Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 22, 2025

Week Ahead Economic Preview: Week of 25 August 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US interest rate outlook under scrutiny amid inflation update

The Fed's preferred measure of inflation is updated to hopefully add some clarity to the forward path for US interest rates alongside consumer spending, household confidence and durable goods orders. GDP updates are also provided for the US and Canada, as well as India, France and Italy. PMI data for mainland China will meanwhile be a key focus for APAC alongside tier one economic data for Japan and central bank policy meetings in South Korea and the Philippines.

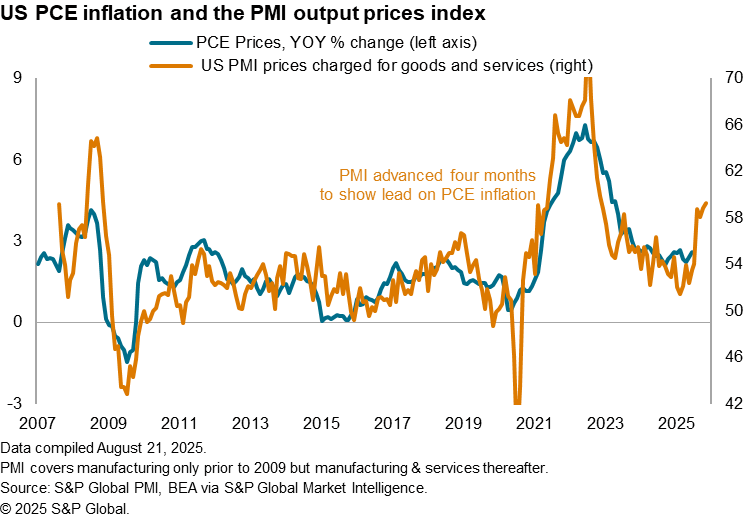

At the time of writing, the market is pricing in a 70% chance of the FOMC reducing interest rates at its next policy meeting in September. To the increasing frustration of President Donald Trump, the Fed has held rates steady at 4.25-4.50% over the year-to-date so far, but the perception in the market is that the balance of power is shifting to the dovish side among FOMC members. It is likely, however, that the price gauges from the personal consumer expenditure (PCE) release, due on Friday, will need to bring some reassuring news on inflation to persuade the majority of policymakers that such an imminent rate cut is warranted.

To recap, June's PCE data showed a 0.3% rise after a 0.2% gain in May. That took the annual rate of increase from 2.4% to 2.6%, so increasingly above the FOMC's 2% target. Core PCE inflation held at 2.8%. Since then, consumer price inflation (CPI) data brought some relief by holding steady at 2.7% in July, but core CPI inflation accelerated to 3.1% and producer price inflation hit 3.3%, the highest since January.

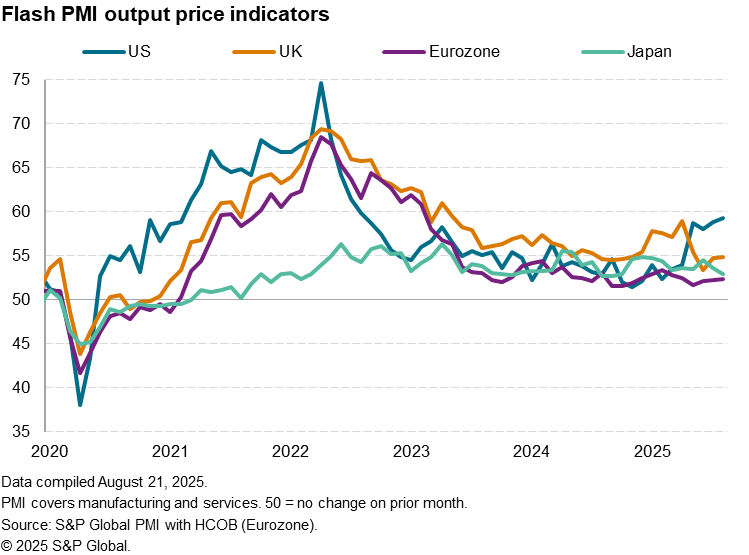

Survey data have been even less encouraging for the doves. The latest data from S&P Global's flash PMI surveys showed that average prices charged for goods and services rose in the US at the steepest rate for three years in August, building on especially strong rises in the prior three months. The price rises were overwhelmingly blamed on companies passing higher costs linked to tariffs through to customers.

Key to the consumer inflation outlook and Friday's PCE data is therefore whether retailers and other consumer-facing firms will soak up some of these price increases through squeezed margins, or whether we will start to see some greater pass-through of tariff costs on to households. A further question is whether this tariff impact will merely cause a one-off lift in the price level, or lead to more entrenched, stickier inflation. It is likely that the answers to these questions will not be known before the September FOMC meeting, encouraging some scepticism that rates will be cut.

