Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jan 24, 2025

Flash eurozone PMI top five takeaways: Economy steadies at start of 2025 as confidence revives in manufacturing

The flash PMI® survey data showed the eurozone economy edging back into growth territory at the start of 2025, hinting at some stabilisation of business conditions. A welcome cooling of the manufacturing sector's steep decline was reported, but services growth remains among the weakest seen over the past year.

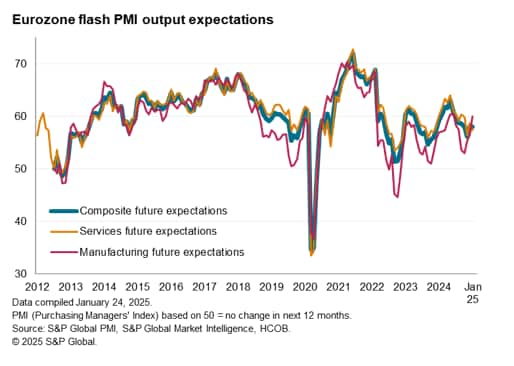

Manufacturers also reported a substantial improvement in business optimism for the year ahead, contrasting with a growing gloom among service providers, to hint at a potential further shifting of growth drivers from services back to manufacturing in the coming year.

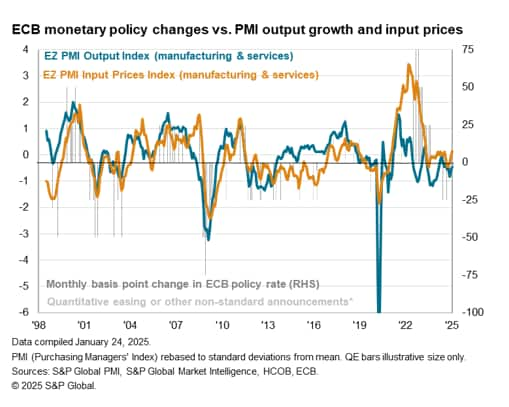

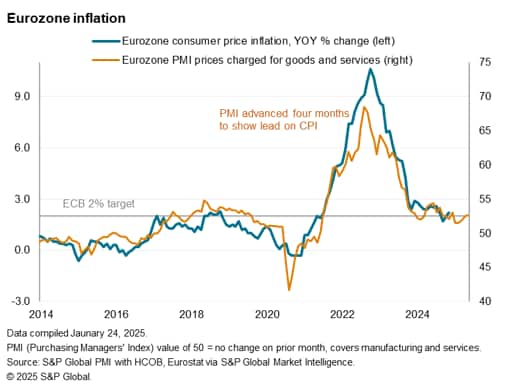

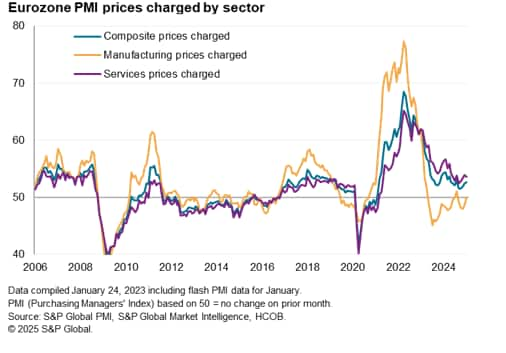

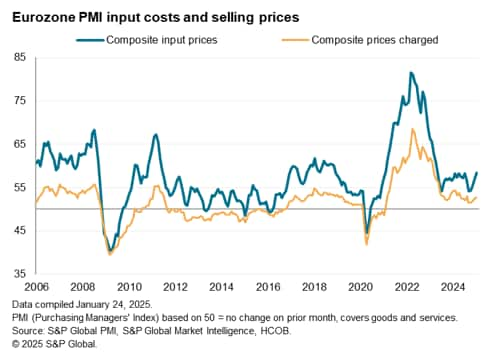

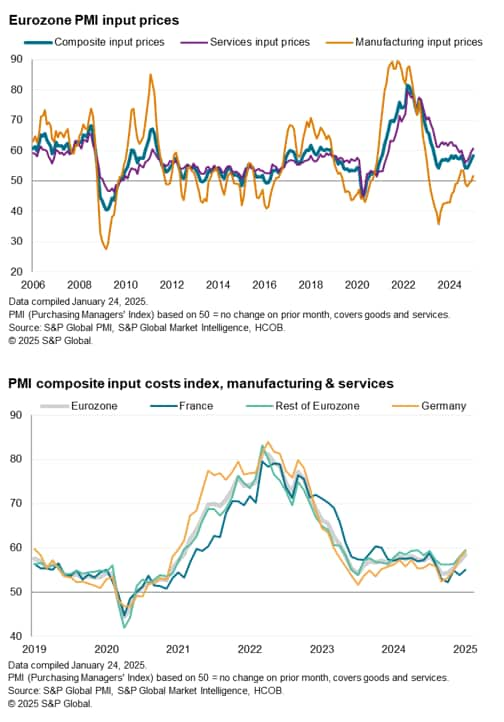

Price pressures meanwhile ticked higher, both in terms of selling prices and input costs, though remained broadly consistent with the ECB's inflation target.

