Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 22, 2025

US prices spike higher in May as tariff impact hits, but confidence also rebounds

The early flash PMI data indicate that business confidence has improved in May from the worrying slump seen in April, with gloom about prospects for the year ahead lifting somewhat thanks largely to the pause on higher rate tariffs. Current output growth has also picked up from April's recent low, which had seen the weakest rise for over one-and-a-half years, in response to an upturn in demand.

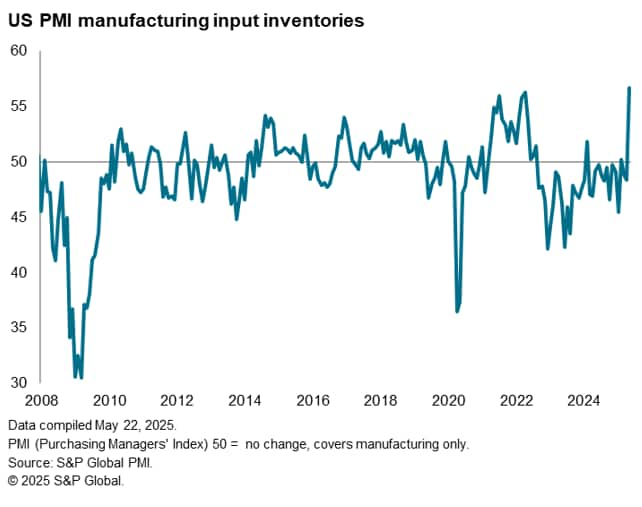

However, both sentiment and output growth remain relatively subdued, and at least some of the upturn in May can be linked to companies and their customers seeking to front-run further possible tariff-related issues, most notably the potential for future tariff hikes after the 90-day pause lapses in July. In particular, concerns over tariff-related supply shortages and price rises led to the largest accumulation of input inventories recorded since survey data were first available 18 years ago.

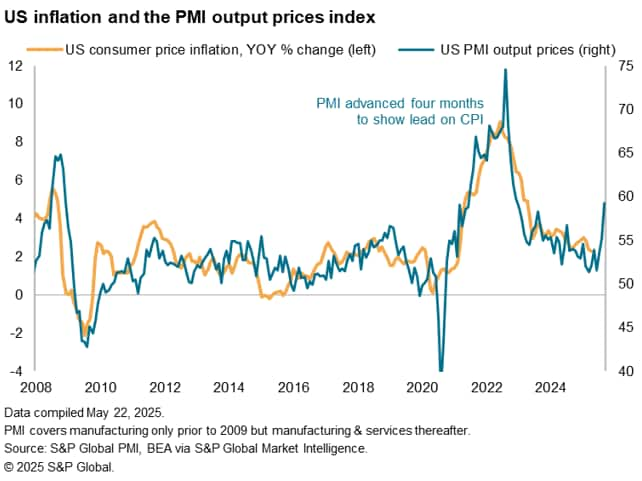

Supply chain delays are now more prevalent than at any time since the pandemic led to widespread shortages in 2022, and prices charged for both goods and services have spiked higher as firms and their suppliers seek to pass on tariff levies to customers. The overall rise in prices charged for goods and services in May was the steepest since August 2022, which is indicative of consumer price inflation moving sharply higher.

US improves from 19-month low

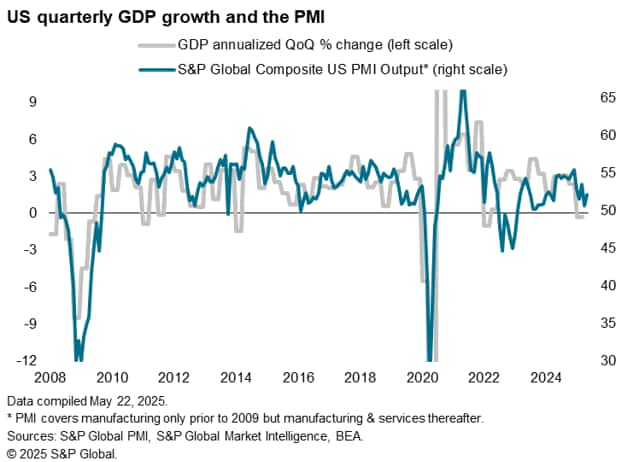

The headline S&P Global US PMI Composite Output Index rose from 50.6 in April to 52.1 in May, according to the 'flash' reading (based on about 85% of usual survey responses). The rise in the index signaled an acceleration of activity growth from April's 19-month low to the fastest since March, although it remained one of the weakest readings seen since early-2024.

