Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 30, 2025

Week Ahead Economic Preview: Week of 2 June 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US payrolls and global PMIs, plus a rate cut from the ECB?

The key economic data releases in the coming week include the worldwide PMI surveys for both manufacturing and services, as well as the monthly US employment report. Central bank watchers will meanwhile be expecting the ECB to cut interest rates.

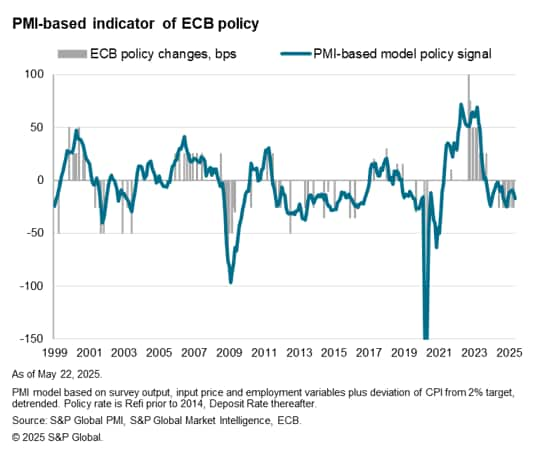

Markets are expecting another rate cut from the European Central Bank when policymakers gather for their June meeting, according to consensus forecasts and market pricing. The last meeting in April saw the ECB make a seventh 25 basis point reduction to take the Deposit Rate to 2.25% from last year's peak of 4.00%, as policymakers responded to a weakening growth and inflation outlook amid tariff-related uncertainty. Since then, the flash PMI survey has shown eurozone business activity slipping into decline in May while price pressures cooled, notably in the services economy, and employment stagnated. A composite indicator based on key PMI gauges consequently slipped further into rate-cutting territory in May (see chart).

We expect the eurozone economy to grow by just 0.8% in 2025, thereby sustaining the same sluggish expansion recorded in 2024. Meanwhile the stronger euro, lower energy prices, and cheaper imports as trade (notably from mainland China) is diverted from the US to Europe, look set to help keep inflation low.

Clues as to the next move in US interest rates will meanwhile be sought from updates to non-farm payrolls, wages and unemployment data on Friday. The last report showed non-farm payrolls up by a consensus-beating 177,000 in April, albeit down from a 185,000 gain in March, while the unemployment rate held steady at 4.2%. There is some concern, however, that the impact of April's tariff announcements has yet to be fully felt and could dampen hiring.

Tariff impact will be also assessed via the global PMI releases. Early indications for the major developed economies showed the US outperforming as the eurozone, Japan and UK all reported slight falls in business activity. However, there were signs of business levels having been temporarily buoyed by the front-running of tariffs. Among the worldwide PMIs, the data out of mainland China will be especially important to monitor given the uncertainty generated by recent tariff updates.

Key diary events

Monday 2 Jun

China (Mainland), Colombia, Malaysia, New Zealand Market

Holiday

Worldwide Manufacturing PMIs, incl. global PMI* (released across

Jun 2-3)

Indonesia Trade (Apr)

Indonesia Inflation (May)

Switzerland Retail Sales (Apr)

Switzerland GDP (Q1)

United Kingdom Mortgage Lending and Approval (Apr)

Mexico Business Confidence (May)

United States ISM Manufacturing PMI (May)

Tuesday 3 Jun

South Korea, Thailand Market Holiday

South Korea Inflation (May)

Australia RBA Meeting Minutes (May)

Switzerland Inflation (May)

Spain Unemployment Change (May)

Türkiye Inflation (May)

Italy Unemployment Rate (Apr)

Eurozone Inflation (May, flash)

South Africa GDP (Q1)

Brazil Industrial Production (Apr)

United States JOLTs Job Openings (Apr)

United States Factory Orders (Apr)

Wednesday 4 Jun

Worldwide Services, Composite PMIs, inc. global PMI* (released

across Jun 4-5)

Australia GDP (Q1)

United States ADP Employment Change (May)

Canada BoC Interest Rate Decision

United States ISM Services PMI (May)

Thursday 5 Jun

Denmark, Egypt, Saudi Arabia, Türkiye, UAE Market

Holiday

Australia Trade (Apr)

Singapore retail Sales (Apr)

Switzerland Unemployment Rate (May)

Germany Factory Orders (Apr)

Eurozone Construction PMI* (May)

Italy Retail Sales (Apr)

Taiwan Inflation (May)

United Kingdom Construction PMI* (May)

Eurozone ECB Interest Rate Decision

Canada Trade (Apr)

United States Trade (Apr)

S&P Global Sector PMI* (May)

Friday 6 Jun

Egypt, Indonesia, Kazakhstan, Kuwait, Saudi Arabia, Singapore,

South Korea, Sweden, Türkiye, UAE Market Holiday

Japan Household Spending (Apr)

Germany Trade and Industrial Production (Apr)

United Kingdom Halifax House Price Index* (May)

France Trade and Industrial Production (Apr)

Eurozone Retail Sales (Apr)

Canada Unemployment Rate (May)

United States Non-Farm Payrolls, Unemployment Rate and Average

Hourly Earnings (May)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Worldwide PMI releases for May

Global manufacturing, services and composite PMI, alongside detailed sector PMI data, will be published in the first week of June. Insights into May conditions will be sought with the releases, particularly regarding global output and inflation developments after early flash PMI data revealed that major developed economies recorded subdued growth, while US prices spiked higher. Changes in business confidence will also be assessed with April data having indicated subdued confidence around the world following the announcement of US tariffs.

Americas: US labour market report, ISM PMI and jobs opening data; BoC meeting, Canada trade and unemployment figures

US economic release highlights in the week include non-farm payrolls on Friday, alongside the ISM PMI updates. Early S&P Global Flash US PMI revealed that employment fell slightly in May amid concerns over future demand prospects, raising the risk of a weak NFP reading in the upcoming release. Despite faster output growth in May, underlying data showed that front-running of possible tariff-related issues mean any growth upturn could prove temporary.

Separately, the Bank of Canada convenes for their June meeting with the market not entirely convinced that the next rate cut will happen at the mid-year event amid inflation challenges. Trade and employment data will also be released through the week.

EMEA: ECB meeting, eurozone inflation and unemployment data; Germany trade and production numbers

The European Central Bank is set to lower its main interest rate by 25 basis points at its upcoming meeting, according to consensus. This is expected to unfold against a backdrop of contracting business activity in May while selling price inflation eased, according to the latest HCOB Flash Eurozone PMI update. Official flash CPI data will also be refreshed in the eurozone on Tuesday for a check on price conditions just prior to the ECB meeting. Key trade and industrial production data will also be due from Germany.

In the UK, mortgage data will be keenly awaited alongside the final PMI updates, including construction.

APAC: RBA minutes, Australia GDP and trade data; South Korea, Taiwan, Indonesia and Philippines inflation

Besides the PMI data shedding light on May economic conditions in the week, key updates in the APAC region include the first quarter GDP reading out of Australia, while inflation numbers will also be published across various APAC economies.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-june-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-june-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+2+June+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-june-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 2 June 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-june-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+2+June+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-2-june-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}