Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 31, 2025

Week Ahead Economic Preview: Week of 3 February 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

The coming week opens with global PMI surveys and closes with the US monthly employment report, collectively providing some key insights into central bank policy paths around the world. Also watch out for eurozone inflation numbers, due Monday. As for central bank meetings, policymakers at the Bank of England and Reserve Bank of India gather to decide on rates.

The week builds up to the US jobs report on Friday, which will add to the growing interest rate debate. To the frustration of President Trump, who has called for lower interest rates, the Fed held rates at 4.25-4.50% at its January meeting after three successive cuts. Policymakers were also considered to have tilted in a more hawkish direction amid signs of robust economic growth, a strong labour market and inflation remaining "somewhat elevated". Headline inflation rose to a five-month high of 2.9% in December and core inflation has been largely unchanged for a couple of months. More time was needed, it said, to evaluate the likely impact of the new administration's policies.

There's a widely held belief that, if widely applied, tariffs and policies designed to reduce immigration will add to US inflation. At the same time, pro-business policies touted by the new administration have lifted business optimism and encouraged a sharp increase in hiring in the US, likely fueling more price pressures.

Hence, the January payrolls report will be eagerly assessed to ascertain whether hiring has indeed accelerated, and whether wage growth is following suit. To recap, December's job market conditions had been better than expected, with 256,000 jobs added (after a 212,000 rise in November) and the unemployment rate dropping to 4.1% from 4.2%. A further strong report, consistent with the current survey signals, will add to speculation that the FOMC may not even deliver two rate cuts in 2025.

Meanwhile the Bank of England is expected to cut rates from 4.75% to 4.50% when its meeting concludes on Thursday. Two more cuts are priced in for 2025 as traders weigh up the need to boost the stalled economy, but the pace of any future cuts remains uncertain amid rising price pressures, drawing focus on the meeting's press briefing for guidance.

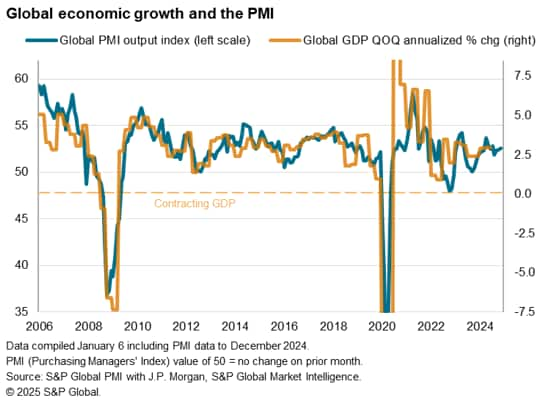

Global PMI data will meanwhile help guide insights into regional and sectoral economic divergences (see box).

Focus on global PMI surveys

The January PMI data will help shed light on how companies around the world are faring amid the heightened political and economic uncertainty which has dominated 2025 so far.

Prior PMI data showed steady global GDP growth at just below long-term trend in December, but the US has outperformed the developed economies with a robust expansion amid improved optimism. In contrast, business activity in both the UK and Eurozone has been very subdued, with the UK notably reporting a worryingly steep employment decline.

Growth also slowed late last year in mainland China as trade worries exacerbated local growth headwinds, with new weakness also evident in Brazil. India likewise reported a slowing in January, according to its flash PMI data, adding to signs of a broader emerging market slowdown.

By sector, services continue to greatly outperform manufacturing in most major economies, with financial services the stand-out performer amid looser financial conditions.

Besides revealing how these recent growth trends have developed, the updated PMIs will add detail on trade flows, supply chains and prices, all of which are coming under increased scrutiny in the light of changing geopolitical tensions.

