Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 02, 2025

April's manufacturing PMI data reveal worsening global trade, confidence and inflation trends

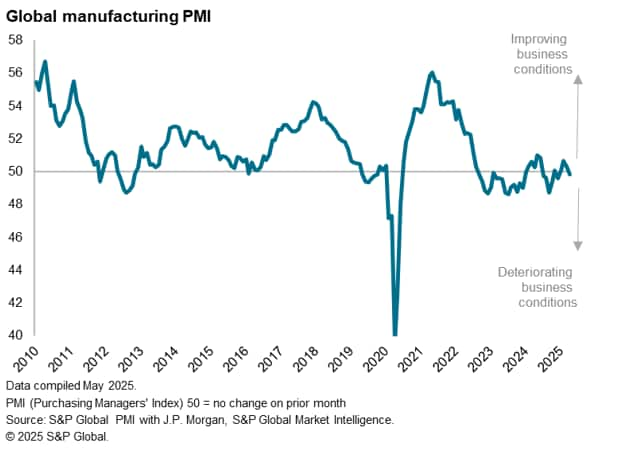

Worldwide manufacturing business conditions deteriorated for the first time since the end of last year, according to April's PMI survey data, though the rate of decline was very marginal to hint at little impact so far on factories from recent tariff announcements. However, the headline numbers masked more worrying trends in trade, inflation and business sentiment, with anecdotal evidence from survey participants underscoring how tariffs, trade protectionism and uncertainty are adversely impacting the global economy. Some marked regional variations also became increasingly apparent, notably with North America seeing an unwelcome combination of especially weak export orders and particularly high price pressures.

PMI falls into contraction territory

The Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, fell from 50.3 in March to 49.8 in April, dropping below the 50 'no change' level to indicate a marginal worsening of overall business conditions for the first time so far this year.

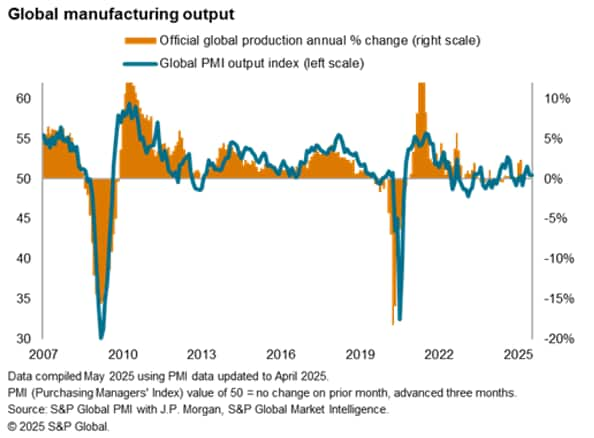

At face value, the marginal decline signaled by the PMI suggests global manufacturing has remained broadly flat in the face the announced tariffs by the US and responses from trading partners, and in fact even the survey's production index - one of the five components of the PMI and a reliable indicator of official manufacturing output data - indicated little cause for concern, remaining slightly above the 50.0 no change level to indicate a further small increase in production in April.

Similarly, while the survey's new orders index slipped into contraction territory to signal the first overall drop in demand for goods worldwide since December, the rate of order book loss was only very modest due to two key factors. First, in some cases - notably in the US - some demand had moved from imports to domestic production in response to tariffs on imports. Second, some factories reported increased demand due to front-running of tariffs, after increased tariffs announced by the US on 2nd April had been paused by 90 days. India's exports, for example, rose at the second-sharpest rate in over 14 years, and German exports rose for the first time in over three years.

However, one does not have to dig too deep beyond the headline PMI numbers to see a more worrying impact of recent tariff developments.

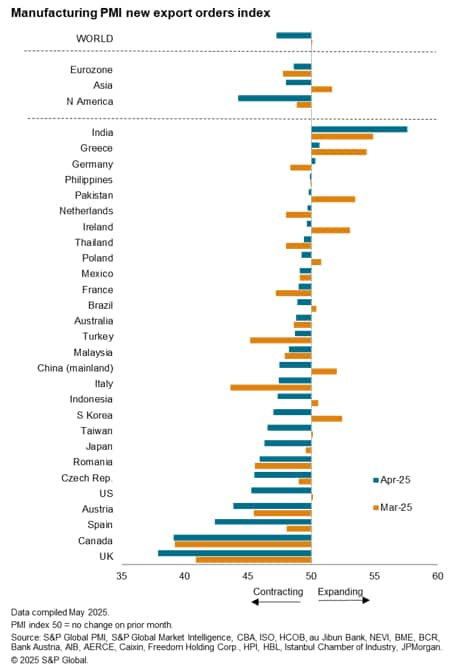

Trade slumps at fastest rate for 20 months

Even with the help from tariff front-running, the survey recorded the steepest drop in global export orders since August 2023. Barring the post-pandemic years, April's drop in exports was the largest recorded since October 2012.

