Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 11, 2025

Emerging market growth softens at the start of 2025 as firms shed staff

Emerging markets expanded at a slower rate in the opening month of 2025, in line with a softening global growth trend. This was while the gap between manufacturing and services narrowed as manufacturing production growth gained speed ahead of concerns over the implementation of tariffs.

Business optimism meanwhile remained historically subdued among emerging market firms despite improving since the end of 2024. A renewed fall in staffing levels also reflected some sense of apprehension among emerging market businesses pertaining to the growth outlook.

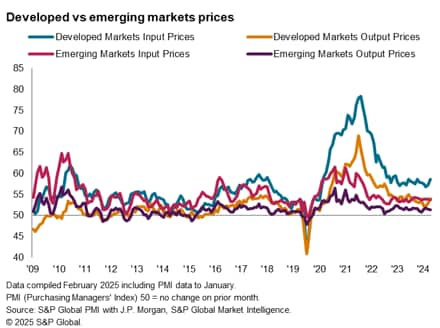

Output price inflation among emerging market firms was meanwhile stable going into 2025, remaining slightly below the long-run average. That said, while price pressures remained subdued, concerns over elevated uncertainties, including the impact of a strong dollar, highlighted the multitude of factors that continue to influence monetary policy decisions among emerging market central banks.

Emerging market output growth eases to four-month low in January

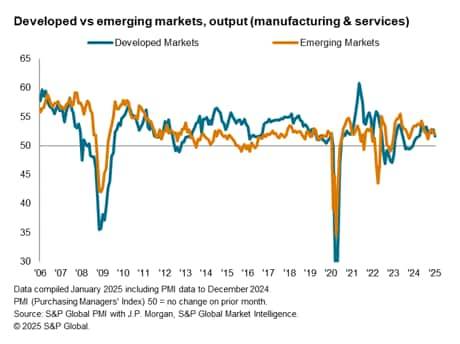

The PMI surveys compiled globally by S&P Global revealed that the rate at which output expanded across the collective emerging markets slowed for a second successive month in January to the softest since last September. The GDP-weighted Emerging Market PMI Output Index slipped to 51.9 in January, down from 52.4 in December.

Faster manufacturing output growth at the start of 2025 failed to offset slower services activity expansion, resulting in emerging market output growth cooling to a pace further below the long-run average. The latest data nevertheless signalled that emerging markets have now extended their growth streak to just over two years.

The softening of emerging market growth was in line with the global trend. Developed economies had similarly seen the rate of business activity growth ease at the start of the year. Where trends diverged was in terms of growth contributions, whereby the emerging market expansion remained broad-based in January while developed markets growth was largely services-driven for the seventh month in a row.

Emerging market manufacturing output growth accelerates in January

While it is unclear to what extent that the latest boost to emerging market manufacturing was attributed to the front-loading of shipments ahead of US tariffs, emerging market production had clearly expanded at a quicker rate after slowing in December, helping to lift global manufacturing output into expansion in January.

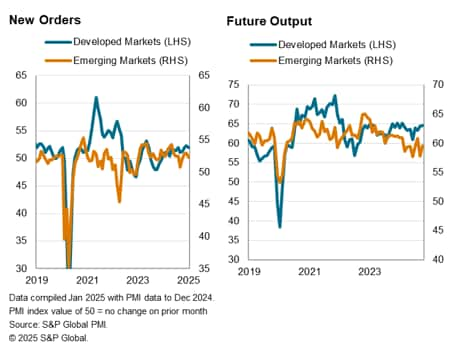

The uptick in emerging market goods production growth was attributed to a faster rise in new orders. Renewed growth in export orders, the second recorded in six months, further offered some clues that front-loading of purchases from emerging market manufacturers may be at play in supporting faster production expansion in January.

Meanwhile, emerging market services activity rose at the softest pace in four months at the start of 2025, easing from the solid rate of growth in December. This was as services new business fell back below its long-run average rate of growth in January, though export business demand growth notably picked up speed against a backdrop of rising tourism demand globally.

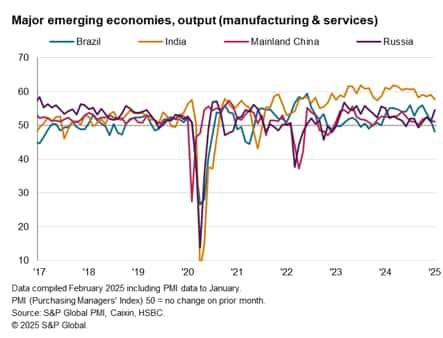

India and mainland China growth rates slow in January

The softening of emerging market growth can be attributed to slower expansions across the four major 'BRIC' emerging market economies bar Russia in January.

