Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 21, 2025

Week Ahead Economic Preview: Week of 24 February 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US economic data updates to be watched for policy impact

The coming week brings a slew of data from the US to gauge growth and price trends after flash PMI data signaled a sharp slowing of the economy and an upturn in cost pressures. The data include US PCE price data plus revised fourth quarter GDP, with comparable GDP data also updated for Brazil, Canada, India, Switzerland, Hong Kong SAR and Taiwan during the week.

Monetary policy decisions are meanwhile scheduled from Thailand and South Korea, both of which are eyed for rate cuts. Also watch out for eurozone inflation and business sentiment updates.

The biggest news out of the February flash PMIs was a sharp slowing of business growth in the US, accompanied by rising prices. Whereas the US had been by far the fastest growing major (G4) developed economy late last year and into January according to the PMIs, February saw the US expansion falter to a near-stalled pace; a 17-month low rate which was weaker than the expansions seen in Japan and the UK and only marginally above that of the eurozone.

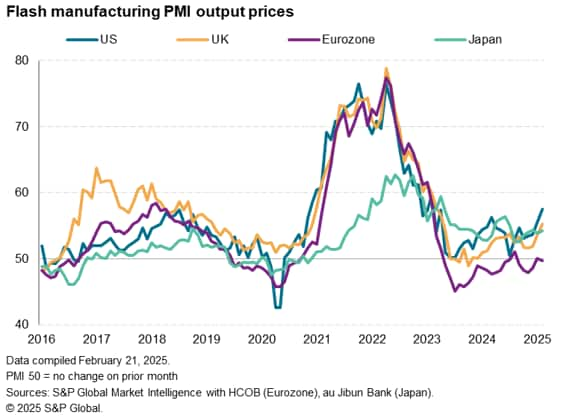

The renewed US malaise was centred on the service sector, which contracted slightly to now be the only G4 services economy in decline. Companies widely blamed uncertainty surrounding new government policies in the US, including federal spending cuts and tariff-related developments. The latter were also blamed for upward pressure on prices, with US manufacturers now reporting the highest input cost inflation for two years, and a pace now outstripping that seen in the other G4 economies.

More data out in the coming week will add to the economic picture developing in the US this year, though we urge caution in interpreting any signs of stronger growth purely from the manufacturing sector amid updates from regional Fed surveys and durable goods orders, as the flash PMI hinted strongly at temporary front-running of sales and shipments ahead of growing tariff concerns.

Elsewhere, the growth profiles depicted by the flash PMIs were far from impressive, with near-stalled pictures also evident in the Eurozone and UK, though a more encouraging expansion was seen in Japan. For the latter, we await industrial production and retail sales data to further assess the economy's start to the year and interest rate implications.

Key diary events

Monday 24 Feb

Japan Market Holiday

Singapore Inflation (Jan)

Germany Ifo Business Climate (Feb)

Eurozone Inflation (Jan, final)

United States Chicago Fed National Activity Index (Jan)

United States Dallas Fed Manufacturing Index (Feb)

Tuesday 25 Feb

South Korea BoK Interest Rate Decision

Germany GDP (Q4, final)

Taiwan Industrial Production (Jan)

United States S&P/Case-Shiller Home Price (Dec)

United States CB Consumer Confidence (Feb)

Wednesday 26 Feb

India Market Holiday

Australia Monthly CPI Indicator (Jan)

Germany GfK Consumer Confidence (Mar)

Thailand BoT Interest Rate Decision

Hong Kong SAR GDP (Q4, final)

Taiwan GDP (Q4, final)

United States New Home Sales (Jan)

Thursday 27 Feb

Taiwan Market Holiday

Taiwan Consumer Confidence (Feb)

Turkey Balance of Trade (Final)

Spain Inflation (Feb, prelim)

Switzerland GDP (Q4)

Eurozone Economic Sentiment (Feb)

France Unemployment Benefit Claims (Jan)

Brazil Unemployment Rate (Jan)

Mexico Trade (Jan)

Canada Current Account (Q4)

United States GDP (Q4, 2nd est.)

United States Durable Goods Orders (Jan)

United States Pending Home Sales (Jan)

Friday 28 Feb

South Korea Market Holiday

Japan Tokyo CPI (Feb)

Japan Industrial Production (Jan, prelim)

Japan Retail Sales (Jan)

Philippines Trade (Jan)

Thailand Industrial Production (Jan)

Japan Housing Starts (Jan)

Germany Retail Sales (Jan)

Turkey GDP (Q4)

United Kingdom Nationwide Housing Prices (Feb)

France Inflation (Feb, prelim)

Germany Unemployment Rate (Feb)

Italy Inflation (Feb, prelim)

Brazil GDP (Q4)

India GDP (Q4)

Germany Inflation (Feb, prelim)

Canada GDP(Q4)

United States Core PCE (Jan)

United States Personal Income and Spending (Jan)

United States Wholesale Inventories (Jan)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US GDP, durable goods orders, core PCE, home sales, consumer confidence, personal income and spending data; Canada GDP; Brazil GDP

In addition to Fed appearances, highlights for the US in the week include an update to Q4 GDP, durable goods orders and core PCE data. A slight downward revision to Q4 GDP from 2.3% is expected according to consensus. Meanwhile the Fed's preferred inflation gauge, the core PCE index, is set to reflect rising inflationary pressures, in line with indications from the January US PMI data. Additionally, home sales, consumer confidence, personal income and spending data will also be closely watched from the US.

Over in Canada, Q4 GDP data will be released on Friday. Although Canada had started the quarter on a stronger footing, it concluded 2024 on a subdued note, furthering recording a marginal contraction in January according to PMI data. Brazil also releases Q4 GDP on Friday.

EMEA: Eurozone inflation, economic sentiment; Germany GDP, Ifo and GfK survey; France GDP

Following the release of HCOB Eurozone PMI, which has signalled a firming of price pressures so far in 2025, we will be anticipating the release of final official January inflation figures in the eurozone and a series of preliminary February figures from Germany, France, Italy and Spain.

Additionally, Germany and France also provide updates for Q4 GDP readings in the week, alongside various other economies in the EMEA region. Sentiment indicators will also be observed through the week from both the eurozone and Germany. The latest HCOB Flash PMI data revealed that business optimism has deteriorated broadly across the eurozone, including in Germany, during February.

APAC: BoK, BoT meetings; Australia monthly CPI; Japan industrial production; India GDP

Central bank meetings in South Korea and Thailand unfold in the APAC region in the new week with rate cuts on the table. Specifically, the Bank of Korea may lower rates by 25 basis points, according to consensus, with subdued conditions observed including in the manufacturing sector, where output rose only marginally for the first time in five months in January.

Additionally, monthly CPI data from Australia is anticipated with the latest S&P Global Flash Australia PMI output prices index, which precedes the trend for the former, showing charges rising at a softer pace in February. Finally, India's GDP from the October to December period will be published at the end of the week with more up-to-date HSBC Flash India PMI having shown substantial improvements in output growth in February, boosted by the service sector.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-february-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-february-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+24+February+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-february-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 24 February 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-february-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+24+February+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-24-february-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}