Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 14, 2025

Eurozone employment edges higher in April despite worsening outlook

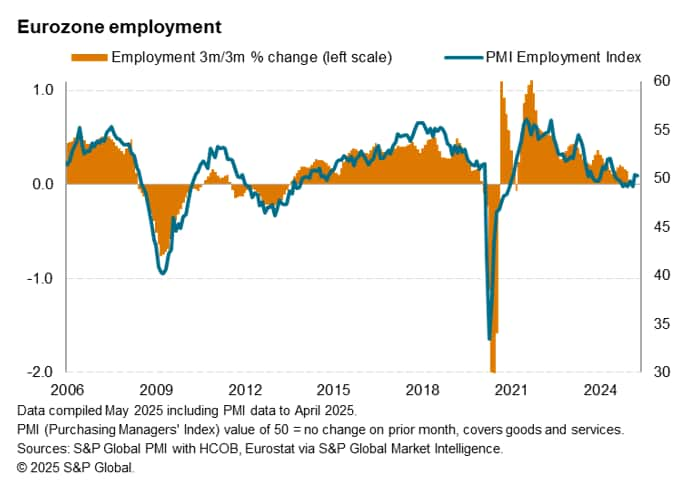

Latest PMI data showed employment rising across the eurozone for the second month running in April, albeit marginally, despite trade-related concerns and uncertainty leading to a notable drop in firms' growth expectations for the coming year.

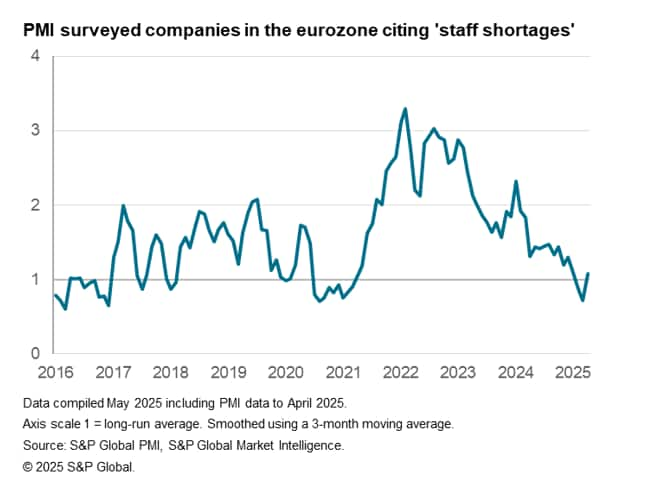

Labour market conditions showed resilience throughout previous slumps in confidence in 2022 and 2023. However, latest PMI panel comment tracker data indicate that staff shortages are less of an issue than in previous years, suggesting that firms are now less likely to hoard labour in the event of a downturn.

