Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 10, 2025

Global PMI slips at start of 2025 but optimism and employment trend higher

The worldwide PMI survey - produced S&P Global in association with ISM and IFPSM for J.P.Morgan - recorded the slowest output growth for a year in January, but business confidence and employment growth improved globally to hint at the slowdown being temporary.

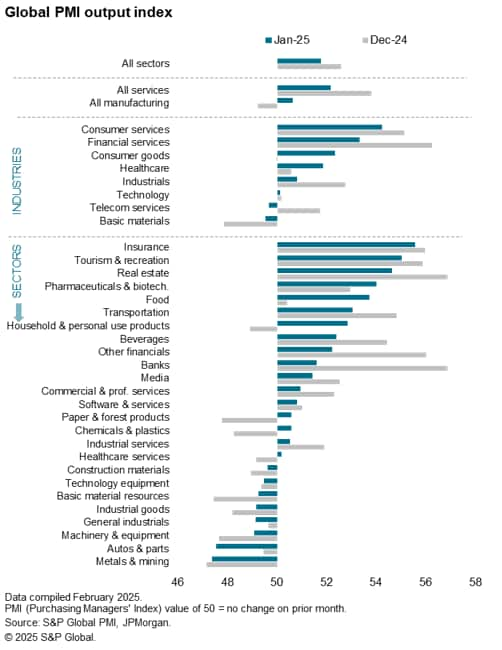

Growth in the major economies was again generally led by the services economies, though the overall global services expansion slowed while manufacturing output returned to tentative growth to signal a narrowing sectoral divergence. Consumer-facing companies and financial services firms reported especially robust growth.

By region, the US continued to outperform the other major developed economies - with a marginal fall in Canada's output accompanied by only modest gains elsewhere. India again far outpaced the other major emerging markets, with Brazil notably in decline and mainland China losing further momentum.

The US and India also reported especially strong job gains (the latter at a survey high) amid elevated business optimism, to point to widening economic divergences notable against mainland China, the UK and eurozone, where jobs were cut. UK job cutting was again especially severe.

<span/>Global economic growth slows at start of 2025

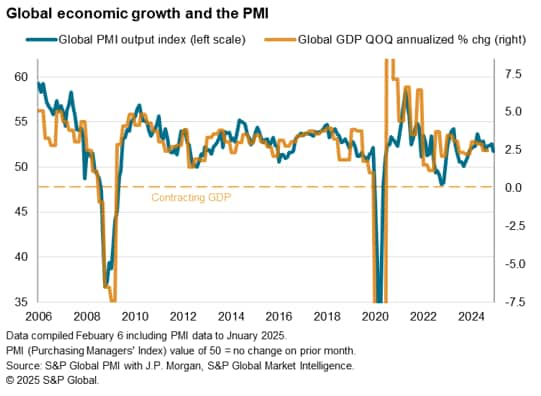

S&P Global Market Intelligence's PMI surveys indicated that global business activity expanded for a twenty-fourth successive month in January, albeit with the rate of growth waning to the slowest for a year.

The headline J.P. Morgan Global Composite PMI® Output Index, covering manufacturing and services in over 40 economies, fell from 52.6 in December to 51.8 in January.

At its current level, historical comparisons indicate that the PMI is broadly consistent with the global economy growing at an annualized rate of 2.3%, down from a 2.7% expansion signalled for the fourth quarter of last year. That compares with an average GDP growth rate of 3.1% in the decade prior to the pandemic.

The latest official data indicate that worldwide GDP rose by 2.5% in the third quarter of last year; broadly in line with the PMI.

Consumers provide additional support to growth

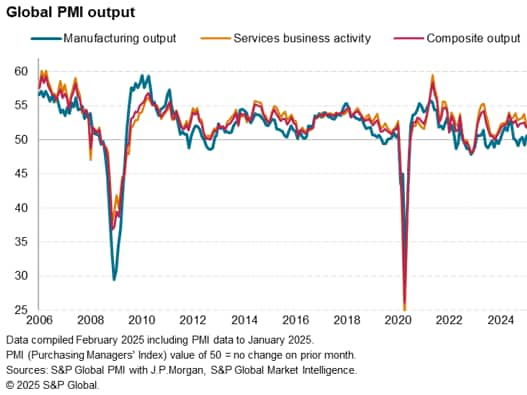

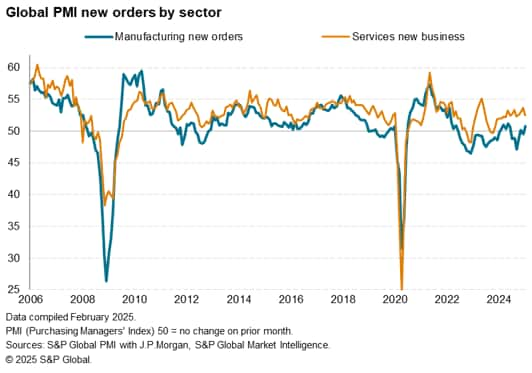

The gap in performance between the global services and manufacturing sectors narrowed in January from a one-and-a-half year high at the end of 2024. While factory output grew modestly, rising to the greatest extent for seven months after a brief decline in December, service sector growth slowed to the weakest since December 2023.