The survey data indicate that the US economy is growing at a modest annualized rate of just 1.0% so far in the second quarter.

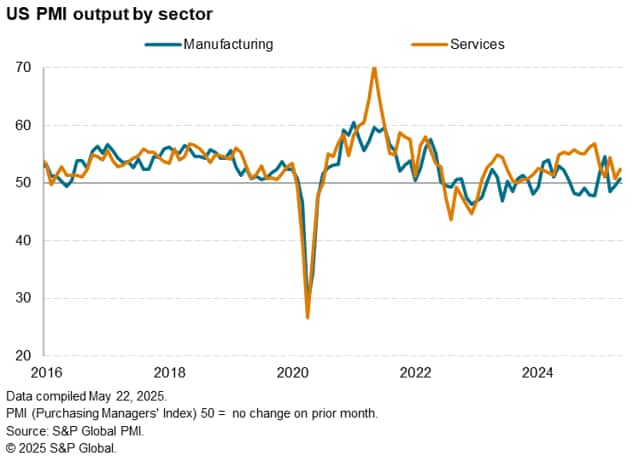

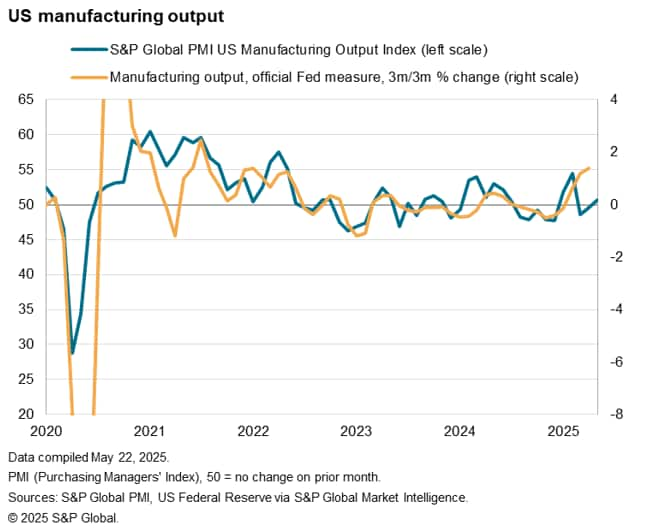

The strongest expansion was recorded in the service sector, where business activity growth rebounded from April's 17-month low but remained below March's pace and the average seen in 2024. Manufacturing output meanwhile returned to growth after falling in both March and April, albeit expanding only slightly.

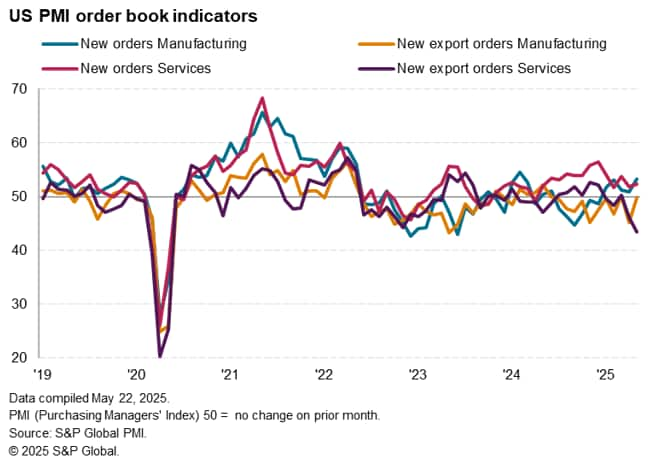

The improved performances were driven by faster rates of growth of new orders. Inflows of new work in the manufacturing sector notably rose at the sharpest pace for 15 months while demand growth for services was merely the strongest since March.

