Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 27, 2025

Flash PMI survey signals subdued developed world growth in May amid tariff uncertainty, as US prices spike higher

The flash PMI data compiled by S&P Global Market Intelligence indicated that business output among the four largest developed economies - the 'G4' economies - grew at a slightly increased rate in May. The rise was nonetheless still the second weakest recorded over the past 17 months amid ongoing heightened economic uncertainty, widely linked to US tariff announcements. Only the US reported growth as marginal declines were seen in the eurozone, UK and Japan.

Price pressures meanwhile varied, with a sharp tariff-related spike in US prices contrasting with cooler inflation rates in the other G4 economies.

Subdued G4 output growth

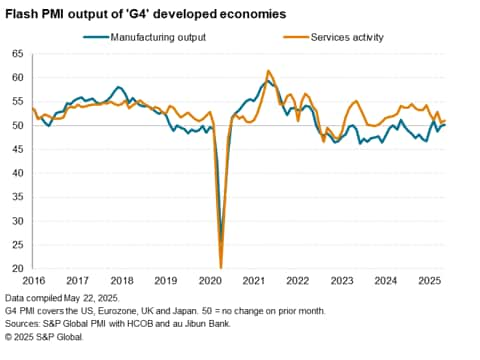

The Composite PMI Output Index from the G4 economies, a GDP-weighted gauge covering both goods and services, rose from 50.5 in April to 50.9 in May, according to the preliminary 'flash' reading. While the latest reading signalled an ongoing expansion of output, the rate of growth signalled was still only very modest and the second weakest since December 2023.

Growth in the second quarter of 2025 is consequently currently signalled to be below that seen in the first quarter, and the lowest recorded since the fourth quarter of 2023.

Weakness was broad-based by sector across the collective G4. The service sector reported only very modest growth, albeit up slightly from April's 17-month low, accompanied by a marginal increase in manufacturing output, the latter being the best performance for three months despite the meagre gain.

Only the US reports output growth

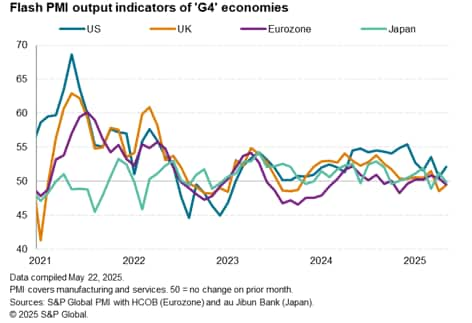

Of the G4 economies, only the US reported growth of output in May, with the rate of increase ticking higher yet remaining among the slowest seen over the past year. Marginal output declines were seen elsewhere, with a second successive monthly decline in the UK accompanied by renewed falls in the eurozone and Japan.

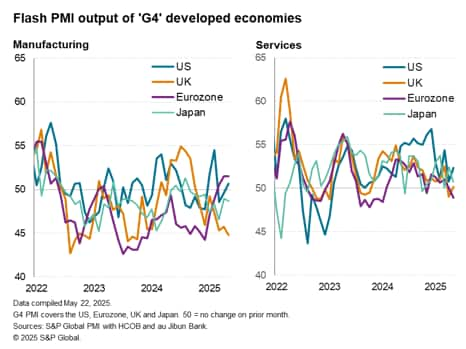

By sector, the US outperformed in the G4 in terms of services growth, as only marginal expansions were seen in Japan and the UK and a slight decline was reported in the eurozone (its worst performance for 16 months).

The marginal rise in manufacturing output across the G4 meanwhile reflected higher production volumes in the US and eurozone, the latter having enjoyed its best growth spell for three years over the past three months. These gains were largely offset by increased rates of decline in Japan and the UK, the latter reporting an especially steep downturn.

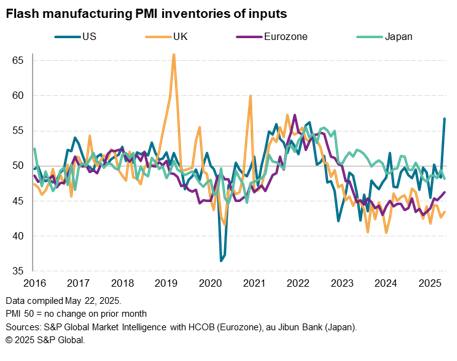

However, it should be noted that some of the US and eurozone manufacturing gains likely overstated the underlying health of manufacturing, as May saw US factories accumulate inventories of inputs to the greatest extent recorded in the 18 year history of the US S&P Global PMI survey, as firms sought to front-run tariffs or safeguard against potential supply shortages.

