Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 24, 2025

Flash PMIs signals further subdued developed world growth in June, but also diverging inflation trends

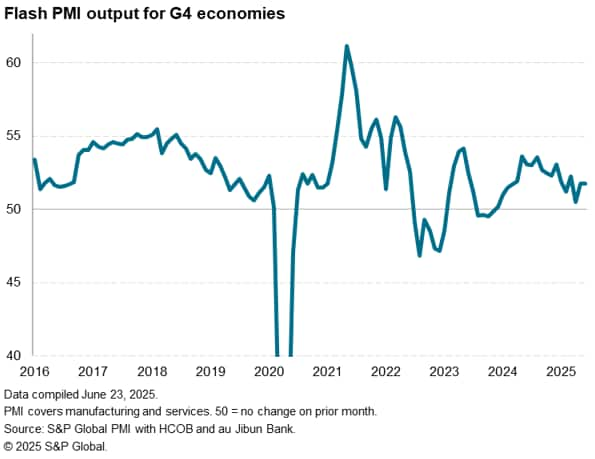

The flash PMI data compiled by S&P Global Market Intelligence indicated that business output among the four largest developed economies - the 'G4' economies - continued to grow in June, though the rise rounded off the weakest calendar quarter since late 2023. An upturn in manufacturing growth was offset by a slight softening of growth in the services economy across the G4.

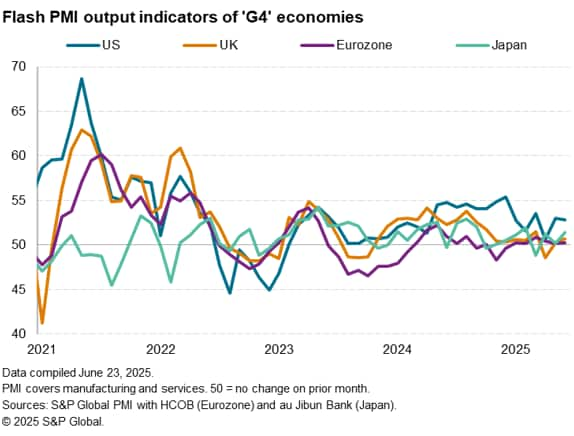

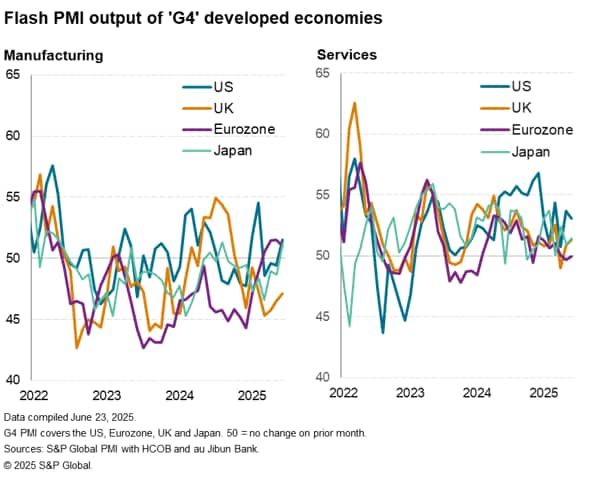

The US continued to report stronger growth than seen in the eurozone, UK and Japan, both in terms of manufacturing output and service activity, but also reported higher price pressures. A further sharp tariff-related rise in US prices, for both goods and services, contrasted with much cooler inflation rates in Europe.

Soft G4 output growth in Q2

The Composite PMI Output Index from the G4 economies, a GDP-weighted gauge covering both goods and services, edged up from 51.7 in May to 51.8 in June, according to the preliminary 'flash' reading. The rise adds weight to the suggestion that April, which saw the PMI index hit a 16-month low of 50.5, represented a nadir in recent collective economic activity growth among the major developed economies.

That said, growth over the second quarter of 2025 was still the lowest recorded on average since the fourth quarter of 2023.

Growth across the collective G4 was again led by the service sector, despite a slight moderation in the pace of expansion to one of the weakest rates seen over the past year-and-a-half.

More encouragingly, June saw a revival of G4 manufacturing output growth at the joint-fastest since May 2024. While still only marginal, and still lagging the pace of expansion seen in the service sector, the improvement represented an encouraging signal for the goods producing sector after the output declines seen throughout much of the past three years.

US reports fastest output growth

Of the G4 economies, the US reported the fastest growth of output for the twelfth time in the past 14 months in June, despite its rate of increase ticking lower to remain among the weakest seen over the past year. However, Japan closed the gap with the US by reporting its best output gain since February, contrasting with only marginal output growth in both the eurozone and UK.

The US outperformance was due to sustained, albeit moderating, service sector growth combined with an upturn in manufacturing output for the first time in four months.

Japan and the UK also reported sustained services growth, but their rates of expansion lagged that seen in the US. While Japan benefitted from an additional upturn in manufacturing output, which rose for the first time in ten months, the UK's service sector gain was largely offset by another marked fall in goods production.

