Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 04, 2025

PMI surveys indicate elevated US price growth as tariffs drive inflation differential with rest of world

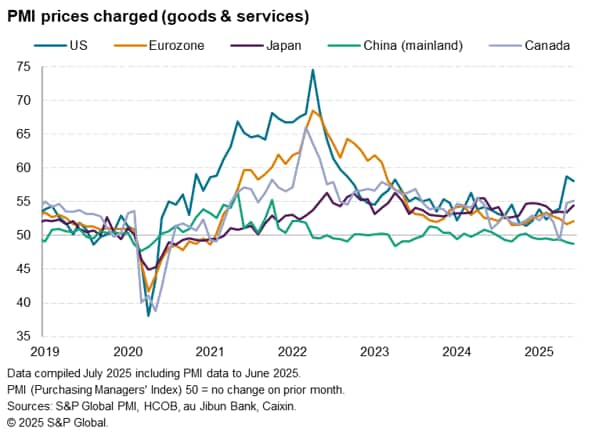

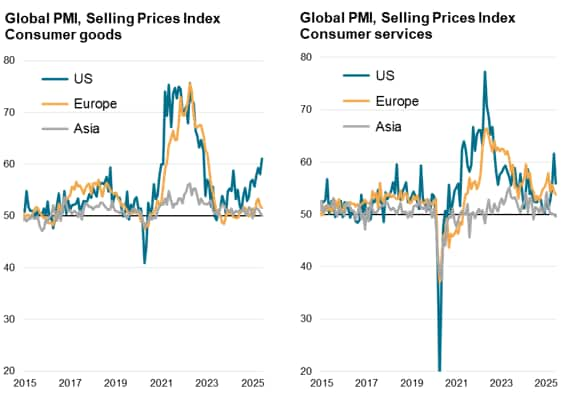

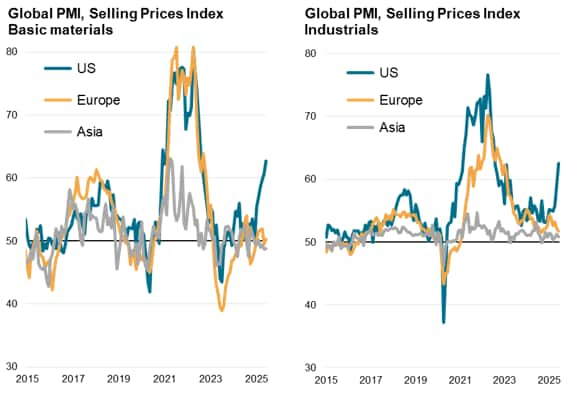

The worldwide PMI surveys - produced by S&P Global in association with ISM and IFPSM for J.P.Morgan - showed US selling price inflation across goods and services running far higher than the rest of the world, with notably wide differentials between the US and economies such as the eurozone and mainland China.

The elevated US price growth was widely linked by companies to US tariffs, and was especially evident for basic materials, industrials and consumer goods, which are bearing the brunt of higher import costs due to the levies imposed on imported inputs.

Global PMI signals rising price pressure

S&P Global Market Intelligence's PMI surveys indicated that global selling price inflation cooled slightly in June after hitting a 14-month high in May, but remained elevated by standards seen over the past year.

