Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 07, 2025

Emerging markets growth slows while confidence slips to near five-year low

Emerging market growth decelerated in April for the first time in three months, according to the latest PMI data, as both manufacturing output and service sector activity expanded at softer rates. Detailed survey data showed that additional US tariffs announced at the start of April negatively affected emerging economies, though traces of front-loading of goods orders ahead of higher tariffs continued to be reported.

Business confidence among emerging market firms meanwhile fell for a second successive month as companies reported the lowest optimism about prospects for the year ahead since the peak of the COVID-19 pandemic. Job shedding was also sustained for a second successive month. Concurrently, price pressures intensified among emerging market firms, adding to the uneasy outlook for growth in the coming months.

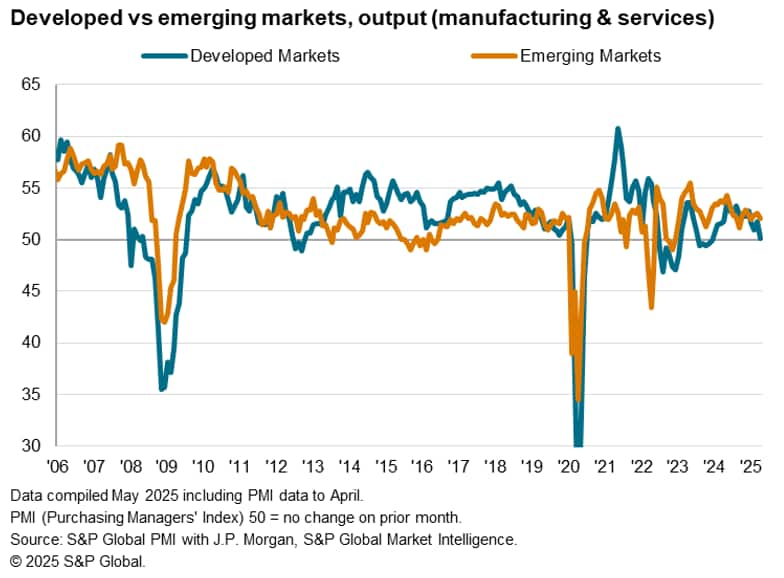

Emerging markets remain driver of global growth as developed economies near-stall

The PMI surveys compiled globally by S&P Global indicated that emerging markets continued to expand at the start of the second quarter of 2025. The GDP-weighted Emerging Market PMI Output Index posted 52.0 in April, down from 52.6 in March. This extended the period of expansion that commenced in January 2023, albeit at the softest pace since January.

Despite the easing of growth, emerging markets remained the key driver for global output expansion during the latest survey period. This was as developed markets reported only a very marginal expansion, posting the softest rise in overall output in the current 16-month sequence.

The biggest reported influence on economic conditions in the month of April had no doubt been the April 2 tariff announcement in the US. While the tariff news had directly impacted the goods producing sector, including a second successive monthly reduction in developed markets' manufacturing output, service sectors across both emerging and developed economies also expanded at softer rates, with the latter near-stalling according to latest data.

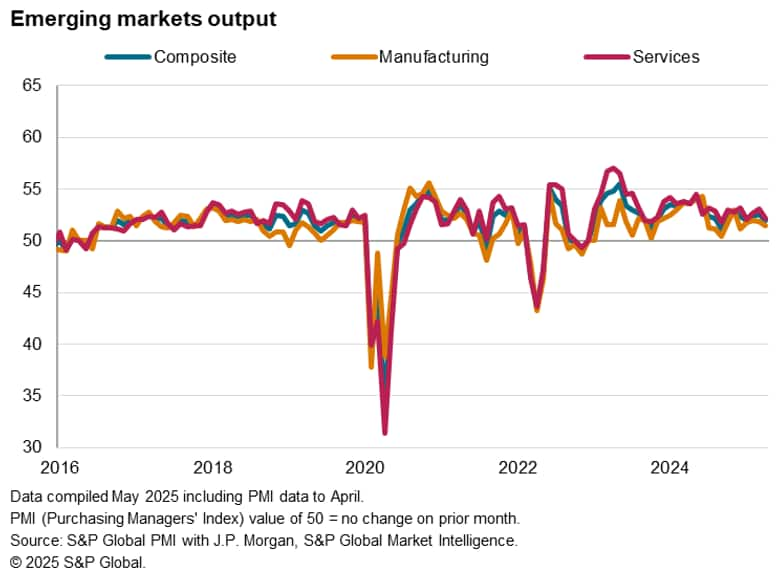

Broad-based deceleration in output growth in April

By sector across the emerging markets, the manufacturing sector recorded a slower rate of expansion compared to services for a fifth successive month in April, though with the gap narrowing as growth for services also softened. Manufacturing output rose at the slowest pace since last December, affected by higher US tariffs according to panellists.

Broadly, the global manufacturing sector suffered worsening global trade, easing confidence and rising inflation in the face of higher trade barriers in April. These trends were similarly observed across emerging markets, where goods export orders declined for the first time so far in 2025, while business optimism slumped, and rates of inflation climbed. Factory employment trends were also concerning, as job shedding resumed, replacing services in becoming the source of falling employment. The renewed reduction in headcounts was in tandem with falling backlogs at the start of the second quarter.

