Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jul 01, 2025

Global manufacturing PMI pulls back into expansion in June, but concerns persist over outlook while price trends diverge

Worldwide manufacturing output growth rebounded in June from a decline in May, according to the latest PMI surveys. But with business confidence remaining subdued and the modest upturn in part reflecting unusually high inventory building in the US amid tariff worries, there are downside risks to output in the coming months. More encouragingly, some of this pay-back from tariff frontloading may be offset by signs of strengthening domestic demand in many economies.

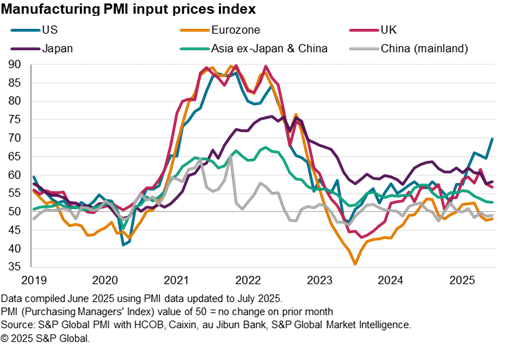

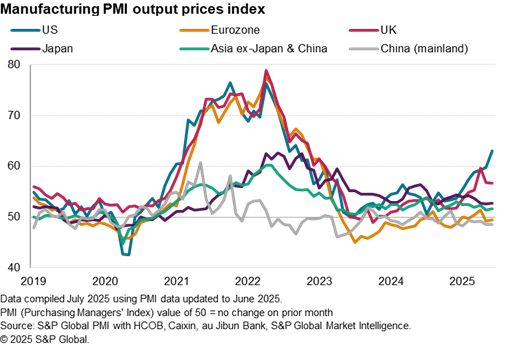

Price disparities have meanwhile continued to widen, with US producers reporting especially strong inflation pressures linked to tariffs, which have the potential to cause monetary policy trends to diverge among the major developed economies.

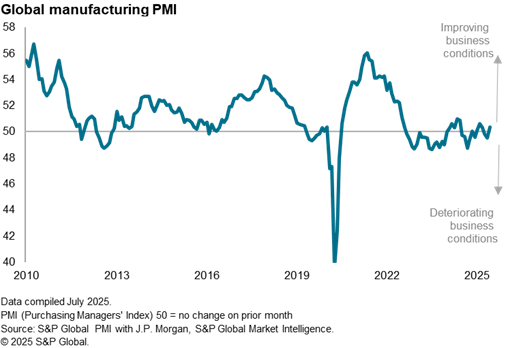

PMI edges back into expansion territory

The Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, rose from 49.5 in May to 50.3 in June, edging above the 50 'no change' level for the first time in three months to indicate a marginal improvement in business conditions at the end of the second quarter.

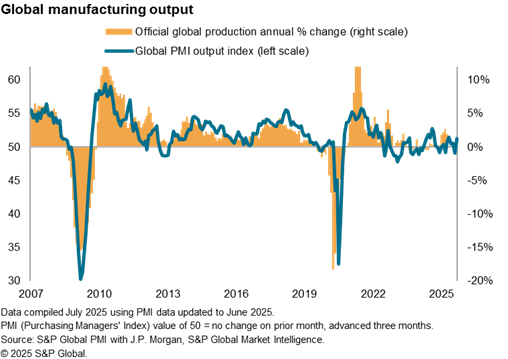

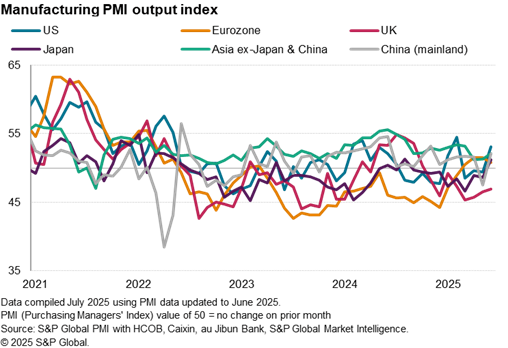

The PMI's Output Index, which measures monthly changes in factory production volumes, also showed an encouraging rebound in June, having signaled a decline in May. Although only modest, the upturn in production was the best recorded since February (and the second-best over the past year).

