Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 15, 2025

UK first quarter GDP growth spurt set to fade

Official data showed the UK economy enjoying a growth surge in the first quarter, but recent years have seen similar strong periods of growth early in the year to have faded as the year proceeds. There's a hint of the data not fully accounting for seasonal trends, meaning growth is possibly being exaggerated in the first half of the year and understated in the second half. Survey data can provide some helpful insights into the likely true underlying growth rate.

UK enjoys strong first quarter GDP rise… again

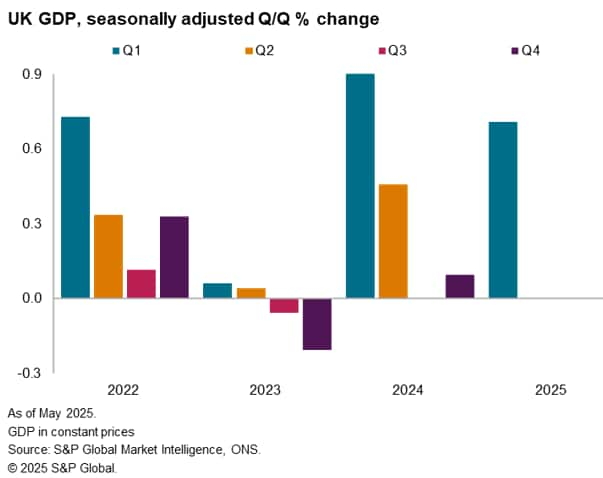

Official data showed UK gross domestic product (GDP) growing 0.7% in the three months to March compared to the prior three-month period, suggesting that economic growth has accelerated sharply in the first quarter compared to the lacklustre 0.1% growth seen in the fourth quarter of 2024. The January to March quarterly expansion was the strongest since the first quarter of last year.

However, we note something of pattern emerging in the GDP data since the very disrupted 2020 and 2021 pandemic years, in which the first quarter of the year has consistently been the strongest of the year. This suggests that there may be some residual seasonality in the GDP data.

Statistical techniques are applied to try to remove any usual seasonal impacts on the economy throughout the year to provide a better guide to underlying growth trends. For example, the data are adjusted to make an allowance for the increased energy for heating needed in the winter, or any typical upturn in summer garden centre business or ice cream sales. These techniques are by no means perfect, and are especially susceptible to encountering difficulties when the data series have been distorted by major events. The pandemic, of course, was such a major event. In the case of leisure activities, including garden centres, hotels, bars, restaurants and sporting events, the distortions to normal seasonal trends were especially marked, as enforced lockdowns shifted spending patterns away from the usual seasonal norms.

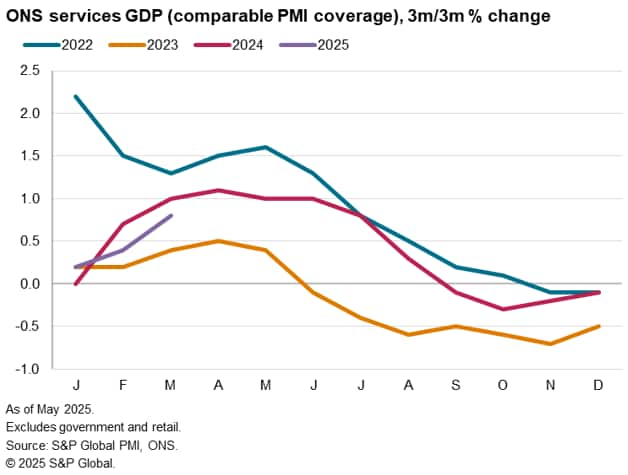

We note that recent (post-pandemic) years have in fact seen especially marked seasonal patterns in the private sector service industries even after seasonal adjustment. This segment of the economy accounts for around 60% of GDP, so it is an important driver of the overall trend. These private sector service industries have seen strong growth in the spring, only for this growth to fade later in the year. Note that this is evident not just for the GDP numbers but also for the business surveys to some extent. It seems that the usual seasonal adjustment techniques are struggling to fully remove variations in spending and activity patterns through the year.