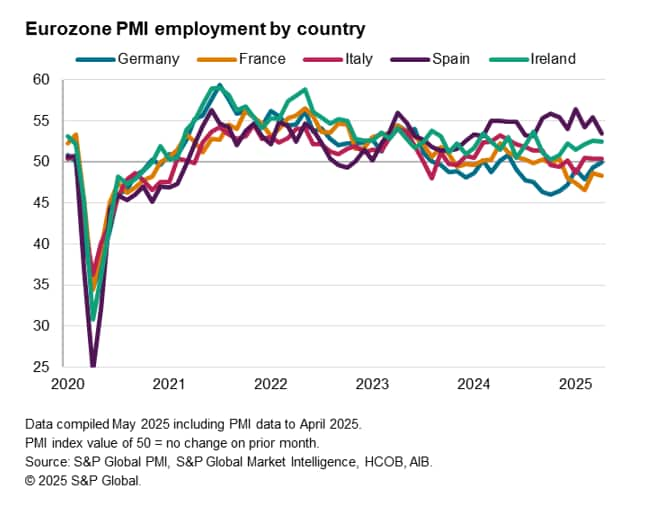

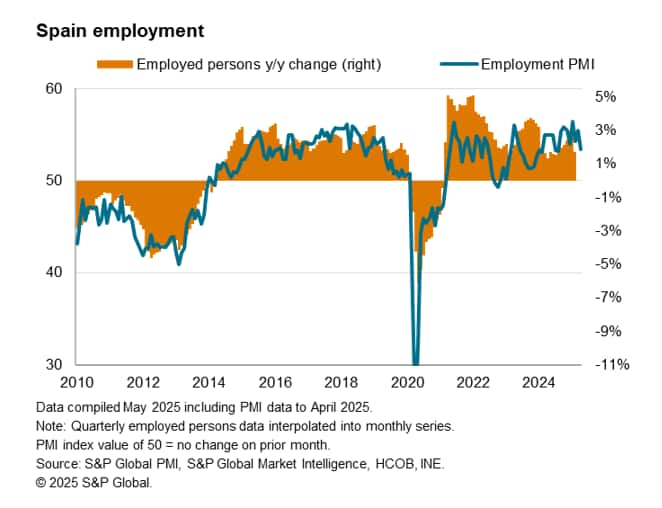

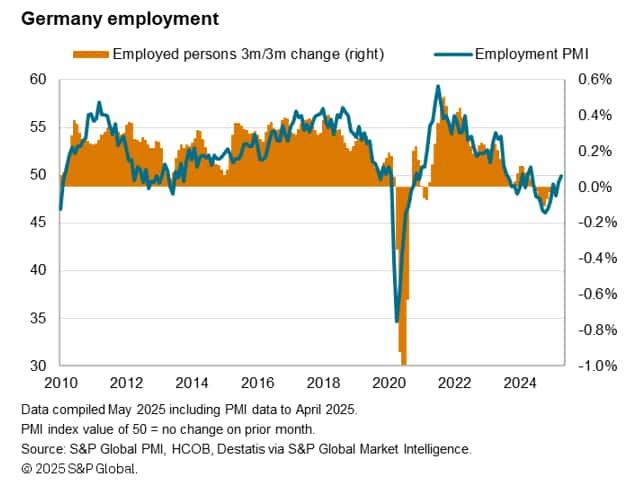

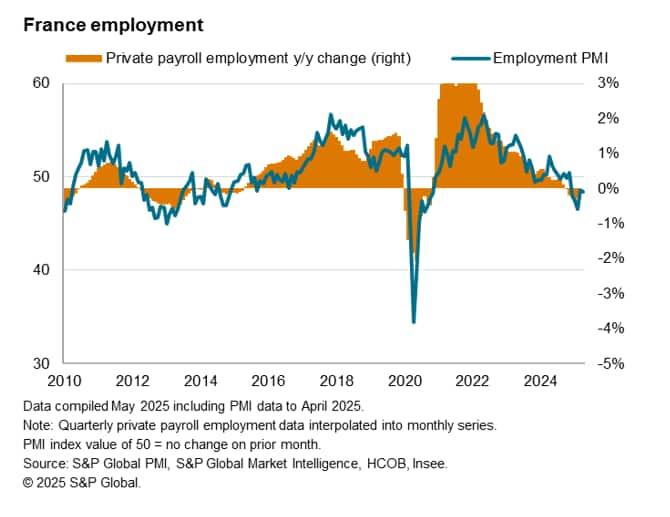

Employment trends continue to vary across the euro area, with further jobs growth in Spain, Ireland and Italy, contrasting with broadly no-change in workforce numbers in Germany and staff retrenchment in France.

Employment rises in line with output…

March and April saw back-to-back monthly rises in employment across the eurozone. Although the increases were only marginal, they followed reductions in workforce numbers in the seven months up to and including February. The HCOB Eurozone Employment PMI Index, compiled by S&P Global and covering manufacturing and services, registered 50.3, little-changed from March's 50.4 and just above the 50.0 no-change value.