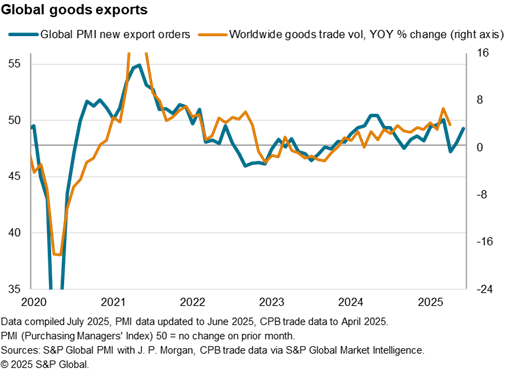

This upturn in production was in part due to an easing in the recent downturn in global exports, which fell for a third successive month in June but at a rate than was the weakest seen over this period. The resulting PMI New Export Orders Index was in fact consistent with rising global trade flows.

Uncertainty prevails

The improved expansion in June occurred despite the survey data being collected at a time of continued uncertainty, notably in relation to tariffs. The 90-day pause on higher rate US tariffs is due to expire on 9th July.

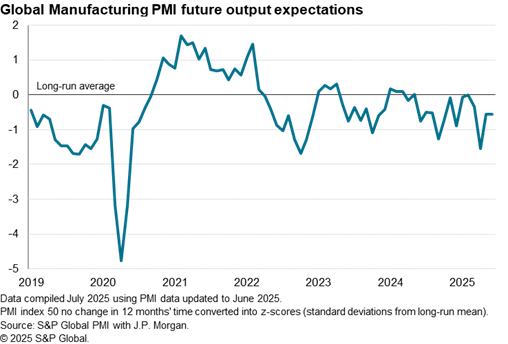

Concerns over US trade policy consequently played a key role in subduing business confidence among manufacturers worldwide in June to a level well below the survey's long-run average, unchanged compared to May and slightly below the average seen over the past three years.

The expansion of current output levels in the face of subdued confidence is in part explained by companies front-running the potential higher-rate levies on exports to the US. The concern is that this additional activity has merely pulled-forward production from later in the year, posing downside risks to global manufacturing in the second half of 2025.

US leads production upturn

To assess the impact of tariff front-loading in more detail, we note that June upturn in global production was driven by an improvement in output from the US, where factories reported the largest rise in output since February (after three months of sustained decline). However, output also notably rebounded in mainland China after a steep fall in May, growing at the fastest rate since last November, while Japan reported the first rise in production since last August. Production across the rest of Asia meanwhile accelerated to the fastest for three months and sustained output growth was seen in the eurozone. Although growth in the latter moderated slightly, the past four months have seen the best growth spell for the region for three years.

The UK remained something of an outlier among the major economies, reporting a further marked drop in production (what is perhaps noteworthy here is that the UK is the only economy to have so far agreed on a trade deal with the US, at the time of writing).

US inventory build

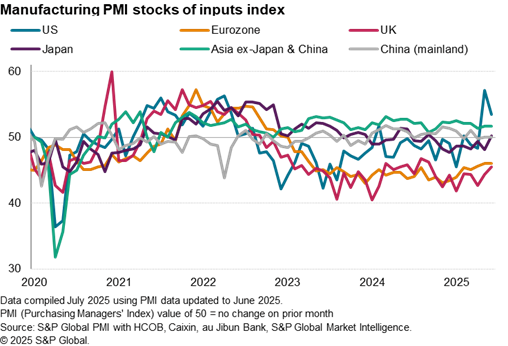

Importantly, US factories also reported a further marked accumulation of stocks of inputs in June, which followed a record (18-year) survey rise in May. This inventory build-up in the US has contrasted with either falling or largely unchanged inventories in Japan, Europe and mainland China, widely attributed to weak demand.

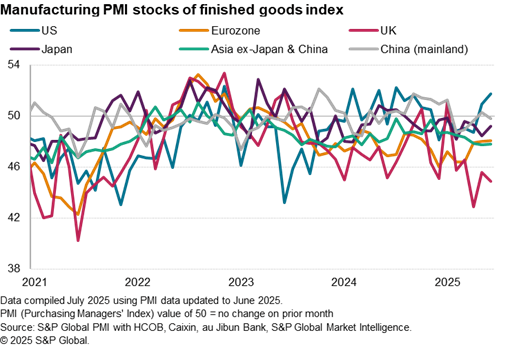

Similarly, US producers reported a near-record rise in

inventories of finished goods in June, contrasting with falling

inventories in the other major economies.

US producers report further steep price rises

Looking at the survey price data helps one further understand some of this inventory accumulation, as firms have grown concerned over the price impact of tariffs.

