Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 21, 2025

UK flash PMI signals fastest growth for a year in August despite persistent job cuts

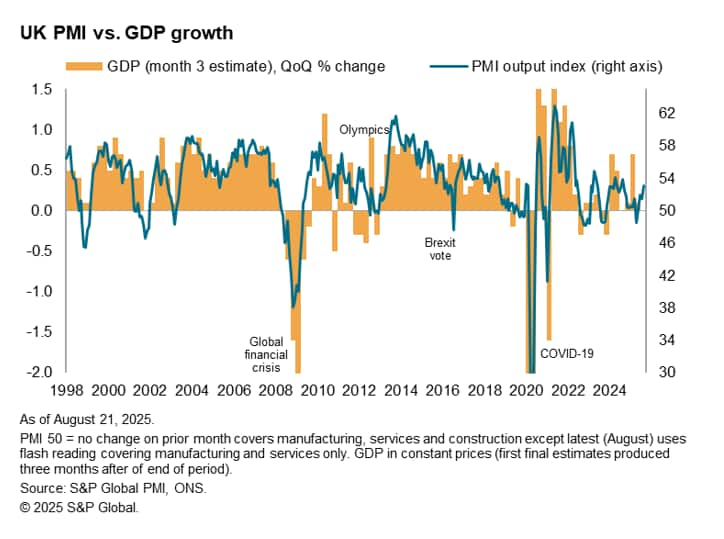

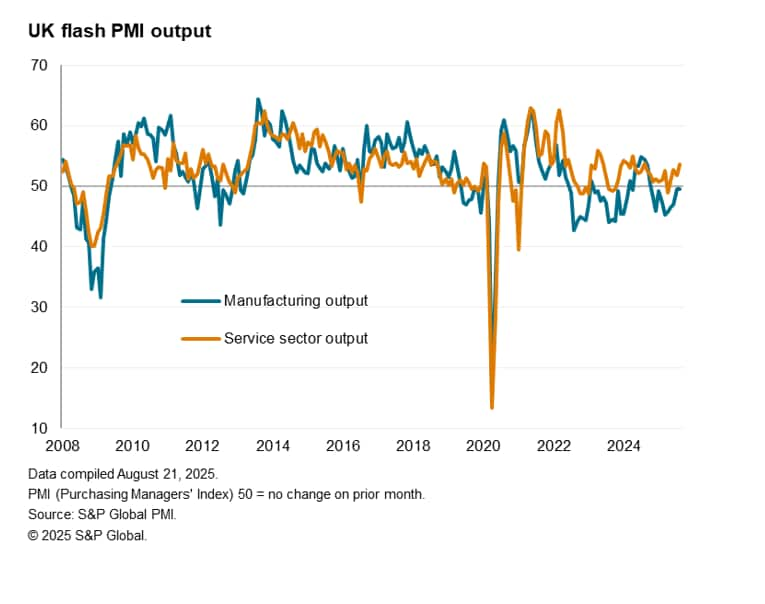

The flash UK PMI survey for August indicated that the pace of economic growth has continued to accelerate over the summer after a sluggish spring, the rate of expansion now at a one-year high. The services sector has led the upturn, but manufacturing also showed further signs of stabilising.

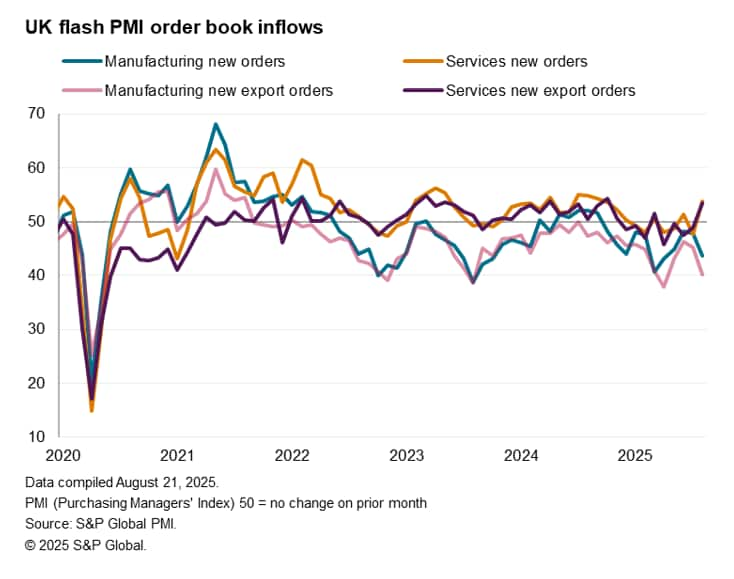

It's evident from survey measures of order books, however, that the demand environment remains both uneven and fragile. Companies report concerns over the impact of recent government policy changes, as well as unease emanating from broader geopolitical uncertainty. Goods exports are still falling especially sharply.

