Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 15, 2025

Week Ahead Economic Preview: Week of 19 May 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMI data to provide guidance on tariff impact

Official data from mainland China, including retail sales and industrial production, will provide important guidance on the impact of US tariffs on Monday. But the flash PMI data to be released on Thursday will supply markets with more detailed insights into economic resilience in the face of changing global trade conditions among the major economies midway through the second quarter of 2025. Central bank action meanwhile comes from policy meetings in Australia and Indonesia.

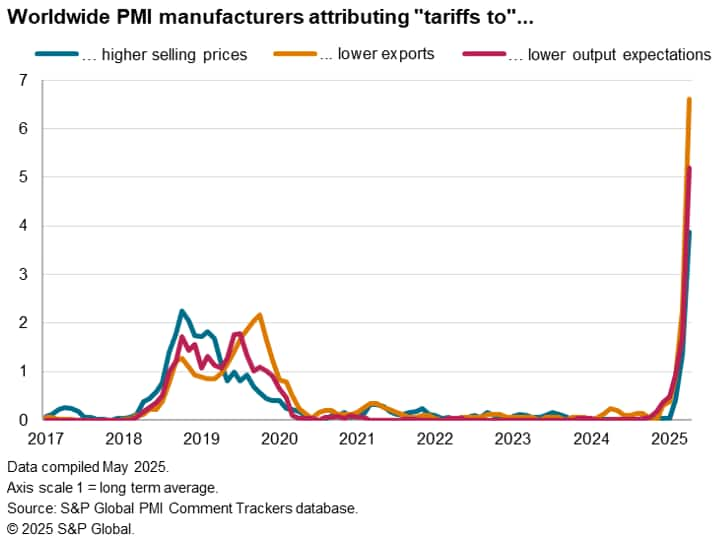

PMI surveys have already highlighted how global growth slowed to the lowest for nearly one-and-a-half years in April, with global exports falling at the sharpest rate for over two years while business optimism slumped to its lowest since the early months of the pandemic. Moreover, the reported detrimental impact of tariffs on exports, sentiment and prices was already greater than recorded during President Trump's first term (see chart). For more insights into how tariffs have affected business, see our recent analysis of PMI tariff impact trackers.

Note that the flash PMI data for May have been collected after the US and mainland China agreed to pause additional levies for 90 days, which has helped buoy financial market sentiment. It remains to be seen how businesses have reacted. The international trading environment clearly remains highly uncertain amid worries over the impact of the surviving tariffs levied by the US and mainland China, which are widely expected to dampen global growth and raise inflation. The US PMIs notably showed weak growth and surging goods prices in April. The prospect of the pauses on extra tariffs announced 2nd April ending mid-July may have also distorted business behaviour, potentially through exporters front-running these prospective higher levies.

Meanwhile, in Europe the impact of April's payroll tax rise in the UK and political change in Germany will be under further scrutiny through the flash PMIs. April's flash UK PMI showed business activity and employment falling, raising downturn risks, while the eurozone struggled to expand despite news of a brightening picture from Germany's manufacturers, who reported the largest rise in production for three years.

Any impact of tariffs on Japan will also be eagerly awaited after flash PMI showed business confidence sliding to a five-year low.

Key diary events

Monday 19 May

Canada, Türkiye Market Holiday

China (Mainland) Industrial Production, Retail Sales, Fixed Asset Investment, Unemployment (Apr)

Thailand GDP (Q1)

Spain Balance of Trade (Mar)

Eurozone Inflation (Apr, final)

United Kingdom Consumer Sentiment Index* (Apr)

Tuesday 20 May

China (Mainland) Loan Prime Rate (May)

Malaysia Trade (Apr)

Australia RBA Interest Rate Decision

Germany PPI (Apr)

Taiwan Export Orders (Apr)

Canada Inflation (Apr)

Eurozone Consumer Confidence (May, flash)

Wednesday 21 May

Japan Trade (Apr)

Australia Westpac Consumer Confidence (May)

United Kingdom Inflation (Apr)

Indonesia BI Interest Rate Decision (May)

South Africa Inflation (Apr)

Canada New Housing Price Index (Apr)

Thursday 22 May

Australia S&P Global Flash PMI, Manufacturing & Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

Japan Machinery Orders (Mar)

Malaysia Inflation (Apr)

Germany Ifo Business Climate (May)

Hong Kong SAR Inflation (Apr)

Mexico GDP (Q1, final)

United States Chicago Fed National Activity Index (Apr)

United States Existing Home Sales (Apr)

Friday 23 May

Japan Inflation (Apr)

Singapore Inflation (Apr)

Germany GDP (Q1, final)

United Kingdom Retail Sales (Apr)

Taiwan Industrial Production (Apr)

Mexico Balance of Trade (Apr)

Canada Retail Sales (Mar, final)

United States New Home Sales (Apr)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

May flash PMI release

Flash PMI data for May will be published across major developed economies for insights into business conditions following the series of changes to trade policies so far this year. While April PMI data revealed detrimental impacts on the manufacturing sector from US tariffs, production performance had been buoyed in some cases by front-loading of goods orders due to additional tariffs being paused. The ongoing impact will be scrutinised with the upcoming flash releases, data collection for which occurred after the temporary reduction to US-China tariffs.

Americas: Canada inflation and retail sales data; US existing home sales; Mexico GDP

Canada publishes inflation and retail sales numbers in the week. April's S&P Global Canada PMI data indicated that average selling prices declined for the first time since February 2021, pointing to softening inflationary pressures amid falling demand. This was despite another steep increase in costs, as competitive pressures triggered the lowering of charges among services firms in April. A more challenging business environment also led to falling services new business and activity in Canada during April, hinting at subdued retail sales performance.

Besides flash PMI data, the US also releases new and existing home sales figures, while Q1 GDP is due for Mexico.

EMEA: Eurozone inflation; UK inflation and retail sales

In addition to the focus on May flash PMI out of Europe, the UK and eurozone update inflation numbers. Notably, the eurozone figures will be the final April numbers, with more up-to-date May price trends to be observed in the release of flash PMI. Over in the UK, April inflation numbers will be watched for an official confirmation of the inflation trend after S&P Global UK PMI signalled that selling price inflation rose to the highest in nearly two years, with an especially marked increase in manufacturing as good producers reported rising raw material prices and increases to staff costs associated with tax and wage changes implemented at the start of April. UK retail sales are also expected to show subdued performance amid subdued consumer confidence.

APAC: RBA, BI meetings; China activity data; Japan inflation, trade and machinery orders; Thailand GDP

Central bank meetings in Australia and Indonesia unfold in the new week with the market expecting the Reserve Bank of Australia (RBA) to lower rates amid concerns over the impact of US tariffs. Meanwhile, industrial production and retail sales data out of mainland China will be key for assessing April economic conditions. Japan also updates inflation numbers for April shortly after the May flash PMI release.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-may-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-may-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+19+May+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-may-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 19 May 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-may-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+19+May+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-16-may-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}