Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 17, 2025

Week Ahead Economic Preview: Week of 21 April 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

Flash PMIs to offer early insights into April conditions

Flash PMI data for April will be anticipated midweek for insights into changes in economic conditions and sentiment across major developed economies following recent trade developments. Meanwhile, Fed comments and a series of economic data releases, including US durable goods and home sales data, UK retail sales figures plus other tier-1 data out of APAC economies shed light on the prospective path forward for policies amid evolving trade influences.

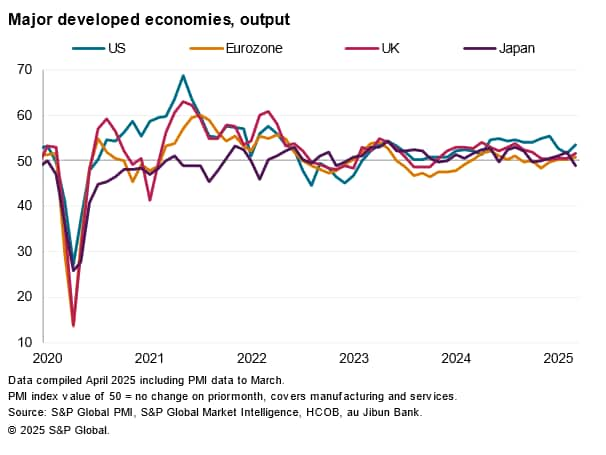

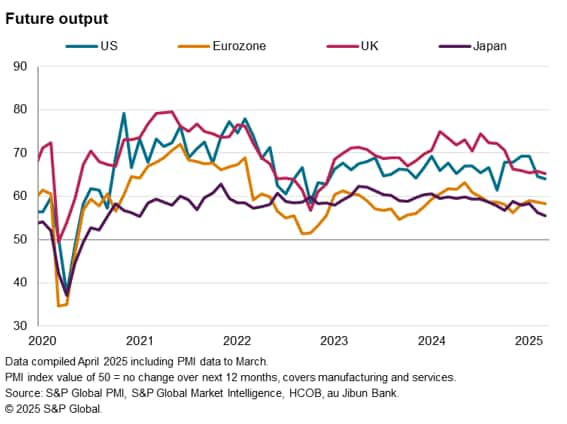

The key set of data awaited in the coming week will be the flash PMI numbers for April. While the market turmoil in April so far offered insights into changes in investors' sentiment, alongside our own S&P Global Investment Manager Index which showed weak risk appetite among money managers at the start of April, flash PMI releases will present the earliest 'hard data' for a check on how business conditions have been altered by recent trade policy updates. As it is, March figures already outlined the negative impact of tariffs on North America trade and the uplift especially for manufacturing input prices in the US. Further impact from tariffs implemented in April will be watched, as we continue to track them via the assortment of PMI indicators. Additionally, business sentiment will also be closely followed, with one of the most concerning trend observed from the March PMI being the softening of business confidence, and this was notable across both the manufacturing and service sectors.

Beyond the PMI releases, we will look to Fed comments for clues regarding their utmost concern between inflation and growth risks as the market appear mixed regarding the path forward for interest rates during this period of heightened uncertainty. Durable goods orders data come in timely for an assessment of whether front-loading ahead of tariffs dissipated into March. Meanwhile Canada and the UK update retail sales data, with the former likely to see pressure in retail spending amid concerns over the tariff impact.

Across in APAC, Bank Indonesia convenes for their April monetary policy meeting against a backdrop of heightened currency volatility. Several tier-1 data including South Korea's GDP and inflation numbers out of Singapore, Malaysia and Hong Kong SAR offer a look into economic conditions at the end of the first quarter of 2025.