The eurozone meanwhile not only lagged in terms of stalled service sector growth, but its manufacturing sector also lost some growth momentum, albeit having led the G4 over the prior two months.

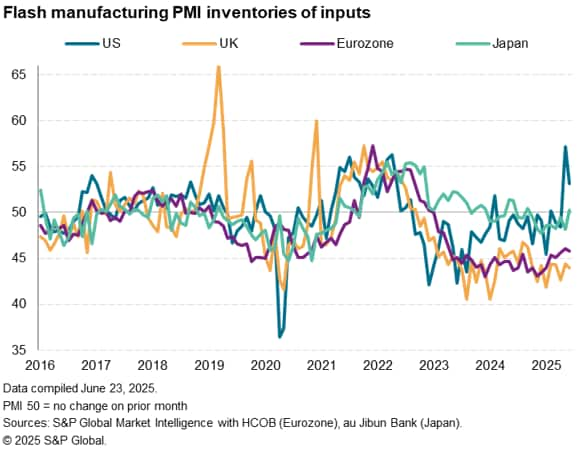

While manufacturing gains in the eurozone, and to a lesser extent Japan, reflected rising domestic demand, we note that some of the manufacturing gains reported in June likely reflect the front-running of possible further tariff hikes by exporters shipping to the US.

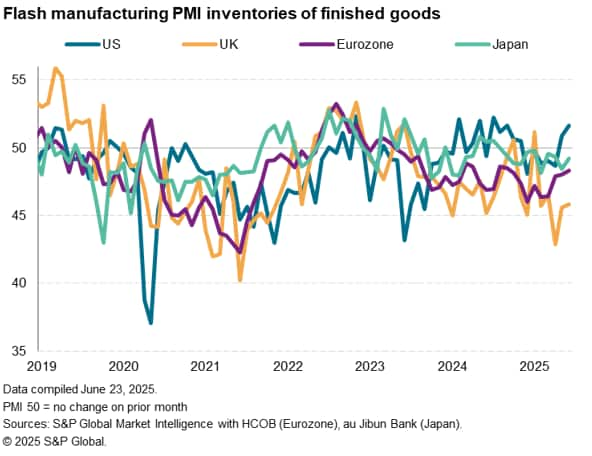

The prospect of further tariff rises encouraged US factories to further accumulate inventories of inputs in June, which over the past two months have increased to an extent rarely exceeded over the 18-year history of the US S&P Global PMI survey (with May having seen a record rise).

Tariff worries also buoyed US production, as US firms sought to boost safety stocks of finished goods, which rose sharply in contrast to falling inventories in the other G4 economies.

US sees second month of steep price rises

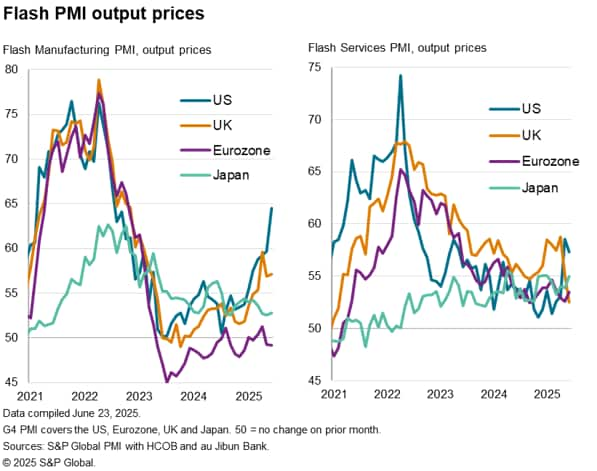

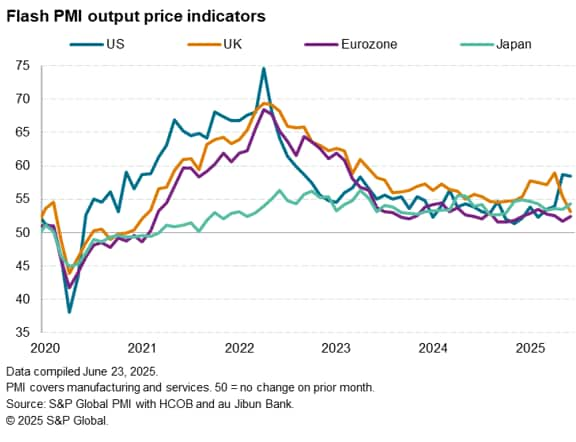

The impact of tariffs was also evident again in terms of prices. Higher import costs in the US were widely blamed on tariffs, driving the largest rise in average input costs for manufacturing, and the largest rise in factory gate selling prices, since July 2022. Close to two-thirds of all US manufacturers reporting higher input costs attributed these to tariffs, whilst just over half of respondents linked increased selling prices to tariffs.

In marked contrast to the US, manufacturing selling prices fell on average for a second successive month in the eurozone. While some upward pressure on goods prices were reported in the UK and Japan, rates of increase remained subdued compared to that seen in the US.

Prices also rose sharply in the US service sector, outpacing rates of inflation seen in the other G4 economies by a wide margin for a second straight month. US services price hikes were likewise often attributed to tariffs, notably for food inputs.

