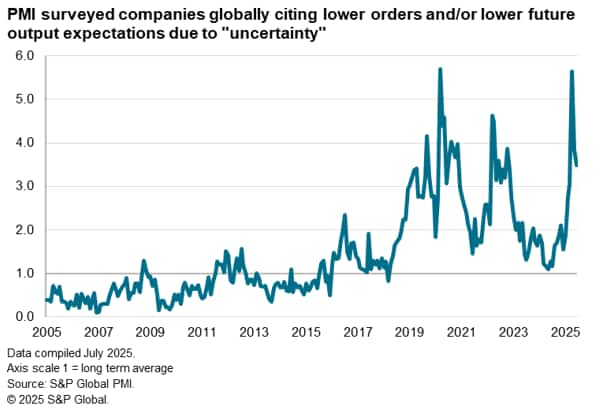

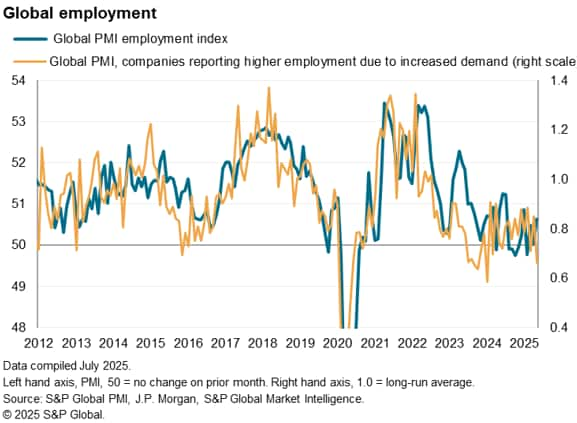

The subdued overall pace of economic expansion was accompanied by a deterioration in business expectations about the year ahead, which fell to one of the lowest levels seen since the pandemic. Although reports of the damaging effect of "uncertainty" on businesses have eased since April, they remain elevated by historical standards. Moreover, weak demand conditions have dampened firms' appetites to hire new staff to a degree only usually seen in times of global economic stress.

Global PMI edges higher for second month in June

S&P Global Market Intelligence's PMI surveys indicated that worldwide business activity expanded at a slightly increased rate for a second successive month in June, albeit remaining subdued by standards seen late last year.

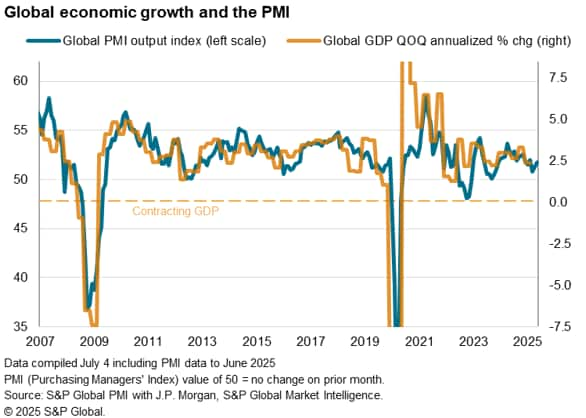

The headline J.P. Morgan Global Composite PMI Output Index, covering manufacturing and services in over 40 economies, rose from 51.2 in May to 51.7 in June to signal the fastest pace of expansion since March.

Despite the further upturn in June, the average expansion signalled by the PMI over the second quarter has been the weakest since the fourth quarter of 2023.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.3% in June, and 2.0% in the second quarter. This compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic and an estimated 3.0% rate in the past three years.

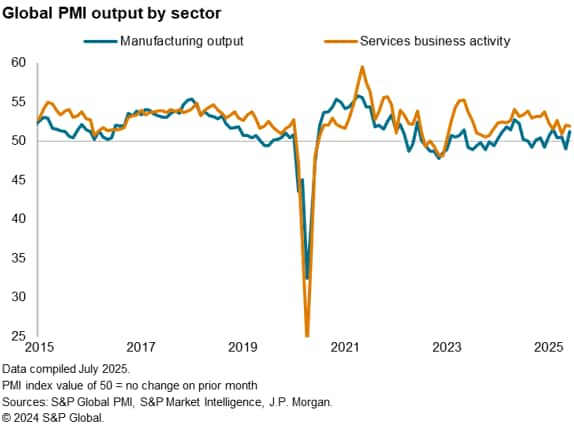

The improved rate of expansion in June was fueled by an acceleration of global manufacturing output growth to the highest since February (and second fastest seen over the past year), reviving from a brief downturn in May. However, services business activity growth meanwhile moderated worldwide in June. Although June's services expansion was in line with the average seen in the first five months of the year, growth in the sector has cooled noticeably since late last year.

Varied growth trends

Of the 13 largest economies surveyed by the PMI, growth trends varied markedly. Among the major economies, signs of current economic stress were largely limited to Canada and to lesser extents Brazil and Russia, though with pockets of concern also evident notably in the French services economy and the manufacturing economies of the UK and Italy.

In contrast, India's upturn remained impressive in June, while the US economy has enjoyed a solid expansion over the past two months. Growth has edged higher in the UK, Australia, Japan, mainland China and the eurozone, though remained subdued in all cases, and especially modest in the latter.

