Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 15, 2023

Vietnam strengthens economic ties with US during President Biden's visit

The visit by US President Joe Biden to Vietnam on 10-11 September has resulted in a further significant strengthening of bilateral economic ties, with the signing of the new US-Vietnam Comprehensive Economic Partnership agreement. A wide range of industry sector level agreements were also concluded, including a new semiconductors partnership to support resilient supply chains.

In the near-term, Vietnam's manufacturing export sector is still facing significant headwinds due to weak growth in the US and EU, which are two key export markets accounting for around 42% of Vietnam's goods exports. Vietnam's goods exports fell by 10.3% y/y in the first seven months of 2023.

However, despite the near-term downturn in exports, Vietnam is expected to resume rapid economic growth over the medium-term economic outlook, as exports rebound. Vietnam is expected to continue to be a key beneficiary of the shift in global manufacturing supply chains towards competitive Southeast Asian manufacturing hubs.

Vietnam's GDP growth softens as exports weaken

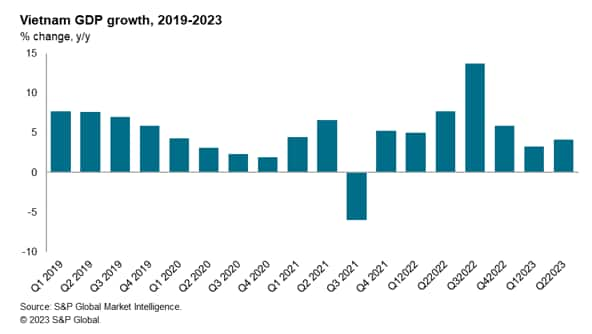

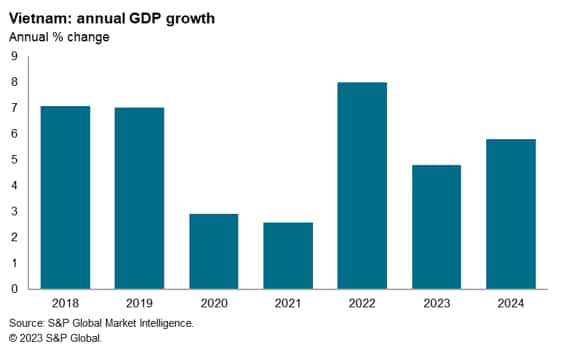

Vietnam's real GDP grew by 8.0% in 2022, as the economy rebounded strongly from the economic disruption caused by the COVID-19 pandemic during second half of 2021. However economic growth momentum moderated significantly in the first half of 2023, to a pace of 3.7% year-on-year (y/y), reflecting the impact of weakening growth in industrial production and exports. The pace of GDP growth in the second quarter of 2023 was 4.1% y/y, somewhat improved compared with the 3.3% y/y rate recorded in the first quarter of 2023.

Vietnam's goods exports rose by 10.6% in 2022. However, the economic slowdown in the US and EU, which together account for 42% of Vietnam's total goods exports, has resulted in a significant weakening in exports during the first seven months of 2023, with Vietnam's total goods exports declining by 10.3% y/y.

The US remains Vietnam's largest export market, accounting for 29.4% of total merchandise exports. Vietnam's exports to the US rose by 13.6% in 2022, with the bilateral trade surplus with US increasing to USD 95 billion. However, in the first seven months of 2023, merchandise exports to the US fell by 21.8% y/y. Although exports of computers, electrical products and parts showed a small rise of 1.4% y/y for the seven-month period, exports of mobile phones and parts fell by 38.9% y/y, while exports of textiles and garments fell by 24% y/y.

Exports to the EU have also been weak. Exports to the EU of computers, electrical products and components fell by 23.9% y/y in the January-July 2023 period, while exports of textiles and garments to the EU fell by 9.6% y/y.

Exports to mainland China have started to show a turnaround after considerable weakness in early 2023. Vietnam's exports to mainland China rose by 1.8% y/y in the first seven months of 2023, after having shown significant declines in early 2023. Exports of computers, electrical products and components to mainland China rose by 13.7% y/y in the January-July 2023 period, much improved on the 14.9% y/y decline recorded for exports for this segment in the first four months of 2023. However, exports of mobile phones and parts to mainland China remained weak in the January to July 2023 period, down by 2.9% y/y, although this was a much smaller decline than in the first half of 2023.

Reflecting the slump in exports, the manufacturing sector has slowed in the first seven months of 2023, with industrial production contracting by 0.7% y/y for the first seven months of 2023, compared with strong positive growth of 8.6% y/y in the first seven months of 2022. Vietnam's industrial production had risen by 7.8% y/y in calendar year 2022, with manufacturing output up by 8.0% y/y.