Weakness ahead

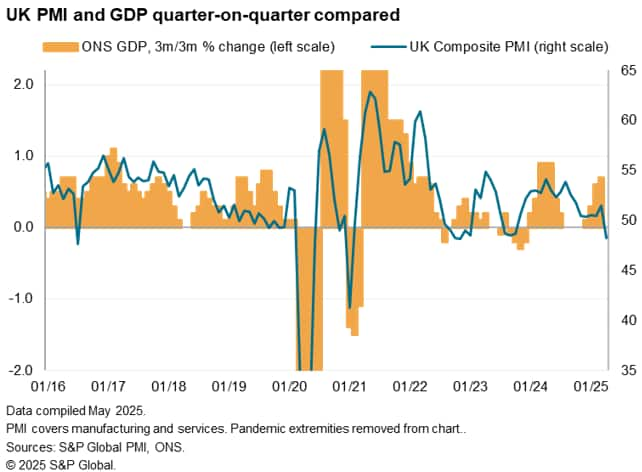

If we compare the GDP data with other sources of information on the health of the economy, such as the PMI surveys, the relatively higher volatility of the GDP over the past 18 months in particular is further highlighted, though both series have undoubtedly been volatile since the pandemic.

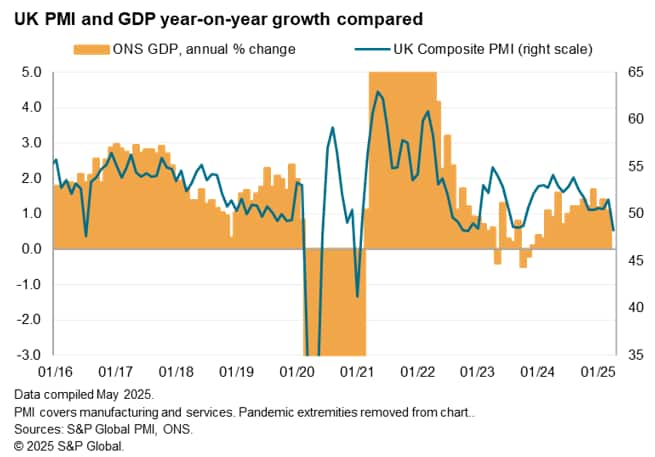

It is also noteworthy that the official data also showed GDP up by merely 1.2% compared to a year ago in the first quarter, down from 1.4% in the fourth quarter. So in year-on-year terms, which perhaps better removes any seasonality, the economy in fact slowed slightly in the first quarter.

If correct, this suggests that the quarterly GDP data may be exaggerating the strength of the economy in the first half of 2025, setting us up for a period of exaggerated weakness in the second half of the year.

While the PMI data do also suggest that growth improved in the first quarter, the upturn was considerably less impressive than signalled by the GDP numbers, and that a marked weakening in the economy had in fact become apparent in April. The PMI covering the output of manufacturing, services and construction sectors fell to 48.4 at the start of the second quarter, down from 51.0 in March and below the 50.0 no change level - to signal a drop in business activity - for the first time since October 2023.

You can read more about the early PMI indications for April, and what caused the downturn, here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-first-quarter-gdp-growth-spurt-set-to-fade-May25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-first-quarter-gdp-growth-spurt-set-to-fade-May25.html&text=UK+first+quarter+GDP+growth+spurt+set+to+fade+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-first-quarter-gdp-growth-spurt-set-to-fade-May25.html","enabled":true},{"name":"email","url":"?subject=UK first quarter GDP growth spurt set to fade | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-first-quarter-gdp-growth-spurt-set-to-fade-May25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+first+quarter+GDP+growth+spurt+set+to+fade+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuk-first-quarter-gdp-growth-spurt-set-to-fade-May25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}