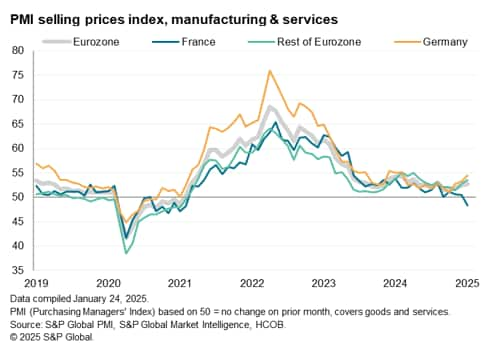

However, while signs of an improving economic situation were most evident in Germany, contrasting with a sustained downturn in France, Germany also reported the largest upturn in price pressures. With input costs in Germany rising at the sharpest rate for nearly two years, the data may lead to some caution in terms of loosening monetary policy.

Here are our top takeaways from the December flash PMI data:

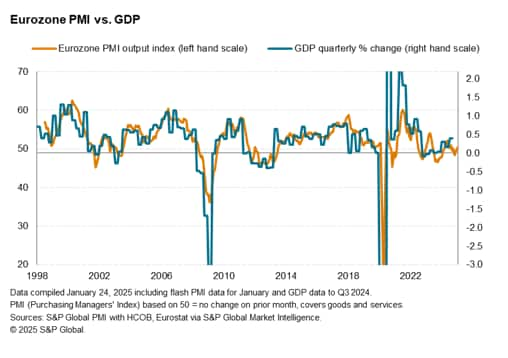

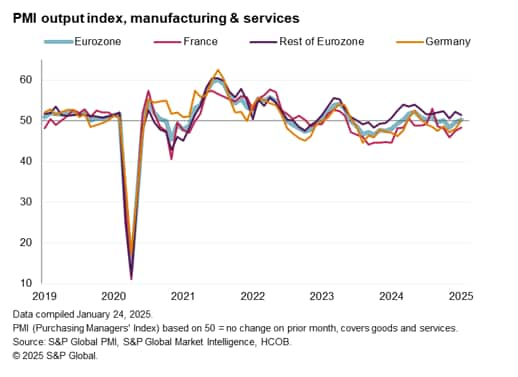

1. Eurozone economy edges back into growth

The seasonally adjusted HCOB Flash Eurozone Composite PMI Output Index, based on approximately 85% of usual survey responses and compiled by S&P Global, rose above the 50.0 no-change mark for the first time in five months in January. However, at 50.2, up from 49.6 in December, the latest reading is consistent with just 0.1% GDP growth after a largely stalled economy in the fourth quarter.

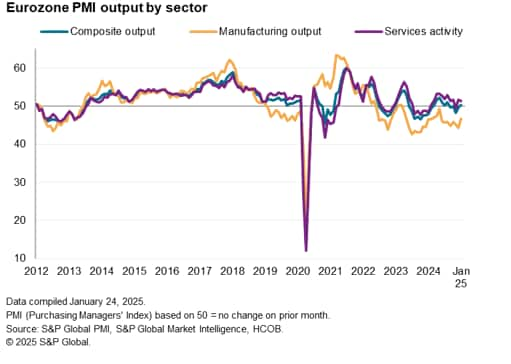

2. Sector divergence narrows as manufacturing downturn moderates

Although sector divergences remained noteworthy, these differences narrowed in January. While services growth cooled to one of the weakest rates seen over the past year, expanding only very modestly, manufacturing output fell at the slowest rate for eight months, albeit still contracting at a marked pace.

Limiting the pace of recovery in output across the Eurozone was continued demand weakness. New orders decreased for the eighth consecutive month, albeit only slightly and to the smallest degree since August last year. As was the case with output, a rise in services new business - the largest for five months - contrasted with an ongoing steep order book decline in the manufacturing sector. However, the latter - though still steep - was the smallest since last May.

Perhaps even more notable was the sector shift in future output expectations. Whereas service sector optimism cooled to the second-lowest recorded over the past 14 months, manufacturing optimism rose sharply - its biggest jump in two years - to reach a seven-month high.

3. Divergence between Franco-German core and rest of region also narrows

The recent weakness of the Franco-German core relative to the rest of the region also narrowed. Germany returned to marginal growth, contrasting with the declines seen over the prior six months, and output fell in France at the slowest rate in four months.

Germany saw service sector growth rise to the fastest since last July while its manufacturing downturn moderated considerably to the slowest since last May.

France's manufacturing downturn likewise moderated markedly to the weakest since last June, but its service sector remained in decline for a fifth straight month.

Growth in the rest of the eurozone as whole meanwhile fell to the second-lowest recorded over the past year. A cooling manufacturing downturn was offset by slower services growth.