Meanwhile the emerging market service sector recorded the softest rate of growth since January, expanding at a pace that was below the 2024 average to date. The easing of services activity growth momentum was in line with the trend for new business, which rose at the slowest pace since December 2022, which was when the current sequence of growth commenced. Export business growth decelerated as well, rising only marginally in April.

Globally, the impact of US tariff changes was reported to have dampened services performance as well. Among the detailed sectors tracked, only the insurance and 'other' non-bank financials sectors saw any substantial growth in export business. Banks and real estate had in fact led the reduction in export business as global business confidence softened.

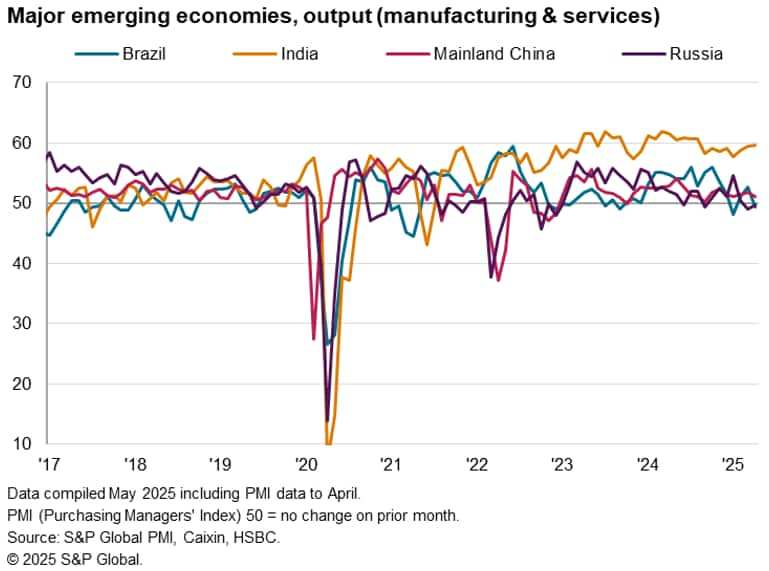

India continues to lead output growth among major emerging economies

The number of major 'BRIC' emerging market economies posting output growth further shrank in April, leaving only India and mainland China in expansion while Brazil joined Russia in contraction.

India had continued to lead the emerging market expansion going into the second quarter of the year. In contrast to the global trend, the rate of output expansion in India was the fastest in eight months as growth in both the manufacturing and service sectors accelerated. In particular, India's manufacturing sector recorded the second-fastest upturn in exports for 14 years, which supported the growth in production. Anecdotal evidence suggested that some exporters pinned the positive performance on continued front-running of US tariffs.

Mainland China also remained in growth territory in April, albeit with the pace of expansion softening to a three-month low as services firms recorded a more pronounced deceleration in growth.

On the other hand, Russia remained in contraction for a second successive month on the back of falling goods output. The rate of growth moderated since March, however, and was only fractional. Brazil also recorded a marginal contraction in April, its first in three months, with a drop in services activity underpinning the change.

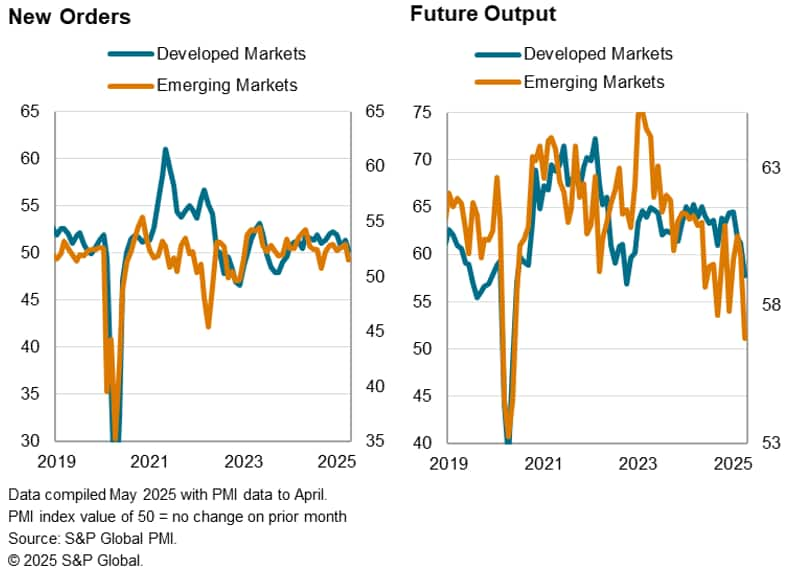

Forward-looking indicators continue to paint a mixed picture for near-term performance

While business activity remained in expansion, the Future Output Index fell markedly across emerging markets on average in April to signal reduced optimism regarding growth in the year ahead. Confidence levels fell to the lowest since the height of the pandemic in the first half of 2022, with anecdotal evidence pointing primarily to fears of both the direct and indirect impact from higher US tariffs dampening sentiment during April. By sector, business confidence was lower in the goods producing sector, though services firms also saw the optimism falling in the latest period, easing further below the long-run average.