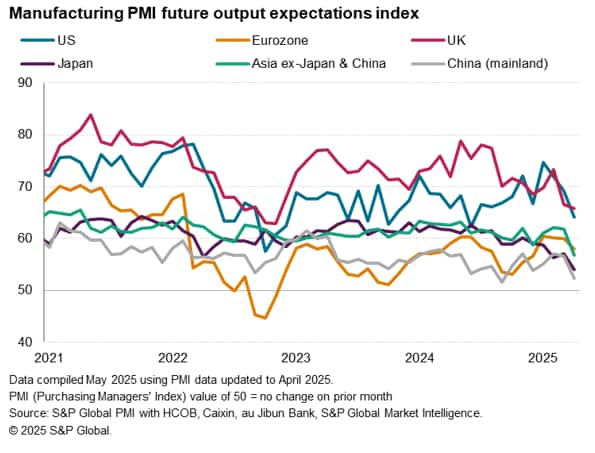

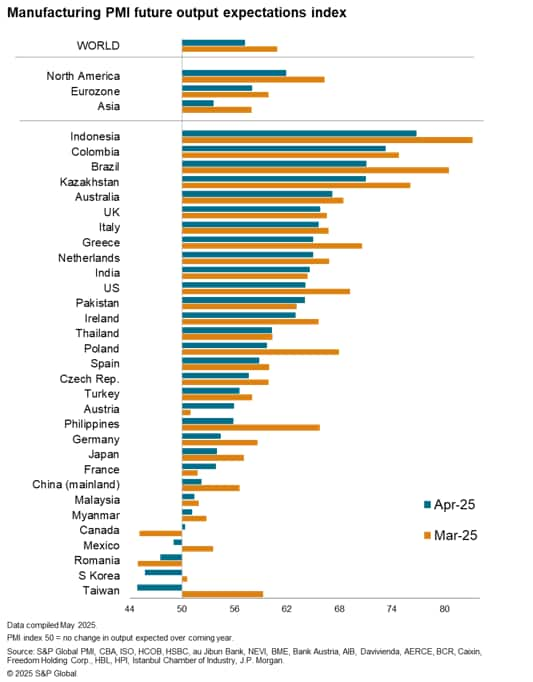

Sentiment hits two-and-a-half year low

A second indicator of concern from beneath the headline PMI was the survey's index of future output expectations. Measuring views on firms' likely levels of output in the year ahead, this index is the PMI's only subjective gauge of manufacturing conditions, and in April plunged to its lowest since October 2022. The level of global business sentiment is now not far off the lows seen in 2019, when business confidence was hit by the trade protectionism which escalated during US President Trump's first term in office.

Reasons cited by companies for their gloomier outlooks were most commonly centered on concerns over the impact of tariffs and protectionism on their order books, supply chains and pricing.

