Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 14, 2025

Global manufacturing sectors struggle in opening quarter of 2025 amid strengthening headwinds

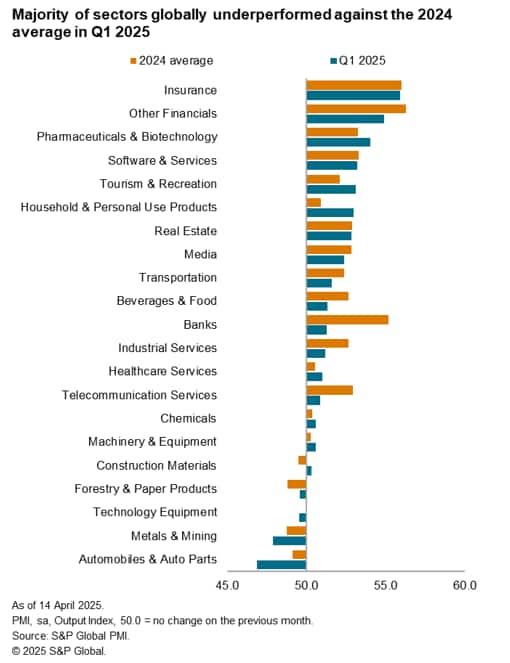

The latest S&P Global Sector PMI data indicated a challenging end to the first quarter of the year among manufacturing-based sectors, with services segments signalling a relatively stronger performance in March. The malaise in goods-producing sectors permeated through almost all monitored segments in the manufacturing economy. In contrast, growth in business activity was broad-based by services-based sector at the global level.

The March survey period (12th - 27th March) was conducted before the US government announcement of additional tariffs to the automotive sector and swathes of nation-specific tariffs, and the subsequent 90-day pause on the implementation of these tariffs. However, a better understanding of sector performance globally and at the regional level enables us to identify those likely to be impacted most significantly and the scope those industries have to adapt to a new and constantly shifting business landscape which will test business and sector resilience.

Heavy manufacturing continues to be impacted significantly by weak demand in first quarter of 2025

With the exception of data for February 2025, the Basic Materials broad sector (consisting of Chemicals, Forestry & Paper Products and Metals & Mining) has been the worst performing category since July 2024. March data signalled a decline in production across the three contributing sectors for the first time in 2025 so far, as Chemicals output fell back into contraction.

Meanwhile, since July 2024 the Metals & Mining segment has been a consistent poor performer, falling within the bottom four sectors throughout this period.

With the exception of a fractional expansion in February 2024, new sales in the segment have fallen in each month since May 2023. Subsequently, firms have cut workforce numbers in each of the last ten months.

That said, rates of contraction were only slight and paled in comparison to the marked drop in Automobiles & Auto Parts output at the global level.

Moreover, at the regional level, autos & parts producers in Europe were alone in recording an end to a sustained period of malaise, with March data indicating stable output levels and the end of a 21-month period of decrease in production. The rate of contraction in global autos & parts output was the steepest since November 2022, however, with European producers still signalling fragile demand conditions despite no change to output on the month.

The March data collection period spanned from 12th - 27th March, before additional US automotives tariffs were announced. Upcoming PMI data for April (released in early May) will give an insight into the immediate impact of uncertainty stemming from widespread tariffs.

Although the Automotives & Auto Parts sector has remained in the doldrums, with the rate of decline seen on average through the opening quarter of 2025 outpacing the trend for 2024, other aspects of the Consumer Goods category fared better. Output in the Food & Beverages sector tipped into decline for the first time in almost a year-and-a-half during March. The falls in production and new orders were only fractional, however.

Meanwhile, Household & Personal Use Products remained in expansion territory at the end of the first quarter of 2025. In fact, the average pace of growth in output in the sector was sharper than the trend for 2024 and solid overall, following a sustained uptick in new sales.

That said, business confidence in the sector dropped notably in March, as - according to anecdotal evidence from a range of our manufacturing surveys - the looming impact and uncertainty of more challenging trade conditions and the anticipated drag on investment spending as a result dampened optimism.

All services sectors signal expansion in activity in March

In contrast to their manufacturing counterparts, services-based sectors monitored by the S&P Global Sector PMI all recorded growth in output in March. The expansion in Insurance business activity accelerated notably, with the sector regaining the top spot in the rankings following a brief interlude in February.

The overall Financials category continued to perform well, despite the rise in Banks (including financial intermediation and credit granting) output slowing to only a fractional pace that was the weakest in the current 18-month sequence of increase, and a softer upturn in Real Estate activity.

Nonetheless, each of the contributing sectors to the overall Financials category underperformed in the opening quarter of 2025 relative to the average for 2024. Although Insurance and Real Estate saw only a fractional difference, the gap in performance was larger at Other Financials (including auxiliary activities to financial intermediation, insurance and pension funding) and Banks. Moreover, the latter saw the largest gap in performance between the average over 2024 and that of the first quarter of the new year of the 21 monitored sectors.

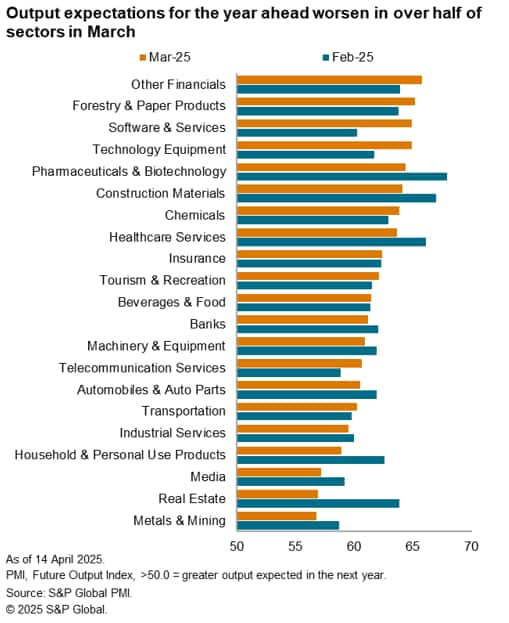

Optimism historically subdued in majority of sectors in March

Political and economic uncertainty, alongside weakness in demand in key markets for manufactured goods weighed on business confidence in March, as 17 of the 21 sectors signalled a lower level of optimism in the outlook for output in the next year relative to their respective long-run averages. Moreover, 11 segments registered lower positive sentiment in the outlook compared to the previous survey period.

Larger-than-anticipated tariff announcements have sent shockwaves through markets and the initial impact on business activity will likely be seen in April PMI data. At time of writing, the upcoming data collection period will fall under a 90-day pause for negotiations on trade policy, however, preparations and contingencies will likely begin to be put in place globally.

Global, Asia and Europe data will become available on 6th May 2025. S&P Global US Sector PMI data is released a day earlier, on 5th May 2025.

Sian Jones, Principal Economist, S&P Global Market Intelligence

Tel: +44 1491 461 017

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-sectors-struggle-in-opening-quarter-of-20.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-sectors-struggle-in-opening-quarter-of-20.html&text=Global+manufacturing+sectors+struggle+in+opening+quarter+of+2025+amid+strengthening+headwinds+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-sectors-struggle-in-opening-quarter-of-20.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing sectors struggle in opening quarter of 2025 amid strengthening headwinds | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-sectors-struggle-in-opening-quarter-of-20.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+sectors+struggle+in+opening+quarter+of+2025+amid+strengthening+headwinds+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-sectors-struggle-in-opening-quarter-of-20.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}