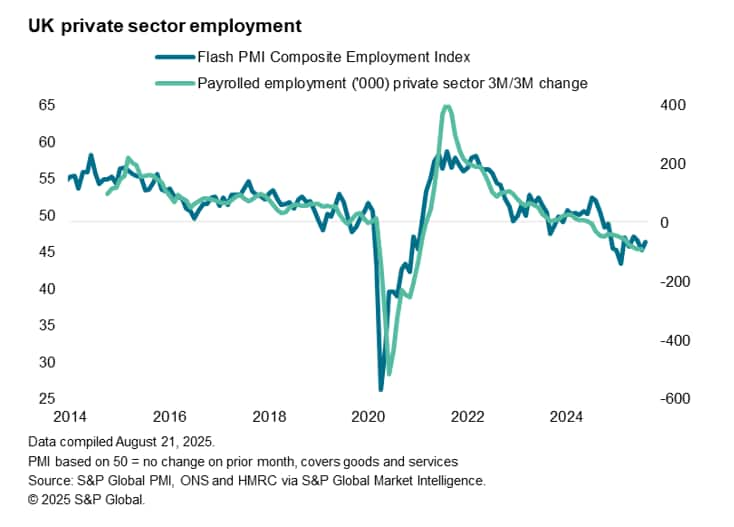

Payroll numbers also continue to be cut at an aggressive rate by historical standards as firms cite weak order books and concerns over rising staff costs due to the policies announced in the autumn Budget, which also contributed to persistent inflation pressures.

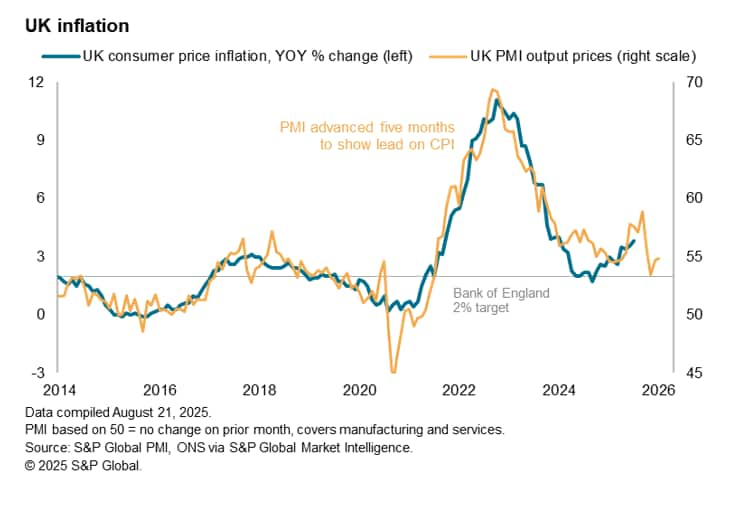

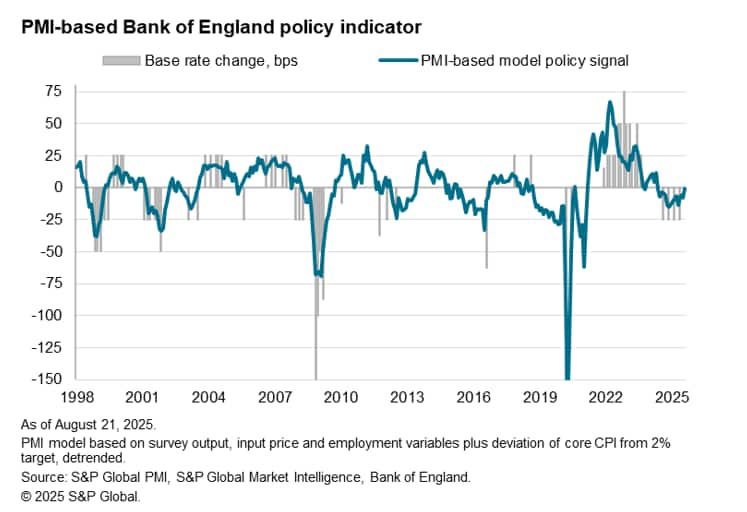

While the rise in business activity signalled by the PMI alongside the uplift in inflation to 3.8% in July lower the chances of further rate cuts this year, more data are required to assess both the sustainability of robust economic growth as well as the stickiness of the upturn in price pressures. Among a divided Bank of England rate setting committee, the perceived need for any future rate cuts will be very much data dependent.

