Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 21, 2025

Acceleration in business activity growth in Japan masks mixed sectoral demand trend

Japan's private sector business activity expanded at the quickest pace in six months in August, according to the flash PMI. Moreover, the latest expansion was broad-based as manufacturing output rejoined services activity in growth. New orders similarly rose at the fastest pace since February, albeit with a clear divide by sector as faster services new business growth contrasted with a persistent contraction in goods new orders. Coupled with falling optimism among manufacturers, the latest PMI data added to doubts over whether the recovery in the goods producing sector can be sustained. This was also with continued weakness in external conditions causing a solid drop in new export orders.

Rising input cost inflation coupled with a competition-driven suppression of output price inflation meant that Japanese private sector companies faced greater margin pressures midway through the third quarter of the year. While the rise in cost pressures provides some impetus for the Bank of Japan to act sooner than later, the falling selling price inflation trend and shaky manufacturing recovery add to uncertainty over when the next interest rate hike will be enacted.

Japan's flash PMI at six-month high

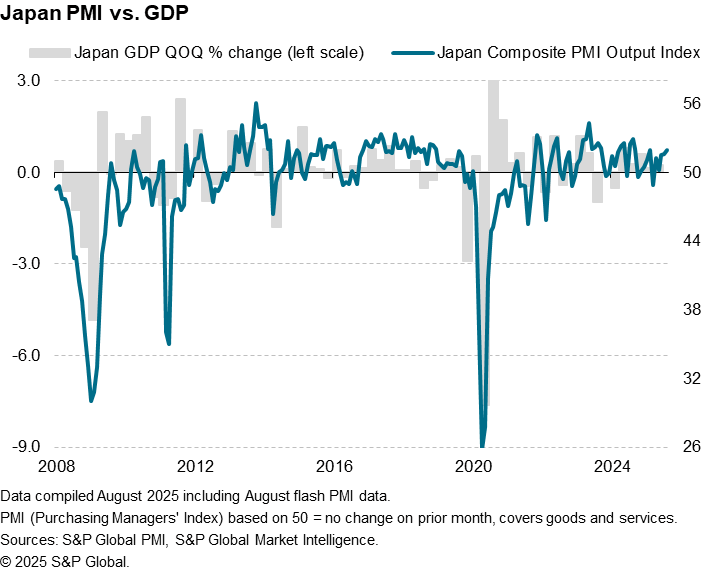

The S&P Global Flash Japan PMI Composite Output Index posted 51.9 in August, up from 51.6 in July. This marked the fifth straight month in which the headline reading remained above the 50.0 neutral mark to signal an expansion of business activity. Additionally, the latest reading reflected the fastest growth since February.

At current levels, the latest PMI reading is indicative of GDP growing at a quarterly rate at about 0.7% in July, which is slightly higher than the 0.2% average seen over the past decade.

Broad-based expansion in private sector output

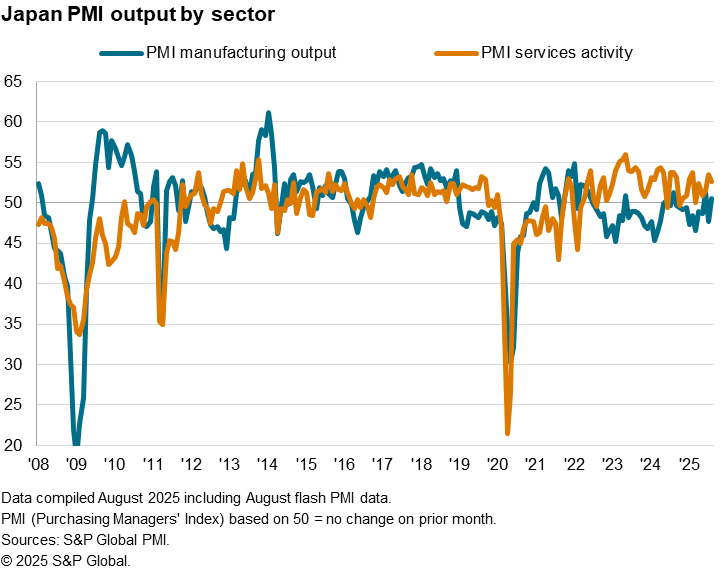

The latest rise in private sector output was notably broad-based. This was only the second time in which both manufacturing output and services activity rose in tandem in the past year.

After contracting in July, manufacturing production returned to expansion in August. That said, the rate of expansion was only marginal. Anecdotal evidence suggested that some factories lifted production in August in response to requests from customers, including for the Expo 2025 event. The uptick in production was neither accompanied by growth in purchasing activity nor stocks of purchases, however, as demand stayed subdued. This included overseas demand as new export orders fell at the steepest pace in nearly one-and-a-half years on the back of tepid economic conditions abroad, according to panellists.

Meanwhile the service sector remained in growth with services activity rising at a rate that was slower than July but still solid. This was driven by further improvements in demand conditions, though limited to the domestic sector as services export business fell for a second successive month, and at a strong pace.

Despite the expansion in new work, staffing levels at services companies fell for the first time in nearly two years. That said, it should be noted that job shedding was underpinned by both retirements and resignations rather than redundancies linked to a deterioration in confidence. In fact, overall optimism among service providers improved in the latest survey period.