The downturn in Vietnam's construction sector has also hit manufacturing output for building materials, with domestic cement sales down by 21% y/y in the January to June 2023 period. Steel sales in the first half of 2023 were down by an estimated 17.5% y/y, with steel output down by 20.9% y/y.

The challenges facing Vietnam's manufacturing sector were compounded during May and June by power shortages resulting in electricity supply disruptions. A heat wave had driven up electricity consumption and reduced hydroelectric power supply, causing widespread disruption to manufacturing output due to power outages. Manufacturing production in industrial parks in northern regions of Vietnam were particularly badly impacted, notably in Bac Ninh and Bac Giang provinces.

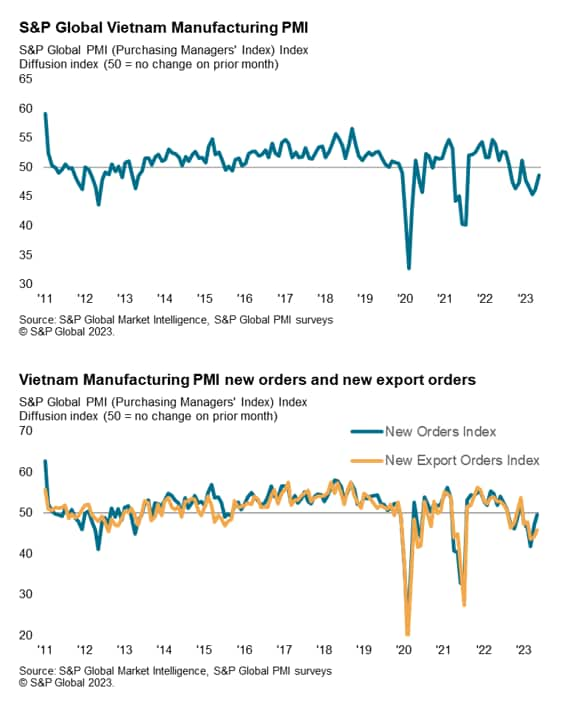

The S&P Global Vietnam Manufacturing Purchasing Managers' Index (PMI) moved back above the 50.0 no-change mark for the first time in six months during August. At 50.5, the index was up from 48.7 in July and pointed to a marginal monthly improvement in business conditions in the sector. The nascent recovery in the health of the sector reflected tentative signs of demand improving.

Manufacturers recorded the first increase in new orders for six months, while new export business also rose following a five-month sequence of declines. Growth rates were modest, however, amid some reports of ongoing demand fragility.

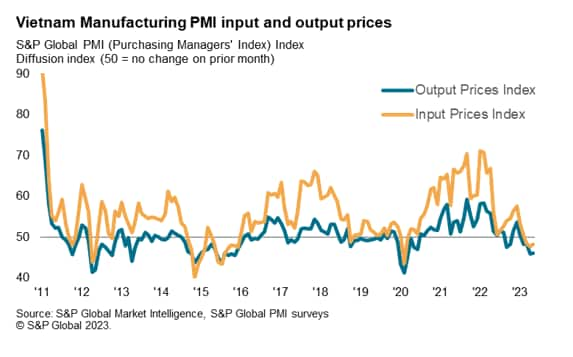

August data pointed to a solid increase in input prices, thereby ending a three-month period of decline. A number of panellists linked higher input costs to rising oil prices, while increased food prices were also mentioned. In turn, firms also raised their own selling prices, albeit only slightly. The increase in charges was the first since March.

The CPI inflation rate has moderated to 3.0% y/y in August 2023 compared with 3.4% y/y in March and 4.3% y/y in February. However, month-on-month CPI inflation rose by 0.9% m/m in August, reflecting some renewed upturn in inflation pressures due to higher world oil prices. Core CPI inflation was somewhat higher, rising by 4.3% y/y in August.

In response to rising inflation and the strengthening USD versus the dong during 2022, Vietnam's central bank, the State Bank of Vietnam (SBV), had raised its policy rate by 200 basis points (bps) in two 100bp steps during September and October 2022. However, with Vietnam's economy slowing significantly in the first half of 2023, the SBV has started easing monetary policy. The SBV cut its policy rates by 100bps on March 15 and again by 50bps on April 3 as concerns have increased about the impact of rising interest rates on the property sector, which has faced rising liquidity pressures. A further 50bps rate cut was announced on 23 May as the economy continued to slow, followed by a further 50bp rate cut on 16 June.

Medium-term growth drivers

Over the medium-term outlook for the next five years, a number of key drivers are expected to continue to make Vietnam one of the fastest growing emerging markets in the Asian region.

Firstly, Vietnam will continue to benefit from its relatively lower manufacturing wage costs relative to coastal Chinese provinces, where manufacturing wages have been rising rapidly over the past decade.

