Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 21, 2025

Flash US PMI signals faster growth and hiring, but also shows tariff-driven inflation

US business activity grew at the fastest rate recorded so far this year in August, according to early 'flash' PMI data, adding to signs of a strong third quarter. Hiring also picked up, with job creation reaching one of the highest rates seen over the past three years as companies reported the largest build-up in uncompleted work since May 2022.

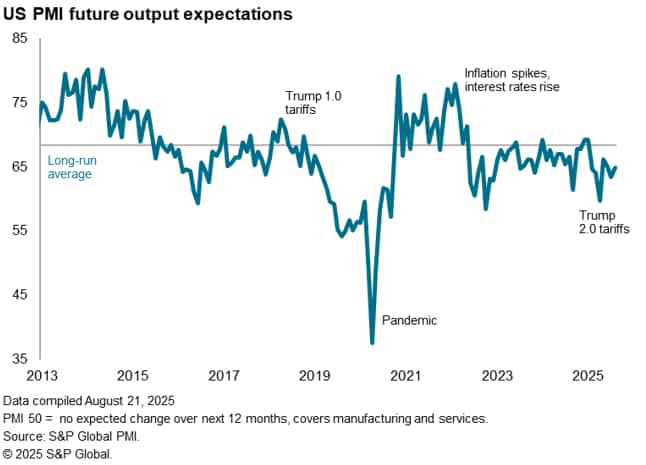

Business confidence in the outlook meanwhile improved but remained much weaker than seen at the start of the year as companies reported ongoing concerns over the impact of government policies, especially in relation to tariffs.

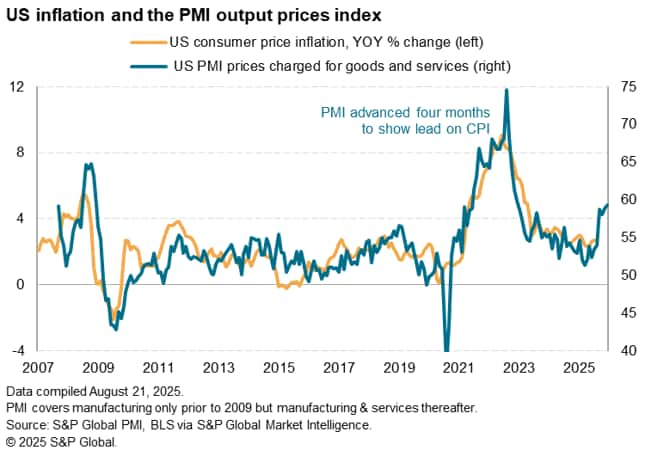

Tariffs were again widely cited as the principal cause of sharply higher costs, which in turn fed through to the steepest rise in average selling prices recorded over the past three years. Prices rose at increased rates for both goods and services, hinting at higher consumer price inflation in the coming months.

Faster growth and stronger job gains in August

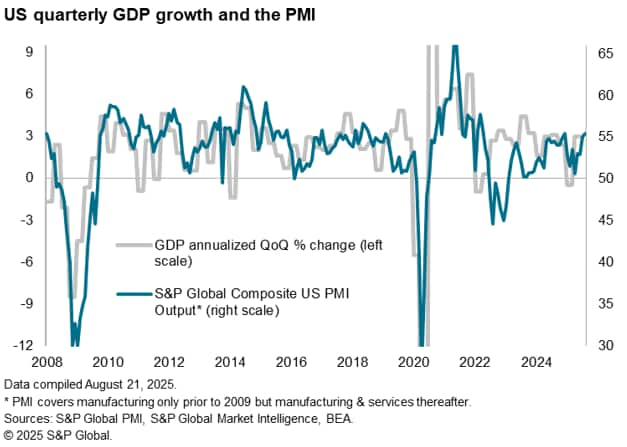

A strong flash PMI reading for August adds to signs that the US businesses have enjoyed a strong third quarter so far. The headline S&P Global US PMI Composite Output Index rose to an eight-month high in August, edging up from 55.1 in July to 55.4, according to the 'flash' reading (based on about 85% of usual survey responses). Output has now grown continually for 31 months, with the latest two months seeing the strongest back-to-back expansions since the spring of 2022.

The data are consistent with the economy expanding at a 2.5% annualized rate, up from the average 1.3% expansion seen over the first two quarters of the year.