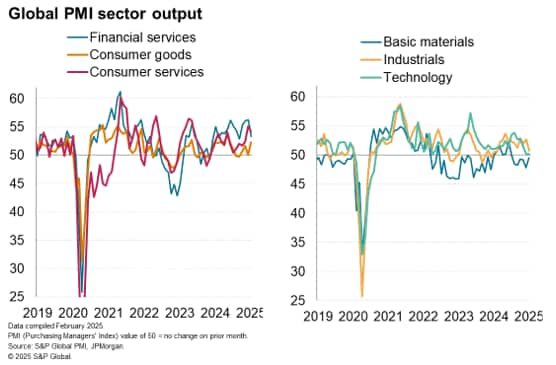

By broad industry, January's expansion was led by consumer services (for the first time in nearly a year, led by tourism & recreation) followed by financial services, albeit with growth slowing in both cases.

Signs of consumer-led growth were also evident in manufacturing, with consumer goods makers reporting the strongest growth for eight months.

In contrast, basic material producers again reported the sharpest contraction, albeit its downturn eased sharply and - by sector - metals & mining, autos and machinery & equipment reported especially steep falls.

Technology and telecoms output was notably broadly stalled, the former posting its worst performance since mid-2020.

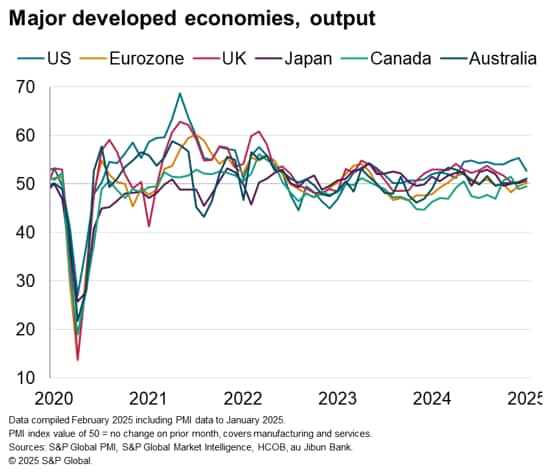

US leads other major - broadly stalled - developed economies, but by diminished margin

The US reported the strongest expansion among the major developed economies for a ninth straight month, but the pace cooled from December's 32-month high to sit at a nine-month low. Slower services growth offset a renewed manufacturing upturn, though at least some of the slowdown could be linked to adverse weather.

Broad malaise was again reported elsewhere in the major developed markets, albeit with some signs of modest improvements. Modest gains were recorded in Japan and Australia, with growth edging up to four- and five-month highs respectively, and the eurozone nudged back into growth territory for the first time in five months (thanks in part to revived growth in Germany), albeit merely joining the UK in reporting a broadly stalled performance.

Output meanwhile fell for a second successive month in Canada, though dropped only slightly and at a reduced rate compared to December.

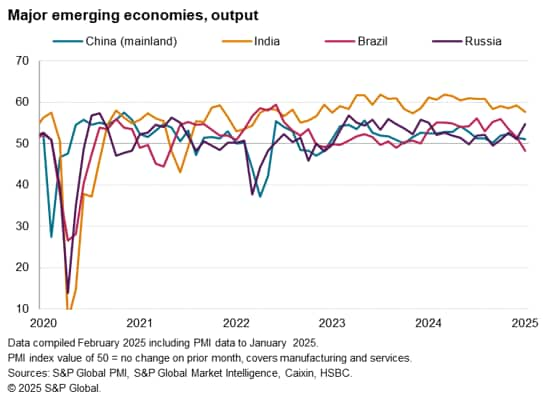

India heads up major emerging markets as Brazil slips into decline

India continued to lead the BRIC 'emerging' economies, as has been the case since July 2022, despite growth cooling to the slowest for 14 months as a service sector slowdown offset improved manufacturing growth.

Brazil meanwhile, reported the worst performance among the BRICs, falling into decline for the first time in 16 months and reporting the sharpest contraction of output since April 2021 amid an especially marked drop in service sector activity. Companies reported concerns over high inflation, a weakened currency, and rising interest rates.

Mainland China's performance also deteriorated, remaining in expansion but with growth edging down to a four-month low. Only very modest growth was recorded in both manufacturing and services.

Russia bucked the weakening trend, reporting the strongest expansion of output for a year thanks to combined faster service sector and manufacturing growth.

