Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 04, 2025

Top five economic takeaways from February manufacturing PMI data as global output growth accelerates and sentiment improves

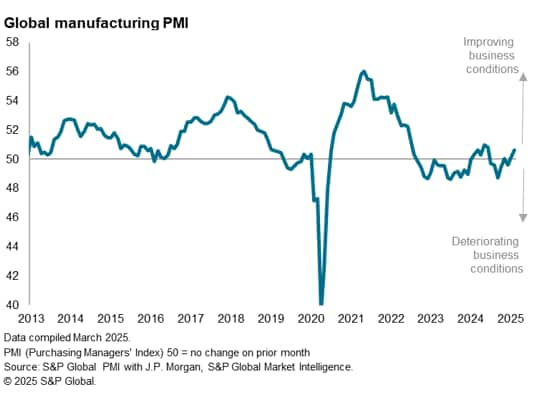

The global manufacturing sector moved further into expansion territory in February, signalling improving economic conditions. At 50.6, up from 50.1 in January, the Global Manufacturing PMI, sponsored by J.P. Morgan and compiled by S&P Global Market Intelligence, edged above the 50.0 no-change level to signal a second month of improving operating conditions, albeit at a still-modest rate of change.

Regional variations were again marked, notably with improved performance in the US helping drive the global upturn. However, the US also reported weakened exports and a particularly steep rise in factory selling prices amid rising input costs.

Here are our top five takeaways from February's manufacturing PMI survey sub-indices, which provide a deeper insight into business conditions.

1. Global production growth at eight-month high

The PMI survey's sub-index of production, which tracks reported month-on-month changes in factory output, signalled the largest rise in output for eight months in February, the expansion building on a marginal return to growth in January. However, the overall rate of expansion remains lacklustre, and equivalent to global production growing at a modest 1.5% annual rate.

2. US outperforms in terms of production growth

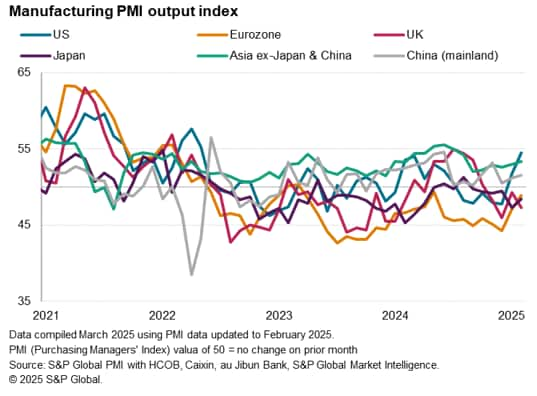

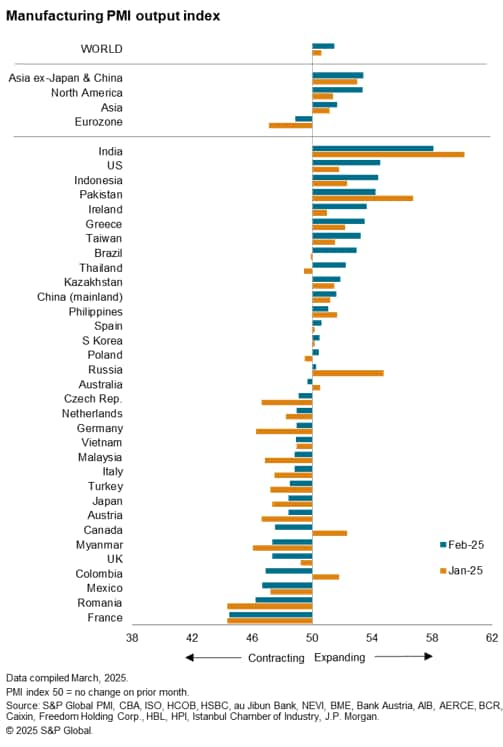

The key change was seen in the US, where production growth accelerated sharply to register the steepest monthly increase since May 2022. This year has therefore seen the US manufacturing sector recover from a five-month run of continual decline at the end of last year. Putting the latest US output gain in context, only India - the global star-performer in recent months - reported higher growth in February.

At the other end of the scale, France reported the steepest contraction of output of the 33 manufacturing economies tracked by the S&P Global PMI surveys. However, although the eurozone as a whole was also the worst performing region ranked by factory output growth, with production falling across the single currency area for a twenty-third straight month, its rate of contraction was only modest and the lowest seen over this near two-year stretch, thanks in part to a marked cooling of Germany's industrial downturn.

After France and Romania, the steepest contraction was recorded in Mexico, where tariff fears contributed to the second largest drop in production seen over the past two and a half years. Similarly, tariff worries helped push output lower in Canada after the robust growth seen in January, resulting in the first fall in output recorded for five months.