These order book improvements were fueled principally by domestic demand, as exports of both goods and services fell for the second successive month in May. While tariffs had, in some instances, reportedly helped encourage new sales to domestic customers and prompted increased activity to front-run tariff-related price hikes, trade policy was widely linked to falling foreign sales of both goods and services.

Although manufacturing reported an easing in the steep export decline reported in April, exports of services (which includes spending by foreigners in the US) fell at the sharpest rate since the pandemic lockdowns of early 2020. In fact, excluding the pandemic, the fall in exports of services was the largest recorded since comparable data were first available in late 2014.

Future sentiment revives

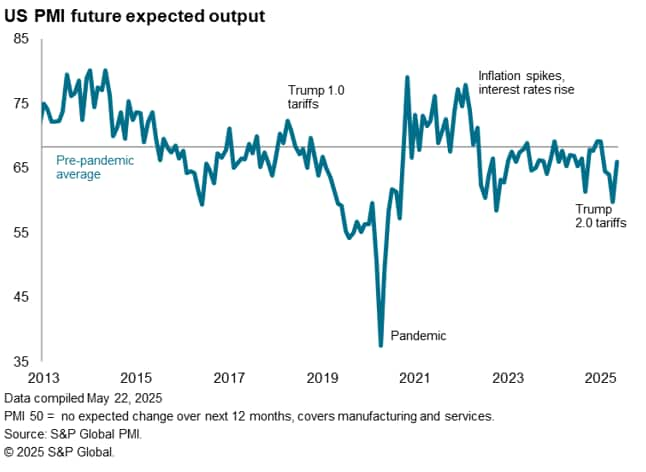

Having slumped sharply to a two-and-a-half year low in April, sentiment among companies about their output over the coming year rebounded in May to its highest since January.

Sentiment was buoyed in part by reduced trade worries following the pause on additional tariffs and accompanying improved economic growth prospects. Confidence about the outlook rose to a four-month high in services and the best in three months in manufacturing. Goods producers also continued to display relatively greater optimism largely based on hopes of greater reshoring of production and demand switching to domestically produced goods in response to tariffs.

Despite the rebound, overall optimism was still slightly below the average seen in 2024, attributable to reports of supply worries, rising prices, ongoing uncertainty and concerns over detrimental impacts from government policies including tariffs and spending cuts.

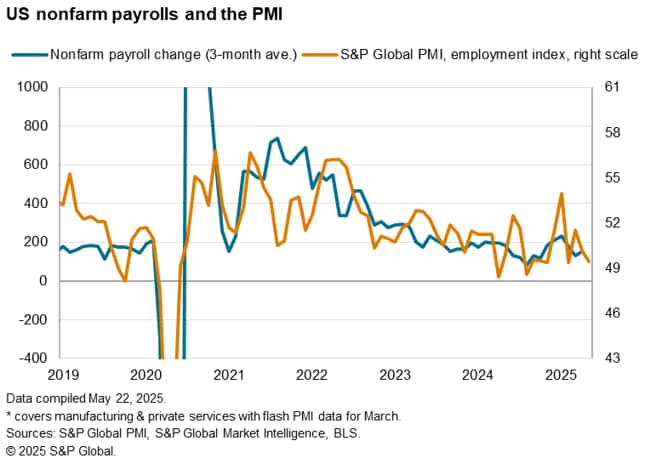

Employment

Employment fell slightly in May, having risen in March and April, primarily reflecting concerns over future demand prospects but also in response to worries over rising costs and labor shortages.

Service sector payrolls were trimmed for the second time in four months, while manufacturing jobs were cut for a second successive month.

Inventories and supply chains

Manufacturers stocked up on inputs, generally citing concerns over potential tariff-related price increases and supply shortages, the latter reflected in suppliers' delivery times lengthening in May to the greatest extent since October 2022.

The increase in buying activity was the highest since July 2022 and the resulting rise in inventories of purchases was the largest recorded in the 18-year survey history.

Prices rise at fastest rate since August 2022

Average prices charged for goods and services jumped higher in May, rising at a rate not witnessed since August 2022, when pandemic-related shortages caused widespread price inflation.

An especially steep rise was seen for manufacturers' selling prices, which posted the largest monthly increase since September 2022. Charges levied for services rose to the greatest extent since April 2023.