More positively, incoming new orders continued to rise across emerging markets in April, with both manufacturing and services firms receiving higher volumes of new work. That said, the rate of new business growth softened in the latest survey period, and some caution in interpreting growth here may be warranted as comments from panellists suggested that the front-running of tariffs may have partially helped buoy performance in April. The 90-day extension for higher US tariffs, and looming US sector tariffs, reportedly encouraged some clients to secure inventory ahead of time from emerging market firms. As it is, falling headcounts and the lowering of manufacturing purchasing activity reflected reduced operating capacity requirements among businesses. This was also accompanied by the first decline in the level of outstanding business in six months.

Inflationary pressures heighten in April

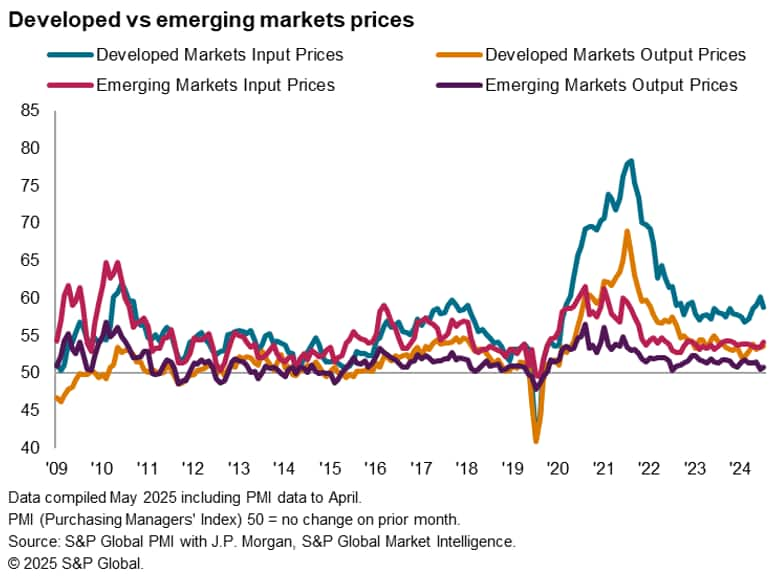

Turning to prices, both input cost and output price inflation increased in April. Average input prices rose at a solid pace as both manufacturing and services costs climbed at quicker paces. Likewise for charges, emerging market businesses opted to pass on higher costs to customers, leading to a higher rate of inflation in both monitored sectors.

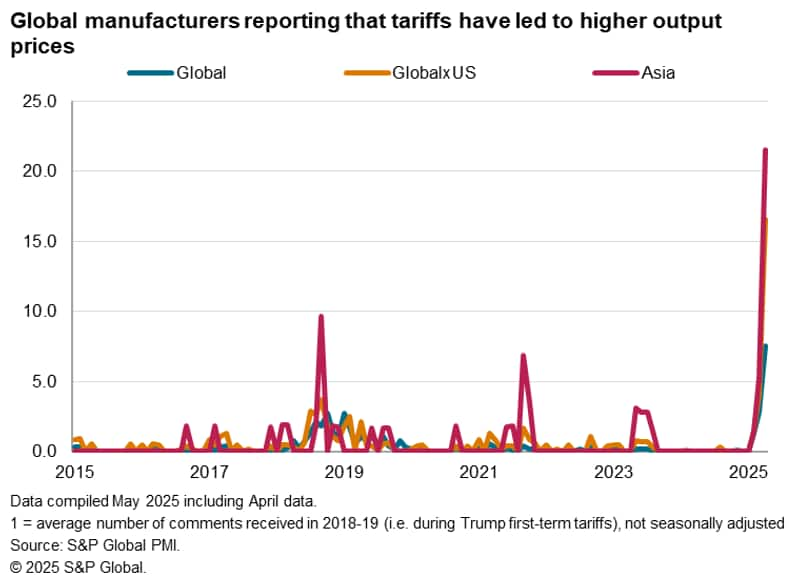

Although the rate of selling price inflation remained subdued by historical standards, providing room for regional central banks to lower interest rates in the face of growth threat from rising trade barriers, the outlook for prices remains uncertain. According to our expanded tracking of panel comments focusing on the topic of tariffs, a sharp rise in instances of manufacturers in Asia reporting higher output prices as a result of tariffs was observed. As a key source of manufactured goods around the world, the trend here will have to be closely monitored for risk of higher inflation down the road.

Access the global PMI press releases.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-slows-while-confidence-slips-to-near-fiveyear-low-May25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-slows-while-confidence-slips-to-near-fiveyear-low-May25.html&text=Emerging+markets+growth+slows+while+confidence+slips+to+near+five-year+low+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-slows-while-confidence-slips-to-near-fiveyear-low-May25.html","enabled":true},{"name":"email","url":"?subject=Emerging markets growth slows while confidence slips to near five-year low | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-slows-while-confidence-slips-to-near-fiveyear-low-May25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+markets+growth+slows+while+confidence+slips+to+near+five-year+low+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-markets-growth-slows-while-confidence-slips-to-near-fiveyear-low-May25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}