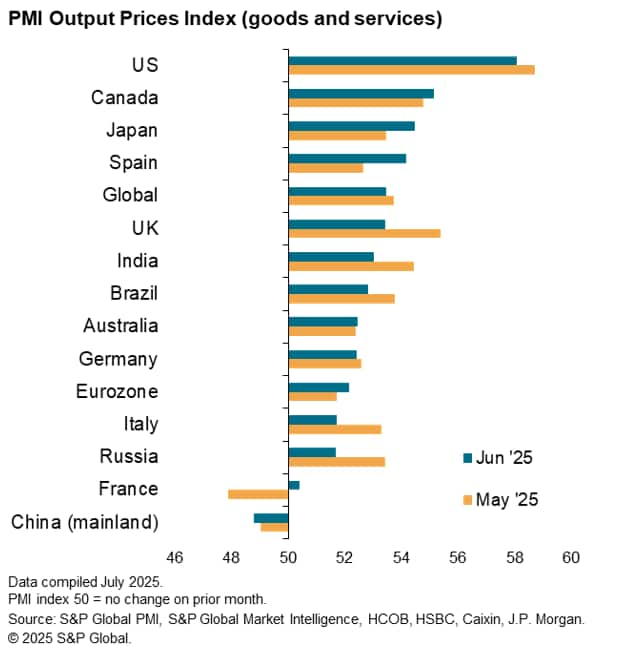

The headline J.P. Morgan Global Composite PMI® Prices Charged Index, covering prices levied for goods and services in over 40 economies, fell from 53.7 in May, its highest since March 2024, to 53.5 in June. The current reading remained the second-highest seen over the past 15 months and compares with an average reading of 52.7 throughout 2024.

Historical comparisons indicate that the PMI Prices Charged Index for June is broadly consistent with global consumer price inflation running at close to 4% in the coming months, up from the 3.1% rate currently being indicated by official data in May.

The main driver of global inflation was again the service sector where, although the rate of price growth eased compared to May, June saw the second-largest monthly increase in selling prices since April 2024. While global manufacturing price growth remained relatively muted, June's rise in factory gate prices was the second-strongest recorded for over two years.

US inflation spike contrasts with disinflationary trend in rest of world

Looking at the world's largest economies, the US once again stood out in reporting the largest rise in prices in June following the sharp acceleration of US inflation in May, continuing to outpace the rate of inflation seen in the rest of the world by a margin not witnessed since the pandemic. Although the overall rate of selling price inflation for goods and services in the US moderated slightly, it was still the second-highest recorded since April 2023. Inflation in the rest of the world meanwhile cooled on average to the lowest since January 2021.

Especially marked differentials in inflation were seen between the US and mainland China, the latter seeing prices charged for goods and services fall at the fastest rate since April 2023, and between the US and the eurozone (and notably France), where prices rose only modestly in June.

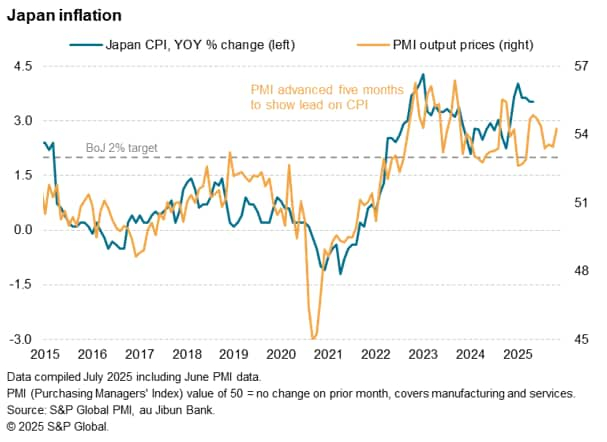

However, Canada reported the steepest rise in prices for 14 months in June, narrowing the inflation gap with the US. Similarly, the rate of inflation in Japan meanwhile reaccelerated in June, hitting a five-month high.

