Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2025

Week Ahead Economic Preview: Week of 27 January 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link

Monetary policy in spotlight amid US Fed and ECB meetings

Monetary policy meetings from the FOMC and ECB are eagerly awaited for guidance on rate paths in 2025.

The two key policy meetings in the coming week involve the US FOMC and the eurozone's ECB. While the former is expected to sit on its hands and hold rates, the latter is expected to cut, according to consensus.

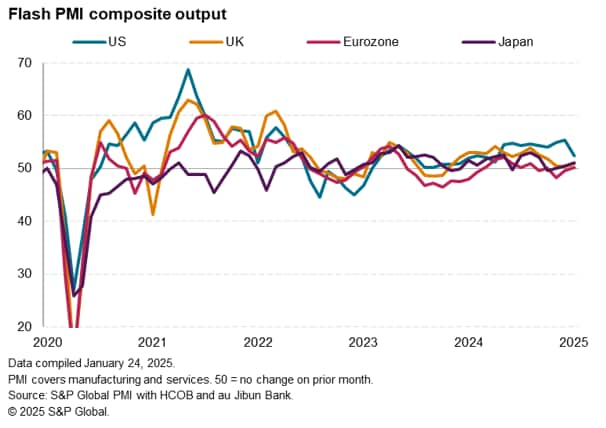

These different policy prescriptions seem reasonable given recent growth divergences between the two economies. Output growth signaled by PMI data for the US has significantly outpaced that of Europe over the past six months. Including January's flash PMI numbers, the US composite PMI (covering goods and services) has averaged 54.3 since last August, pointing to a robust expansion, whereas the equivalent eurozone PMI has averaged just 49.8, indicating a marginal decline. Note that we'll know more about fourth quarter US GDP with the advance estimate, due Thursday.

Importantly, the flash PMIs also showed future output expectations continuing to run close to three-year highs in the US in January, contrasting with a far more subdued outlook in the eurozone.

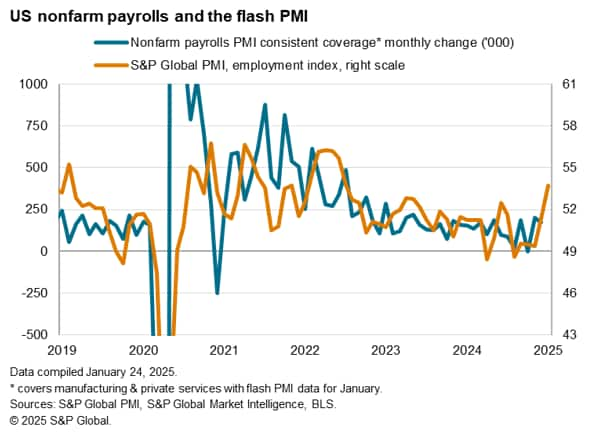

These varying prospects have fed through to a widening job market differential: measured across manufacturing and services, the flash PMI showed US job creation surging to a two-and-a-half year high in January. Jobs in the eurozone were meanwhile cut for a sixth straight month.

The strength of the US economy in terms of recent GDP signals and its labour market had in fact already prompted policymakers to rein in their expectations of the number of rate cuts in 2025 from four to two at their last meeting, with the FOMC likely pausing its easing cycle by mid-year. In contrast, we anticipate the ECB to cut by a total of 125 basis points in 2025.

However, the economic environment is changing rapidly, and how policymakers are anticipating the landscape to change in the coming months will be a major aspect to monitor from any messaging around the policy meetings. In particular, markets will be looking for clues as to how the FOMC expects US inflation to be affected by President Trump's policy agenda. It will also be interesting to see if policymakers respond to the President's recent calls for rates to fall.