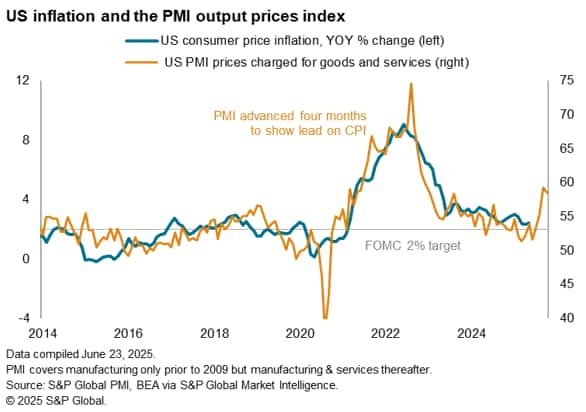

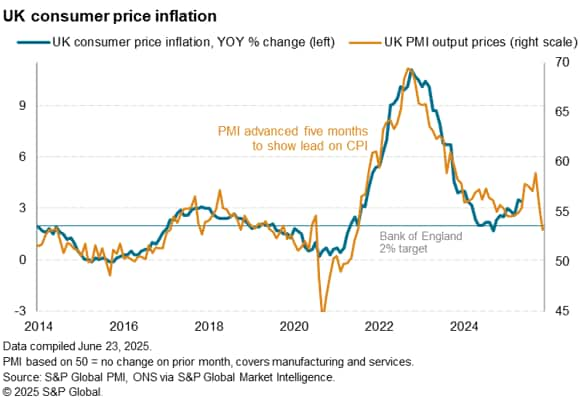

The resulting rise in prices charged for US goods and services was the second highest since September 2022, exceeded only by the rise seen in May and far outpacing the price inflation signalled for the eurozone, Japan and the UK. The latter saw a welcome cooling of recent tax-related price increases, which took effect in April.

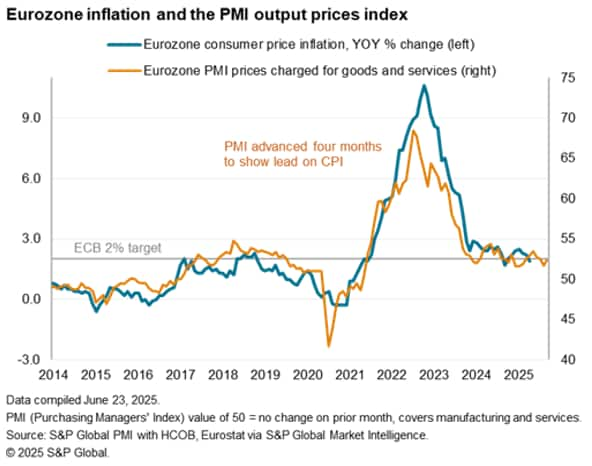

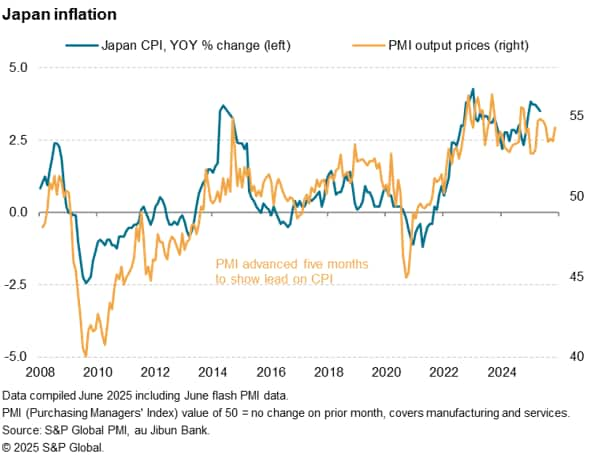

While historical comparisons indicate that the US PMI prices charged index is consistent with consumer price inflation accelerating to around 4% in the coming months, eurozone and UK PMI price gauges are broadly indicative of inflation running in line with central bank 2% targets. Japan's rate of price increase is meanwhile indicative of inflation staying elevated above the 2.0% mark in the coming months.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-signals-further-subdued-developed-world-growth-in-june-but-also-diverging-inflation-trends-Jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-signals-further-subdued-developed-world-growth-in-june-but-also-diverging-inflation-trends-Jun25.html&text=Flash+PMIs+signals+further+subdued+developed+world+growth+in+June%2c+but+also+diverging+inflation+trends+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-signals-further-subdued-developed-world-growth-in-june-but-also-diverging-inflation-trends-Jun25.html","enabled":true},{"name":"email","url":"?subject=Flash PMIs signals further subdued developed world growth in June, but also diverging inflation trends | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-signals-further-subdued-developed-world-growth-in-june-but-also-diverging-inflation-trends-Jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMIs+signals+further+subdued+developed+world+growth+in+June%2c+but+also+diverging+inflation+trends+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-signals-further-subdued-developed-world-growth-in-june-but-also-diverging-inflation-trends-Jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}