Diverging outlook trends

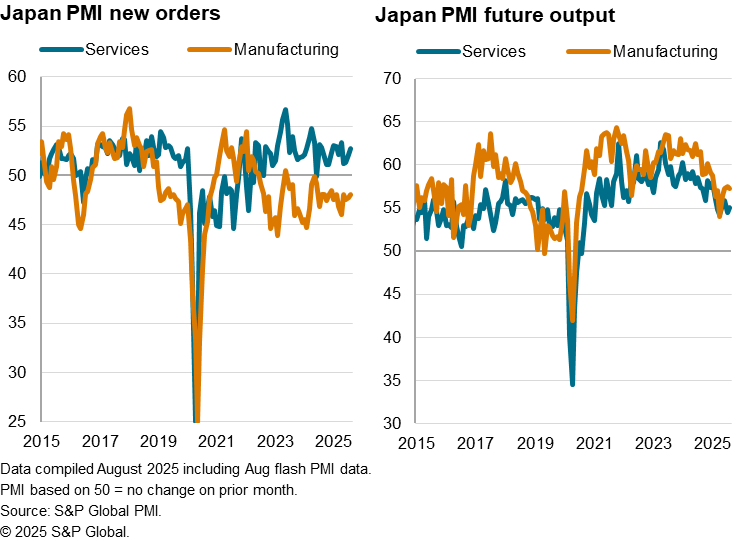

While the latest flash PMI data reflected a positive picture regarding growth midway through the third quarter, the forward-looking indicators continued to provide mixed signals for growth in the coming months.

Most notably, the latest broad-based improvement in output was not accompanied by widespread expansions in new orders by sector. This is crucial as the New Orders Index serves as a useful demand indicator assessing the near-term output trend. Overall new business growth accelerated in August mainly on the back of faster services new business growth, but manufacturing new orders fell for the twenty-seventh month in a row. Comments from panellists suggested that goods new orders declined on the back of the negative impact of US tariffs, inventory adjustments and subdued market conditions.

Additionally, the Future Output Index reflected that rising business confidence among service providers contrasted with falling optimism among manufacturers in August. The latter group cited concerns over global trade disruptions, a worsening demographic trend and the eventual conclusion of the Expo 2025 event which could lead to weaker performance in the year ahead.

Altogether, the data are suggesting that while composite growth may be supported by growth in services, the manufacturing sector could get left behind.

Margin pressures on the rise

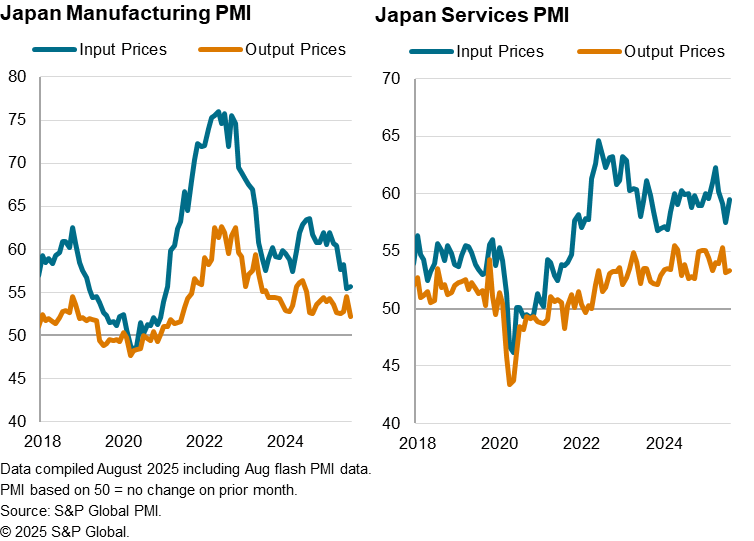

Finally, the latest flash PMI data also revealed that Japanese companies saw their margins getting squeezed in August.

Average input prices increased at a sharper pace across both the manufacturing and service sectors. with services companies again experiencing the higher rate of input price inflation of the two. According to panellists, higher input material, transportation and wage costs all contributed to the rise in expenses. This was further aggravated by unfavourable exchange rates, reinforcing recent calls for the Bank of Japan (BoJ) to act in curbing excessive yen weakness.

Despite the intensification of cost pressures, Japanese companies raised their selling prices at a slower pace in August, marking the softest rise since last October. This was mainly attributed to moderating manufacturing selling price inflation as panellists noted that strong competition limited their ability to share their cost burdens with clients. In contrast, service providers raised their selling prices at a faster rate than in July, though the rate of output price inflation remained below the year-to-date average.

The latest intensification of margin pressure coupled with the broadly positive output growth trend may add to the conviction for the BoJ to act sooner rather than later. However, with the PMI price gauges indicative of inflation returning to the 2.0% mark in the coming months. and tariff-related uncertainty dogging the manufacturing sector's outlook, we continue to see the BoJ being more likely to delay the hike to December.

Access the full press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2facceleration-in-business-activity-growth-in-japan-Aug25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2facceleration-in-business-activity-growth-in-japan-Aug25.html&text=Acceleration+in+business+activity+growth+in+Japan+masks+mixed+sectoral+demand+trend+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2facceleration-in-business-activity-growth-in-japan-Aug25.html","enabled":true},{"name":"email","url":"?subject=Acceleration in business activity growth in Japan masks mixed sectoral demand trend | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2facceleration-in-business-activity-growth-in-japan-Aug25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Acceleration+in+business+activity+growth+in+Japan+masks+mixed+sectoral+demand+trend+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2facceleration-in-business-activity-growth-in-japan-Aug25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}