Key diary events

Monday 27 Jan

Australia, Indonesia, Taiwan Market Holiday

China (Mainland) Industrial Profits (Dec)

Hong Kong SAR Trade (Dec)

Germany Ifo Business Climate (Jan)

United States Chicago Fed National Activity Index (Dec)

United States New Home Sales (Dec)

United States Dallas Fed Manufacturing Index (Jan)

Tuesday 28 Jan

China (Mainland), Indonesia, Malaysia, South Korea, Taiwan Market Holiday

Australia NAB Business Confidence (Dec)

France Consumer Confidence (Jan)

United States Durable Goods Orders (Dec)

United States S&P/Case-Shiller Home Price (Nov)

United States CB Consumer Confidence (Jan)

Wednesday 29 Jan

China (Mainland), Hong Kong SAR, Indonesia, Malaysia, Philippines, Singapore, South Korea, Taiwan Market Holiday

Australia Inflation (Q4)

Australia Monthly CPI Indicator (Dec)

Japan Consumer Confidence (Jan)

Germany GfK Consumer Confidence (Feb)

Sweden GDP (Q4)

Spain GDP (Q4, flash)

United States Goods Trade Balance (Dec, adv)

United States Wholesale Inventories (Dec, adv)

Canada BoC Interest Rate Decision

United States Fed FOMC Interest Rate Decision

Brazil BCB Interest Rate Decision

Thursday 30 Jan

China (Mainland), Hong Kong SAR, Malaysia, Singapore, South Korea, Taiwan Market Holiday

New Zealand Trade (Dec)

France GDP (Q4, prelim)

Spain Inflation (Jan, prelim)

Germany GDP (Q4, flash)

Italy GDP (Q4, adv)

United Kingdom Mortgage Lending and Approval (Dec)

Eurozone GDP (Q4, flash)

Eurozone Unemployment (Dec)

Mexico GDP (Q4)

Eurozone ECB Interest Rate Decision

United States GDP (Q4, adv)

United States Pending Home Sales (Dec)

Friday 31 Jan

China (Mainland), Hong Kong SAR, Taiwan Market Holiday

Japan Unemployment Rate, Industrial Production, Retail Sales (Dec)

China (Mainland) NBS PMI (Jan)

Germany Retail Sales (Dec)

United Kingdom Nationwide Housing Prices (Jan)

France Inflation (Jan, prelim)

Germany Unemployment (Jan)

Germany Inflation (Jan, prelim)

United States Core PCE Price Index (Dec)

United States Personal Income and Spending (Dec)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: FOMC, BoC meetings; US GDP, core PCE, new home sales, durable goods orders, consumer confidence and personal income and spending data

The Fed convenes for their first meeting of the year with the market consensus pointing to no change in the upcoming meeting after the Fed lowered fed funds rate in December to 4.25%-4.50%. While the consensus is for further rate cuts in the year, the pace of cutting is widely expected to slow especially with improving economic conditions at the end of 2024. Our forecast team is currently seeing March as the first 25 basis points (bps) cut of just two in 2025. Meanwhile a series of key data releases are anticipated including advance Q4 GDP and the core PCE reading for December.

In contrast, the Bank of Canada is set to cut interest rates by 25bps according to consensus in the lead up to the meeting, though cooling inflation and US tariffs cloud the outlook.

EMEA: ECB meeting, Eurozone GDP, consumer confidence data; German inflation, Ifo, GfK surveys and employment data; France inflation

The European Central Bank (ECB) is also widely expected to lower rates further in January amid subdued economic performance in the eurozone. More rate cuts in the year, totalling 125bps, are also pencilled in by our forecast team. This is especially with eurozone output remaining subdued in January amid weak price pressures, according to the HCOB Eurozone PMI. We will await the Q4 GDP release for confirmation of the weak growth signals late last year.

Other data highlights include consumer confidence data after the latest January HCOB Eurozone PMI Future Output data showed business sentiment was little changed from December with confidence levels remaining below-average.

Early official inflation data from Germany and France are also expected, with the HCOB PMI data outlining diverging trends with inflationary pressures intensifying in the former but France seeing prices charged decline for the first time in nearly four years.

APAC: China NBS PMI; Australia inflation; Japan industrial production, consumer confidence data; Philippines GDP

In APAC, PMI data released by mainland China's National Bureau of Statistics will be updated on Friday amid Spring Festival holidays. Other key updates include inflation data from Australia and Japan's industrial production and consumer confidence figures. According to the latest au Jibun Bank Flash Japan PMI, manufacturing output fell at the quickest pace in nine months while business optimism slipped eased across the private sector, hinting at softer readings for the upcoming Japanese data releases.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-january-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-january-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+27+January+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-january-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 27 January 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-january-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+27+January+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-27-january-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}