Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 05, 2025

Tracking tariff impact via the PMI: Assessing changing manufacturing performance through PMI indicators

Manufacturing PMI data for January were collected worldwide from 08 to 31 January, straddling the inauguration of Donald Trump as the 47th president of the United States but preceding the announcement of tariffs being imposed by the US on its three main trading partners. At the time of writing, these include 25% tariffs on goods imported from Canada and Mexico (now postponed for one month and with a reduced 10% rate on oil imports from Canada) and an additional 10% tariff on goods from mainland China, to which the latter has responded with targeted measures.

We look below, though the lens of the S&P Global's PMIs produced in the US and these trading partners, at how the respective manufacturing sector have so far been affected by the prospect of the new US administration, as well as highlighting key indicators to watch in the coming month.

Headline manufacturing PMI

The headline PMI is a composite indicator derived from five sub-indices measuring production, new orders, employment, suppliers' delivery times and inventories. It is seen as an overall barometer of the health of the manufacturing sector.

In January, the US manufacturing PMI rose above 50, climbing from 49.4 to 51.2 to signal expansion for the first time in seven months. In contrast, Canada's PMI signaled a slower expansion, falling from 52.2 in December to a three-month low of 51.6. Albeit still above the US PMI, and registering growth for a fifth successive month, January's fall in the Canadian PMI was the first such decline seen for six months.

Meanwhile, the Caixin manufacturing PMI for mainland China also lost ground, dropping from 50.5 to 50.1 to point to a near-stagnation of business conditions and its worst performance since last September.

Finally, Mexico's manufacturing PMI, at 49.1 down from 49.8, signaled a deterioration of business conditions for a seventh straight month and the steepest decline for three months.

The US headline PMI therefore bucked the trend by rising when comparable PMIs for Canada, Mexico and mainland China all fell in January.

New Export orders

January saw Canada's new export orders for goods rise, albeit only marginally, for the first time in 17 months, while rate of decline slowed to near-stagnation in both the US and mainland China. It is unclear to what extent these changes reflected the front-running of mooted tariffs, but upcoming export data will be especially important to watch to gauge the initial impact of tariffs. The situation looks especially worrying in Mexico, where January saw exports fall sharply again and US tariffs will likely add to the downward trend.

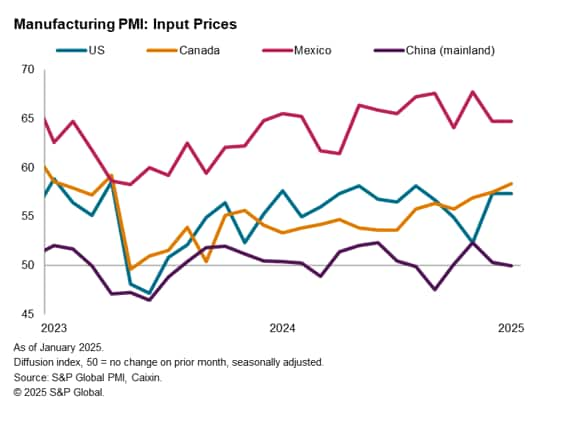

Input prices

Another direct tariff impact likely in the near-term will also be evident on prices. In manufacturing, higher input cost inflation could feed through to consumer price inflation rates, but could also dampen producers' margins or drive sales lower.

While global input price inflation remained subdued by historical standards in January, trends were varied around the world - including among tariff-affected economies. Notably, input costs were unchanged in mainland China whereas robust cost growth was already being recorded across North America. While tariffs are set to raise import costs in the US, any reciprocation could also push up prices in other economies.

Exchange rate movements arising from the tariff concerns could also materially affect import costs, as the recent strengthening US dollar could offset some of the tariff impact while weakening currencies could add to inflation in other markets.

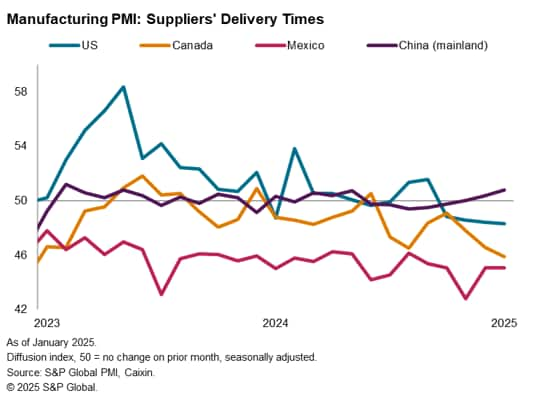

Suppliers' delivery times

A widespread concern is that the implementation of tariffs will also impact supply chains, notably in industries such as automobiles, across North America but also with China. A key gauge of supply chain conditions is the PMI Suppliers' Delivery Times Index, for which readings above 50 signal faster deliveries and readings below 50 indicate slower deliveries. In January, mainland China's factories reported faster delivery times, but lead-times lengthened across North America. The rate at which delivery times extended in Mexico was especially sharp, while Canada and the US experienced increasing delays.

