Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 11, 2025

Week Ahead Economic Preview: Week of 14 April 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

ECB and Bank of Canada set to cut rates amid global growth worries

As markets grapple with implications from changing tariff news, the reaction from central banks including the Bank of Canada and ECB will be monitored amid expectations of both loosening policy further in the coming week. Some key data out of the US and mainland China will meanwhile be awaited for economic growth assessments, with UK inflation also in the spotlight.

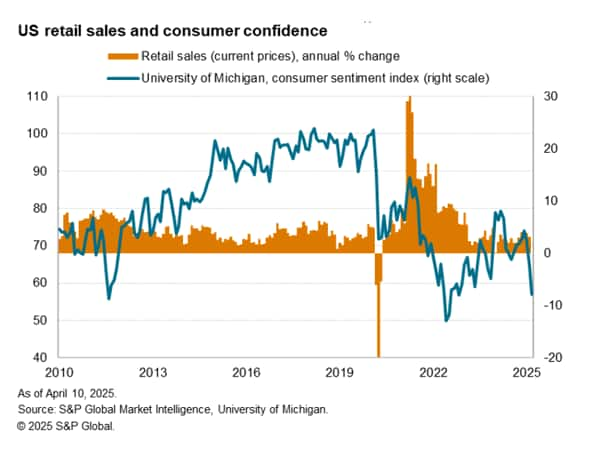

With data hinting at weak, or even contracting, US GDP in the first quarter, updates to industrial production and retail sales for March will provide key additions to economists' nowcast models. Disappointing readings could add to recession risk, which for many remains a close call. Of particular interest will be the retail sales numbers, which will be eyed for signs that households may be cutting back on spending after recent disappointing consumer confidence surveys. Inventory data will also be important to watch to assess tariff-related stock changes, as will import price data.

The coming week should also see some rate cuts from major central banks. The Bank of Canada is widely anticipated to lower its policy rate further on Wednesday after a 25-basis point reduction in March took the overnight rate to 2.75%, with more cuts likely to come quickly in the coming months as policymakers respond to a likely technical recession.

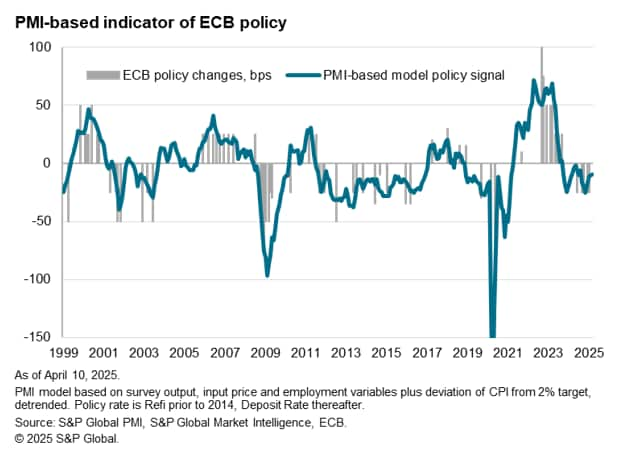

Expectations have meanwhile been rising that the European Central Bank will also cut interest rates by 25 basis points when policymakers meet on Thursday. That would take the Deposit Rate to 2.50%, its lowest for two years. Trade tensions have led to a downgrading of the eurozone's economic growth prospects, while recent inflation numbers have shown encouraging signs, especially in relation to cooler services inflation. We expect to see two further 25 basis point cuts to take the rate to 2.0%, though much depends on the tariff environment, which remains in a heightened state of flux.

Speculation has also risen that the Bank of Korea will likewise reduce rates amid the tariff-related uncertainty. However, the biggest data news out of Asia will likely be the release of first quarter GDP from mainland China, which will come at a time that many are reassessing growth prospects amid escalating tariff announcements.

Bank of England watchers will also be keenly awaiting UK inflation and wage data, and in particular any signs of companies hiking prices ahead of employee tax rises.