Business growth at one-year high

Faster growth of UK business activity was reported in August, suggesting that economic growth has accelerated over the summer after an especially weak patch in the spring.

At 53.0, up from 51.5 in July, the flash PMI's headline composite output index rose to its highest for a year in August. At this level, the PMI is broadly consistent with GDP growing at a 0.3% quarterly rate.

Growth was led by the service sector, which saw an increase in activity for a fourth successive month after a brief decline back in April, the rate of expansion hitting the highest for a year. Although manufacturing output fell in August, the drop in production was only marginal for a second successive month, contrasting with steeper declines over the prior eight months to hint at a near stabilisation in the factory sector over the peak summer months.

Demand drag from goods exports

Higher new order inflows helped drive the upturn in output, but demand growth was markedly different by sector. Although new business placed at service providers revived to show the largest gain since last September, buoyed by the largest jump in exports since last October, manufacturing new orders fell at an increasingly sharp rate, driven in turn by one of the steepest downturns in exports of goods seen since the pandemic. Within services, the recovery of demand was largely driven by financial services, linked in part to lower interest rates, and IT.

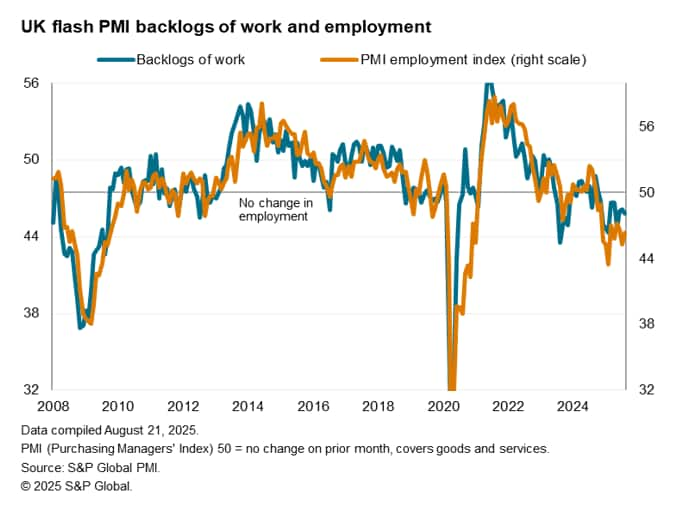

Further job losses

The upturn in new order inflows was insufficient to prevent a further marked fall in overall backlogs of orders - a key indicator of whether companies are operating with a shortfall or excess of capacity relative to demand. The drop in backlogs in turn caused firms across both manufacturing and services to reduce headcounts. However, companies also reported that higher staffing costs, associated with increased National Insurance (NI) contributions and the raised Minimum Wage introduced in April, also drove employment lower.

August's employment decline represented an eleventh successive month of job cutting, initiated by last autumn's Budget, and a continuation of the worst spell for employment since the global financial crisis of 2008-9 bar only the pandemic. August's PMI signals about 50,000 private sector jobs being cut during the month.

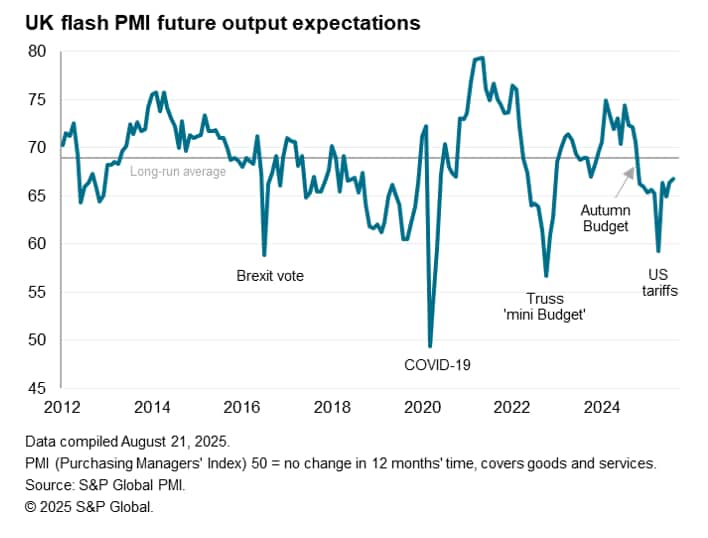

Confidence improves but remains subdued

More encouragingly, optimism about future prospects edged higher in August, improving to the highest seen since last autumn's Budget. The overall degree of confidence remained well below the survey's long-run average, however. Although the latest survey saw some signs of brightening optimism about future growth linked to lower borrowing costs, greater marketing, promotional work and new product developments, and an easing in some of the geopolitical concerns that had spiked higher earlier in the year, many companies remained cautious about the economic outlook, and many expressed particular concerns about government policy.

