Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 22, 2025

Flash PMIs show broad-based developed world upturn in August

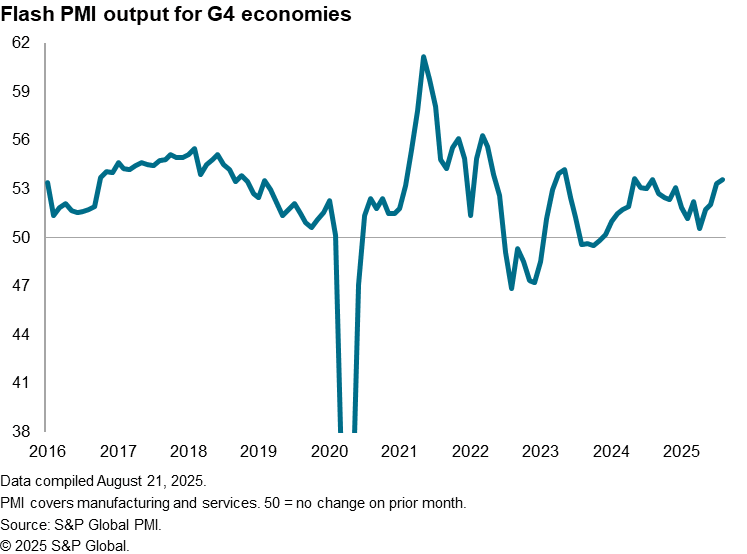

The flash PMI data compiled by S&P GlobalMarket Intelligence indicated that major develop economies showed resilience in the face of recent geopolitical uncertainty, with business activity across the four largest developed economies growing collectively at a rate not surpassed since May 2023.

Growth was led by an improved expansion in the US, but the eurozone, Japan and UK also reported faster growth. However, at least some of the upturn may prove temporary, as tariff-related stock building in the US is likely to fade in the coming months.

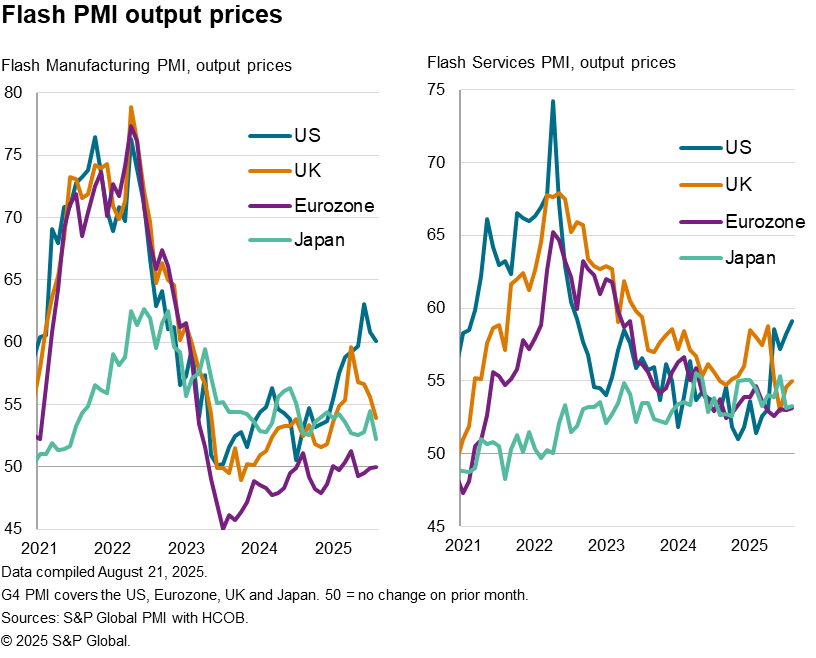

Meanwhile, although the US led the upturn, it also continued to report far higher price pressures than the other major economies.

Output growth accelerates across developed world

Businesses in the developed world are reporting faster growth, boding well for the global economic expansion at a time of heighted geopolitical uncertainty and disruptions caused by changing US tariff policy.