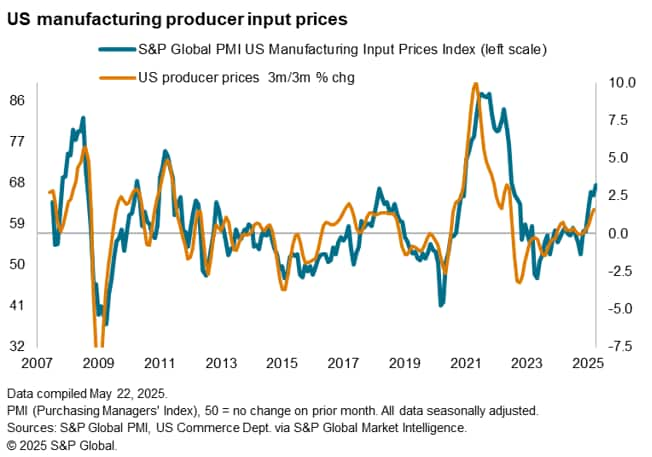

The latest rise in output prices was overwhelmingly linked to tariffs, having directly driven up the cost of imported inputs or caused suppliers to pass through tariff-related cost increases. Manufacturing input costs rose at the sharpest rate since August 2022 while service sector costs rose at the fastest rate since June 2023.

With policymakers recently stating that "the risks of higher unemployment and higher inflation have risen" in the new tariff policy environment, the rise in prices in the May PMI survey will add fuel to concerns that consumer price inflation will indeed lift higher in the coming months, potentially limiting the scope for the Federal Reserve to reduce interest rates.

Outlook

Our forecast team expects the Federal Reserve to keep interest rates unchanged at 4.25% to 4.50% throughout the rest of 2025 up to December, when a further cut is anticipated. This follows 100 basis points of rate cuts in late 2024, since when the FOMC has decided on a "wait and see" approach to policy in the light of changing economic conditions generated by US policy announcements from the new Trump administration, notably including tariffs.

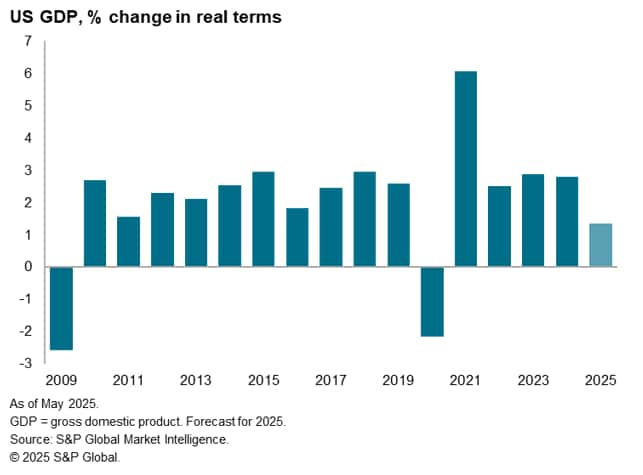

With rate cuts on hold, we forecast the US economy to grow by just 1.3% in 2025, down from 2.8% in 2024, which - barring the pandemic-affected year of 2020 - would be the worst performance since the global financial crisis in 2009.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-prices-spike-higher-in-may-as-tariff-impact-hits-but-confidence-also-rebounds-May25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-prices-spike-higher-in-may-as-tariff-impact-hits-but-confidence-also-rebounds-May25.html&text=US+prices+spike+higher+in+May+as+tariff+impact+hits%2c+but+confidence+also+rebounds+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-prices-spike-higher-in-may-as-tariff-impact-hits-but-confidence-also-rebounds-May25.html","enabled":true},{"name":"email","url":"?subject=US prices spike higher in May as tariff impact hits, but confidence also rebounds | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-prices-spike-higher-in-may-as-tariff-impact-hits-but-confidence-also-rebounds-May25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+prices+spike+higher+in+May+as+tariff+impact+hits%2c+but+confidence+also+rebounds+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fus-prices-spike-higher-in-may-as-tariff-impact-hits-but-confidence-also-rebounds-May25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}