India leads global expansion

Of the nine economies reporting growth in June, India stood out once again as the strongest performer by a wide margin, both in terms of goods and services.

The US reported the second fastest output growth of the major economies, its rate of expansion edging slightly lower from May and remaining lower than seen at the end of last year but nonetheless signalling annualized economic growth of approximately 1.5%. Slightly weaker services growth was part countered by a return to growth for US manufacturing output after three months of decline.

The UK meanwhile reported an encouraging acceleration of growth to the fastest since last September, indicative of the economy having grown at a pace of around 0.3% (1.2% annualized) to end the second quarter on a high note by recent standards.

Growth also lifted higher in Australia, reaching a three-month high (and the joint-highest for ten months), though remaining subdued thanks in part to a stalled manufacturing sector.

Japan's upturn also gathered pace, though likewise remained only modest, as the first rise in manufacturing output for ten months was accompanied by a slight lift in services growth.

A mild upturn was also reported in mainland China, where output rose modestly after a brief decline in May. A rebound in manufacturing output was part countered, however, by a near-stalling of services growth to the weakest for nine months (and one of the weakest since the pandemic).

Although eurozone growth also remained subdued on the whole amid only very modest growth of both manufacturing and services output, its expansion hit a three-month high to indicate 0.1% GDP growth (0.4% annualized) as Spain outperformed, albeit still registering the second weakest expansion recorded over the past 17 months. Only weak growth was seen in both Italy (a three-month low) and in Germany, despite the latter's manufacturing sector reporting a sustained expansion, which over the past four months has enjoyed its best growth spell for three years.

Canada reports sharpest downturn

While only four of the 13 economies recorded falling output (measured across manufacturing and services), Canada's downturn remained particularly marked, continuing a period of decline which has been the worst since the early pandemic lockdowns in 2020, amid a broad-based contraction that was widely blamed on uncertainty and disruptions caused by US policy changes this year.

Output also fell in Russia, Brazil and France. Russia reported the largest fall in output since December 2022, while Brazil's downturn was the second steepest since early-2021. France's downturn was again only modest, albeit masking a marked decline in the services economy.

Lower confidence

Although current global growth accelerated slightly in June, business confidence in the outlook deteriorated. While up on the recent nadir seen in April, when heightened tariff uncertainty had caused confidence to slide to its lowest since the early pandemic lockdowns, business sentiment dipped in June to the second lowest since last year's US presidential election, and one of the lowest levels seen this side of the pandemic.

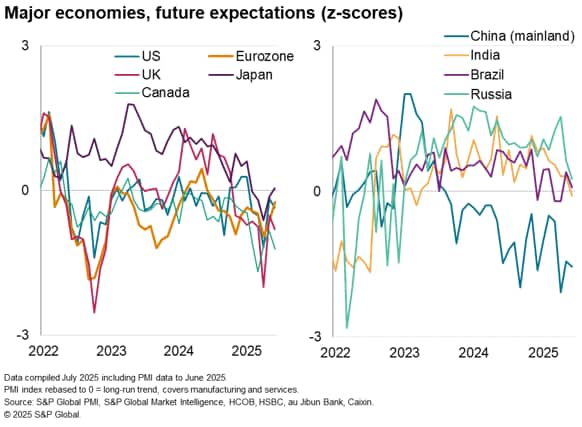

Of the major developed economies, sentiment about the year ahead improved in the eurozone, Australia and Japan, though only in the latter has it risen above its long-run average to indicate above-par sentiment. Recent improvements in confidence in the US, Canada and the UK meanwhile lost some ground in June.

In the major emerging markets, sentiment about the year ahead meanwhile fell across the board, notably now running below its long run average in India and drawing close to long-run averages in Russia and Brazil. However, mainland China's companies remained especially pessimistic by long-run standards.

Rising confidence in the eurozone, Australia and Japan could be part-traced to reports of improving domestic demand conditions and international inbound travel helping support services, combined with reduced worries over the adverse impact of US policy, especially in relation to tariffs. The latter has also played a role in helping keep sentiment toward the economic outlook in other markets off the lows seen back in April.

However, companies globally clearly remain concerned over the heightened geopolitical uncertainty caused by recent US policy announcements, with reports of current demand or future expectations having been dampened by "uncertainty" continuing to run at a level rarely exceeded in the survey's history.

Similarly, the number of companies worldwide reporting higher employment due to stronger customer demand has fallen sharply, now running at its lowest since late-2023 and a level typically indicative of heightened economic stress, and a likely harbinger of falling global employment in the months ahead.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-subdued-growth-as-confidence-and-hiring-sentiment-slide-lower-Jul25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-subdued-growth-as-confidence-and-hiring-sentiment-slide-lower-Jul25.html&text=Global+PMI+signals+subdued+growth+as+confidence+and+hiring+sentiment+slide+lower+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-subdued-growth-as-confidence-and-hiring-sentiment-slide-lower-Jul25.html","enabled":true},{"name":"email","url":"?subject=Global PMI signals subdued growth as confidence and hiring sentiment slide lower | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-subdued-growth-as-confidence-and-hiring-sentiment-slide-lower-Jul25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+signals+subdued+growth+as+confidence+and+hiring+sentiment+slide+lower+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-subdued-growth-as-confidence-and-hiring-sentiment-slide-lower-Jul25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}