Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 26, 2025

Week Ahead Economic Preview: Week of 30 June 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Global PMIs, US payrolls and eurozone inflation in focus

Central bank policymakers will have plenty of new information to process in the coming week, notably including worldwide PMI surveys for both manufacturing and services, the US non-farm payroll report and flash inflation data for the eurozone. All of which are released as markets are set to see continued uncertainty as the end of April's 90-day US tariff pause draws closer.

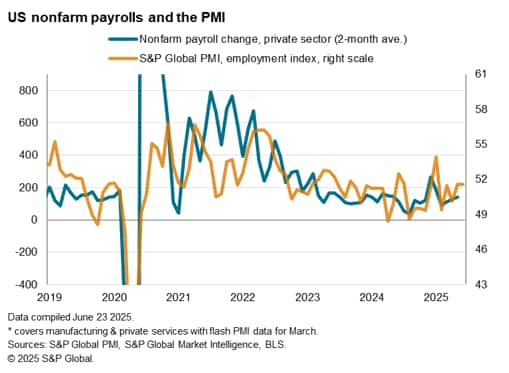

With splits starting to appear among FOMC policymakers on the timing of potential rate cuts, the early release of the monthly US employment report on Thursday will likely garner more attention than usual. The Fed is in wait-and-see mode, reassured by signs of recent economic and labour market resilience amid current soft inflation readings, but concerned that inflation may soon rise as the impact of tariffs takes hold. So far, the inflationary impact of tariffs has only really been visible in the business surveys, meaning any marked weakening of the jobs market in Thursday's report could tilt the policy stance towards earlier rate cuts. That said, survey data available so far for June, such as the S&P Global Flash US PMI, have signalled robust US hiring as firms enjoyed increased workloads. Although it remains to be seen how much of this represents a short-term ramping up of business activity as firms seek to front-run tariffs (trade data to be released in the week may help in this respect), the short-term impact on the jobs market data should be positive.

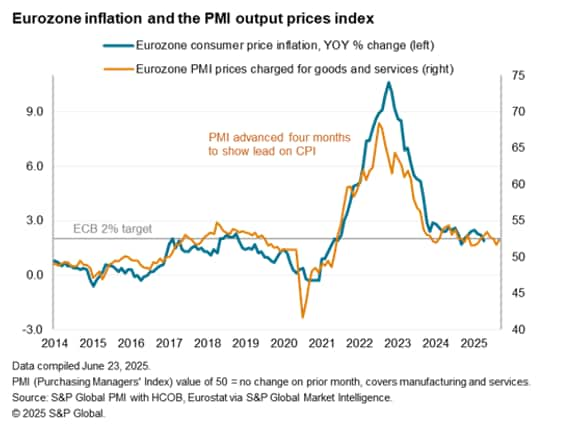

Meanwhile, the European Central Bank is also awaiting greater clarity on the eurozone's economic outlook in determining its next move. The ECB has already cut its Deposit Rate to 2.0%, which represents a broadly neutral stance according to staff estimates, and policymakers wish to get greater clarity in particular on the impact of tariffs on both economic growth and inflation. Clues as to the former will be provided by the detailed final PMIs for the region, while the early official estimate of eurozone consumer price inflation for June will give an up-to-date signal on price trends. Weak flash PMI data, in terms of both growth and firms' selling prices, hint at an ongoing easing bias to ECB policy in the coming months.

More broadly, policymakers and markets around the world will be eager to assess the impact of tariffs in June via the global PMI manufacturing and services data, which have so far indicated that the global economy has been growing in the second quarter at its weakest rate since late-2023. An overview of May's PMI data is available here.

US non-farm payrolls are due on Thursday with survey data hinting at sustained job market resilience.

