Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 10, 2025

Week Ahead Economic Preview: Week of 10 February 2025

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US inflation and UK economic growth to help guide central bank policy

The focus shifts to US inflation in the coming week amid updates to CPI data and a speech by Fed Chair Powell. The UK's growth trajectory also comes under renewed scrutiny with the publication of official GDP data and new labour market statistics.

The data highlight of the week will be consumer price inflation from the US on Wednesday, which is expected to show core inflation ticking higher to show a 0.3% monthly gain after a 0.2% rise in December, followed swiftly by testimony from FOMC Chair Powell. The Fed held rates at its last meeting amid signs of robust economic growth, solid labour market conditions and stubborn inflation. Hence official US manufacturing output and retail sales data will also be key gauges to watch in order to ascertain whether the robust economic growth momentum seen late last year has persisted, and whether the uplift survey optimism and "animal spirits" since the Presidential election has buoyed output and spending.

After recent jobs report data showed US unemployment falling to 4.0% and average hourly earnings up 4.1% (above an expected 3.8% rate), any upsides to inflation and the activity data would naturally add to further speculation of the Fed keeping rates on hold for longer.

UK GDP will also be in the spotlight after the Bank of England slashed its growth forecast for 2025, from 1.5% to 0.75%, as it cut interest rates again in February. While this merely brings their outlook down from unrealistic levels, any further disappointment from the monthly GDP data for December will add to speculation that the Bank may need to cut rates more aggressively in the coming months. You can read our overview of the latest survey signals here, which paints a picture of a UK business environment which has grown increasingly gloomy in recent months.

Meanwhile, amid volatility with official UK labour market statistics, the REC/KMPG survey of recruitment market trends, consolidated by S&P Global Market Intelligence, have provided useful insights into hiring, wage growth and staff availability. Like the UK PMI, it has recently shown jobs growth deteriorated sharply in the aftermath of the recently announced increase in employment payroll tax, so January's update (due Monday) will be closely watched for further clues as to whether the Bank of England should be worried about job market trends.

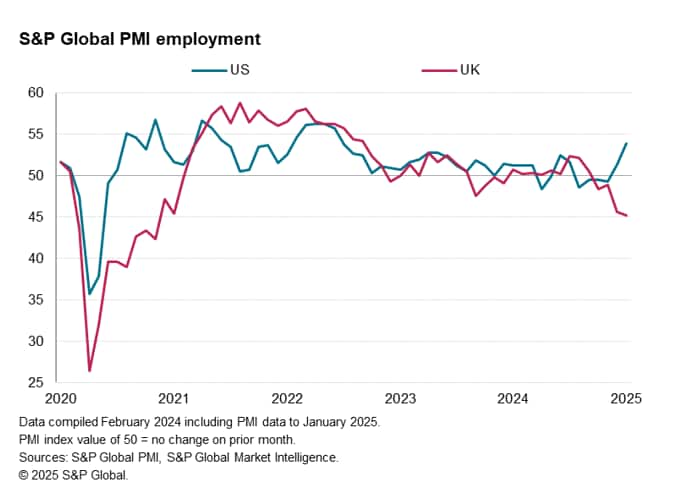

Recent PMI survey data have shown divergent employment trends between the United States and the United Kingdom. While US jobs growth has picked up in recent months, consistent with falling unemployment, a steep fall in employment signaled by the corresponding UK PMI is indicative of rising unemployment.

Key diary events

Monday 10 Feb

Japan Current Account (Dec)

Japan Bank Lending (Jan)

China (Mainland) New Yuan Loans, M2, Loan Growth (Jan)

Malaysia Unemployment Rate (Dec)

Turkey Industrial Production (Dec)

United Kingdom KPMG/REC Report on Jobs* (Jan)

United States Consumer Inflation Expectations (Jan)

Tuesday 11 Feb

Japan Market Holiday

Australia Westpac Consumer Confidence Change (Feb)

Australia NAB Business Confidence (Jan)

France Unemployment Rate (Q4)

South Africa Manufacturing Production (Dec)

Brazil Inflation (Jan)

Mexico Industrial Production (Dec)

S&P Global Investment Manager Index* (Feb)

Wednesday 12 Feb

Australia Home Loans (Q4)

Italy Industrial Production (Dec)

India Industrial Production (Dec)

India Inflation Rate (Jan)

United States CPI (Jan)

Canada BoC Summary of Deliberations

United States Monthly Budget Statement (Jan)

Global GEP Supply Chain Volatility Index* (Jan)

OPEC Monthly Report

Thursday 13 Feb

Japan PPI (Jan)

Germany Inflation (Jan, final)

Philippines BSP Interest Rate Decision

United Kingdom monthly GDP, incl. Manufacturing, Services and

Construction Output (Dec)

United Kingdom GDP (Q4, prelim)

United Kingdom Trade (Dec)

Switzerland Inflation (Jan)

Eurozone Industrial Production (Dec)

Brazil Retail Sales (Dec)

United States PPI (Jan)

Friday 14 Feb

Malaysia GDP (Q4)

India WPI (Jan)

Germany Wholesale Prices (Jan)

Spain Inflation (Jan, final)

Eurozone GDP (Q4, 2nd est.)

Eurozone Employment Change (Q4, prelim)

United States Retail Sales (Jan)

United States Industrial Production (Jan)

United States Business Inventories (Dec)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: Fed comments, US inflation, retail sales and industrial production

Fed comments will be watched in the new week in relation to views regarding inflation and monetary policy amidst the uncertainties pertaining to tariffs. Meanwhile, the economic data highlight will be January's US CPI release, providing an official confirmation on inflation trends at the start of the year. According to S&P Global US PMI Output Prices data, which tends to precede the trend for inflation, inflationary pressures but had intensified slightly at the start of the year.

Additionally, US retail sales and industrial production numbers are also anticipated. Latest S&P Global Manufacturing PMI revealed that the sector returned to growth in January, later confirmed by the ISM, hinting at positive industrial production numbers. Robust consumer demand in the services PMI also bodes well for retail sales.

EMEA: Eurozone GDP, industrial production; UK GDP and monthly output data

The second estimate of eurozone fourth quarter GDP will be published at the end of the week, alongside industrial production numbers for December. While subdued economic activity into the end of 2024 confirmed the weak HCOB Eurozone PMI data, the latest January PMI numbers have indicted some steadying of the eurozone economy at the start of the year.

In the UK, fourth quarter GDP reading coupled with detailed December output data will also be released. Latest S&P Global UK PMI data showed that the UK economy remained stalled in January which, alongside steep job cuts and a further loss of confidence, hints at some further disappointing news from the official statistics.

APAC: BSP meeting; Malaysia GDP; India industrial production, WPI

A relatively light week is expected for APAC though a central bank meeting in the Philippines, Malaysia's GDP and India's industrial production figures will be closely watched.

Investment Manager and Supply Chain Volatility Indices

S&P Global Investment Manager Index, tracking risk sentiment, expected returns and sector preference among money managers with approximately $3500 billion in assets under management, will be updated for February on Tuesday, offering clues on investment sentiment amid changing US tariff developments.

Meanwhile the GEP Supply Chain Volatility Index, compiled by S&P Global Market Intelligence, will also be tracked for changes in supply chain conditions just prior to the partial tariffs implementation so far announced in February.

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-february-2025.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-february-2025.html&text=Week+Ahead+Economic+Preview%3a+Week+of+10+February+2025+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-february-2025.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 10 February 2025 | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-february-2025.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+10+February+2025+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-10-february-2025.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}