Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 23, 2025

US growth slips lower as goods prices jump higher, but job gains accelerate

US business activity continued to grow in June, though the overall rate of expansion lost a little momentum to remain well below those seen late last year.

Falling exports of goods and services acted as a drag on growth, in part offset by stock building by US companies, often linked to concerns over tariffs.

Tariffs were also widely blamed for higher prices. These rose at an especially sharp and increased rate in manufacturing, but also continued to rise steeply in services.

Companies meanwhile struggled to meet rising workloads, with backlogs of work increasing at the fastest rate for over three years and encouraging firms to take on additional staff to the greatest degree for a year.

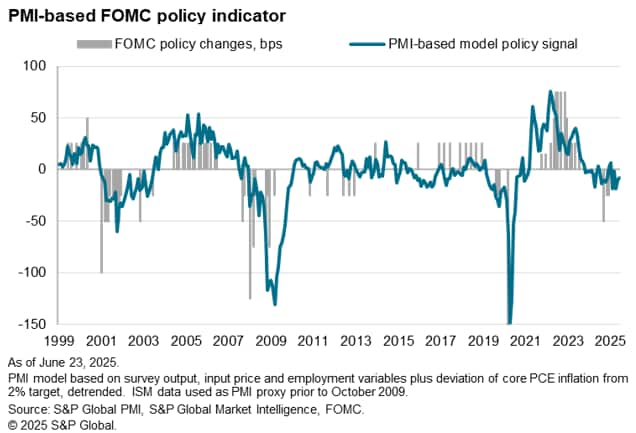

This labour market resilience, coupled with inflationary pressures moving higher, means the survey data suggest that the Fed will maintain a cautious approach to policy, awaiting more information on how tariffs and economic uncertainty might affect the outlook before reducing interest rates any further.

US growth slips lower

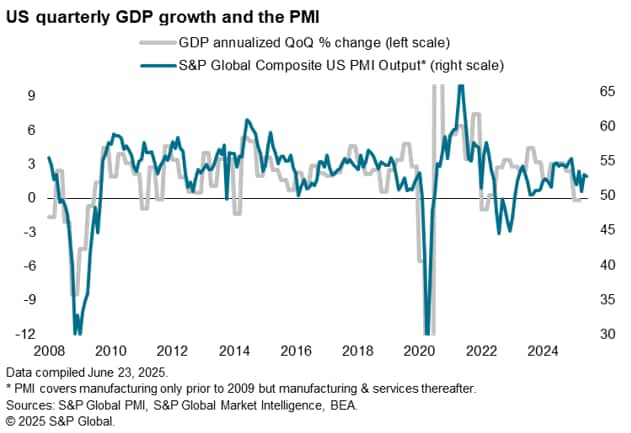

The headline S&P Global US PMI Composite Output Index registered 52.8 in June, according to the 'flash' reading (based on about 85% of usual survey responses), down from 53.0 in May. While the June rise in output was the third strongest so far this year, the pace of growth remains well below that recorded in late 2024. Output has nevertheless now grown continually for 29 months.

Comparisons with official GDP data suggest that the PMI is broadly consistent with the economy growing at a 1.5% annualized rate in June, .and a 1.3% rate of over the second quarter as a whole.