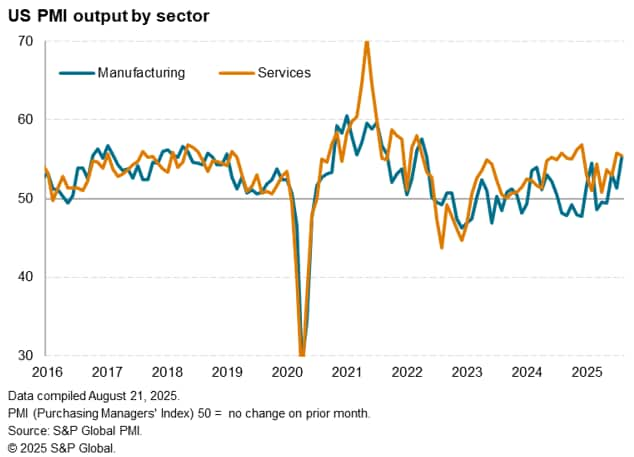

A sustained robust expansion was reported in the services economy, albeit with business activity growth dipping slightly from July's year-to-date high. New orders growth in the sector nevertheless gathered pace to register the steepest improvement in demand for services since last December, assisted by a modest return to growth of service sector exports.

The ongoing service sector expansion was accompanied by a marked acceleration of output growth in the manufacturing sector to the fastest since May 2022. New order inflows in the goods-producing sector also picked up, hitting the highest since February 2024 principally on the back of rising domestic demand, but also helped by the largest rise in goods exports for 15 months.

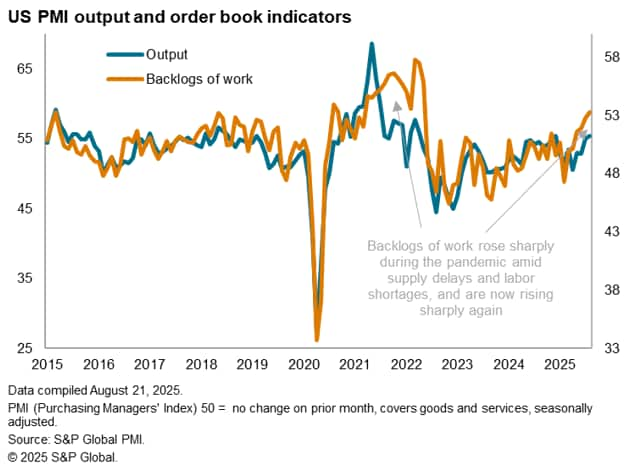

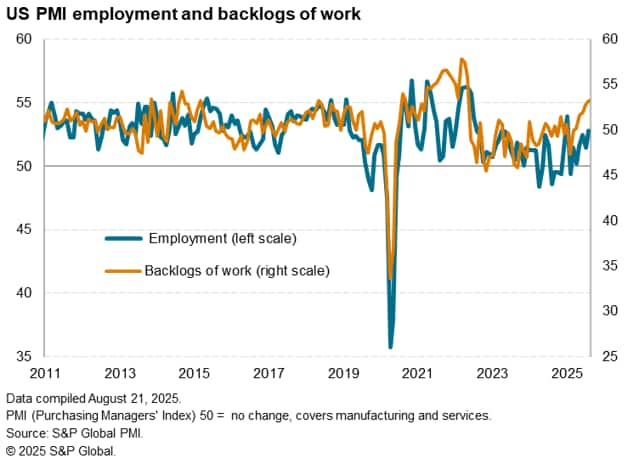

While companies across both manufacturing and services are reporting stronger demand conditions, there are signs that many are struggling to meet sales growth. This has caused backlogs of work to rise at a pace not seen since the pandemic-related capacity constraints recorded in early 2022.

Employment rose for a sixth successive month as firms sought to meet demand and reduce backlogs of work. The rate of job creation hit the highest since January (and one of the highest rates seen for over three years). Service providers took on staff at the fastest pace since the start of the year while factory job gains reached the highest since March 2022.

Subdued expectations

Looking ahead, having dipped in July, companies' expectations about output in the year ahead meanwhile rose to a two-month high in August, though remained below that seen at the start of the year and below the survey's long-run average.

Service sector sentiment revived partly from a drop in July but continued to run weaker than seen in May and June, and far below levels seen at the turn of the year, largely linked to ongoing concerns regarding government policy.

While support from policies such as tariffs helped lift manufacturing optimism in August to a level well-above the post-pandemic average, the degree of optimism in the goods-producing sector remained below January's recent high, reflecting concerns over higher costs and the impact of geopolitical uncertainty, especially in relation to international trade and supply chains.