Eurozone inflation is expected to have run close to the ECB's target in June when flash CPI data are published Tuesday

Key diary events

Monday 30 June

Colombia Market Holiday

South Korea Industrial Production (May)

Japan Industrial Production (May, prelim)

China (Mainland) NBS PMI (Jun)

United Kingdom GDP (Q1, final)

Germany Retail Sales (May)

United Kingdom Mortgage Lending & Approval (May)

Italy Inflation (Jun, prelim)

India Current Account (Q1)

Germany Inflation (Jun, prelim)

United States Chicago PMI (Jun)

United States Dallas Fed Manufacturing Index (Jun)

Tuesday 1 July

Canada, Hong Kong SAR Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Jun)

Japan Tankan Large Manufacturers Index (Q2)

South Korea Trade (Jun)

Indonesia Inflation (Jun)

Indonesia Trade (Jun)

Japan Consumer Confidence (Jun)

United Kingdom Nationwide Housing Prices (Jun)

Germany Unemployment Rate (Jun)

Eurozone Inflation (Jun, flash)

United States ISM Manufacturing PMI (Jun)

United States JOLTs Job Openings (May)

Wednesday 2 July

South Korea Inflation (Jun)

Australia Retail Sales and Building Permits (May)

Eurozone Unemployment Rate (May)

Brazil Industrial Production (May)

United States ADP Employment Change

Canada Manufacturing PMI* (Jun)

Thursday 3 July

US (Partial), Egypt Market Holiday

Worldwide Services, Composite PMIs, inc. global PMI* (Jun)

Australia Trade (May)

Switzerland Inflation (Jun)

Turkey Inflation (Jun)

Canada Trade (May)

United States Non-Farm Payrolls, Unemployment Rate, Average Hourly

Earnings (Jun)

United States Trade (May)

United States ISM Services PMI (Jun)

United States Factory Orders (May)

Friday 4 July

US Market Holiday

Japan Household Spending (May)

Hong Kong SAR PMI* (Jun)

Philippines Inflation (Jun)

Germany Factory Orders (May)

France Industrial Production (May)

Italy Retail Sales (May)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

June manufacturing, services and detailed sector PMI

Worldwide manufacturing, services and detailed sector PMI data will be published over the course of the new week. This followed early indications of accelerating developed world economic growth, according to flash PMI data. That said, growth was uneven with the US and Japan leading growth while the UK and eurozone expanded only marginally. Additionally, inflation trends also diverged.

The worldwide PMI data will be in focus for insights into how all major developed and emerging economies have fared globally while the detailed sector data will offer a look into where the key areas of strength and weakness lie amid uncertainty as US tariff deadlines loom on 9th July.

Americas: US labour market report, ISM PMI, factory orders and trade data; Canada trade

The US publishes non-farm payrolls data for June on Thursday ahead of the Independence Day holiday. This comes after the latest S&P Global Flash US PMI, which is computed from around 85% of all survey responses, revealed that US companies hired at the quickest pace in just over a year in response to higher workloads, thereby hinting at another positive payroll reading in June. The final S&P Global US PMI readings will also be published in the new week alongside ISM PMI data. Official data, including the factory orders and trade data will also be in focus as analysts weigh up the impact of tariffs.

Separately, Canada publishes trade data for May for continued insights into the impact of US tariffs on growth midway through the second quarter.

EMEA: Eurozone inflation; UK GDP, nationwide housing prices, mortgage lending and approval data; Germany unemployment rate

The key official data release from the eurozone will be the flash inflation data for June. The HCOB Flash Eurozone PMI indicated average selling prices continued to rise at a rate in line with the ECB's 2% inflation target in June, and therefore provides room for further rate cuts.

Additionally, highlights in the week also include the final Q1 GDP reading from the UK plus Germany's employment data.

APAC: China PMI; Japan Tankan survey and consumer confidence data; Australia trade; India industrial production; Indonesia and Philippines inflation

PMI data from mainland China's National Bureau of Statistics and Caixin/S&P Global will be due during the week. The Bank of Japan's Tankan survey, or short-term economic survey of enterprises in Japan, will meanwhile be updated for the second quarter for a check on business expectation.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-june-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-june-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+30+June+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-june-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 30 June 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-june-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+30+June+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-30-june-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}