Key diary events

Monday 14 Apr

India, Thailand Market Holiday

Singapore GDP (Q1, adv)

Japan Industrial Production (Feb, final)

India WPI (Mar)

Tuesday 15 Apr

Thailand Market Holiday

Australia RBA Meeting Minutes

Germany Wholesale Prices (Mar)

United Kingdom Labour Market Report (Feb)

Eurozone Industrial Production (Feb)

Eurozone ZEW Economic Sentiment (Apr)

Germany ZEW Economic Sentiment (Apr)

Canada Inflation (Mar)

United States Export and Import Prices (Mar)

United States NY Empire State Manufacturing Index (Apr)

Wednesday 16 Apr

Norway Market Holiday

New Zealand Trade (Mar)

Japan Machinery Orders (Feb)

China (Mainland) GDP (Q1)

China (Mainland) Industrial Production, Retail Sales, Fixed Asset

investment (Mar)

China (Mainland) House Price Index (Mar)

United Kingdom Inflation (Mar)

Eurozone Inflation (Mar, final)

United States Retail Sales (Mar)

United States Industrial Production (Mar)

Canada BoC Interest Rate Decision, Monetary Policy Report

United States Business Inventories (Feb)

Thursday 17 Apr

Argentina, Colombia, Denmark, Mexico, Norway, Philippines,

Sweden Market Holiday

New Zealand Inflation (Q)

Japan Trade (Mar)

Singapore Non-oil Domestic Exports (Mar)

South Korea Interest Rate Decision

Australia Employment (Mar)

Germany PPI (Mar)

Switzerland Trade (Mar)

Turkey TCMB Interest Rate Decision (Apr)

Eurozone ECB Interest Rate Decision

United States Building Permits, Housing Starts (Mar)

Friday 18 Apr

Argentina, Australia, Austria, Brazil, Canada, Colombia,

France, Germany, Hong Kong SAR, India, Indonesia, Ireland, Italy,

Mexico, Netherlands, New Zealand, Norway, Philippines, Singapore,

South Africa, Spain, Sweden, Switzerland, UK, US Market

Holiday

Japan Inflation (Mar)

Malaysia GDP (Q1)

Malaysia Trade (Mar)

Italy Trade (Feb)

Sunday 20 Apr

China (Mainland) Loan Prime Rate (Apr)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: BoC meeting, Canada inflation; US retail sales, industrial production, import and export prices, housing data

The Bank of Canada (BoC) convenes for their April meeting with another 25 basis points rate cut on the table following the move in March, according to market expectations. This comes amidst a deterioration in economic conditions, with the latest March S&P Global Canada Composite PMI indicating the fastest fall in private sector output since June 2020 while job losses were sustained for a third straight month. March's inflation figures will also be due Tuesday to help guide the BoC, with softer price increases preluded by the latest PMI price data, though rising cost pressures will be an area to monitor in coming months.

In the US, retail sales and industrial production data will be released following indications of opposing trends for manufacturing production and services activity performance according to early PMI releases. Import price data will also be in focus for official confirmation of the rising manufacturing cost trend observed via PMI data.

EMEA: ECB meeting; UK inflation, labour market report; Germany ZEW survey, wholesale prices data

The European Central Bank (ECB) is expected to lower rates at their upcoming April according to consensus. March's HCOB Eurozone Composite PMI revealed that the euro area expanded at the quickest pace since August 2024, but growth was still only modest overall and weaker than the long-run trend, while inflationary pressures softened to back another move by the ECB.

Meanwhile key releases in the UK include inflation and employment data. PMI price trends hinted at softening, but still elevated, inflation as services selling prices rose at a slower pace in March. Job losses were meanwhile observed for a sixth successive month.

APAC: BoK meeting, RBA minutes; Australia employment; mainland China GDP and activity data; Japan inflation and trade figures; Singapore GDP

The Bank of Korea (BoK) may join major central banks in lowering rates to support the economy in April given recent challenges. Key data out of the APAC region will meanwhile be mainland China's Q1 GDP and March industrial production and retail sales figures. A positive, though slightly lower first quarter average was seen for the Caixin China General Composite PMI, while higher March manufacturing and services activity data point to improvements for upcoming monthly activity data to be released. Australia's employment data and Japan's inflation and trade figures will also be highlights in the new week.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-april-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-april-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+14+April+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-april-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 14 April 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-april-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+14+April+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-april-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}