Tariffs drive stock building and price inflation

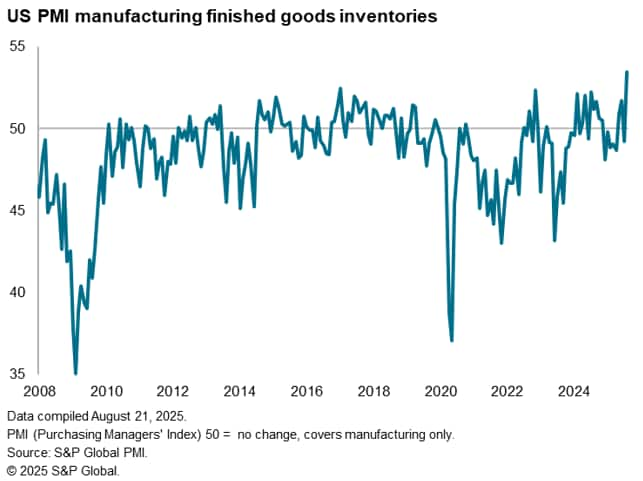

Stock building has also risen to a survey record level, linked in part to worries over future supply conditions.

While this upturn in demand has fueled resurgent hiring, it has also bolstered firms' pricing power. Companies have consequently passed tariff-related cost increases through to customers in increasing numbers, indicating that inflation pressures are now at their highest for three years.

The resulting rise in selling prices for goods and services suggests that consumer price inflation will rise further above the Fed's 2% target in the coming months.

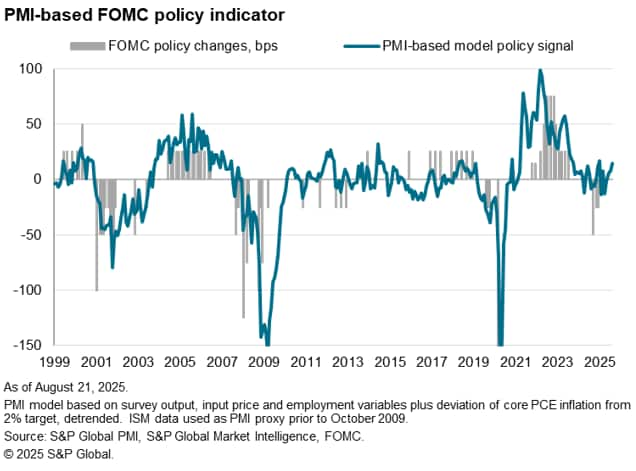

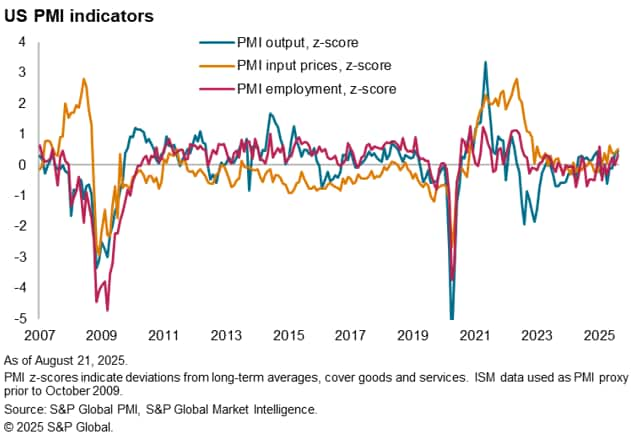

Combined with the upturn in business activity and hiring, the rise in prices signaled by the survey puts the PMI data more into rate hiking - rather than cutting - territory according to the historical relationship between these economic indicators and FOMC policy changes.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-faster-growth-and-hiring-but-also-shows-tariffdriven-inflation-Aug25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-faster-growth-and-hiring-but-also-shows-tariffdriven-inflation-Aug25.html&text=Flash+US+PMI+signals+faster+growth+and+hiring%2c+but+also+shows+tariff-driven+inflation+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-faster-growth-and-hiring-but-also-shows-tariffdriven-inflation-Aug25.html","enabled":true},{"name":"email","url":"?subject=Flash US PMI signals faster growth and hiring, but also shows tariff-driven inflation | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-faster-growth-and-hiring-but-also-shows-tariffdriven-inflation-Aug25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Flash+US+PMI+signals+faster+growth+and+hiring%2c+but+also+shows+tariff-driven+inflation+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-us-pmi-signals-faster-growth-and-hiring-but-also-shows-tariffdriven-inflation-Aug25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}