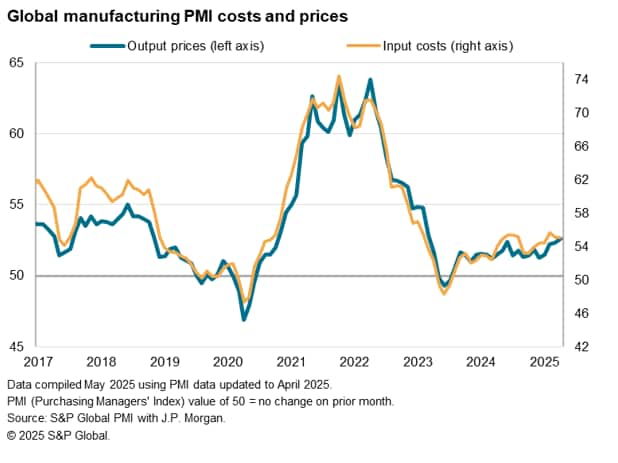

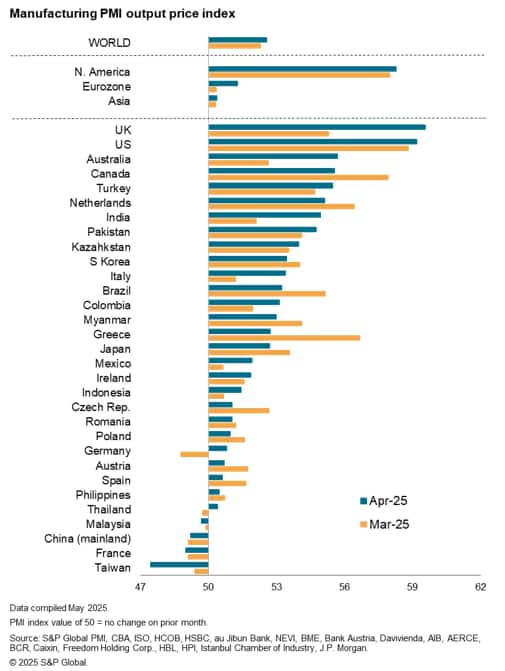

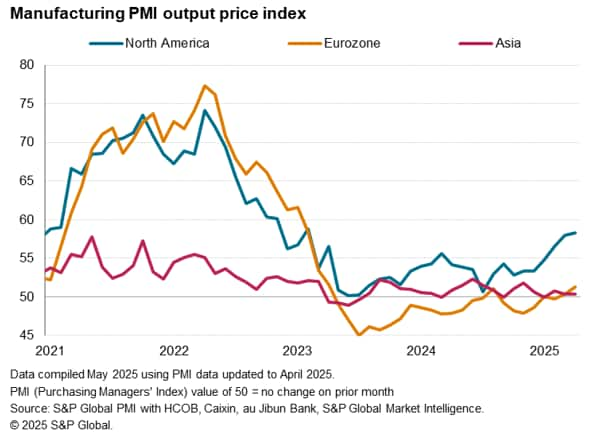

Price pressures highest for over two years

A third key area for which the survey data behind the headline PMI are raising concerns is in relation to inflation. Average prices charged worldwide for goods by factories rose in April at the fastest rate since March 2023. Prices were commonly hiked in response to tariffs, according to contributing companies, and reflected another month of markedly rising input costs.

Although still very modest by standards seen during the pandemic, the upward creep of goods prices represents an unwelcome development at a time when central banks around the world are still concerned about bringing inflation down sustainably to policy targets.

North America sees especially weak exports, as well as strong price growth

While the global manufacturing picture from the PMI survey sub-indices on exports, sentiment and prices is therefore more worrying than the headline PMI suggests, there are of course important regional variations.

Of the 31 economies for which PMI data are so far available for April (publication of data for Russia and Vietnam are delayed due to public holidays), only three reported higher export orders, of which only India reported any meaningful gain as mere marginal gains were seen in Germany and Greece. The steepest declines were recorded in the UK, Canada, Spain, Austria and the US.

Measured collectively, new export orders placed at North American manufacturers fell at the fastest rate for 23 months, while Asian export orders fell at the sharpest rate for 21 months (with exports from mainland China notably also dropping at the sharpest rate for 21 months). Eurozone exports, in contrast, posted the smallest decline for three years, in part helped by the front-running of tariffs.

Price trends also varied markedly around the world. The steepest rise in prices worldwide was recorded in the UK, where recent tax changes were passed on to customers, but with the US close behind, the latter registering the sharpest rise for over two years.

Notably, while prices charged across North America rose to the greatest extent since February 2023, prices barely rose in Asia and only a modest increase was recorded in the eurozone, underscoring the concentration of the near-term inflationary impact of tariffs in North America.

The was, however, a more common theme regionally in terms of future sentiment, as declines were recorded in North America, Asia and Europe alike.

In fact, only six economies reported a brightening of prospects for the year ahead. Of note, the largest improvement was seen in Canada, ahead of elections which were widely anticipated as having a positive impact on manufacturing prospects, contrasting with deteriorating sentiment in the US, Mexico, the eurozone, Japan and mainland China. The lowest levels of confidence were meanwhile seen in Taiwan and South Korea amid growing concerns over global trade downturns.

Access the latest release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faprils-manufacturing-pmi-data-reveal-worsening-global-trade-confidence-and-inflation-trends-May25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faprils-manufacturing-pmi-data-reveal-worsening-global-trade-confidence-and-inflation-trends-May25.html&text=April%27s+manufacturing+PMI+data+reveal+worsening+global+trade%2c+confidence+and+inflation+trends+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faprils-manufacturing-pmi-data-reveal-worsening-global-trade-confidence-and-inflation-trends-May25.html","enabled":true},{"name":"email","url":"?subject=April's manufacturing PMI data reveal worsening global trade, confidence and inflation trends | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faprils-manufacturing-pmi-data-reveal-worsening-global-trade-confidence-and-inflation-trends-May25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=April%27s+manufacturing+PMI+data+reveal+worsening+global+trade%2c+confidence+and+inflation+trends+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2faprils-manufacturing-pmi-data-reveal-worsening-global-trade-confidence-and-inflation-trends-May25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}