Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 21, 2025

US economic growth falters and goods prices spike higher, according to flash PMI surveys

A key development evident in the February flash PMIs was a sharp slowing of business growth in the US, accompanied by rising goods prices. Companies widely blamed the weaker expansion to uncertainty and disruption caused by recent US government policy initiatives, while tariffs were widely cited as a key cause of higher prices in the manufacturing sector. Overall, however, stiff competition limited selling price growth in the services economy to offset the manufacturing price rise, boding well for inflation. But this reduced pricing power alongside weaker growth bodes ill for profits.

US growth falters

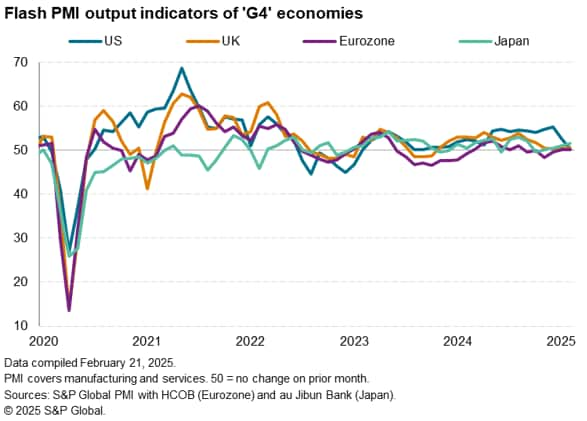

Whereas the US had been by far the fastest growing major (G4) developed economy late last year and into January according to the PMIs, February saw the US expansion falter to a near-stalled pace; a rate which was even weaker than rates seen in Japan and the UK and only marginally above that of the eurozone.

The US Composite Flash PMI Output Index, which measures month-on-month changes in output across both goods and services, fell from 52.7 in January to 50.4, a 17-month low. Back in December, this index had stood at a near-three year high of 55.4. While readings above 50.0 signal growth, the PMI for the US has signaled a steep deceleration in the pace of economic growth over the past two months from a buoyant rate seen late last year.

The comparable PMI Output Index for Japan rose from 51.1 to 51.6 in February, signaling accelerating growth. In Europe, the PMI output gauges meanwhile continued to register near-stalled expansions, the UK PMI edging down from 50.6 to 50.5 and the eurozone PMI stuck at 50.2. The US therefore appears to have now joined these European economies in the slow lane, having been in the fast lane last year.

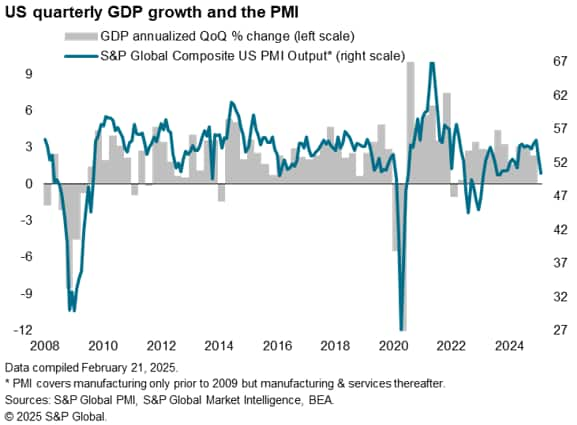

Historical comparisons suggest the US PMI is now indicating just 0.6% annualized GDP growth in February. That compares with a 2.4% signal for the fourth quarter (initial GDP estimates point to a similar, 2.3% fourth quarter expansion).

Service sector malaise

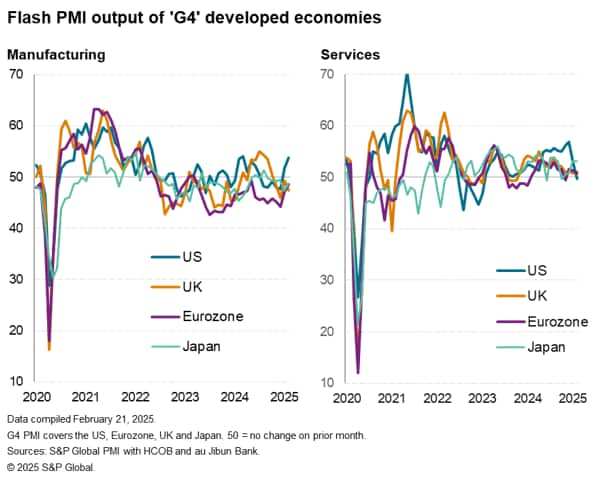

The renewed US malaise was centered on the service sector, which contracted slightly to now be the only G4 services economy in decline. February was the first time in just over two years that US services activity contracted.

Robust growth of services activity was meanwhile reported in Japan, though more sluggish rates were recorded in the eurozone and UK.

