Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 27, 2025

Flash PMI data underscore sustained US outperformance among developed economies

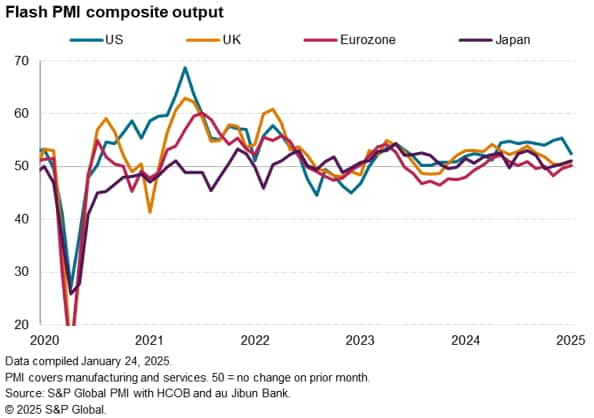

The flash PMI data compiled by S&P Global Market Intelligence indicated that the US economy continued to outperform relative to other major developed economies in January, albeit with the divergence narrowing.

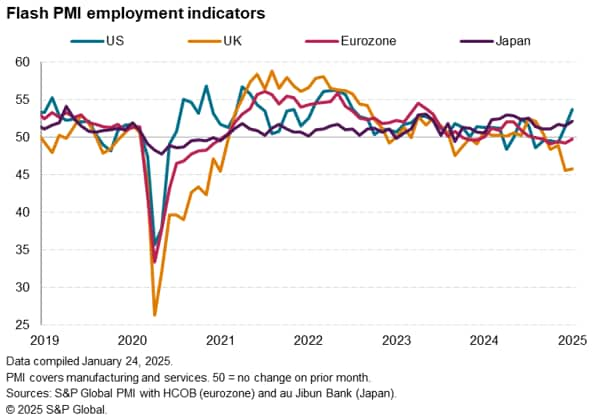

However, business confidence about the year ahead remains especially elevated in the US compared to subdued readings in the eurozone, UK and Japan. This optimism has been matched by much stronger hiring in the US than elsewhere at the start of 2025. That said, there are some pockets of stronger optimism appearing elsewhere, notably in the German manufacturing sector.

Questions remain, however, as to fiscal policy outlooks as well as inflation and monetary policy trends in the coming year.

We run through the latest flash PMI signals and consider the survey variables to monitor as we head further into 2025.

US outperformance wanes

The new year brought a narrowing of the recent economic divergence seen among the G4 largest developed economies. Whereas the US has continued to outpace its peers in January, as was the case throughout much of 2024, its pace of expansion slowed while growth improved elsewhere.

The US composite PMI output index (covering goods and services) had risen to a 32-month high of 55.4 in December, but the flash estimate for January showed a marked fall to 52.4. That signalled the slowest output growth since last April.

While the US PMI remained higher than equivalent numbers in Europe and Japan, it was the only economy to see the PMI turn lower. The eurozone flash PMI rose from 49.6 in December to 50.2 in January, edging back into growth territory after two months of decline, while the UK PMI nudged up to 50.9 from 50.4. Japan's equivalent PMI reading was 51.1 from 50.5 in December.

While these subdued readings mean the US continues to outperform by some margin, the gap has shown signs of closing.

The data caused a softening of the US dollar, notably against the euro, and also caused the German stock market to rally while US stocks dipped post-release.

A key question facing the markets, and policymakers, is therefore whether this divergence will continue to narrow, or whether the US may resume its outperformance.