The PMI surveys indicated another month of strongly diverging price pressures globally. Rates of inflation for factory input costs and selling prices accelerated sharply in the US from already strong rates seen in May, reaching the highest since July 2022 and September 2022 respectively. These price rises were overwhelmingly blamed on tariffs.

In contrast, input costs and prices charged by factories fell on average in mainland China and the eurozone and elsewhere remained far more subdued than seen in the US.

For both input costs and selling prices, the increases reported in the US in fact outstripped all other economies and countries for which PMI data are so far available for June (we await data for Canada and Pakistan).

Confidence varies

These inventory build-ups in the US hint at two potential developments, both of which augur for weaker global production growth in the coming months.

First, the accumulation of US inputs indicated that we are likely to see lower buying of inputs by US manufacturers in the coming months, and hence lower demand for imported goods shipped from economies such as the eurozone and Asia.

Second, the rise in inventories of finished goods in the US hinted at lower US production in coming months unless demand growth picks up.

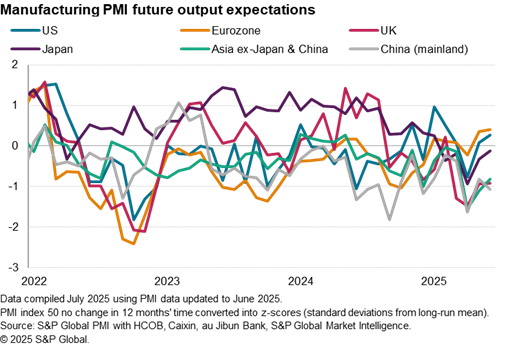

Some caution is needed here in two respects. First, some of these US stock build-ups represent greater confidence in sales over the coming year. We note that US producers remain confident in the year ahead to a degree that has risen further above the US survey's long-run average in June.

Similarly, confidence has also risen in economies such as the eurozone and Japan, which in part reflected greater optimism about the impact of domestic demand in these economies, which is expected to help counteract any adverse impact from US trade policies. This is especially evident in the eurozone and in particular Germany, where economic sentiment has been buoyed by expectations of increased government spending on items such as defense.

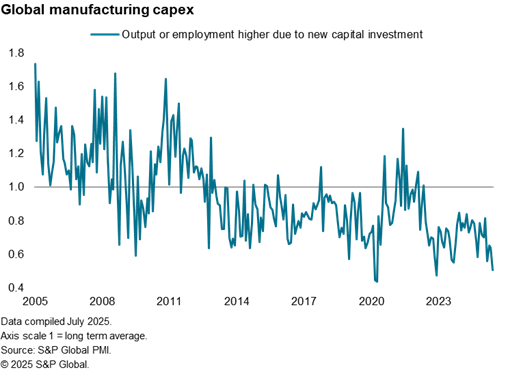

It is clear, however, that the elevated uncertainty that has persisted into June has deterred companies from investing. The proportion of companies reporting that they had increased either output or employment due to new capital investment has sunk to a low exceeded only twice since comparable data were first available 20 years ago.

Outlook

The PMI data therefore highlight some potential downside risks to global manufacturing output in the coming months, stemming from the build-up of US inventories. The potential imposition of higher tariffs on 9th July absent US trade deals also poses downside risks to the outlook. However, some offsetting impact is evident from rising demand in other economies.

Key developments to watch will be the news on US tariffs in July, the resilience of production levels, as well as the impact of existing tariffs on US inflation. At present, the indications from the PMI surveys are that inflation looks set to rise in the US, contrasting in particular with subdued price pressures in Europe, which will potentially lead to further disparities in monetary policy.

Access the latest global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-pulls-back-into-expansion-in-june-but-concerns-persist-over-outlook-while-price-trends-diverge-Jul25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-pulls-back-into-expansion-in-june-but-concerns-persist-over-outlook-while-price-trends-diverge-Jul25.html&text=Global+manufacturing+PMI+pulls+back+into+expansion+in+June%2c+but+concerns+persist+over+outlook+while+price+trends+diverge+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-pulls-back-into-expansion-in-june-but-concerns-persist-over-outlook-while-price-trends-diverge-Jul25.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing PMI pulls back into expansion in June, but concerns persist over outlook while price trends diverge | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-pulls-back-into-expansion-in-june-but-concerns-persist-over-outlook-while-price-trends-diverge-Jul25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+PMI+pulls+back+into+expansion+in+June%2c+but+concerns+persist+over+outlook+while+price+trends+diverge+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmanufacturing-pmi-pulls-back-into-expansion-in-june-but-concerns-persist-over-outlook-while-price-trends-diverge-Jul25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}