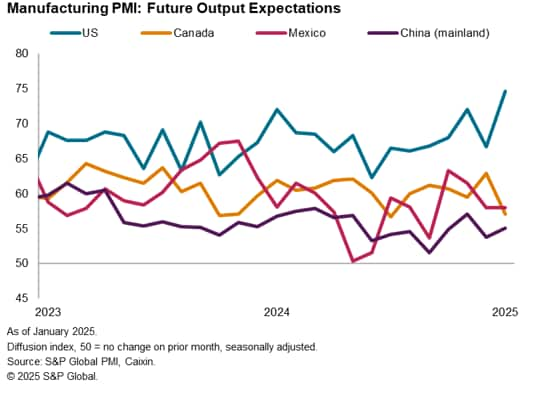

Business confidence

A factor that could magnify the economic impact of tariffs is the effect on business confidence. This is especially so if uncertainty caused by tariff developments discourages business investment. In this respect, it will be useful to watch the PMI's Future Business Expectations Index, which tracks companies' views on their anticipated output in the coming year.

January saw US manufacturers' business confidence surge to the highest for nearly three years amid optimism surrounding the pro-business policies of the new US administration. The flip side was a weakening of confidence in many other economies, notably in Canada. February's PMI data will be the first to capture the impact of actual tariff announcements on business sentiment around the world, even if the actual tariffs on Canada and Mexico will be delayed by a month according to latest updates.

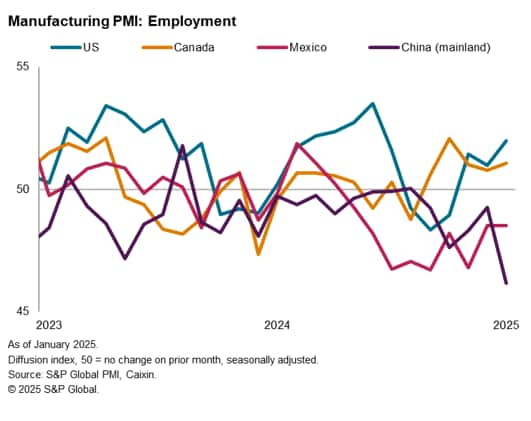

Employment

The feed-though (and arguable ultimate goal) of tariffs will be the impact on employment. January saw US factories take on new staff in increasing numbers, with jobs growth hitting a seven-month high. In stark contrast, factories in mainland China shed workers at a rate not seen since February 2020, during the initial COVID-19 lockdowns. Job losses were also reported for a ninth successive month in Mexico. Job gains were reported for a fifth month running in Canada. Upcoming job market data therefore will be instrumental in monitoring the impact of tariffs.

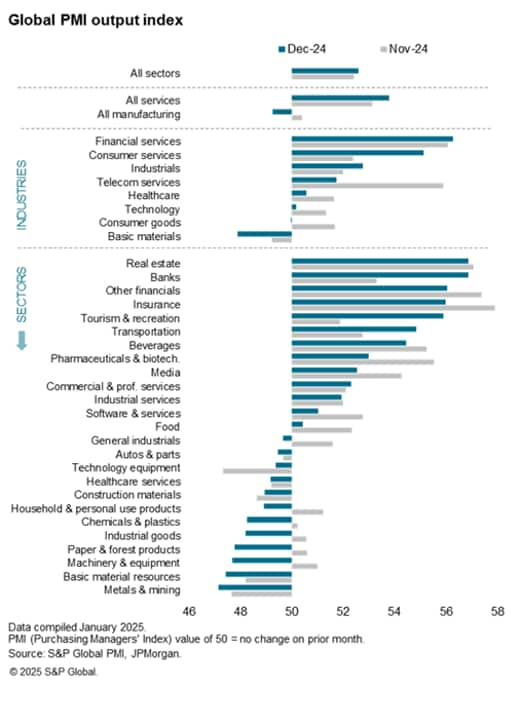

Sector impact

In addition to the national impact of tariffs, PMI data also allow the identification of changing trends by sector, either globally, regionally or among broad national sectors. The impact of autos, food and construction materials will be especially keenly eyed in the coming months.

Access the latest release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2025, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-tariff-impact-via-the-pmi-assessing-changing-manufacturing-performance-Feb25.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-tariff-impact-via-the-pmi-assessing-changing-manufacturing-performance-Feb25.html&text=Tracking+tariff+impact+via+the+PMI%3a+Assessing+changing+manufacturing+performance+through+PMI+indicators+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-tariff-impact-via-the-pmi-assessing-changing-manufacturing-performance-Feb25.html","enabled":true},{"name":"email","url":"?subject=Tracking tariff impact via the PMI: Assessing changing manufacturing performance through PMI indicators | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-tariff-impact-via-the-pmi-assessing-changing-manufacturing-performance-Feb25.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tracking+tariff+impact+via+the+PMI%3a+Assessing+changing+manufacturing+performance+through+PMI+indicators+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftracking-tariff-impact-via-the-pmi-assessing-changing-manufacturing-performance-Feb25.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}