At 53.6, up from 53.3 in July, the flash PMI output index for the 'G4' major developed economies (the US, eurozone, Japan and the UK) signalled that the pace of expansion has accelerated continually since hitting a 16-month low back in April, when uncertainty caused by US tariff policy announcements caused output growth to come close to stalling. Since then, output growth has improved steadily such that August's rise was the strongest for a year, and the joint-highest recorded since May 2023.

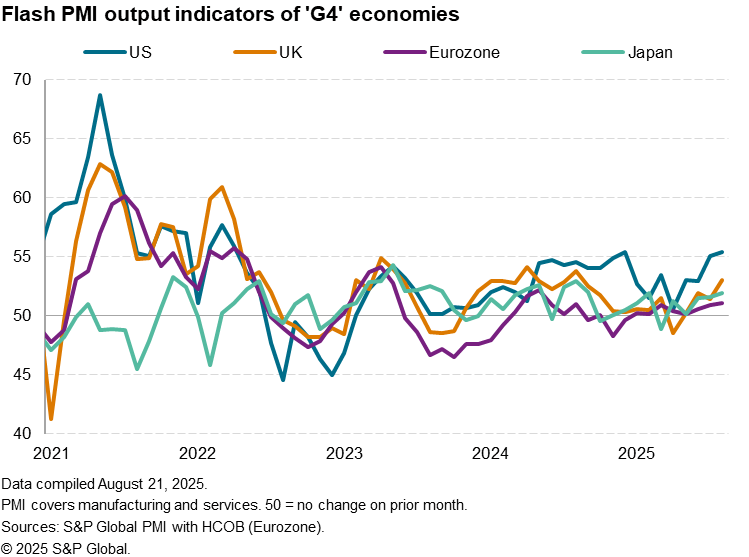

Broad based 'G4' upturn led by US

The improving upturn was broad-based across the G4 economies, though was once again led by the US. The US flash PMI composite output index rose from 55.1 in July to 55.4 in August, which was the highest reading seen so far this year. Strong growth was recorded across both manufacturing and services. Although the latter lost a little momentum, both sectors saw growth rates outpace the other G4 economies by considerable margins.

The next best performance was seen in the UK, where growth accelerated to the fastest for a year, the composite output index up from 51.5 in July to 53.0 in August. The UK upturn was led by the service sector but saw further signs of the manufacturing sector coming close to stabilizing.

Although growth in Japan's services economy slowed, it remained robust and was accompanied by the first rise in manufacturing output for a year, pushing the composite output index up from 51.6 to 51.9, its highest since February and second-highest for nearly a year.

While the worst performance of the G4 economies was seen in the eurozone, thanks to a lacklustre services economy, the region's composite PMI output index rose from 50.9 to 51.1, its highest for 15 months. Moreover, the headline PMI for the eurozone's manufacturing sector broke above the 50.0 no change level in August for the first time since June 2022, signalling an ending of the region's steep post-pandemic factory downturn.