India continued to spearhead growth at the start of 2025 but saw its lead against other major emerging market economies fall to the smallest in just over a year. This was as India's output expanded at the slowest pace since November 2023 amid a reduced, but still solid, services activity expansion.

Russia emerged second placed among the BRICs, with business activity across manufacturing and services rising at the fastest pace in a year. Moreover, growth was broad-based as demand growth widely accelerated in January.

Mainland China meanwhile saw the rate of output growth moderate to a four-month low in January as slower services activity expansion offset a slight improvement in factory output growth. The rates of both manufacturing and services output expansions were mild, outlining subdued conditions going into 2025 and ahead of new US tariffs established in February.

Finally, Brazil returned to contraction for the first time in 16 months, falling at the most pronounced pace since April 2021. This was mainly attributed to lower services activity with elevated price pressures and soaring borrowing costs eroding demand.

Forward-looking indicators point to growth in the near-term

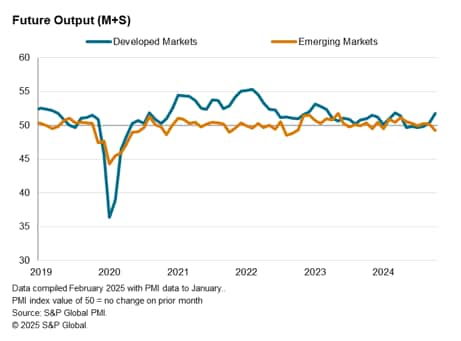

Forward-looking indicators signalled that emerging markets are expected to remain in growth in the near-term, albeit at a slower pace.

Overall emerging market new orders expanded for the twenty-fifth month in a row in January. Furthermore, growth was broad-based even as the overall rate of new business expansion softened since December. Business confidence also recovered slightly in January, though this was based on data collected ahead of the US tariffs announcements in the first weekend of February - including additional tariffs on mainland Chinas' goods, which was later implemented. The lack of immediate action by the new US administration following the Presidential Inauguration on January 20th likely contributed to reduced trade concerns, but was not enough to push emerging market business confidence back above the long-run average in January. With the latest updates on tariffs, we will be closely tracking upcoming February PMI Future Output data for insights into changes in sentiment.

Emerging market employment levels fall at the start of 2025

Although expansions in new business and rising sentiment levels continued to paint a picture of growth for emerging markets, falling employment at the start of the year outlined a sense of caution among businesses, especially in relation to cost control.

A reduction in emerging market staffing levels, the first in three months and the fastest in two years, contrasted with the accelerating employment growth among developed market firms. Moreover, the reduction in emerging market headcounts was concentrated in the goods producing sector, further outlining the fact that production likely rose with front-loading ahead of potential US tariffs in January but firms are lowering staff in anticipation of growth uncertainties further in the year.

Charge inflation remains stable among emerging market firms

Finally on prices, output price inflation was unchanged for emerging market firms at the start of 2025. Firms continued to pass on past and present increases in costs at a pace below the long-run average in January. Subdued input price inflation, the lowest for four months, further hints at the potential for charge inflation to stay low in the near-term. These are altogether supportive of further rate cuts among emerging market central banks.

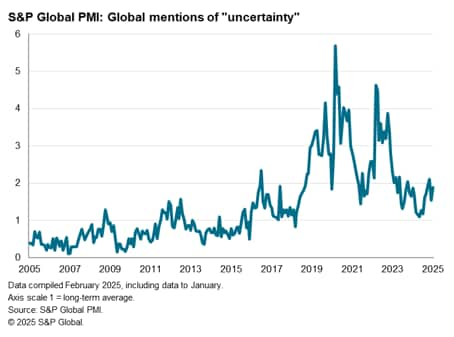

That said, globally, 'uncertainty' mentions by panel members continued to trend high in January with the prospects of an elevated Fed rate and a strong dollar among worries for emerging market businesses, which both complicates the path for central banks in the region, and also casts uncertainty over the prospect for demand growth in 2025.

Access the PMI press release here.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-softens-at-the-start-of-2025-as-firms-shed-staff-Feb25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-softens-at-the-start-of-2025-as-firms-shed-staff-Feb25.html&text=Emerging+market+growth+softens+at+the+start+of+2025+as+firms+shed+staff+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-softens-at-the-start-of-2025-as-firms-shed-staff-Feb25.html","enabled":true},{"name":"email","url":"?subject=Emerging market growth softens at the start of 2025 as firms shed staff | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-softens-at-the-start-of-2025-as-firms-shed-staff-Feb25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Emerging+market+growth+softens+at+the+start+of+2025+as+firms+shed+staff+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2femerging-market-growth-softens-at-the-start-of-2025-as-firms-shed-staff-Feb25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}