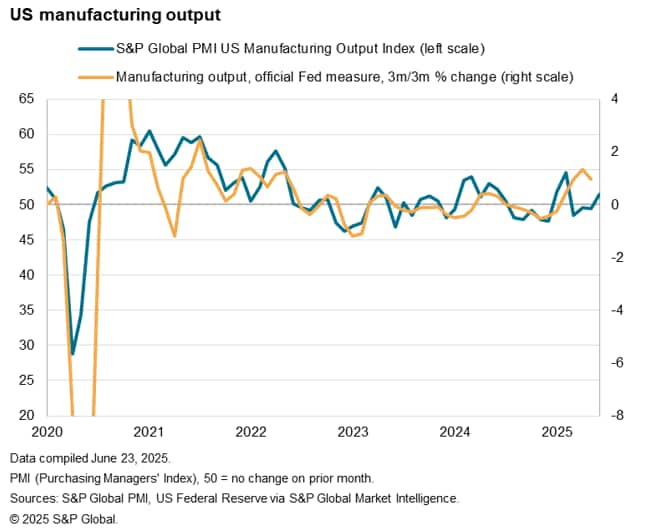

A positive aspect of June's expansion was that growth became more balanced between manufacturing and services. Although service sector output growth cooled slightly, it remained solid while manufacturing output rose for the first time since February.

The ongoing expansion reflected a further rise in new orders, which have now risen continually for 14 months, though the rise in orders dipped slightly in June to remain well below the strong gains seen at the turn of the year. Similar gains in inflows of new work were recorded in the manufacturing and service sectors and, in both cases, growth was driven by rising domestic demand.

This served to mask a fall in export orders in June. Service providers again recorded a steeper contraction than manufacturers, the latter down only slightly in June after a small rise in May. Services exports have suffered the largest quarterly contraction since late 2022 in the three months to June.

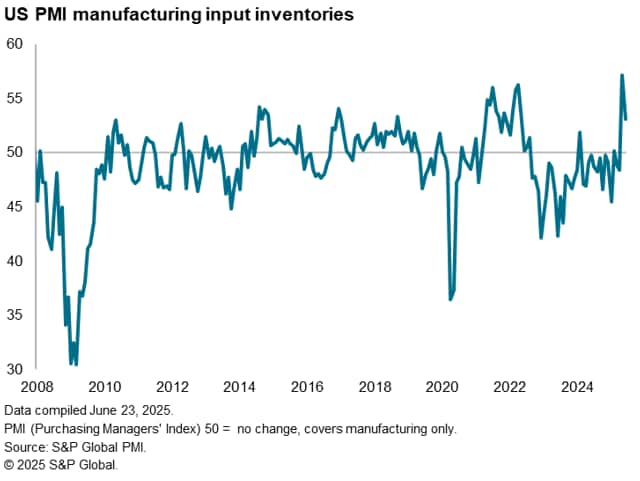

Inventories rise sharply

June saw further inventory building in manufacturing. Purchasing of inputs was expanded at the fastest rate in 37 months, causing inventories of inputs to also rise again, increasing at the second-fastest rate in over three years following May's survey record rise. Inventories of finished goods at factories meanwhile registered the largest rise for nine months; a rise that was among the greatest in the survey's 18-year history.

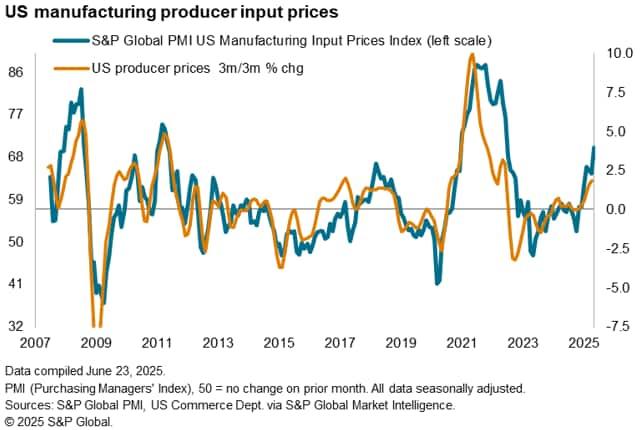

Prices spike higher again in manufacturing

Price pressures rose sharply across both manufacturing and service sectors during June, with the former reporting an especially steep increase, and again commonly linked to tariffs.

Manufacturers' input prices and selling prices both rose at rates not seen since July 2022, as higher costs were passed on to customers. Close to two-thirds of all manufacturers reporting higher input costs attributed these to tariffs, whilst just over half of respondents linked increased selling prices to tariffs.