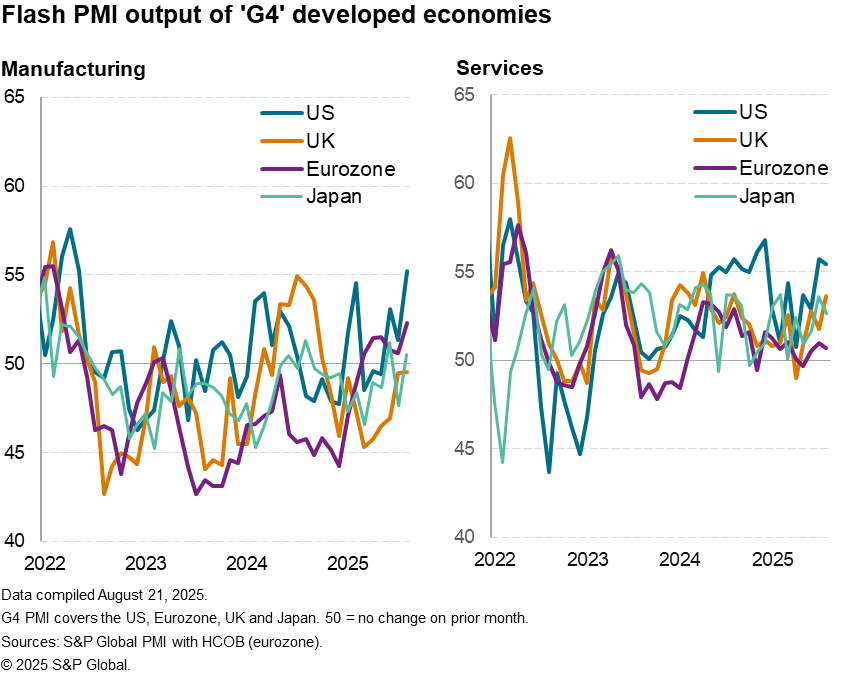

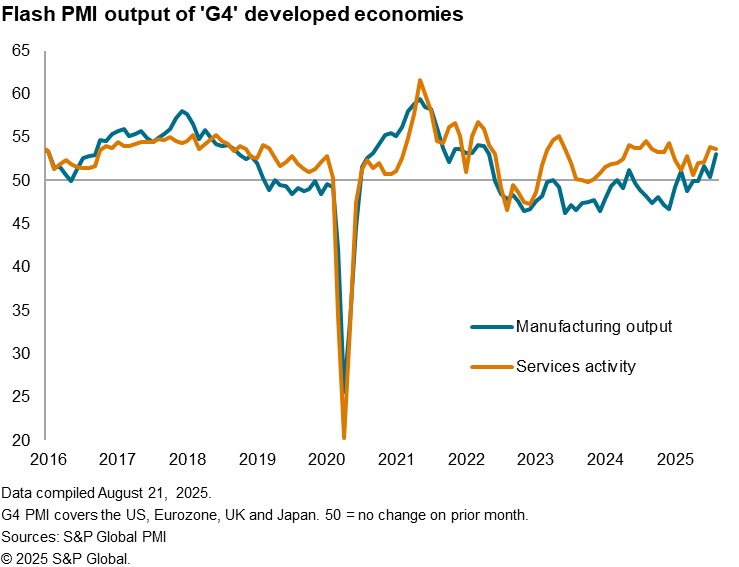

Manufacturing growth fastest since early 2022

Looking across the G4, the upturn was led by the collective services sector, but growth slowed here whereas the manufacturing expansion gained momentum. In fact, manufacturing output grew across the G4 at the fastest rate since April 2022.

Inventory boost

However, some of this manufacturing improvement looks to be linked to tariff-related inventory building in the US. US factories again reported concerns over supply shortages and future prices rises linked to the new tariffs. This caused US inventory building to spike higher, both in terms of raw material inputs (often bought from factories in Europe and Asia) as well as finished goods (helping partly explain the jump in US factory output).

US inventories of finished goods showed the sharpest rise recorded since the survey data were first available in 2007, while inventories of purchased inputs rose to a degree beaten over the past three years only by May's tariff-related surge.

A concern, and downside risk to the outlook, is that we can expect lower production trends once this inventory building winds down.

US suffers further steep price rises

While the US led the economic upturn across the G4 in August for a fourth straight month, it also again reported the highest price pressures. Average prices charged for goods and services in the US rose in August at the steepest rate for three years, rising sharply across both manufacturing and services as firms widely cited the need to pass higher tariff-related costs onto customers.

In contrast, only modest price growth was again recorded in the UK, Japan and the eurozone.

Key to the US inflation outlook is whether retailers and other consumer-facing firms will soak up some of these price increases through squeezed margins, or whether we will start to see some greater pass-through of these tariff costs on to households. A further question is whether this tariff impact will merely cause a one-off lift in the price level, or lead to more entrenched stickier inflation. Future PMI data will provide valuable insights into these trends.

Access the US, UK, Eurozone and Japan press releases.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-broadbased-developed-world-upturn-in-august-Aug25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-broadbased-developed-world-upturn-in-august-Aug25.html&text=Flash+PMIs+show+broad-based+developed+world+upturn+in+August+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-broadbased-developed-world-upturn-in-august-Aug25.html","enabled":true},{"name":"email","url":"?subject=Flash PMIs show broad-based developed world upturn in August | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-broadbased-developed-world-upturn-in-august-Aug25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+PMIs+show+broad-based+developed+world+upturn+in+August+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmis-show-broadbased-developed-world-upturn-in-august-Aug25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}