Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2025

Flash PMI signals buoyant US business optimism at start of 2025

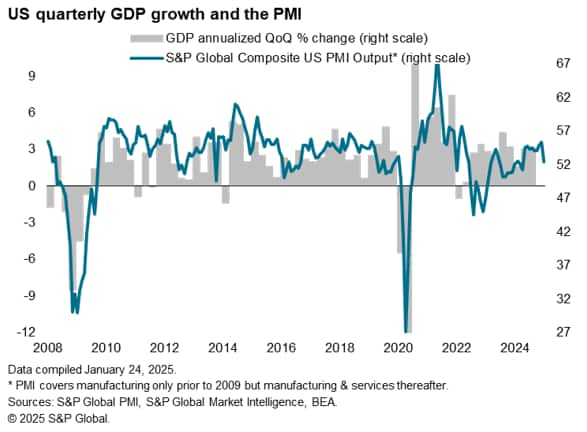

US businesses are starting 2025 in an upbeat mood on hopes that the new administration will help drive stronger economic growth. Expectations of manufacturing growth over the coming year have surged higher as factories await support from the new policies of the Trump administration, though service providers are also entering 2025 in good spirits.

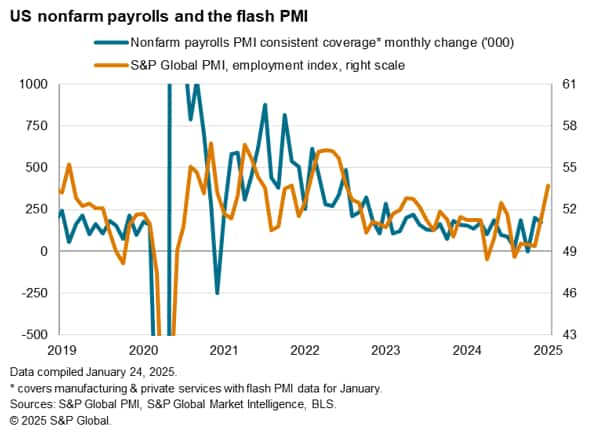

Especially encouraging is an upturn in hiring that has been fueled by the improved business outlook, with jobs being created at a rate not seen for two-and-a-half years.

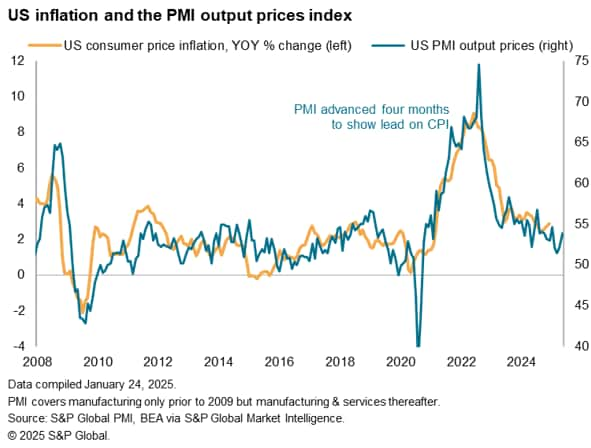

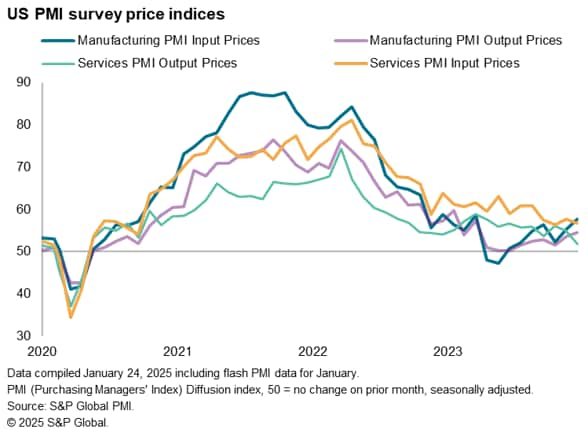

However, rising price pressures are a concern, with companies reporting supplier-driven price hikes as well as wage growth amid poor staff availability. Higher input cost and selling price inflation was broad-based across goods and services and, if sustained, could add to worries that a combination of robust economic growth, a strong job market, and higher inflation could encourage a more hawkish policy approach from the Fed.

Output growth cools from highs

The headline S&P Global US PMI Flash Composite Output Index fell from 55.4 in December to a nine-month low of 52.4 in January, according to the preliminary 'flash' reading, which is based on approximately 85% of usual survey responses.