Confidence lifts in manufacturing

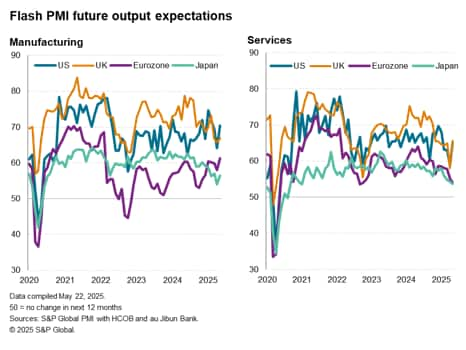

There were also some notable divergences in terms of future output expectations.

Output expectations improved in manufacturing across all G4 economies, often linked to some relief on news of paused tariff increases, though eurozone manufacturers also reported some brightening of prospects relating to hopes of greater government spending in sectors such as defense. Hence the eurozone saw the greatest manufacturing optimism since February 2022. US producers were nevertheless the most confident, with improved sentiment stemming from protection from tariffs alongside anticipated additional government stimulus. While ticking higher, manufacturing sentiment remained especially weak in Japan and the UK, the latter undermined by recent policy changes, notably higher payroll taxes.

Meanwhile, the US and UK saw improved service sector optimism, but confidence levels fell in the eurozone and Japan, In all cases, confirmed remained subdued by recent (post-pandemic) standards.

Measured across the G4, service sector expectations consequently remained more subdued than in manufacturing during May.

US sees steepest price pressures

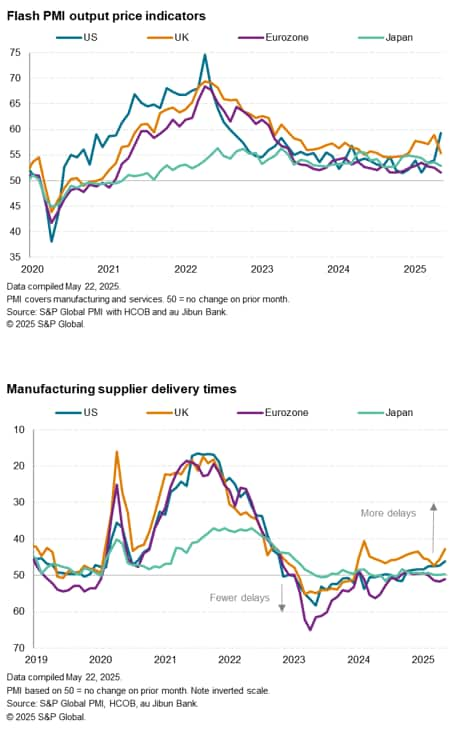

Perhaps the largest variation between the G4 economies was evident in terms of prices. While tariffs were widely blamed on higher import costs in the US, feeding through to the largest rise in average selling prices for goods and services since August 2022, selling price inflation moderated elsewhere in the G4. Selling price inflation hit seven-month lows in the eurozone and Japan and cooled to a five-month low in the UK, albeit the latter remaining somewhat elevated due to the impact of higher payroll taxes.

The rise in US prices was evident for both goods and services, while rates of inflation fell in both cases for the other G4 economies. Prices for goods even fell in the eurozone. These falling prices were often associated with plentiful supply, with eurozone manufacturing reporting faster delivery times in May, notably contrasting with slower deliveries in the UK and the US. US delivery delays were the most widespread since the pandemic delays in October 2022 and UK delivery delays were at their highest since the Red Sea shipping disruptions of February 2024.

Access the US, UK, Eurozone and Japan press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-subdued-developed-world-growth-in-may-amid-tariff-uncertainty-us-prices-spike-May25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-subdued-developed-world-growth-in-may-amid-tariff-uncertainty-us-prices-spike-May25.html&text=Flash+PMI+survey+signals+subdued+developed+world+growth+in+May+amid+tariff+uncertainty%2c+as+US+prices+spike+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-subdued-developed-world-growth-in-may-amid-tariff-uncertainty-us-prices-spike-May25.html","enabled":true},{"name":"email","url":"?subject=Flash PMI survey signals subdued developed world growth in May amid tariff uncertainty, as US prices spike higher | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-subdued-developed-world-growth-in-may-amid-tariff-uncertainty-us-prices-spike-May25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMI+survey+signals+subdued+developed+world+growth+in+May+amid+tariff+uncertainty%2c+as+US+prices+spike+higher+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-subdued-developed-world-growth-in-may-amid-tariff-uncertainty-us-prices-spike-May25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}