Key diary events

Monday 3 Feb

China (Mainland) Market Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (Jan)

South Korea Industrial Production (Dec)

Japan BoJ Summary of Opinions (Jan)

Australia Building Permits and Retail Sales (Dec)

Indonesia Inflation (Jan)

Turkey Inflation (Jan)

Hong Kong GDP (Q4, adv)

Eurozone Inflation (Jan, flash)

Italy Inflation (Jan, prelim)

United States ISM Manufacturing PMI (Jan)

Tuesday 4 Feb

Brazil BCB Meeting Minutes

United States JOLTs Job Openings (Dec)

United States Factory Orders (Dec)

Saudi Arabia PMI* (Dec)

Mexico Manufacturing PMI* (Dec)

Wednesday 5 Feb

Worldwide Services, Composite PMIs, inc. global PMI* (Jan)

South Korea Inflation (Jan)

Philippines Inflation (Jan)

Indonesia GDP (Q4)

Thailand Inflation (Jan)

France Industrial Production (Dec)

Brazil Industrial Production (Dec)

United States ADP Employment Change (Jan)

Canada Trade (Dec)

United States Trade (Dec)

United States ISM Services PMI (Jan)

Thursday 6 Feb

Australia Trade (Dec)

Germany Factory Orders (Dec)

Eurozone HCOB Construction PMI* (Jan)

United Kingdom Construction PMI* (Jan)

Eurozone Retail Sales (Dec)

Europe Sector PMI* (Jan)

United Kingdom BoE Interest Rate Decision

Mexico Banxico Interest Rate Decision

Friday 7 Feb

New Zealand Market Holiday

Japan Household Spending (Dec)

India RBI Interest Rate Decision

Germany Trade (Dec)

United Kingdom Halifax House Price Index* (Jan)

France Trade (Dec)

Taiwan Trade and Inflation (Jan)

Brazil Inflation (Jan)

Canada Employment (Jan)

United States Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings (Jan)

United States UoM Sentiment (Feb, prelim)

Sunday 9 Feb

China (Mainland) CPI, PPI (Jan)

* Access press releases of indices produced by S&P Global and relevant sponsorshere.

What to watch in the coming week

Worldwide PMI data for January

Global PMI data for January, including manufacturing and services, will be released over the course of the new week. Early flash release revealed the US economy's recent outperformance relative to other major developed economies narrowed in January. Meanwhile India also saw 2025 commence with a softening of growth pace. Detailed global and sector PMI data will offer the first comprehensive overviews of key growth, inflation and business confidence trends at the start of the new year.

Americas: US labour market report, Fed comments, ISM PMI and trade data; Canada trade and employment data; Mexico and Brazil inflation data

The key release of the week will be US employment report including non-farm payrolls data. The latest S&P Global Flash US PMI indicating that hiring had been on the upturn at the start of the year as firms commence the year in an upbeat mood regarding growth. Wage data will also be firmly in focus following PMI survey indications of rising price pressure amid growth in labour costs. Additionally, ISM and US trade data will be tracked alongside Fed officials' appearances through the week for insights into the outlook for interest rates.

Over in Canada, where the central bank cut rates for the sixth successive meeting to 3.0% in January, trade and employment data will be watched ahead of rising uncertainties pertaining trade with the US. Inflation data from Brazil and Mexico will also be highlights.

EMEA: BoE meeting; Eurozone inflation; Germany trade

The Bank of England convenes for their first meeting of the year with mixed signals observed from recent data, including the latest flash UK PMI. On the one hand, a stalled economy and steep job provide impetus for the BoE to lower rates, on the other hand, rising price pressures call for greater caution, altogether adding to the event risk.

Eurozone inflation will also be released after early HCOB Flash Eurozone PMI revealed that the rate of inflation quickened to a five-month high in January.

APAC: RBI meeting, BoJ Summary of Opinions; China inflation; Australia trade

Besides detailed PMI data, highlights for APAC in the week include the Reserve Bank of India (RBI) meeting, summary of opinions from the January Bank of Japan meeting (where interest rates were lifted), in addition to inflation data out of mainland China and Australian trade numbers. The latest HSBC Flash India PMI data outlined softening growth in January, supporting the RBI's dovish bias, though recent rupee fluctuations add uncertainty to whether the RBI will move as early as February.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-3-february-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-3-february-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+3+February+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-3-february-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 3 February 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-3-february-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+3+February+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-3-february-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}