Thus, while the downturns seen late last year in France and Germany showed signs of improvement in January, the rest of the region has lost momentum. However, both France, Germany and the rest of the region as a whole have all shown signs of recent manufacturing weakness moderating.

All have likewise seen manufacturing output expectations improve in January, with notable sentiment gains seen in both France and Germany - the latter now at a 35-month high.

Germany also stood out in reporting improved service sector optimism to a five-month high, contrasting with a slide in services optimism in France to a post-pandemic low. These divergences were fueled in part by sentiment around upcoming elections with Germany firms seeing scope for greater stability ahead while uncertainty dominated in France.

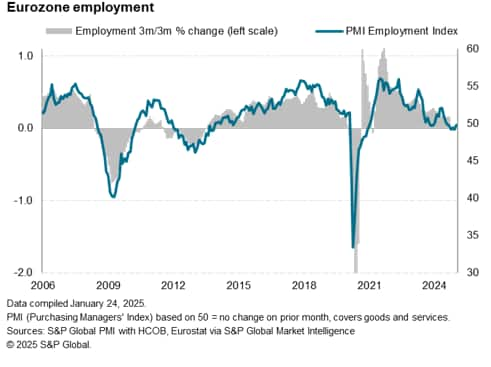

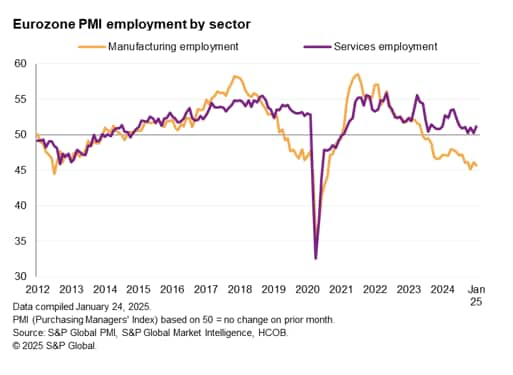

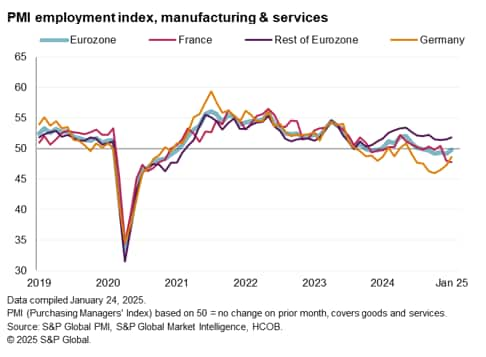

4. Employment index edges up from four-year low

Improved business activity meant that staffing levels showed signs of stabilisation at the start of the year. This is welcome news after the fourth quarter saw the steepest declines registered over the past four years. Although employment decreased for the sixth consecutive month, jobs losses were only marginal.

The fastest increase in workforce numbers in the service sector for six months almost fully offset a marked reduction in manufacturing employment, the latter continuing to fall at a worryingly steep pace.

Germany and France posted further reductions in employment, while the rest of the euro area continued to register job creation. However, while Germany's job market downturn moderated, the situation worsened in France as job losses hit the highest since the pandemic job cuts of 2020.

5. Rising cost pressures could add to policy caution

Output prices rose further at the start of the year, the pace of inflation quickening to a five-month high. The overall pace nonetheless remains broadly consistent with headline inflation running close to the European Central Bank's 2% target according to historical comparisons.

Policymakers would also be pleased to see a renewed edging down of services selling price inflation after the rate picked up to a seven-month high in December. Manufacturing prices were broadly unchanged.

However, there were notable price trend differences within the region. The upswing in selling price inflation was led by Germany, where the rate of increase was the fastest since February 2024 amid a marked rise in services prices. The rest of the Eurozone also saw the pace of output price inflation quicken, but selling prices in France decreased for the first time in almost four years as companies offered discounts amid weak demand.

January also saw a marked upturn in input cost pressures, which could add to selling price inflation in the near-term if companies pass higher costs on to customers. The rate of input cost inflation quickened for the fourth month running and was the steepest since April 2023.

Although manufacturing input costs rose for the first time in five months, the rate of inflation in the sector was dwarfed by that seen in services, where the latest rise was the most pronounced in nine months. An especially steep rise in costs was seen in Germany, linked partly to the new CO2 tax introduced in January.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-steadies-at-start-of-2025-Jan25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-steadies-at-start-of-2025-Jan25.html&text=Flash+eurozone+PMI+top+five+takeaways%3a+Economy+steadies+at+start+of+2025+as+confidence+revives+in+manufacturing+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-steadies-at-start-of-2025-Jan25.html","enabled":true},{"name":"email","url":"?subject=Flash eurozone PMI top five takeaways: Economy steadies at start of 2025 as confidence revives in manufacturing | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-steadies-at-start-of-2025-Jan25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+eurozone+PMI+top+five+takeaways%3a+Economy+steadies+at+start+of+2025+as+confidence+revives+in+manufacturing+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-eurozone-pmi-top-five-takeaways-economy-steadies-at-start-of-2025-Jan25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}