Secondly, Vietnam has a relatively large, well-educated labour force compared to many other regional competitors in Southeast Asia, making it an attractive hub for manufacturing production by multinationals.

Third, rapid growth in capital expenditure is expected, reflecting continued strong foreign direct investment by foreign multinationals as well as domestic infrastructure spending. Total implemented foreign direct investment was estimated at USD 22.4 billion in 2022. Strong investment is expected in infrastructure sector, as the economy continues to grow substantially over the next decade. With strong GDP growth expected to continue to push electricity demand significantly higher over the medium term, the Vietnamese government has estimated that USD 133 billion of new power infrastructure spending is required by 2030, including USD 96 billion for power plants and USD 37 billion to expand the power grid. Severe power shortages during 2023 have highlighted the critical importance of rapid development of new power infrastructure as a key economic policy priority.

Fourth, Vietnam is benefiting from the fallout of the US-China trade war, as higher US tariffs on a wide range of Chinese exports have driven manufacturers to switch production of manufacturing exports away from China towards alternative manufacturing hubs in Asia.

Fifth, many multinationals have been diversifying their manufacturing supply chains during the past decade to reduce vulnerability to supply disruptions and geopolitical events. This trend has been further reinforced by the COVID-19 pandemic, as protracted disruptions created turmoil in global supply chains for many industries, including autos and electronics.

Vietnam has been one of the preferred destinations for South Korean and Japanese firms choosing to shift their production to the ASEAN region.

Free trade agreements

Vietnam is also set to benefit from its growing network of free trade agreements. The new Comprehensive Economic Partnership Agreement with the US is particularly important for Vietnam since the US is Vietnam's largest export market.

As a member of the ASEAN grouping of nations, Vietnam already has benefited considerably from the ASEAN Free Trade Agreement (AFTA), which has substantially removed tariffs on trade between ASEAN member countries since 2010. ASEAN also has a network of free trade agreements with other major Asia-Pacific economies, most notably the China-ASEAN Free Trade Area which entered into force in 2010. This network of free trade agreements has helped to strengthen Vietnam's competitiveness as a low-cost manufacturing export hub.

Vietnam is also a member of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) among 11 Pacific nations, including the G-20 economies of Canada, Mexico, Japan and Australia. In March 2023, the UK Government concluded negotiations on the UK's accession to the CPTPP. As the UK is the world's sixth largest economy, its accession will significantly increase the overall economic size of the CPTPP grouping, providing Vietnam with substantial competitive advantages for exporting to the UK market as well as attracting UK foreign direct investment.

A very important trade deal that took effect in 2020 is the EU-Vietnam Free Trade Agreement (EVFTA). The EVFTA is an important boost to Vietnam's export sector, with 99% of bilateral tariffs scheduled to be eliminated over the next seven years, as well as significant reduction of non-tariff trade barriers. For Vietnam, 71% of duties were removed when the EVFTA took effect on 1st August 2020. The scope of the EVFTA is wide-ranging, including trade in services, government procurement and investment flows. An EU-Vietnam Investment Protection Agreement has also been signed which will help to strengthen EU foreign direct investment into Vietnam when it is implemented. In 2022, Vietnam's exports to the EU reached USD 56 billion, up 10.2% y/y.

Vietnam will also benefit from the Regional Comprehensive Economic Partnership (RCEP) free trade agreement that was implemented from 1st January 2022. The fifteen RCEP countries are the ASEAN ten nations, plus China, Japan, South Korea, Australia and New Zealand. Vietnam has already ratified the RCEP agreement and will therefore benefit immediately from the date of RCEP implementation. The RCEP agreement covers a wide range of areas, including trade in goods and services, investment, e-commerce, intellectual property and government procurement.

US bilateral trade relations

The US deficit for trade in goods with Vietnam has widened significantly in recent years, from USD 55.8 billion in 2019 to USD 116 billion by 2022.

As part of its investigation on currency undervaluation, USTR consults with the US Department of the Treasury as to issues of currency valuation and exchange rate policy. The US Treasury has informed the US Department of Commerce that Vietnam's currency was undervalued by 4.7% in 2019, partly due to intervention by the Vietnamese government. In December 2020, the US Treasury named Vietnam as a "currency manipulator".

However, in its April 2021 semi-annual Report on Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States, the US Treasury determined that with reference to the Omnibus Trade and Competitiveness Act of 1988, there was insufficient evidence to make a finding that Vietnam manipulates its exchange rate for either of the purposes referenced in the 1988 Act and dropped its labelling of Vietnam as a "currency manipulator".