Key diary events

Monday 21 Apr

Australia, Austria, Brazil, France, Germany, Hong Kong SAR,

Ireland, Italy, Netherlands, New Zealand, Norway, Poland, South

Africa, Spain, Sweden, Switzerland, United Kingdom Market

Holiday

Indonesia Trade (Mar)

United States CB Leading Index (Mar)

Tuesday 22 Apr

South Korea PPI (Mar)

Turkey Consumer Confidence (Apr)

Spain Balance of Trade (Feb)

Taiwan Export Orders and Unemployment Rate (Mar)

Eurozone Government Budget to GDP (2024)

Eurozone Consumer Confidence (Apr, flash)

United States Richmond Fed Manufacturing Index (Apr)

Wednesday 23 Apr

Türkiye Market Holiday

Australia S&P Global Flash PMI, Manufacturing &

Services*

Japan au Jibun Bank Flash PMI, Manufacturing & Services*

India HSBC Flash PMI, Manufacturing & Services*

UK S&P Global Flash PMI, Manufacturing & Services*

Germany HCOB Flash PMI, Manufacturing & Services*

France HCOB Flash PMI, Manufacturing & Services*

Eurozone HCOB Flash PMI, Manufacturing & Services*

US S&P Global Flash PMI, Manufacturing & Services*

South Korea Consumer Confidence (Apr)

Malaysia Inflation (Mar)

Singapore Inflation (Mar)

Indonesia BI Interest Rate Decision

South Africa Inflation (Mar)

Taiwan Industrial Production and Retail Sales (Mar)

Eurozone Balance of Trade (Feb)

Hong Kong SAR Inflation (Mar)

Canada New Housing Price Index (Mar)

United States New Home Sales (Mar)

Thursday 24 Apr

South Korea Business Confidence (Apr)

South Korea GDP (Q1, advance)

Australia RBA Bulletin

France Consumer Confidence (Apr)

Turkey Business Confidence (Apr)

Germany Ifo Business Climate (Apr)

United States Durable Goods Orders (Mar)

United States Chicago Fed National Activity Index (Mar)

United States Existing Home Sales (Mar)

Friday 25 Apr

Australia, New Zealand Market Holiday

United Kingdom GfK Consumer Confidence (Apr)

Japan Tokyo CPI (Apr)

Thailand Balance of Trade (Mar)

Singapore Industrial Production (Mar)

United Kingdom Retail Sales (Mar)

France Business Confidence (Apr)

Canada Retail Sales (Feb)

United States UoM Sentiment (Apr, final)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

April flash PMI releases

Flash PMI data for April will be released on Wednesday for insights into economic conditions and sentiment changes across major developed economies and India. This is particularly following the events that have transpired so far this month. Specifically, given ongoing US tariff updates, changes in US business activity and prices performance will be in question. More widely, global growth and supply conditions will also be scrutinised as the series of tariff updates in April extend more widely around the globe.

Americas: Fed comments, US durable goods orders and home sales data; Canada retail sales, housing prices

Comments from the Fed will be watched alongside the series of data releases in the new week. Amidst recent market volatility and uncertainty regarding the outlook for inflation and interest rates, a heightened degree of sensitivity to the Fed's comments may well be expected. Additionally, the data calendar also lists durable goods orders and home sales figures as ones to track for insights into March economic conditions.

In Canada, retail sales and housing prices figures will be released. Falling Canada's services activity in the first quarter of 2025 amidst tariff concerns, according to PMI data, hints at softening retail sales readings.

EMEA: UK retail sales data; Germany Ifo

Besides flash PMI data, economic data highlights in the new week includes UK retail sales figures. Rising services activity and continued job losses across the private sector, according to the March UK PMI, provided mixed signals for retail sales performance in the month.

Additionally, Germany's Ifo business climate data will be in focus on Thursday. This follows the release of Germany's flash PMI on Wednesday, including the only sentiment-based PMI sub-index - the Future Output Index, for insights into changes in business confidence amid ongoing trade challenges.

APAC: BI meeting; South Korea GDP; Malaysia, Singapore, Hong Kong SAR Inflation; Taiwan industrial production and export orders

Bank Indonesia convenes in the new week for their April monetary policy meeting. Amid depreciation pressures, the Indonesian central bank is expected to hold interest rates unchanged, though a further lowering of rates is expected later in the year. Tier-1 data anticipated in the region includes South Korea's first quarter GDP, while inflation readings will also be due across several economies.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-april-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-april-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+21+April+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-april-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 21 April 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-april-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+21+April+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-21-april-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}