While output fell in Japan for a sixth successive month, production across China's mainland economy continued to expand at a modest pace, albeit lagging behind that of the rest of Asia, which collectively reported the strongest output rise for six months. Besides India, especially strong growth rates were seen in Pakistan, Indonesia, Taiwan and Thailand.

3. Global goods trade shows signs of stabilising despite increased drag from North America

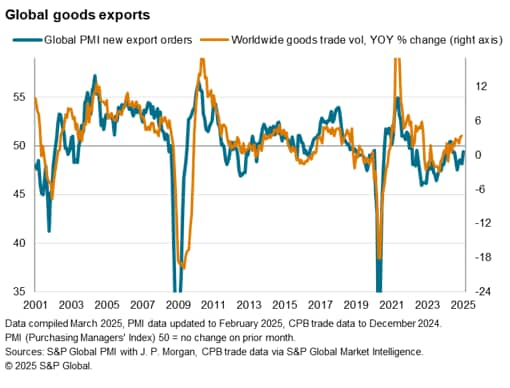

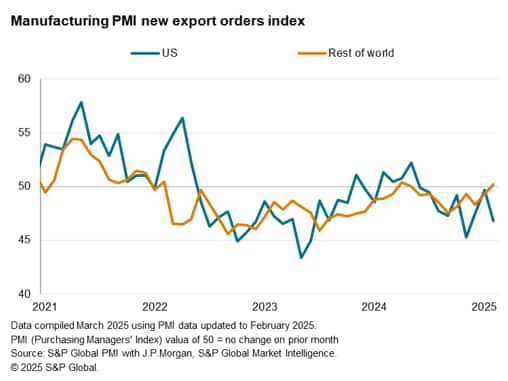

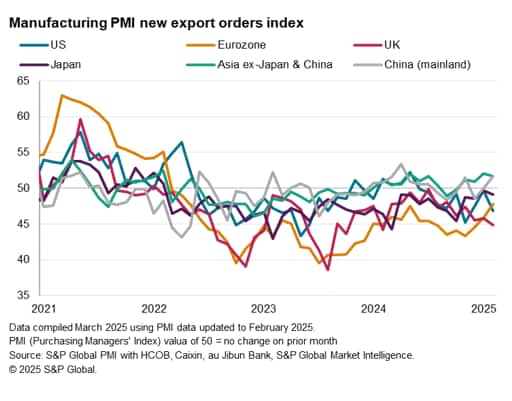

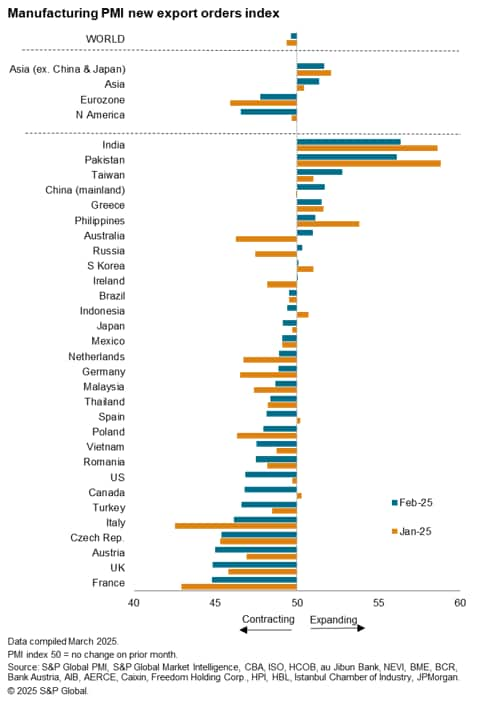

New orders for goods placed at factories rose worldwide at the sharpest rate since March 2022, buoyed by strengthening domestic demand in many economies alongside a near-steadying of global trade. New export orders fell globally only marginally in February, registering the smallest decline seen over the past nine months.

This near-steadying of global trade flows came despite an increased drag from North America. US exports fell at an increased rate in February, registering the second-largest decline recorded over the past 20 months. With falls also seen in Canada and Mexico, North American exports collectively deteriorated at the sharpest rate for three months. North American factories increasingly cited tariffs and trade policy issues as a cause of reduced exports, especially within the region.

Export orders in the rest of the world excluding the US meanwhile rose, albeit marginally, for the first time since last April, registering only the second monthly rise recorded over the past three years. The export upturn was particularly notable in mainland China, which saw exports rise to the sharpest degree since last April. The eurozone's export decline notably also moderated to the weakest recorded for 33 months. However, this upturn in part reflected the advance shipment of goods amid concerns over tariffs.