US government concerns about currency manipulation have been addressed following a bilateral agreement in July 2021 between the US and Vietnam whereby Vietnam has committed to refrain from competitive devaluation of the dong. The agreement was announced in a joint statement by US Treasury Secretary Janet Yellen and State Bank of Vietnam Governor Nguyen Thi Hong. In its December 2021 and June 2022 semi-annual reports, the US Treasury stated that it continues to engage closely with the State Bank of Vietnam to monitor Vietnam's progress in addressing the US Treasury's concerns and is thus far satisfied with progress made by Vietnam.

Bilateral economic relations between Vietnam and the US have been significantly boosted by the new Comprehensive Economic Partnership agreement in September 2023 made by US President Biden and Vietnam's General Secretary Nguyen Phu Trong.

Under the new bilateral Memorandum of Cooperation on Semiconductor Supply Chains agreed during President Biden's visit, the US will partner with Vietnam to expand the capacity of the semiconductor ecosystem, workforce and infrastructure in Vietnam to support US industry.

A bilateral Memorandum of Understanding was also agreed to secure critical mineral supply chains, including technical cooperation to help develop Vietnam's rare earths industry.

Economic outlook

Due to the severe economic impact of lockdowns triggered by the COVID-19 Delta wave in mid-2021, the pace of Vietnam's economic growth moderated to 2.6% in 2021, compared with the 2.9% growth rate recorded in 2020. There was a strong rebound in GDP growth momentum in 2022, at a pace of 8.0 % y/y, as domestic demand and manufacturing export production returned to more normal levels. However, in 2023, Vietnam's economy has shown significant moderation in growth momentum as the slowdown in key export markets, notably the US and the EU, has hit Vietnam's manufacturing exports.

Despite near-term headwinds to Vietnam's economic growth, over the medium-term economic outlook, a large number of positive growth drivers are creating favourable tailwinds and will continue to underpin the rapid growth of Vietnam's economy. This is expected to drive strong growth in Vietnam's total GDP as well as per capita GDP. The economic outlook from 2023 to 2026 is for rapid economic expansion.

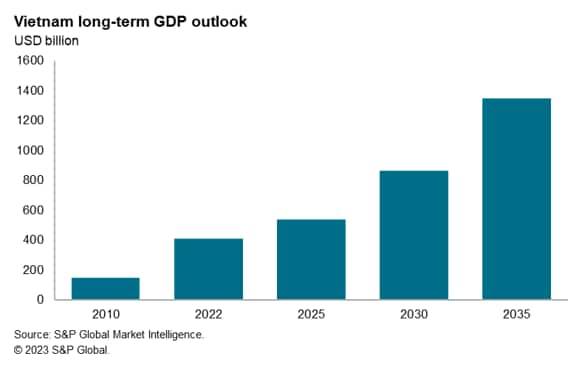

With strong economic expansion projected over the next decade, Vietnam's total GDP is forecast to increase from USD 327 billion in 2022 to USD 470 billion by 2025, rising to USD 760 billion by 2030. This translates to very rapid growth in Vietnam's per capita GDP, from USD 3,330 per year in 2022 to USD 4,700 per year by 2025 and USD 7,400 by 2030, resulting in substantial expansion in the size of Vietnam's domestic consumer market.

Vietnam's role as a low-cost manufacturing hub is also expected to continue to grow strongly, helped by the further expansion of existing major industry sectors, notably textiles and electronics, as well as the development of new industry sectors such as autos and petrochemicals. Vietnam already has a domestic automaker of electric vehicles, Vinfast, which launched its first EV in Vietnam in 2021.

For many multinationals worldwide, significant supply chain vulnerabilities have been exposed by the protracted disruption of industrial production in China as well as some other major global manufacturing hubs during the COVID-19 lockdowns. This will drive the further reshaping of manufacturing supply chains over the medium term, as firms try to reduce their vulnerability to such extreme supply chain disruptions. With US-China trade and technology tensions still remaining high, this is likely to be a further driver for reconfiguring of supply chains. A key beneficiary of the shift in global manufacturing supply chains will be the ASEAN region, with Vietnam expected to be one of the main winners.

Access the press release here.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-strengthens-economic-ties-with-us-during-president-bidens-visit-Sep23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-strengthens-economic-ties-with-us-during-president-bidens-visit-Sep23.html&text=Vietnam+strengthens+economic+ties+with+US+during+President+Biden%27s+visit+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-strengthens-economic-ties-with-us-during-president-bidens-visit-Sep23.html","enabled":true},{"name":"email","url":"?subject=Vietnam strengthens economic ties with US during President Biden's visit | S&P Global &body=http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-strengthens-economic-ties-with-us-during-president-bidens-visit-Sep23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Vietnam+strengthens+economic+ties+with+US+during+President+Biden%27s+visit+%7c+S%26P+Global+ http%3a%2f%2fprod.azure.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvietnam-strengthens-economic-ties-with-us-during-president-bidens-visit-Sep23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}