However, prices also rose sharply in the service sector, likewise often attributed to tariffs but also reflecting higher financing, wage and fuel costs. Service sector input costs and selling prices nonetheless rose at slower rates than in May, in part reflecting more intense competition.

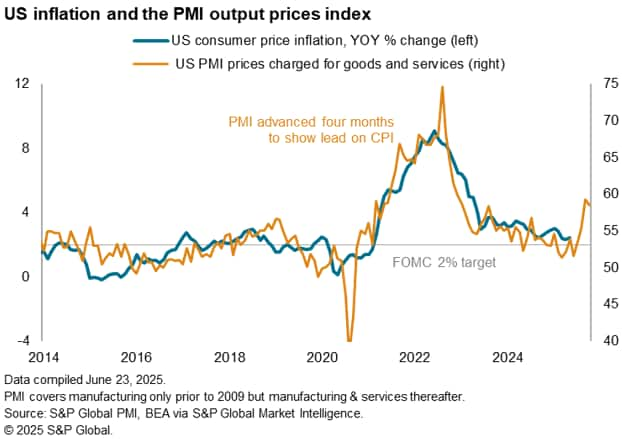

While the slower rates of service sector price inflation helped offset some of the increase in manufacturing prices to bring rates of inflation down from May's recent peaks, the overall rise in costs was still the second largest since the start of 2023. The rise in prices charged for goods and services was the second highest since September 2022.

Historical comparisons indicate that the PMI prices charged index is consistent with consumer price inflation accelerating to around 4% in the coming months.

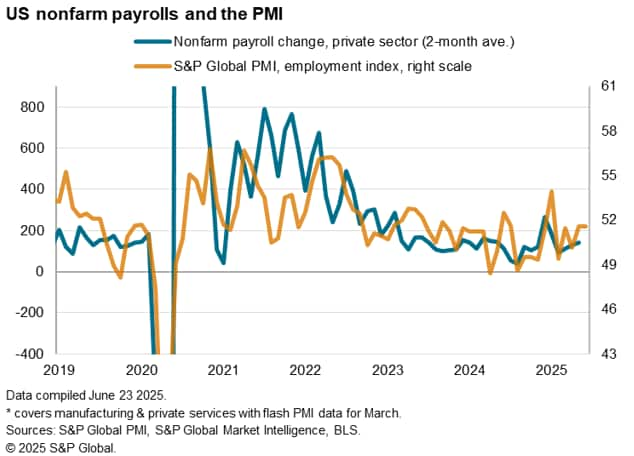

Employment grows as firms meet rising workloads

Companies took on additional staff at a rate not seen for just over a year largely in response to the need to meet higher workloads. A 12-month high rate of job creation in manufacturing was accompanied by a five-month peak in services.

June saw the largest accumulation of uncompleted work recorded for three years. Higher work outstanding in services were accompanied by the first rise in manufacturing backlogs since September 2022.

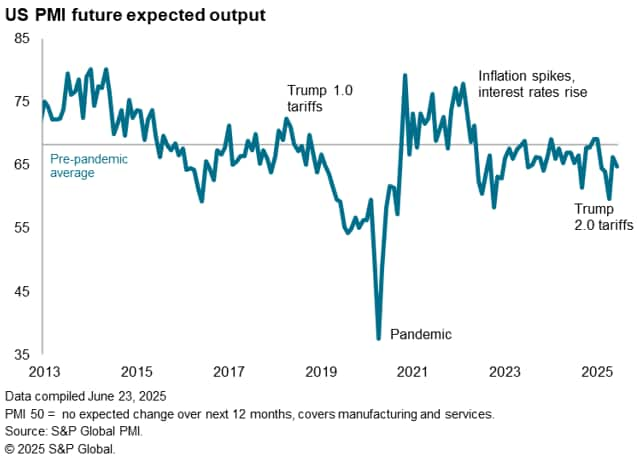

Future sentiment dips lower

Companies' expectations about output in the year ahead dipped slightly in June, remaining well below levels see at the turn of the year (and the surveys' long-run average). Sentiment was however above April's two-and-a-half year low.

