Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 23, 2025

Week Ahead Economic Preview: Week of 26 May 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US GDP, prices and FOMC minutes accompanied by mainland China PMI

US GDP, goods trade and PCE inflation data are accompanied by FOMC meeting minutes to help assess the timing of potential rate cuts amid tariff uncertainty. The impact of the latter on mainland China will also be assessed via the NBS PMI.

The coming week sees revised US GDP numbers for the first quarter, the early estimates having shown a 0.3% annualized rate of contraction. That is widely understood to have understated US economic growth, but it is clear the economy has weakened while price pressures have risen. We will also know more about inflation in the coming week, with the Fed's preferred inflation gauge - core PCE prices - updated.

The flash PMI data have set the scene nicely, though there is not much to celebrate here. The good news from the early US PMI for May was that growth and business confidence pulled up from lows recorded in April. However, that is where the good news ended. While up on April, both gauges remained subdued by recent standards, pointing to annualized US GDP growth of just 1% so far in the second quarter, well below trend. Exports of both goods and services fell for second successive months, the latter (which includes spending by foreigners in the US) in fact falling at the sharpest rate since the pandemic lockdowns. Note that US goods trade numbers are also updated in the coming week.

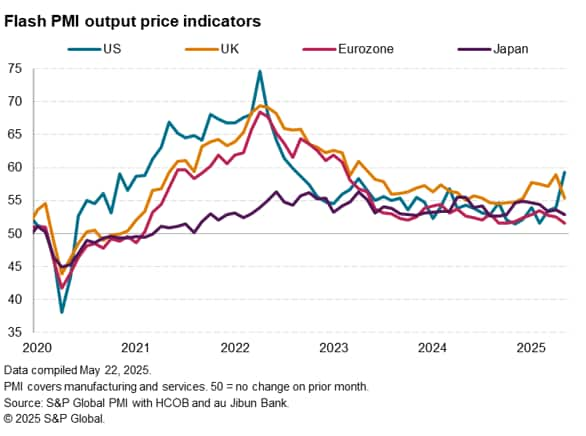

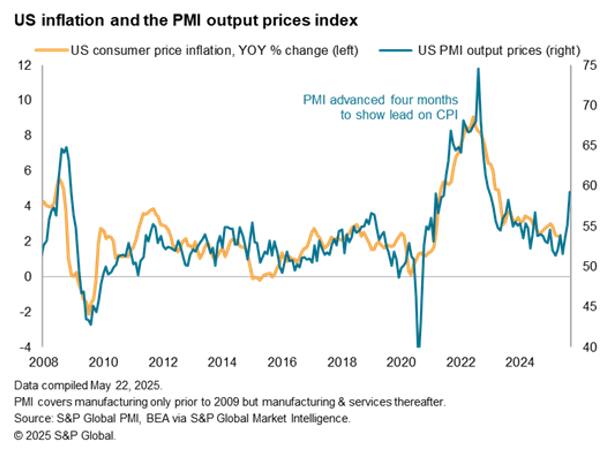

Worries about tariffs meanwhile led to the largest build-up of manufacturing input inventory ever recorded by the S&P Global PMI, those worries reflecting intensifying supply shortages and the largest spike in prices since November 2022. The rise in prices bucked a wider trend among the G4 economies of falling price pressures in May (see first chart) and is indicative of US consumer price inflation moving potentially sharply higher (see second chart).

These data support the view from the forecast team here at S&P Global Market Intelligence, which sees the Fed keeping interest rates unchanged up to December, when a further cut is anticipated. We will know more about Fed thinking in this regard with the publication of FOMC minutes from the last meeting, where rates were again held steady, as well as through some scheduled policymaker speeches.

Rates cuts are meanwhile anticipated in the coming week in New Zealand and South Korea, while the impact of tariffs on mainland China will be gleaned from NBS PMI and official industrial production data for Japan and India.

