Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 28, 2025

Week Ahead Economic Preview: Week of 3 March 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

PMIs and payrolls accompanied by ECB interest rates decision

The week brings a wealth of economic data to assess global economic conditions, including US nonfarm payrolls and worldwide PMI surveys, while the ECB sets interest rates after seeing updated inflation data.

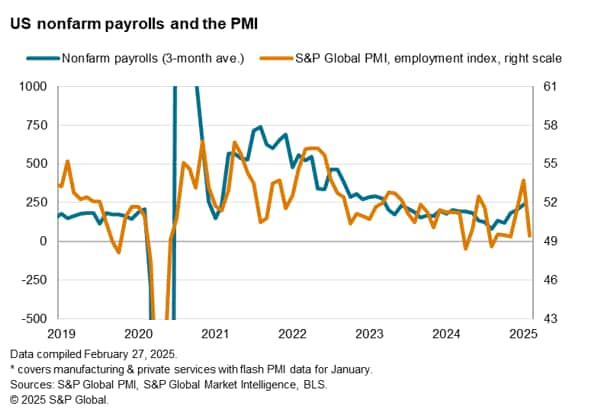

The monthly US jobs report, including non-farm payroll data, will be eagerly awaited as usual on Friday for the latest clues on the strength of the labour market. Prior data showed a below-consensus 143k payroll increase in January, but December's data were revised higher to 307k after a solid 261k rise in November. With the January report also showing the unemployment rate falling from 4.1% to 4.0% and wage growth edging up from 3.8% to 4.1%, the labour market data were widely seen as supporting the Fed's shift to a slower pace of rate cuts this year, albeit awaiting more signs as to how the economy is faring since the presidential election.

Some worries in this respect have been fuelled by downbeat flash PMI and consumer confidence data for February. The PMI notably showed a renewed weakening of the service sector expansion, accompanied by a drop in employment.

US companies reporting lower activity and reduced optimism in the PMI commonly blamed uncertainty caused by the change in government, linked in turn to tariffs and trade policy as well as Federal budget cuts. Whether recent government layoffs will appear in the payroll data yet remains uncertain and will be an important element of the labour market to track in the coming months. A concern is that these job losses and budget cuts could cause a deepening knock-on effect to private sector confidence beyond that already signalled by the surveys.

How businesses globally are faring amid the changing economic and political environment created by the new US administration will also be explored via the manufacturing and services PMIs, published Monday and Wednesday respectively. Some boost to manufacturing from front-loading ahead of tariffs has already been evident, while in the service sectors a key metric to watch will be inflation rates, as these will hold keys to future central bank policy paths.

The ECB in particular has been alert to service sector inflation stickiness, but is nonetheless widely expected to cut rates again at its meeting on Thursday. However, CPI data due earlier in the week could influence the decision.

Key diary events

Monday 3 Mar

Brazil, South Korea Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Feb)

Indonesia Inflation (Feb)

Turkey Inflation (Feb)

United Kingdom Mortgage Lending and Approval (Jan)

Eurozone Inflation (Feb, flash)

Italy GDP (2024)

United States ISM Manufacturing PMI (Feb)

Tuesday 4 Mar

Brazil Market Holiday

South Korea Industrial Production, Retail Sales (Jan)

Australia RBA Meeting Minutes

Australia Retail Sales (Jan)

South Korea Manufacturing PMI* (Feb)

South Africa GDP (Q4)

Eurozone Unemployment Rate (Jan)

Wednesday 5 Mar

Worldwide Services, Composite PMIs, inc. global PMI* (Feb)

Global Sector PMI* (Feb)

South Korea GDP (Q4, final)

Australia GDP (Q4)

Philippines Inflation (Feb)

Thailand Inflation (Feb)

Switzerland Inflation (Feb)

France Industrial Production (Jan)

Italy GDP (Q4, final)

United States ISM Services PMI (Feb)

United States Factory Orders (Jan)

Thursday 6 Mar

South Korea Inflation (Feb)

Australia Trade (Jan)

Malaysia BNM Interest Rate Decision

Eurozone Construction PMI* (Feb)

United Kingdom Construction PMI* (Feb)

Eurozone Retail Sales (Jan)

Turkey TCMB Interest Rate Decision

Brazil Industrial Production (Jan)

Eurozone ECB Interest Rate Decision

Canada Trade (Jan)

United Kingdom Trade (Jan)

Friday 7 Mar

China (Mainland) Trade (Jan-Feb)

Germany Factory Orders (Jan)

United Kingdom Halifax House Price Index* (Feb)

France Trade (Jan)

Taiwan Trade (Feb)

Eurozone GDP (Q4, 3rd est.)

Mexico Inflation (Feb)

Canada Unemployment (Feb)

United States Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings (Feb)

Sunday 9 Mar

China (Mainland) CPI, PPI (Feb)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide manufacturing, services and detailed sector PMI releases

February global PMI data will be released in the fresh week, including manufacturing figures on Monday followed by services and composite figures on Wednesday. Early flash data revealed that Japan's private sector growth accelerated, but the UK, eurozone and US were all near-stalled midway through the first quarter of 2025. Whether this translates to a further softening of global growth will be watched with the upcoming surveys. Concurrently, changes in inflation trends and business sentiment within the PMI surveys will also be key amid uncertainties over US policies and the outlook for interest rates.

Americas: US labour market report, ISM; Canada employment, trade data; Mexico inflation

February's US labour market data will be released on Friday with the latest flash PMI data having outlined a weakening trend whereby the Employment Index fell into contraction territory for the first time in three months, attributed to heightened uncertainty and concerns over rising costs. Public sector job losses are also likely to appear. ISM data will also be watched alongside the S&P PMIs for insights into business conditions midway through the first quarter.

Additionally, Canada releases employment and trade data shortly after the February PMI data are due.

EMEA: ECB meeting, eurozone inflation, GDP; UK house prices, mortgage lending and approvals

The European Central Bank (ECB) convenes for their March monetary policy meeting and is widely expected to lower interest rates by 25 basis points (bps). Latest February HCOB Flash Eurozone PMI revealed that the economy near-stalled, thereby signalling still-subdued conditions. Although selling price inflation accelerated according to the eurozone PMI to the highest in ten months, the latest reading was consistent with headline inflation remaining close to the ECB's 2% target. The upturn could nonetheless worry ECB hawks. Official confirmation of the inflation trend will be sought with the upcoming flash February eurozone CPI release. Additionally, eurozone Q4 GDP will be updated.

APAC: China trade and inflation figures; Australia GDP, trade data, RBA meeting minutes

In addition to PMI releases across APAC for insights into February economic conditions in the region, key data updates in the week include trade and inflation data from mainland China and Australia's fourth quarter GDP. According to PMI data, Australia's private sector concluded Q4 on a subdued note, though the more up-to-date February flash PMI pointed to improving conditions, with business activity expanding at the fastest pace in six months.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-3-march-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-3-march-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+3+March+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-3-march-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 3 March 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-3-march-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+3+March+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-3-march-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}