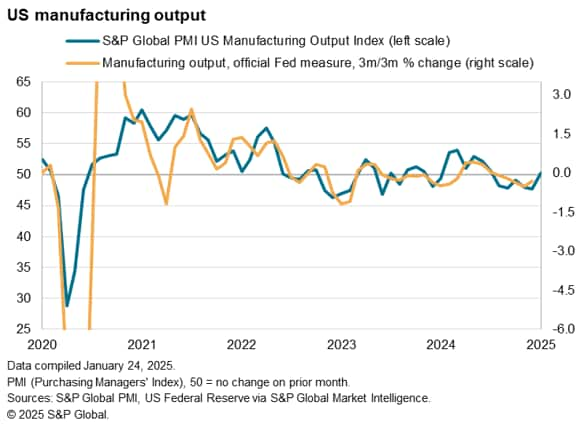

The slowdown was centered on the services economy, where output rose at the slowest rate since last April, albeit sustaining the sector's expansion into a twenty-fourth successive month. Manufacturing output meanwhile rose marginally, representing an improvement on the declines recorded over the previous five months.

Future sentiment at joint-highest since May 2022

At least some of the slowdown also appears to have been due to adverse weather, hinting that growth could pick up again in February. Furthermore, optimism about the coming year continued to run at an elevated level. Measured across goods and services, firms' expectations of their output in the next 12 months were unchanged in December, thereby remaining the joint-highest since May 2022.

Service sector confidence lost some of the shine from December's one-and-a-half year high, but remained the second-highest recorded over the past year. Manufacturing confidence meanwhile surged higher, reaching the highest since March 2022 after posting the largest monthly improvement since November 2020.

Employment surges higher

Optimism about the year ahead was matched by a jump in hiring. Employment rose in January at the fastest rate for two-and-a-half years, up for a second successive month after four months of job shedding. The improvement was led by a surge in service sector hiring, where jobs were added at the sharpest rate for 30 months, though manufacturing payroll growth also edged up to a six-month high. The latter remained modest, however, reflecting ongoing cost concerns at producers amid low sales. Firms more broadly also continued to report ongoing issues with poor staff availability.

Selling price inflation ticks higher

Inflationary pressures meanwhile intensified in January. Both input costs and average selling prices rose at the fastest rates for four months, the rate of inflation of the latter now having increased for two successive months.

Factory input prices rose at the steepest rate since last August, generally linked to supplier-driven raw material price increases. Growth of service providers' costs also revived after having cooled to a ten-month low in December, rising at the fastest rate since last October amid increased staff costs and rising material prices.

Higher costs were passed on to customers, with average prices charged for services rising at the fastest rate since last September. An even larger rise was reported for goods, the rate of inflation of which hit a ten-month high.

Animal spirits laced with caution

The flash PMI data underscore how uncertainty in the lead up to the Presidential Election has been replaced with optimism about the future, notably among manufacturers, according to anecdotal evidence provided by survey respondents. Looser regulation, lower taxes and heightened protectionism were all widely cited, alongside a broader sense of improving economic conditions in the year ahead under the new administration.

However, some companies express concern over the potential for policies such as tariffs to disrupt supply chains and impact sales, or stoke inflation. Others cite concerns over the strong dollar, high prices and the possibility of policymakers taking a more hawkish stance toward interest rates than previously anticipated.

January saw price pressures as some of these concerns showed signs of appearing, although at present the survey's price data remain broadly consistent with the FOMC's 2% inflation target.

Looking ahead, the question is whether strong growth will resume after January's blip, and whether price pressures will continue to revive, especially in the light of the resurgence of jobs growth seen in recent months. Such developments will put further pressure on the FOMC to restrict it's loosening of policy.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-buoyant-us-business-optimism-at-start-of-2025-Jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-buoyant-us-business-optimism-at-start-of-2025-Jan25.html&text=Flash+PMI+signals+buoyant+US+business+optimism+at+start+of+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-buoyant-us-business-optimism-at-start-of-2025-Jan25.html","enabled":true},{"name":"email","url":"?subject=Flash PMI signals buoyant US business optimism at start of 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-buoyant-us-business-optimism-at-start-of-2025-Jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+signals+buoyant+US+business+optimism+at+start+of+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-buoyant-us-business-optimism-at-start-of-2025-Jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}