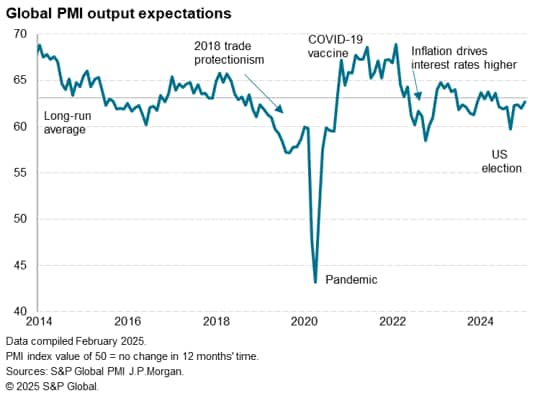

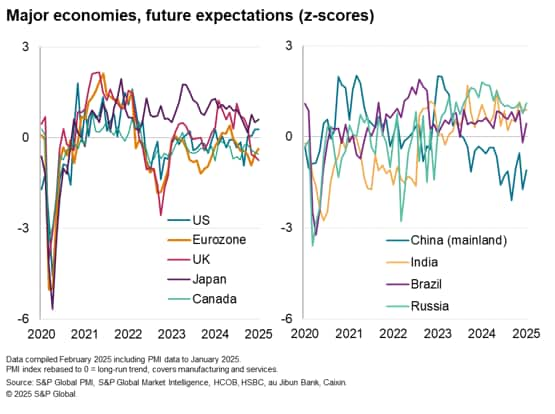

Global business optimism improves to eight-month high

Worldwide business expectations for output in the year ahead rose to an eight-month high in January, running just below the survey's long-run average.

Confidence remained especially robust on the service sector, largely unchanged on the picture seen at the end of last year, but improved markedly in manufacturing from a sudden dip recorded in December.

Sentiment has whip-sawed in manufacturing in recent month amid speculation about US protectionism and the potential imposition of new tariffs with US trading partners. January's upturn in factory optimism to the joint-highest in eight months reflected some easing of global concerns regarding the immediate scale of possible US tariffs, alongside improved confidence around cooling cost of living pressures and the prospect of lower interest rates in many economies.

The January PMI data were collected prior to President Trump's tariff announcements over the first weekend of February.

Among the major developed economies, the highest degree of sentiment relative to long run trends was recorded in Japan, where the weak yen has buoyed exports (both for goods and incoming tourism), but it is in the US where recent months have seen the strongest upturn in confidence. January saw US output expectations unchanged on December's joint-31-month high. An especially marked improvement in US manufacturing confidence was recorded.

The lowest confidence relative to long-run averages was reported in the UK, where expectations sank to a 25-month low amid growing reports of concerns over the impact of recent government policy, followed by Canada and the eurozone, the former suffering concerns over proposed US tariffs more so than the latter.

Confidence about the year ahead meanwhile improved across all four major emerging markets, often linked to diminished trade protectionism worries. However, sentiment remained especially low in mainland China (still running far below its long-run average).

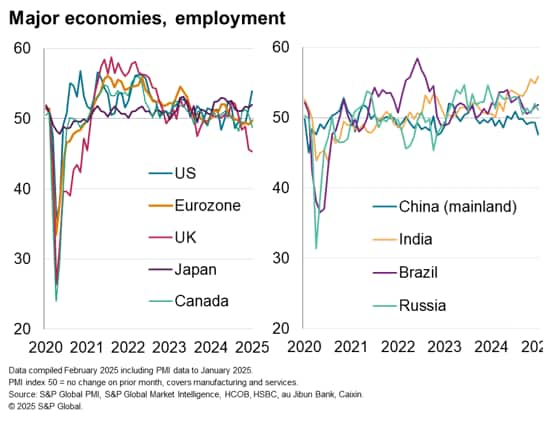

Global employment divergences widen as US and India lead jobs growth

January saw some striking divergences in employment. In the major developed economies, US jobs growth accelerated sharply to the highest since June 2022. Jobs growth also accelerated in Japan. In contrast, UK jobs were cut at a rate not seen since the height of the pandemic, and prior to that, the global financial crisis. Job cuts also rose in Canada.

While some signs of stabilisation in job numbers were seen in eurozone, staffing levels edged lower for a sixth straight month due to a further steep reduction in manufacturing headcounts.

Divergences were also noteworthy in the major emerging markets. Job creation in India hit the highest recorded by the survey which began in 2005, but jobs in mainland China were cut at a rate not witnessed for over two years. Modest job gains were seen in both Brazil and Russia.

Measured overall, global employment rose at the strongest rate for six months, rising modestly for a second month running.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-slips-at-start-of-2025-Feb25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-slips-at-start-of-2025-Feb25.html&text=Global+PMI+slips+at+start+of+2025+but+optimism+and+employment+trend+higher++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-slips-at-start-of-2025-Feb25.html","enabled":true},{"name":"email","url":"?subject=Global PMI slips at start of 2025 but optimism and employment trend higher | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-slips-at-start-of-2025-Feb25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+slips+at+start+of+2025+but+optimism+and+employment+trend+higher++%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-slips-at-start-of-2025-Feb25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}