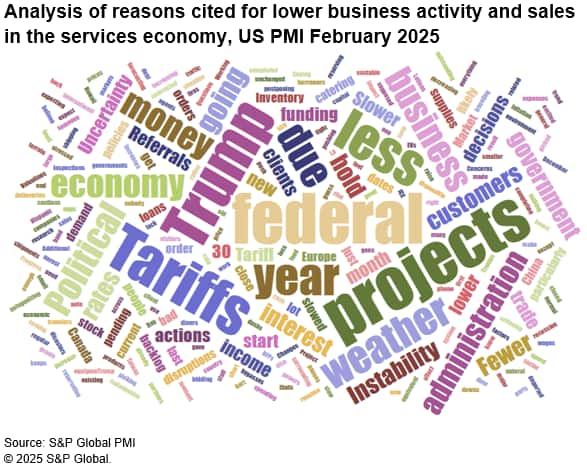

Digging into the anecdotal reporting from companies on the PMI survey questionnaires, US services firms widely blamed lower sales and activity levels on uncertainty and instability surrounding new government policies in the US, including federal spending cuts and tariff-related developments. Adverse (cold) weather also contributed in some cases, as it had in January, providing some hope that at least some of the recent weakness may prove temporary.

US manufacturers enjoy sales boost

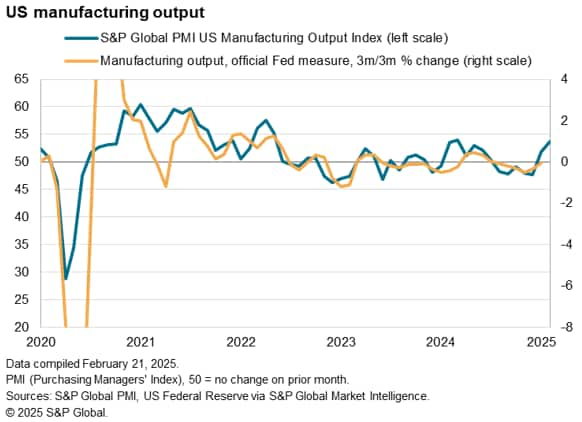

The picture was different in manufacturing, where US manufacturers reported accelerating growth in February - notching up the largest monthly rise in output for nearly a year to contrast markedly with falling production recorded in the eurozone, Japan and UK.

However, the US flash PMI hinted strongly at front-running of sales and shipments ahead of growing tariff concerns, suggesting at least some of the uplift to production in February may prove short-lived.

