Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 09, 2025

Global trade deterioration eases in June

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated that global trade conditions continued to deteriorate at the end of the second quarter of 2025. That said, the rate of decline eased for a second successive month and was only marginal.

The seasonally adjusted Global PMI New Export Orders Index, sponsored by JPMorgan and compiled by S&P Global, rose to 49.1 in June, up from 48.0 in May. Posting below the 50.0 neutral mark for a third successive month, the latest data indicated another contraction in trade activity. The pace of decline was only marginal, however, matching the first five-month average in June.

Broad-based easing of trade contraction

While the manufacturing sector's export contraction persisted in June, the rate of decline softened to the slowest in the current three-month sequence. Further front-loading of goods orders ahead the higher US tariffs deadline (July 9th) supported the slower of deterioration in goods trade. This was evident with global production growth resuming at the quickest pace since February as manufacturers worked through existing orders in the lead up to the anticipated July 9th deadline. Additionally, stock building was again elevated among US manufacturers, though subdued across the rest of the world.

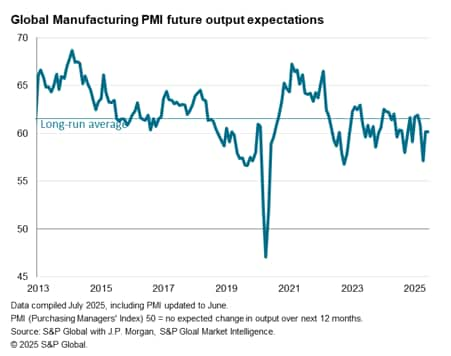

Sentiment data also pointed to muted optimism regarding growth in the year ahead. As seen via the Future Output Index, business confidence stayed below the series average reflecting some apprehension regarding the outlook especially surrounding trade. Mentions of 'uncertainty' among goods producers were also elevated at multiples of the historical average, albeit down further from the peak in April. Notably, the latest data trended in line with concerns that - even if trade uncertainty should ease in the coming months - the hangover from front-loading of goods orders in the first half of 2025 may lead to more subdued trade conditions in the coming months.

Services exports meanwhile contracted for a third straight month in June, though with the rate of decline eased to the softest in the current sequence. Trade challenges linked to US tariff policy continued to dampen services export business. Sentiment in the service sector was also increasingly cautious in June, as seen via a drop in the Future Activity Index to a level further below the long-run average.

Detailed sector PMI revealed that growth in exports was led by the insurance sector for the fifth month in a row. This was followed by commercial & professional services and machinery & equipment sectors, which reported modest growth in export business. On the other hand, the forestry & paper products and general industrials sectors recorded the sharpest reductions in global exports in June.

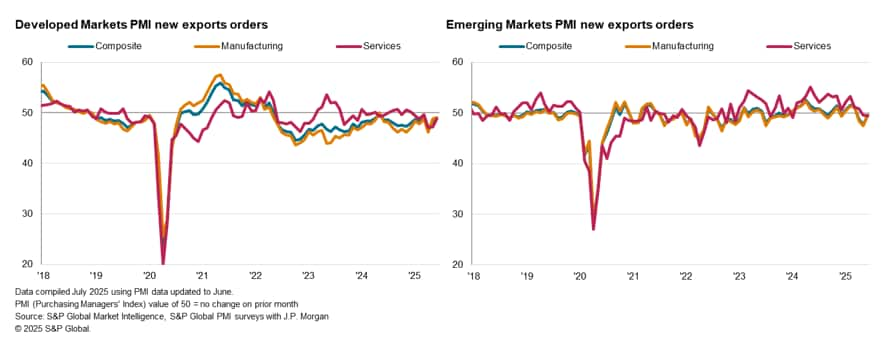

Modest reduction in trade activity across both developed and emerging markets

Regionally, the contraction in export business was broad-based in June but with the rates of reduction softening across both developed and emerging markets.

After recording a steeper rate of export contraction for the first time in three years, emerging markets export business declined only marginally at the end of the second quarter. Slower reductions in the manufacturing sector helped to offset a slight intensification of service-sector export contraction in June. That said, with falling optimism levels across both manufacturing and service sectors in the emerging markets, the easing export contraction trend could reverse in the coming months.

Meanwhile developed economies saw their export contraction easing to register one of the smallest declines seen over the past three years. Both manufacturers and service providers indicated a softer drop in export orders. Here manufacturers' confidence had notably risen to the highest level in four months, contrasting with the paring back of optimism among service providers in June.

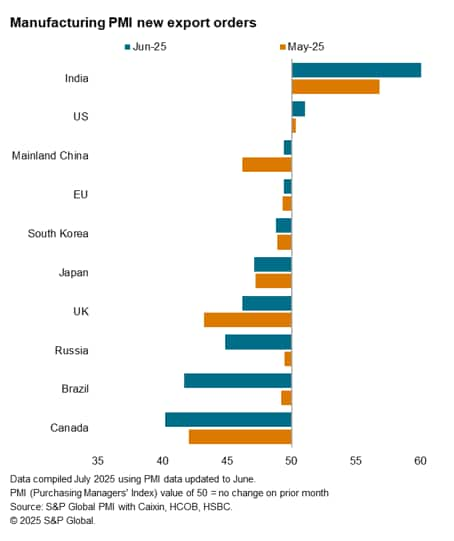

Export growth limited to India and US again in the top 10

The number of top ten trading economies reporting higher goods exports remained at just two (India and the US) at the end of the second quarter of 2025. India continued to lead export growth by a wide margin with a further acceleration in the rate of expansion. Demand strengthened from across the globe, especially from the US, according to comments from panellists. This led to Indian manufacturing exports rising at the third-fastest pace since data collection began for the series in March 2005. Goods export orders growth also accelerated in the US to the quickest pace in just over a year despite trade policy impact.

On the other end of the rankings was Canada, with the sharpest reduction in goods exports as tariffs hit. The rate at which export orders fell was among the steepest on record and contributed to a broader manufacturing downturn in June. Substantial reductions in export orders were also observed in Brazil and Russia in June, the former seeing the most pronounced worsening of conditions compared to May among the top 10. The UK also observed a marked fall in goods export orders, though the latest reading had represented an easing of the rate of reduction from May.

Finally, modest slowdown in goods trade activity was recorded in Japan and South Korea while only marginal declines were reported in the EU and mainland China.

Access the global press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-deterioration-eases-in-june-Jul25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-deterioration-eases-in-june-Jul25.html&text=Global+trade+deterioration+eases+in+June+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-deterioration-eases-in-june-Jul25.html","enabled":true},{"name":"email","url":"?subject=Global trade deterioration eases in June | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-deterioration-eases-in-june-Jul25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+trade+deterioration+eases+in+June+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-trade-deterioration-eases-in-june-Jul25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}