Higher costs

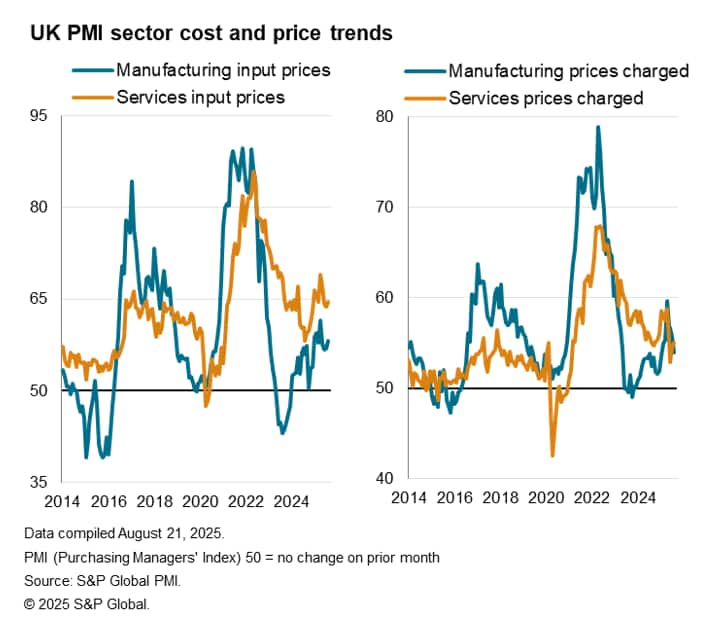

A key area of ongoing concern to business was the increase in staffing costs resulting from the last Budget, which continued to contribute to higher input costs and selling prices. Although input cost inflation rates have moderated since earlier in the year for both goods and services, rates remain elevated by historical standards.

Similarly, average selling prices rose in August at a rate that was far weaker than the recent peak seen in April, when the Budget measures came into effect, but the rate of inflation remained above that consistent with the Bank of England's 2% inflation target, according to historical comparisons, and in fact ticked up slightly in August to a three-month high.

The PMI data therefore suggest that the official gauge of inflation may rise further in the next couple of months after having already risen to 3.8% in July, but some easing is signalled thereafter in the latter months of the year, albeit remaining above the Bank of England's target.

Data add uncertainty to rate cut outlook

The August PMI survey suggests policymakers will be on hold over the next couple of months as they seek further clarity on the underlying economic situation, with question marks increasingly hanging over any further cuts this year.

Since August 2024, the Bank of England has reduced its Bank Rate five times, with the latest August meeting seeing the Bank Rate drop to a two-year low of 4.00%. The meeting saw five committee members voting to cut rates against four voting for no change, the "finely balanced" decision reflecting differing views on the health of the economy which will have likely persisted given the latest survey signals.

On one hand, the recent cuts to interest rates appear to have helped boost business activity and lift confidence. The upturn in the PMI to a one-year high in August will therefore provide encouragement to some hawkish policymakers to that the economy is regaining some momentum. This will obviate any pressing need for any further reduction in interest rates, especially as inflation remains elevated.

On the other hand, it's clear that the underlying demand environment is weak, with business confidence also running at a subdued level by historic standards. Of particular concern is the ongoing drop in employment that has been witnessed since last year's Budget. However, any 'dovish' views are likely to be checked by concerns that more evidence is needed to confirm that the recent upward pressures on inflation represent only a temporary blip that has been caused by government policy, rather than a more concerning fundamental reviving of inflationary pressure linked to supply-side issues.

Hence a further interest rate cut in November, which would follow the quarterly cadence of rate reductions seen over the past year, will be very much data dependent.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-fastest-growth-for-a-year-in-august-Aug25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-fastest-growth-for-a-year-in-august-Aug25.html&text=UK+flash+PMI+signals+fastest+growth+for+a+year+in+August+despite+persistent+job+cuts+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-fastest-growth-for-a-year-in-august-Aug25.html","enabled":true},{"name":"email","url":"?subject=UK flash PMI signals fastest growth for a year in August despite persistent job cuts | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-fastest-growth-for-a-year-in-august-Aug25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+flash+PMI+signals+fastest+growth+for+a+year+in+August+despite+persistent+job+cuts+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-flash-pmi-signals-fastest-growth-for-a-year-in-august-Aug25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}