Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 15, 2025

Week Ahead Economic Preview: Week of 18 August 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI, Fed minutes and inflation data from the UK and Japan

August flash PMI will offer early insights into economic conditions across major developed economies on Thursday, while inflation data are due from the UK, Eurozone, Japan and Canada in the week. Fed minutes from the July meeting will also be keenly watched in a week where comments from central bankers are expected to be heard at the annual Jackson Hole Symposium.

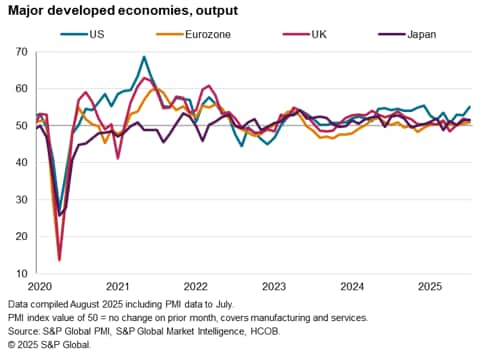

Following the implementation of higher tariffs from August 7th, flash PMI data will be the first set of economic releases published for insights into any changes in economic conditions in the US. Specifically, prices, inventory and overall growth conditions will be among the key items in focus. Chiefly, the impact on prices will be scrutinised with relief having just been granted by lower-than-expected CPI data for July. Any increase in the PMI Output Prices Index from current levels would point to even higher inflationary pressures in the months to come and could pose additional threats to rate cut expectations. Additionally, on the manufacturing front, the question lies with the degree to which US inventory building activity may have reversed with early signs having already been present in July. Finally, the US had been an outperformer so far in the second and start of the third quarter, helping to support global growth. Whether this outperformance continued into August amid recent trade developments will be examined with the flash releases.

Besides the US, flash PMI data from other developed economies will also help to shed light on economic conditions at major trading partners. Business sentiment updates for India, another fast-growing economy in July, will also be in focus amid the threat of higher tariffs.

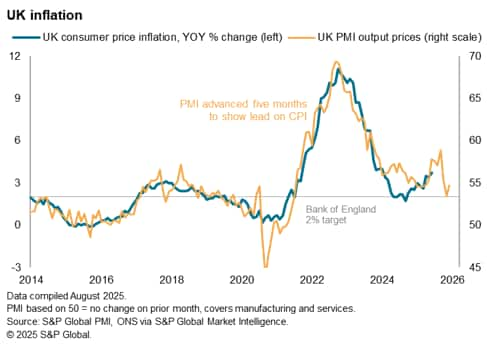

On the inflation front, the UK's CPI data will be published midweek, with a higher headline reading expected, moving up the trajectory preluded by PMI prices data. The key will however be with the flash PMI prices indications with July's data previously showing a renewed rise in inflationary pressure that had added uncertainty to further cuts by the Bank of England.

In APAC, the Reserve Bank of New Zealand (RBNZ) and Bank Indonesia (BI) convene with a rate cut expected at the former meeting. Inflation data will also be due from Japan, Singapore and Malaysia, while Thailand updates second quarter GDP.

The US had outperformed major developed economies in recent months, buoyed in part by inventory building activity ahead of higher tariffs.

The UK PMI Output Prices data point to the likelihood for inflationary pressures to rise in the short-term before easing again into the end of the year.

Key diary events

Monday 18 Aug

Colombia Market Holiday

Singapore Non-Oil Domestic Exports (Jul)

Thailand GDP (Q2)

Spain Balance of Trade (Jun)

Eurozone Balance of Trade (Jun)

Canada Housing Starts (Jul)

United States NAHB Housing Market Index (Aug)

Tuesday 19 Aug

Hungary Market Holiday

Australia Westpac Consumer Confidence Change (Aug)

Malaysia Trade (Jul)

Canada Inflation (Jul)

United States Building Permits (Jul, prelim)

United States Housing Starts (Jul)

Wednesday 20 Aug

Japan Trade (Jul)

Japan Machinery Orders (Jun)

China (Mainland) Loan Prime Rate (Aug)

New Zealand RBNZ Interest Rate Decision

United Kingdom Inflation (Jul)

Germany PPI (Jul)

Indonesia BI Interest Rate Decision

Sweden Riksbank Rate Decision

South Africa Inflation (Jul)

Taiwan Export Orders (Jul)

Eurozone CPI (Jul, final)

Canada New Housing Price Index (Jul)

United States FOMC Minutes (Jul)

Thursday 21 Aug

Philippines Market Holiday

Australia S&P Global Flash PMI, Manufacturing &

Services*

Japan S&P Global Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

New Zealand Trade (Jul)

Switzerland Trade (Jul)

Hong Kong SAR Inflation (Jul)

Canada PPI (Jul)

Eurozone Consumer Confidence (Aug, flash)

United States Existing Home Sales (Jul)

Friday 22 Aug

Japan Inflation (Jul)

Malaysia Inflation (Jul)

Singapore Inflation (Jul)

Germany GDP (Q2, final)

United Kingdom Retail Sales (Jul)

France Business Confidence (Aug)

Mexico GDP (Q2, final)

Canada Retail Sales (Jun, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Flash PMI data for August

August's flash PMI data for major developed economies and India will be published on Thursday for the earliest insights into economic conditions following the implementation of widespread tariffs from August 7th. Besides manufacturing output conditions, the impact of higher US tariff will also be scrutinised through the price channel and the corresponding impact on business sentiment. Whether the latest trade developments have affected the service sector, which outperformed in July, will also be important for the trajectory of global growth going into the second half of 2025.

Americas: Fed minutes, US existing home sales; Canada inflation, retail sales data

Following the release of US CPI data, which showed a lower-than-expected headline reading in July, we will be awaiting Fed minutes from the July Federal Open Market Committee (FOMC) meeting and updates at the annual Jackson Hole Symposium where central bankers are expected to speak.

Separately, Canada's inflation data will be published on Tuesday. According to the latest S&P Global Canada PMI prices data, which preludes the trend for inflation, price pressures remained elevated in July, hinting at the potential for inflation to rise in the coming months.

EMEA: UK inflation and retail sales data; Eurozone inflation

Besides flash PMI releases, the economic data highlights in the new week include UK and eurozone inflation data, plus retail sales figures from the UK. While UK consumer price inflation is expected to tick higher in July, in line with indications from the PMI output prices data, the latest readings have hinted at CPI falling in the months to follow. That said, while June's PMI showed a return to the 2% level, July's data outlined renewed pressure, which presents a dilemma for monetary policy decision makers. As such, the flash PMI data for August will be eagerly watched for indications of whether the inflationary pressures have remained elevated. On retail sales, indications of softening services activity growth in July point to the likelihood for a subdued reading.

Additionally, the eurozone updates July's inflation data, though this will be the final release with more up-to-date direction on prices to be gathered with the PMI updates.

APAC: RBNZ, BI meetings; Japan inflation and trade data; Thailand GDP; Singapore and Malaysia inflation

Central bank meetings in New Zealand and Indonesia unfold in the new week with a rate cut on the table for the Reserve Bank of New Zealand (RBNZ). On the data front, inflation data will be out from Japan, Singapore and Malaysia.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-august-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-august-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+18+August+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-august-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 18 August 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-august-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+18+August+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-18-august-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}