Key diary events

Monday 26 May

UK, US Market Holiday

Singapore Industrial Production (Apr)

Hong Kong SAR Trade (Apr)

Tuesday 27 May

China (Mainland) Industrial Profits (Apr)

Germany GfK Consumer Confidence (Jun)

France Inflation (May, prelim)

EU/Eurozone Economic Sentiment (May)

United States Durable Goods (Apr)

United States S&P/Case-Shiller Home Price (Mar)

United States CB Consumer Confidence (May)

United States Dallas Fed Manufacturing Index (May)

Wednesday 28 May

Sweden Market Holiday

Australia Monthly CPI (Apr)

New Zealand RBNZ Interest Rate Decision

France GDP (Q1, final)

Germany Unemployment Rate (May)

Eurozone ECB Consumer Inflation Expectations (Apr)

Taiwan GDP (Q1, final)

India Industrial Production (Apr)

United States FOMC Meeting Minutes (May)

Thursday 29 May

Denmark, Indonesia, Norway, Sweden Market Holiday

South Korea BoK Interest Rate Decision

Japan Consumer Confidence (May)

Canada Current Account (Q1)

United States GDP (Q1, 2nd est.)

South Africa SARB Interest Rate Decision

United States Pending Home Sales (Apr)

Friday 30 May

Denmark, Indonesia, Taiwan Market Holiday

Japan Tokyo CPI (May)

Japan Unemployment Rate (Apr)

Japan Industrial Production (Apr, prelim)

Japan Retail Sales (Apr)

Australia Building Permits (Apr, prelim)

Australia Retail Sales (Apr)

Japan Housing Starts (Apr)

Germany Retail Sales (Apr)

United Kingdom Nationwide Housing Prices (May)

Switzerland Retail Sales (Apr)

Spain Inflation (May, prelim)

Türkiye GDP (Q1)

Italy Inflation (May, prelim)

India GDP (Q1)

Germany Inflation Rate (May, prelim)

Canada GDP (Q1)

United States Core PCE Price Index (Apr)

United States Personal Income and Spending (Apr)

United States Goods Trade Balance (Apr, adv)

United States UoM Sentiment (May, final)

Saturday 31 May

China (Mainland) NBS PMI (May)

What to watch in the coming week

Americas: Fed comments, FOMC minutes, US GDP, core PCE, durable goods orders, consumer confidence, home prices, personal income and spending; Canada GDP

Fed minutes from the May 6-7 US Federal Open Market Committee (FOMC) meeting will be scoured for insights into the Fed's thoughts after rates were again unchanged. More up-to-date comments from FOMC members will also be heard through the week with views regarding the growth and inflation in focus given the uncertainty surrounding tariffs.

On the data front, the second estimate of first quarter US GDP will be updated, the initial estimate having shown contraction. A check on inflation via the Fed's preferred price gauge, the core PCE price index, will also be eagerly assessed amid the Fed's concerns over the impact of tariffs on prices. According to May's S&P Global Flash US PMI prices data, average charges rose at a pace not seen since August 2022 on the back of higher tariffs.

Additionally, Canada will publish first quarter GDP at the end of the week as March data help to round off the quarter. According to PMI indications, the Q1 average reading was the weakest seen since the closing quarter of 2023, supporting the market forecast for near-stagnant growth.

EMEA: France, Italy, Spain inflation; Germany inflation and GfK Consumer Confidence; Türkiye GDP

Following the flash eurozone PMI release, Germany, France, Italy and Spain update preliminary inflation figures for May. According to PMI data, France's output prices fell for the first time in four months and at the fastest pace since January 2021 amid reductions in both manufacturing and services charges. Selling price inflation meanwhile eased in Germany.

Additionally, GfK Confidence data will also be updated with the early flash PMI Future Output Index having revealed a slight rebound in eurozone business optimism, albeit to a level that remained among the lowest so far this year.

APAC: RBNZ, BoK meetings; Australia CPI; mainland China PMI; India GDP; Japan consumer confidence, unemployment rate and industrial production data

Central bank meetings in New Zealand and South Korea are anticipated, with rate cuts on the table for both amidst ongoing tariff uncertainty. Key data releases in the APAC region meanwhile include Australia's CPI data, PMI data from mainland China's National Bureau of Statistics and GDP figures out of India. Japan's consumer confidence data will also be in focus alongside retail sales, industrial production and unemployment numbers. The flurry of official data follow the latest May au Jibun Bank Flash Japan PMI, which showed that business activity slipped back into contraction midway through the second quarter of the year.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-may-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-may-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+26+May+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-may-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 26 May 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-may-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+26+May+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-26-may-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}