US goods prices spike higher

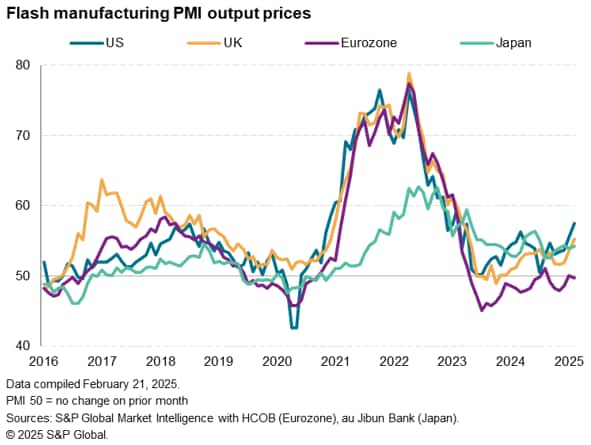

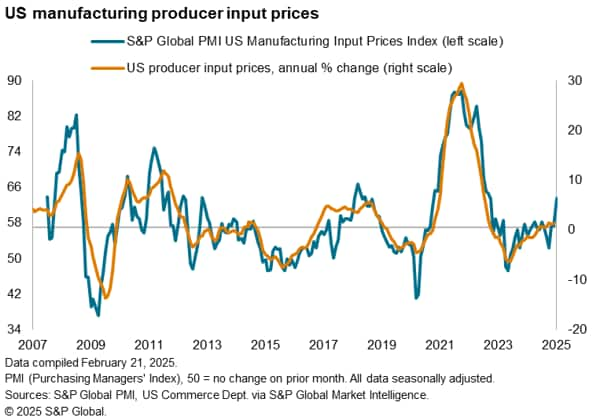

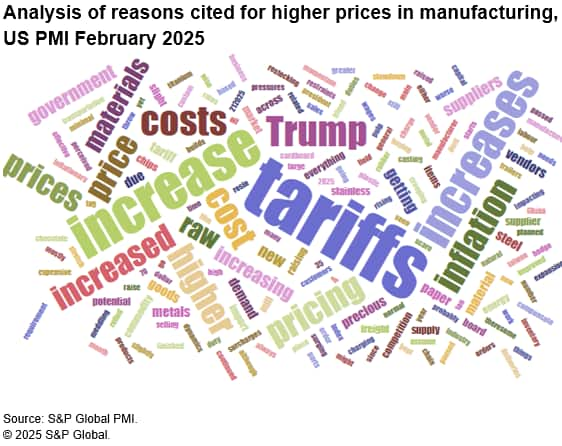

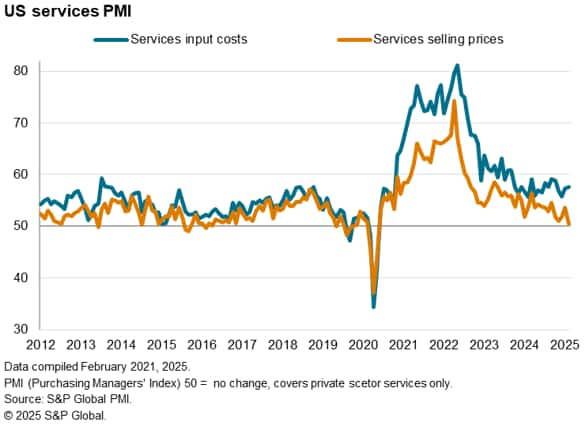

Tariffs were also widely blamed for upward pressure on prices in the US. US manufacturers reported the highest selling price inflation for two years, and a pace now outstripping that seen in the other G4 economies, as input costs in the sector surged higher at a rate not seen since November 2022.

Of those US manufacturers reporting higher input prices, over one-in-three directly attributed the rise to tariffs, with other producers ascribing the rise more generally to the new government's policies.

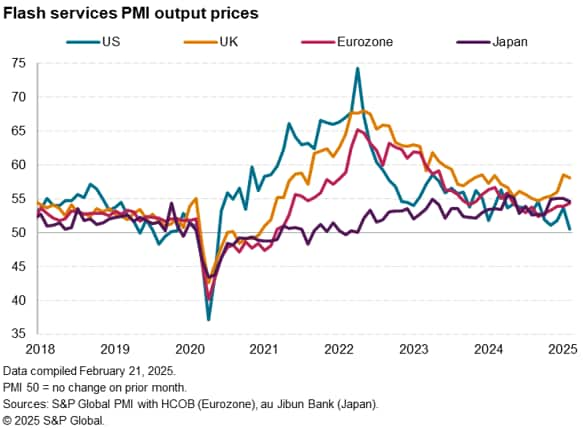

Divergence in service sector pricing helps US inflation picture

From an inflation fighting perspective, it's been the service sector that has been the most closely watched by policymakers in recent times, as this tends to align more closely with core inflation and wages, hence being more indicative of underlying inflation trends. In this respect, the flash US PMI brought good news, with average prices charged for services barely rising in February, showing the smallest monthly rise this side of the pandemic. In contrast, services inflation remained somewhat elevated by historical standards in other major developed economies, most notably in the UK.

Of those US manufacturers reporting higher input prices, over one-in-three directly attributed the rise to tariffs, with other producers ascribing the rise more generally to the new government's policies.

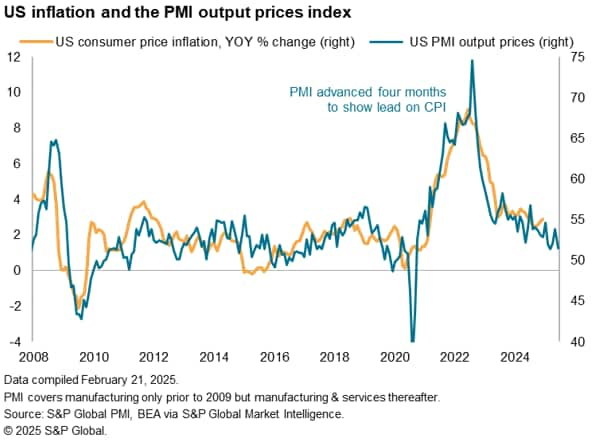

This cooling of service sector inflation more than offset the two-year high increase in manufacturing selling prices, resulting in an overall moderation in selling price inflation across goods and services in February. The resulting rate of inflation signaled by the surveys is consequently below the Fed's 2% target.

Profit warning

However, even here this piece of good news on services selling price inflation out of the US flash PMI is tainted, as reduced price growth was commonly linked to companies having to discount to attract sales. Note that input costs in the US services economy continued to rise at a rate well above the pre-pandemic average, with the rate of inflation even accelerating compared to January.

What's good for inflation is therefore not necessarily good for profits. Our PMI-based indicator of S&P 500 earnings growth, which is derived from a variety of survey subindices which track metrics relevant to profitability, including sales and margins, sank in February to its lowest since December 2022.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economic-growth-falters-and-goods-prices-spike-higher-according-to-flash-pmi-surveys.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economic-growth-falters-and-goods-prices-spike-higher-according-to-flash-pmi-surveys.html&text=US+economic+growth+falters+and+goods+prices+spike+higher%2c+according+to+flash+PMI+surveys+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economic-growth-falters-and-goods-prices-spike-higher-according-to-flash-pmi-surveys.html","enabled":true},{"name":"email","url":"?subject=US economic growth falters and goods prices spike higher, according to flash PMI surveys | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economic-growth-falters-and-goods-prices-spike-higher-according-to-flash-pmi-surveys.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+economic+growth+falters+and+goods+prices+spike+higher%2c+according+to+flash+PMI+surveys+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-economic-growth-falters-and-goods-prices-spike-higher-according-to-flash-pmi-surveys.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}