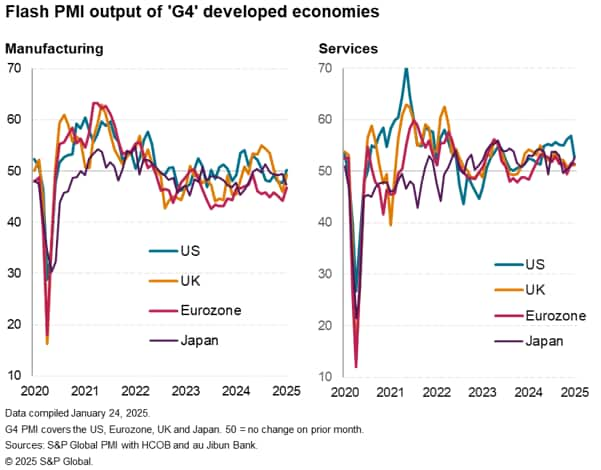

Sector trends

More insight can be gained by drilling into the sector output data for January. Here it becomes evident that the US' weaker performance was led by a pull-back in growth in the services economy from near-three-year highs late last year. US service sector growth is now only marginally faster than that of Japan, which recorded the largest gain for four months in January, albeit still robust compared to the eurozone and UK, where services economies remained subdued.

One point to note from the surveys was than many US service providers reported a hit from particularly adverse weather in January, suggesting some of the weakness may prove temporary.

Also of note was a return to growth for US manufacturing output in January for the first time in six months. That contrasted with a deepening production downturn in Japan's factory sector, and further contractions in the eurozone and UK. The latter two, however, both reported a marked slowing in their rates of production decline.

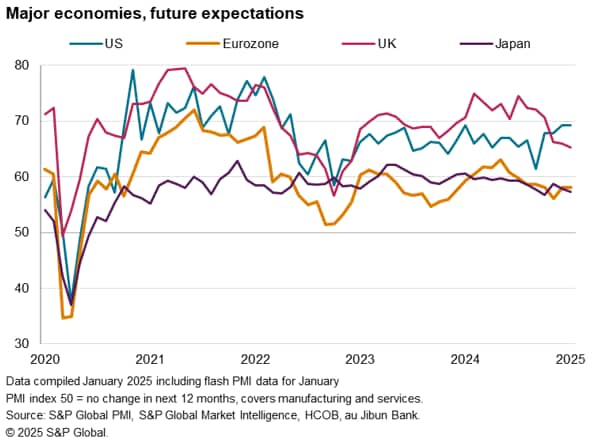

Confidence matters

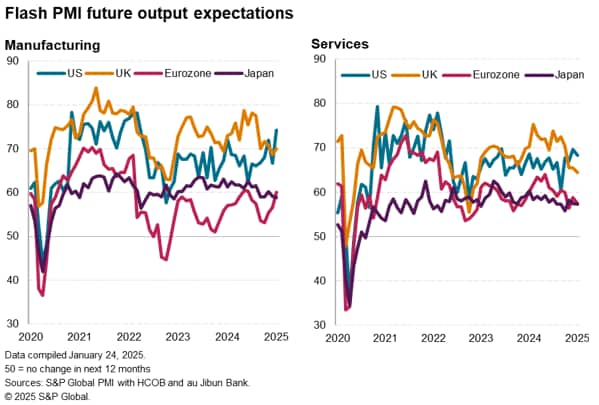

To see where the direction of travel may lie in the coming months, the future output expectations indices from the PMI can help shed some light.

The stand-out development in January was a surge in business optimism among US manufacturers, suggesting the sector will build further on the marginal return of production growth seen at the start of the year. US factories reported improved confidence around the political situation, anticipating pro-business support from the new administration alongside the lifting of pre-election uncertainty.

While still-elevated, and among the highest seen over the past three years, US service sector optimism faded slightly. This reflected some concern over the degree to which interest rates may be cut in 2025, stubborn inflation, job market tightness and broader uncertainty caused by the changing administration. However, even with this pull-back, the services future output expectations index remains supportive of activity in the sector rebounding somewhat in February.

A surprising development was a marked upturn in optimism about the year ahead in the eurozone, and notably Germany. The latter saw manufacturing sentiment hit a near-three-year high, helping also push factory sentiment in the eurozone to one of the highest levels since early 2022. Eurozone producers reporting rising hopes of stimulus from lower interest rates and the easing cost of living crisis, as well as improved political stability post the German elections in February. That said, uncertainty of French elections was a key driver of low confidence in the region's services economy.