While trade worries and anxiety around government policies have moderated since April, companies generally remained less upbeat than prior to the inauguration of President Trump. This was especially notable in the service sector, where confidence fell in June amid heightened uncertainty over government policy such as spending cuts. In contrast, manufacturers grew slightly more upbeat, in part reflecting hopes of greater benefits from trade protectionism than service sector counterparts.

Outlook

While the June flash PMI data indicate that the US economy continued to grow at the end of the second quarter, the outlook remains uncertain while inflationary pressures have risen sharply in the past two months. This uncertainty has likely risen further following US military action in Iran in the days following the flash PMI data collection.

Although business activity and new orders continued to grow in June, growth has weakened amid falling exports of both goods and services. Furthermore, while domestic demand has strengthened, notably in manufacturing, to encourage higher employment, this in part reflects a boost from stock building, in turn often linked to concerns over higher prices and supply issues resulting from tariffs. Such a boost is likely to unwind in the coming months.

Prices for goods have meanwhile jumped sharply again as firms pass higher tariff-related costs on to customers. Service providers are by no means immune to this tariff impact and likewise reported another jump in prices, often linked to tariffs on inputs such as food.

The data therefore corroborate speculation that the Fed will remain on hold for some time to both gauge the economy's resilience and how long this current bout of inflation lasts for.

Our forecast team expects the Federal Reserve to keep interest rates unchanged at 4.25% to 4.50% throughout the rest of 2025 up to December, when a further cut is anticipated. This follows 100 basis points of rate cuts in late 2024, since when the FOMC has decided on a "wait and see" approach to policy in the light of changing economic conditions generated by US policy announcements from the new Trump administration, notably including tariffs.

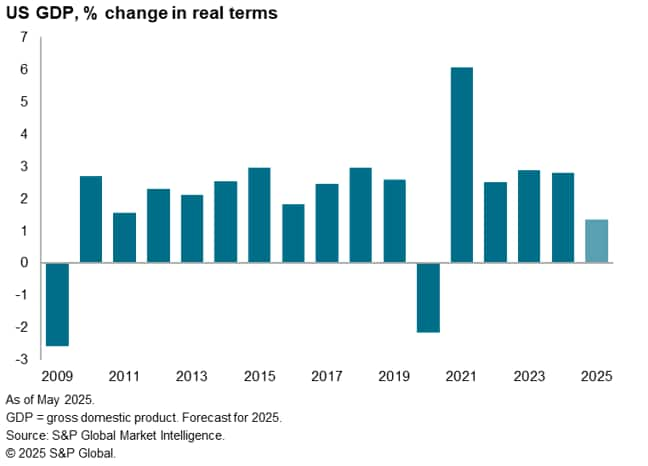

With rate cuts on hold, we forecast the US economy to grow by less than 1.5% in 2025 which - barring the pandemic-affected year of 2020 - would be the worst performance since the global financial crisis in 2009.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-growth-slips-lower-as-goods-prices-jump-higher-but-job-gains-accelerate-Jun25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-growth-slips-lower-as-goods-prices-jump-higher-but-job-gains-accelerate-Jun25.html&text=US+growth+slips+lower+as+goods+prices+jump+higher%2c+but+job+gains+accelerate+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-growth-slips-lower-as-goods-prices-jump-higher-but-job-gains-accelerate-Jun25.html","enabled":true},{"name":"email","url":"?subject=US growth slips lower as goods prices jump higher, but job gains accelerate | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-growth-slips-lower-as-goods-prices-jump-higher-but-job-gains-accelerate-Jun25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+growth+slips+lower+as+goods+prices+jump+higher%2c+but+job+gains+accelerate+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-growth-slips-lower-as-goods-prices-jump-higher-but-job-gains-accelerate-Jun25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}