The US also once again reported by far the sharpest rise in prices of the major developed economies, blamed on tariffs, according to August's flash PMI data.

Key diary events

Monday 25 Aug

UK, Philippines Market Holiday

Germany Ifo Business Climate (Aug)

United States Chicago Fed National Activity Index (Jul)

United States Dallas Fed Manufacturing Index (Aug)

Tuesday 26 Aug

Australia RBA meeting Minutes (Aug)

Singapore Industrial Production (Jul)

Taiwan Industrial Production (Jul)

Hong Kong SAR Trade (Jul)

United States Durable Goods Orders (Jul)

United States S&P/Case-Shiller Home Price (Jun)

United States CB Consumer Confidence (Aug)

Wednesday 27 Aug

India Market Holiday

South Korea Business Confidence (Aug)

Australia Monthly CPI Indicator (Jul)

China (Mainland) Industrial Profits (Jul)

Germany GfK Consumer Confidence (Sep)

Mexico Balance of Trade (Jul)

Thursday 28 Aug

South Korea BoK Interest Rate Decision

Philippines BSP Interest Rate Decision

Switzerland GDP (Q2, final)

Eurozone Economic Sentiment (Aug)

India Industrial Production (Jul)

Canada Current Account (Q2)

United States GDP (Q2, 2nd est.)

United States Pending Home Sales (Jul)

Friday 29 Aug

Japan Industrial Production, Retail Sales, Unemployment Rate

(Jul)

Japan Consumer Confidence (Aug)

Germany Retail Sales (Jul)

Sweden GDP (Q2, final)

United Kingdom Nationwide Housing Prices (Aug)

France Inflation (Aug, prelim)

France GDP (Q2, final)

Spain Inflation (Aug, prelim)

Germany Unemployment Rate (Aug)

Italy GDP (Q2, final)

Italy Inflation (Aug, prelim)

Germany Inflation (Aug, prelim)

India GDP (Q2)

Canada GDP (Q2)

United States Core PCE (Jul)

United States Personal Income and Spending (Jul)

United States Goods Trade Balance (Jul, adv.)

United States Wholesale Inventories (Jul)

United States UoM Sentiment (Aug, final)

Sunday 31 Aug

China (Mainland) NBS PMI (Aug)

What to watch in the coming week

Americas: US GDP, core PCE, durable goods orders, new home sales, consumer confidence, personal income and spending data; Canada GDP

The US updates second quarter GDP data following an initial print of 3.0%. Additionally, we will also get the core PCE price index data for July. CPI data showed a lower-than-expected headline reading with a steady 2.7% increase, but core CPI rose to the fastest rise since January at 3.1%, and producer price inflation was higher than expected at 3.3%. Indications from the Fed's preferred inflation gauge will be crucial for expectations relating to the interest rate path ahead of the September meeting, for which markets are pricing in a strong likelihood of a rate cut. Other key US economic data releases include durable goods orders, new home sales and personal income and spending.

Separately, Canada also releases GDP data for the second quarter. According to PMI data, the worst of the US tariff shock appears to be over in the near term for the Canadian economy, but growth clearly remains subdued.

EMEA: Germany, Italy, France and Spain inflation; Eurozone economic sentiment; Germany Ifo business climate and GfK consumer confidence; Switzerland GDP

Preliminary August inflation data from Germany, Italy, France and Spain will be released at the end of the week. This comes after the latest HCOB Flash Eurozone PMI continued to suggest muted inflation in the months ahead.

Additionally, economic sentiment data from Germany and the eurozone will also be released during the week with early flash PMI data showing a slight cooling of business optimism among German companies, but with further signs of manufacturing starting to recover from its post-pandemic decline.

APAC: BoK, BSP meetings, RBA meeting minutes; China NBS PMI data; India GDP; Australia CPI, Japan consumer confidence, industrial production and unemployment data

A busy economic data calendar is expected in the new week for APAC, in addition to central bank meetings in South Korea and the Philippines. PMI data from mainland China's National Bureau of Statistics (NBS) will be due over the weekend. Meanwhile, GDP for the April to June period will be released for India.

Other key releases in the week include monthly CPI data from Australia and Japan's consumer confidence and industrial production numbers. The latest S&P Global Flash Japan PMI revealed that manufacturing output returned to growth in August, albeit only marginally, after contracting in July.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-august-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-august-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+25+August+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-august-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 25 August 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-august-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+25+August+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-august-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}