In the UK, sentiment also sank further in the services economy and remained subdued in manufacturing by recent standards. Companies reported concerns over the economic outlook amid already-stalled economic growth and the prospect of employer-based tax hikes commencing April.

Japan also saw falling sentiment, linked to the prospect of higher interest rates (the Bank of Japan hiked by 25 basis points in a well-flagged meeting on 24th January) as well as concerns over international trade frictions.

US hiring spree contrasts with job cuts in the UK

US confidence therefore remains especially elevated, auguring well for a resumption of strong growth in February. This is lent further weight by the flash PMI signalling a marked rise in US employment as companies sought to raise operating capacity. US jobs were created at a rate not seen for two-and-a-half years.

In sharp contrast, the UK saw jobs being cut sharply again, the last two months having seen the steepest job losses since 2009 barring only the initial pandemic months, as companies react to the tax changes announced in November.

Eurozone employment also fell, down for a sixth straight month, albeit only marginally, though an improved picture was seen in Japan.

The jobs data therefore hint at ongoing US outperformance, and most notably relative to the UK.

The widening gulf between employment trends in the US and UK in part illustrates how survey respondents have reacted to divergent pollical approaches from new governments, meaning it will be important to assess any new government rhetoric after elections in both Germany and France.

In the US, the Trump administration's optimistic outlook for the domestic economy has unleashed 'animal sprits' in the form of higher confidence and hiring in the PMI survey. In the UK, the new government has presented a more downbeat assessment of economic challenges, focusing on fiscal discipline amid a longer-term growth focus. Strong growth and optimism seen in the UK PMI prior to their election has consequently faded.

Policy support

While it remains to be seen how these approaches to governing play out, monetary policy will also play a role in determining growth in the coming year. In this respect, the UK seems further challenged.

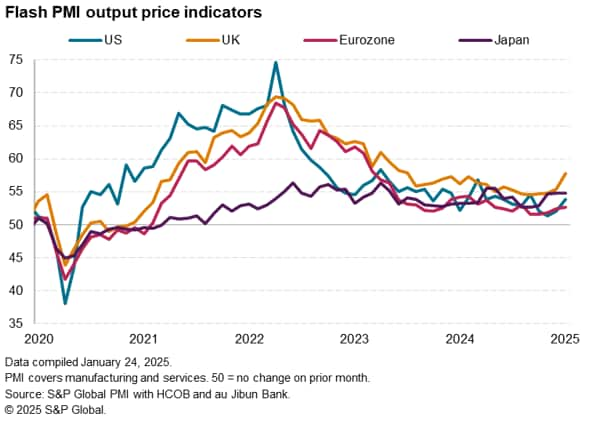

Average selling prices for goods and services in the UK rose especially sharply in January, according to the flash PMI data, rising at the steepest rate for one-and-a-half years. Comparisons with official data suggest the UK PMI numbers are indicating inflation to reignite and push further above the Bank of England's 2% target.

In contrast, the comparable PMI price data for the US and eurozone continued to run at levels broadly consistent with central bank targets, albeit edging higher.

These price gauges will be especially important to monitor in the coming months, particularly in terms of any feed through from supply-side or trade protectionism related developments. Any rekindling of higher inflation could limit policymaker willingness to cut interest rates, leading to tighter financial conditions and thereby curbing a key prop to recent economic growth from financial services, notably in the US.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-underscore-sustained-us-outperformance-among-developed-economies-Jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-underscore-sustained-us-outperformance-among-developed-economies-Jan25.html&text=Flash+PMI+data+underscore+sustained+US+outperformance+among+developed+economies+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-underscore-sustained-us-outperformance-among-developed-economies-Jan25.html","enabled":true},{"name":"email","url":"?subject=Flash PMI data underscore sustained US outperformance among developed economies | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-underscore-sustained-us-outperformance-among-developed-economies-Jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+data+underscore+sustained+US+outperformance+among+developed+economies+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-underscore-sustained-us-outperformance-among-developed-economies-Jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}