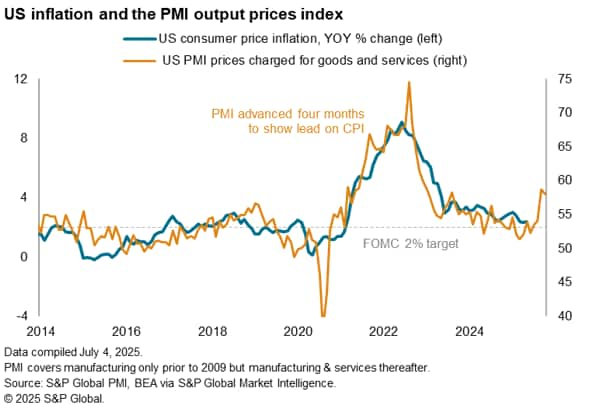

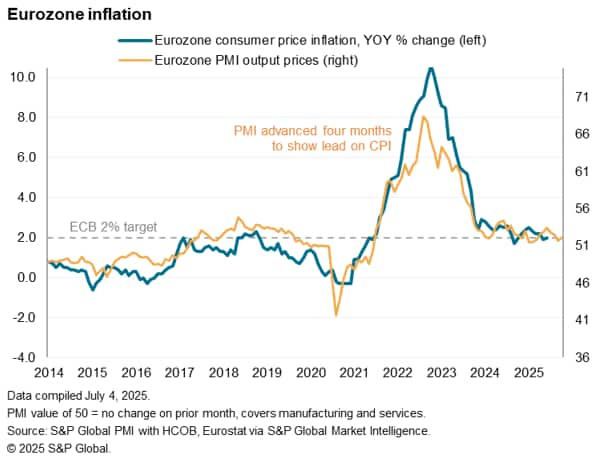

Comparisons with official data

The strength of the price growth reported in the US remains broadly indicative of consumer price inflation running close to 4%, according to historical comparisons, and well above levels consistent with the central bank's 2% target.

In contrast, the equivalent PMI Prices Charged Index for the eurozone has remained relatively subdued in recent months, running at levels broadly consistent with 2% inflation.

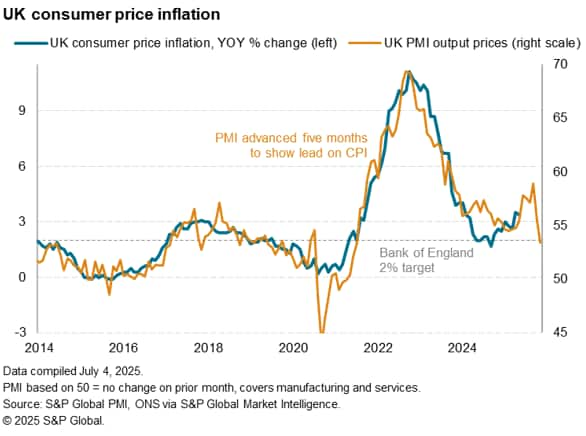

Similarly, in the UK, the PMI Prices Charged Index has fallen back to a level comparable with 2% consumer price inflation. The rate of increase has slowed sharply in June after having risen briefly in prior months in response to higher rate payroll taxes and Minimum Wage legislation.

The rate of price increase in Japan meanwhile signals inflation of just below 3% per annum, and above the Bank of Japan's target, albeit below recent official estimates of inflation. [*]

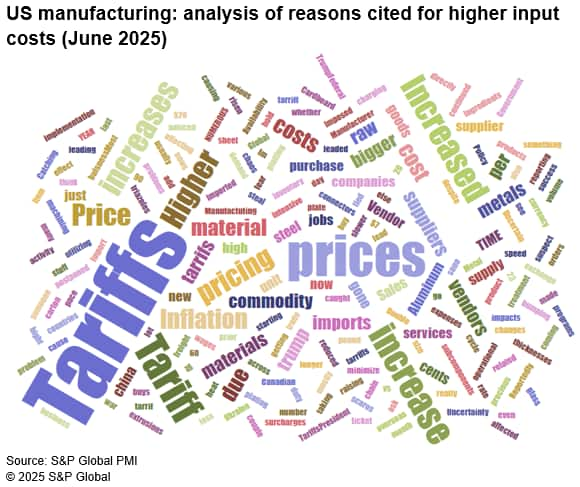

US inflation linked to tariff impact

The relatively stronger US price growth was again widely attributable to the impact of tariffs, according to anecdotal evidence collected in the June survey.