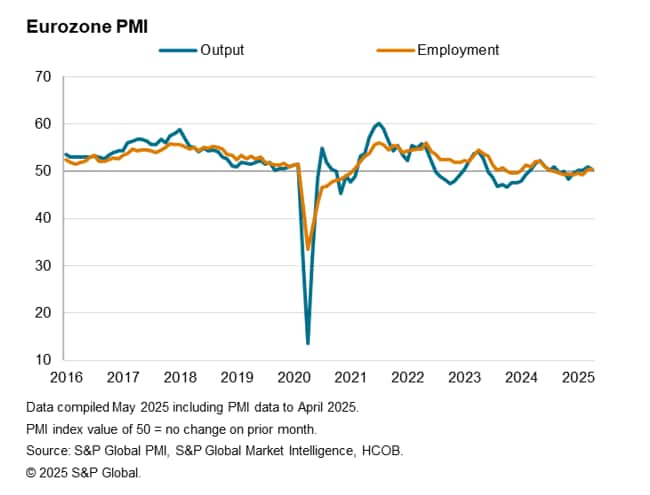

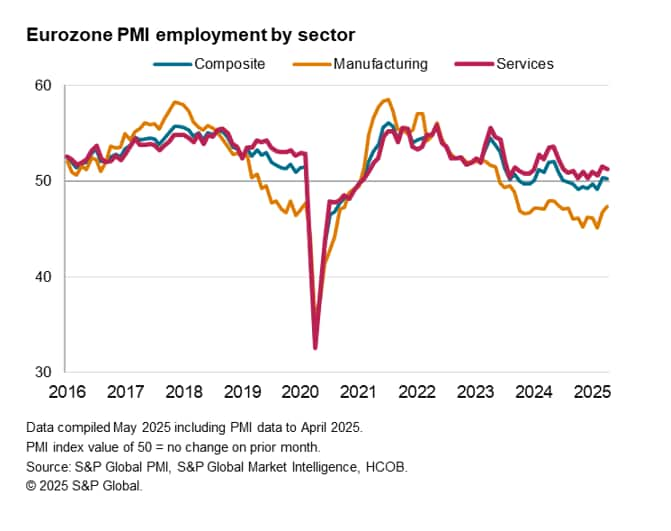

The marginal rise in employment coincided with a similar small upturn in output of goods and services, which has grown marginally throughout the first four months of the year. But whereas the increase in output in April was driven by the manufacturing sector, with activity in the larger services sector more or less stalling during the month, job creation was centred on the services economy. Factory staffing levels in fact continued to fall, although the rate of job shedding eased for the second month running and was the slowest since June last year.

…but business confidence sinks

Although both output and employment continued to edge higher across the eurozone during April, the more forward-looking data on new orders and business expectations pointed to a weakening outlook, mainly reflecting reports from surveyed firms of concerns towards US tariffs and related uncertainty.

Inflows of new orders fell for the eleventh month running and at a slightly quicker rate than in March. The decline was broad-based by sector, although it was still only modest overall.

The fall in business expectations towards output prospects in the coming year was more notable, with the respective index dropping to its lowest since October 2023.

We can track the historical relationship between business expectations and employment by comparing the z-scores [*] of the respective indexes.

Since the beginning of 2024, the employment and future output indexes have tracked each other almost step-for-step. Both hit a recent high in May 2024, before moving below their long-run averages in June 2024 and July 2024, respectively, where they have since stayed.

However, April saw a notable divergence between the z-scores as business expectations weakened, hinting that employment in the eurozone could see a renewed decline in the coming months unless confidence rebounds from its current low level.

Eurozone firms no longer short of staff

We previously highlighted the resilience of the eurozone labour market during the latter stages of the pandemic, when employment continued rising despite periods of falling activity and low business confidence. Between March 2022 and November 2023, the z-score for the employment index was consistently above that of future output, the gap hitting a record of 1.99 in October 2022.

This labour market resilience in part reflected efforts to catch up with backlogs of work that had built up as demand surged following the easing of pandemic lockdown restrictions.

PMI Panel Comment Tracker (PCT) data - which utilise qualitative evidence provided by survey participants worldwide - showed mentions of 'staff shortages' reaching nearly three-and-a-half times the long-run average in early 2022, and subsequently staying elevated throughout 2023 and into early 2024.

However, reports of staff shortages are currently broadly in line with the long-run average, and backlogs of work across the eurozone have now declined almost every month for the past three years. This suggests that the drop in business confidence - if it is sustained and translates into lower demand and activity - represents a greater risk to the labour market conditions than in previous years.

Spain seeing solid workforce growth

Underlying data show varied employment trends across the eurozone. Spain remained the top performer, seeing employment rise solidly in April, albeit at the slowest rate for eight months. Ireland also enjoyed a sustained rise in workforce numbers, maintaining a sequence of continuous job creation there stretching back to December 2020.

Employment in Germany meanwhile came close to stabilising at the start of the second quarter, after having fallen in the previous ten months. A reduced drag from factory job cuts coincided with an upturn in service sector recruitment, which saw the strongest growth in almost a year. Employment in Italy was likewise little-changed as hiring activity at the country's services firms was countered by a further, albeit modest, reduction in employment among their manufacturing counterparts.

France meanwhile saw a fifth successive monthly decrease in workforce numbers, and one that was broad-based by sector. The pace of staff retrenchment remained only modest overall, however, and was slower than seen on average during the opening quarter of the year.

[*] Z-score is a statistical measurement that is calculated by subtracting the mean average of the sample (to correct for any inherent differences in the index levels) and then dividing by the standard deviation of the sample (to correct for any inherent differences in index volatility).

Phil Smith | Economics Associate Director

Tel: +44 149

1461009

phill.smith@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-employment-edges-higher-in-april-despite-worsening-outlook-May24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-employment-edges-higher-in-april-despite-worsening-outlook-May24.html&text=Eurozone+employment+edges+higher+in+April+despite+worsening+outlook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-employment-edges-higher-in-april-despite-worsening-outlook-May24.html","enabled":true},{"name":"email","url":"?subject=Eurozone employment edges higher in April despite worsening outlook | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-employment-edges-higher-in-april-despite-worsening-outlook-May24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+employment+edges+higher+in+April+despite+worsening+outlook+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-employment-edges-higher-in-april-despite-worsening-outlook-May24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}