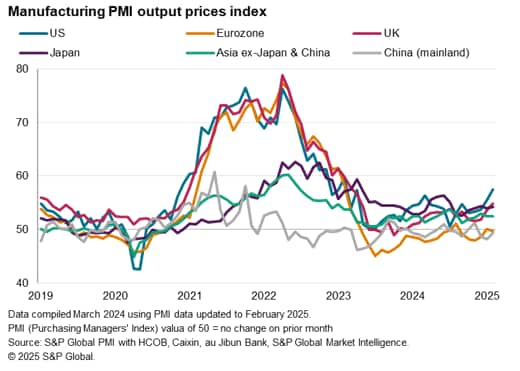

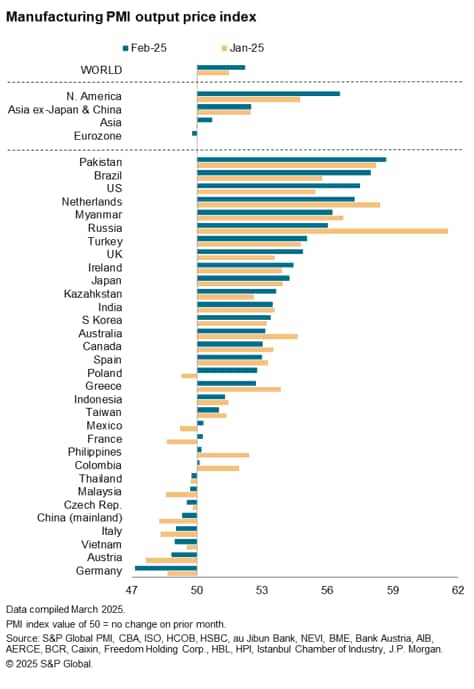

4. US sees especially steep price growth

A detrimental impact of tariffs was apparent in terms of costs and prices. US factories reported the steepest monthly rise in input costs since November 2022. Of the 33 economies monitored, only Brazil, Kazakhstan, Indonesia and Greece recorded higher cost growth than the US in February.

These costs were often passed onto customers by US factories, which reported the sharpest rise in selling prices for two years. Only Pakistan and Brazil reported higher factory gate inflation than the US in February.

By comparison, selling prices were broadly unchanged in the eurozone and mainland China, with the rate of inflation largely steady compared to January in the rest of Asia.

5. Manufacturing sentiment improves

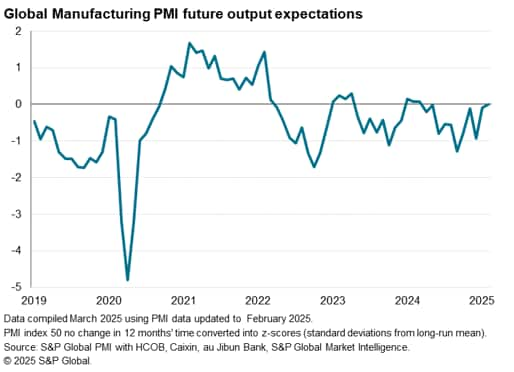

Sentiment among manufacturers about output growth in the year ahead meanwhile improved on average worldwide in February, returning to its long-run average from the recent low seen in December.

However, sentiment trends were very mixed around the world. Confidence in the US remained especially elevated relative both to its long-run average and compared to other major economies, albeit losing some of the optimism seen in January, which had seen US manufacturers at their most confident for nearly three years.

Sentiment about year-ahead outlooks are also above long-run averages in the eurozone and UK, and back close to its long-run mean in Asia excluding Japan and mainland China. However, while the latter has also seen sentiment improve in February, confidence has slipped to its lowest since July 2020 in Japan.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-february-manufacturing-pmi-data-as-global-output-growth-accelerates-Mar24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-february-manufacturing-pmi-data-as-global-output-growth-accelerates-Mar24.html&text=Top+five+economic+takeaways+from+February+manufacturing+PMI+data+as+global+output+growth+accelerates+and+sentiment+improves+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-february-manufacturing-pmi-data-as-global-output-growth-accelerates-Mar24.html","enabled":true},{"name":"email","url":"?subject=Top five economic takeaways from February manufacturing PMI data as global output growth accelerates and sentiment improves | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-february-manufacturing-pmi-data-as-global-output-growth-accelerates-Mar24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Top+five+economic+takeaways+from+February+manufacturing+PMI+data+as+global+output+growth+accelerates+and+sentiment+improves+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftop-five-economic-takeaways-from-february-manufacturing-pmi-data-as-global-output-growth-accelerates-Mar24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}