US tariffs have so far been implemented in two broad ways: against countries and against products. As of late May 2025, the US applied 10% duties on all imports, rising to 30% against those from mainland China. The product levies include duties of 25% on imports of autos, steel and aluminium. The removal of de minimis shipment allowances, whereby packages under US$800 value were not subject to duties, has meanwhile also come into force. The proposed imposition of higher rate levies on countries with no trade deals with the US have been postponed until 9th July.

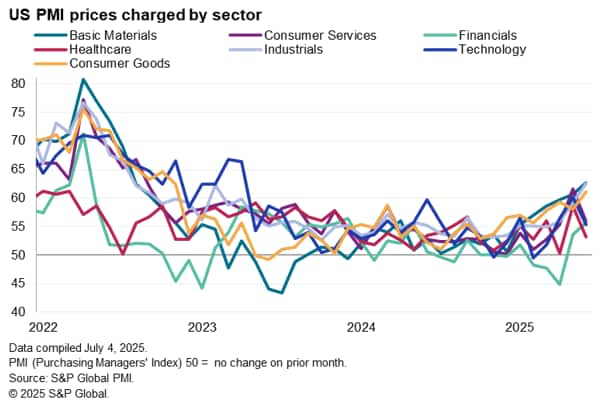

The impact of the broad 10% tariff rate on all imports is evident across all sectors, but the higher rates levied on metals has clearly had a disproportionate impact on costs in US manufacturing sectors. Thus, while price growth was evident also all broad product sectors in the US, the steepest rates of increase were recorded for basic materials and industrials, where the June rise in prices charged was the highest since July 2022, followed by consumer goods, which reported the largest jump in prices since November 2022.

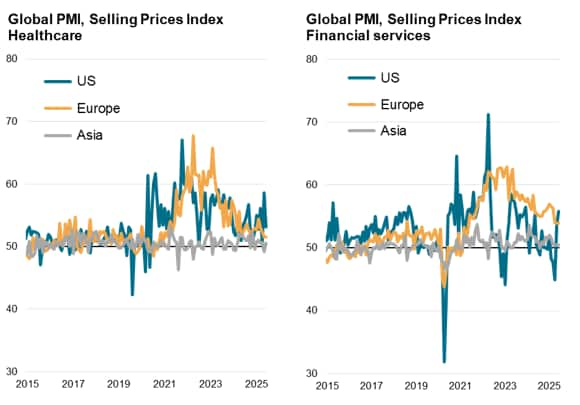

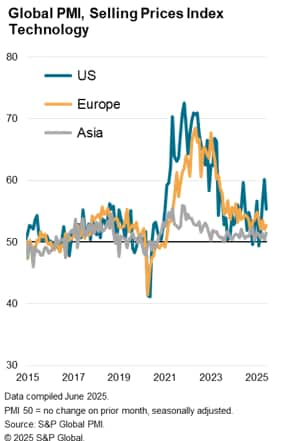

While some easing in price growth was seen for consumer services, technology and healthcare, often linked to the dampening effect of weak demand on pricing power, financial services firms notably reported the largest rise in levies since December 2023, linked in part to higher interest rates on certain products.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-indicate-elevated-us-price-growth-as-tariffs-drive-inflation-differential-with-rest-of-world-Jul25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-indicate-elevated-us-price-growth-as-tariffs-drive-inflation-differential-with-rest-of-world-Jul25.html&text=PMI+surveys+indicate+elevated+US+price+growth+as+tariffs+drive+inflation+differential+with+rest+of+world+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-indicate-elevated-us-price-growth-as-tariffs-drive-inflation-differential-with-rest-of-world-Jul25.html","enabled":true},{"name":"email","url":"?subject=PMI surveys indicate elevated US price growth as tariffs drive inflation differential with rest of world | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-indicate-elevated-us-price-growth-as-tariffs-drive-inflation-differential-with-rest-of-world-Jul25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+surveys+indicate+elevated+US+price+growth+as+tariffs+drive+inflation+differential+with+rest+of+world+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpmi-surveys-indicate-elevated-us-price-growth-as-tariffs-drive-inflation-differential-with-rest-of-world-Jul25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}