Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 02, 2025

Week Ahead Economic Preview: Week of 5 May 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Services PMI numbers are updated around the world to provide updated guidance on growth and inflation trends, and set the scene for FOMC and Bank of England policymaker meetings.

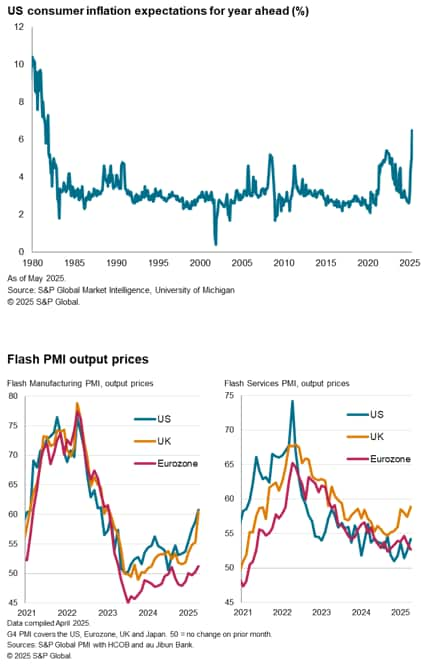

The US Federal Open Market Committee announces its latest policy decision on Wednesday followed by the Bank of England's Monetary Policy Committee on Thursday. Despite the FOMC coming under pressure to cut rates amid signs of economic weakness, with GDP contracting in the first quarter, US policymakers are widely expected to keep rates on hold as they evaluate the impact of tariffs on inflation. US inflation expectations have spiked higher among consumers. Producers responding to PMI surveyshave also reported sharply higher costs, generally associated with higher imported input prices linked to tariffs, which fed through to the steepest rise in prices charged for goods recorded for nearly two and a half years.

In contrast, policymakers at the Bank of England are expected to reduce the policy rate by a further 25 basis points from the current 4.5% level to help shore up the economy. The flash PMI surveys have already shown UK business activity contracting at a rate not seen since the decline caused by the Liz Truss mini Budget in 2022. Analysts will be keen to see if policymakers perceive increased downside growth risks from tariffs, and whether this might justify a faster pace of rate cutting.

However, calls for steeper UK rate cuts may be balanced by worries over inflation. The UK is not only seeing survey evidence of manufacturing prices rising sharply, but is also experiencing sharper inflation in the service sector. Companies are reporting the passing-through of National Insurance hikes and other additional payroll costs which came into effect in April. The question will be whether the central bank "looks through" these policy-related inflationary pressures as a one-off change in the price level, or whether it adds to concern over further unwanted stickiness of inflation.

Both policy decisions are preceded by the release of services PMI data, from which important signals will be obtained on second quarter growth prospects for the world's major economies. While the front-loading of tariffs has distorted the growth signals from manufacturing, the signals from recent flash PMI services data have generally been more uniformly concerning.

Key diary events

<span/>Monday 5 May

China (Mainland), Hong Kong SAR, Japan, South Korea, Thailand, United Kingdom Market Holiday

Worldwide Services, Composite PMIs, inc. global PMI* (Released across May 5-6)

Indonesia GDP (Q1)

Singapore Retail Sales (Mar)

Switzerland Inflation (Apr)

Turkey Inflation (Apr)

United States ISM Services PMI (Apr)

Tuesday 6 May

Egypt, Japan, South Korea Market Holiday

Philippines Inflation (Apr)

Australia Building Permits (Mar, prelim)

Switzerland Unemployment Rate (Apr)

France Industrial Production (Mar)

Spain Unemployment Change (Apr)

Canada Trade (Mar)

United States Trade (Mar)

Wednesday 7 May

New Zealand Unemployment Rate (Q1)

Japan au Jibun Bank Services PMI* (Apr)

Philippines Unemployment Rate (Mar)

Germany Factory Orders (Mar)

France Trade (Mar)

Eurozone S&P Global Construction PMI* (Apr)

Italy Retail Sales (Mar)

Taiwan Inflation Rate (Apr)

United Kingdom S&P Global Construction PMI* (Apr)

Eurozone Retail Sales (Mar)

Brazil Industrial Production (Mar)

United States FOMC Interest Rate Decision

Brazil BCB Interest Rate Decision

Thursday 8 May

<span/>Japan BoJ Meeting Minutes

Philippines GDP (Q1)

Malaysia Industrial Production (Mar)

Germany Trade (Mar)

United Kingdom Halifax House Price Index* (Apr)

Malaysia BNM Interest Rate Decision

Taiwan Trade (Apr)

United Kingdom BoE Interest Rate Decision

Mexico Inflation (Apr)

Friday 9 May

Japan Household Spending (Mar)

China (Mainland) Trade (Apr)

China (Mainland) New Yuan Loans, M2, Loan Growth (Apr)

United Kingdom Industrial Production (Mar)

Turkey Industrial Production (Mar)

Italy Industrial Production (Mar)

Brazil Inflation (Apr)

Mexico Consumer Confidence (Apr)

Canada Unemployment Rate (Apr)

Saturday 10 May

China (Mainland) CPI, PPI (Apr)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide services and detailed sector PMI data

Following the release of manufacturing PMI data from around the world, services and composite numbers will follow at the start of the new week. This comes after the April manufacturing figures showed worsening global trade, confidence and inflation trends as the PMI posted below 50.0 for the first time this year.

Detailed sector PMI data will also be released for insights into performance by sectors across regions, shedding light on the degree to which key sectors have been affected by latest changes in US trade policies. Autos had been the worst performer in March.

Americas: FOMC meeting, ISM Services PMI; Canada trade and employment data

The May Federal Open Market Committee (FOMC) meeting unfolds in the new week with no changes to interest rates expected, though the rhetoric will continue to be closely scrutinised for potential policy changes amidst signs of a deteriorating economic climate. The S&P Global US Manufacturing PMI revealed that the goods producing sector reported subdued output performance and rising inflation on the back of recent changes in trade policies during April.

Over in Canada, trade and employment data will be watched especially after the most up-to-date April Manufacturing PMI data indicated that tariffs led to a sharp decline in orders, including export orders, while manufacturing headcounts fell for a third straight month.

EMEA: BoE meeting, UK industrial production; Germany factory orders and trade figures

The Bank of England (BoE) is expected to lower rates by 25 basis points at their May meeting as higher US tariffs on the UK and global economies weigh on growth. While the latest flash UK PMI pointed to higher inflationary pressures, output data confirmed the fears of renewed economic downturn, the latter expected to be a driver for the lowering of rates.

On the data front, official UK industrial production and Germany factory orders and trade data will be the highlights. Construction PMI from the UK and eurozone, in addition to final services PMI figures will also be anticipated.

APAC: China trade and inflation data; New Zealand Q1 employment; Indonesia, Philippines GDP

A busy economic calendar is expected for the APAC region at the start of May, headlined by releases from mainland China including April trade and inflation numbers. Additionally, New Zealand's employment data will be in focus, while several tier-1 data such as GDP and inflation numbers will be out across various APAC economies.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-5-may-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-5-may-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+5+May+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-5-may-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 5 May 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-5-may-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+5+May+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-5-may-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}